Regarding the legitimacy of DBG MARKETS forex brokers, it provides ASIC, FCA, FSCA and WikiBit, .

Is DBG MARKETS safe?

Pros

Cons

Is DBG MARKETS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

DBG MARKETS (AUSTRALIA) PTY LTD

Effective Date: Change Record

2004-03-10Email Address of Licensed Institution:

compliance@dbgmarket.com.auSharing Status:

Website of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 14 L 11 65 YORK ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0426281215Licensed Institution Certified Documents:

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

DBG MARKETS (UK) LLP

Effective Date: Change Record

2007-10-01Email Address of Licensed Institution:

compliance@dbglondon.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.dbglondon.co.ukExpiration Time:

--Address of Licensed Institution:

Sierra Quebec Bravo 77 Marsh Wall London Canary Wharf E14 9SH UNITED KINGDOMPhone Number of Licensed Institution:

+442038051791Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

DBG MARKETS ZA (PTY) LTD

Effective Date:

2010-09-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SUITE 11 19, 9TH STREET HOUGHTON ESTATE JOHANNESBURG GAUTENG 2198Phone Number of Licensed Institution:

010 020 2176Licensed Institution Certified Documents:

Is DBG Markets A Scam?

Introduction

DBG Markets, a forex and CFD broker, has positioned itself in the competitive landscape of online trading since its inception in 2007. With claims of offering a wide range of trading instruments, including forex, commodities, and cryptocurrencies, DBG Markets appeals to both novice and experienced traders. However, the forex market is fraught with potential risks, making it imperative for traders to conduct thorough due diligence before committing their funds to any broker. This article aims to critically evaluate DBG Markets by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The evaluation will be based on a combination of qualitative narratives and quantitative data derived from multiple sources, including user reviews and regulatory information.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most significant indicators of its legitimacy and reliability. DBG Markets claims to be regulated in several jurisdictions, including Australia and South Africa. Regulatory oversight is crucial as it ensures that brokers adhere to stringent financial guidelines designed to protect traders.

Core Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 247017 | Australia | Verified |

| FCA | 469459 | UK | Verified |

| FSCA | 41920 | South Africa | Verified |

DBG Markets is regulated by the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulators are known for their rigorous compliance requirements, which include maintaining a minimum capital reserve and ensuring that client funds are held in segregated accounts. However, it is worth noting that while ASIC and FCA are considered tier-1 regulators, the FSCA is classified as tier-2, which may indicate a slightly lower level of oversight.

Despite being regulated, there have been numerous reports and complaints from users regarding withdrawal issues and poor customer service, raising questions about the effectiveness of oversight. The regulatory history of DBG Markets appears to be clean, but the presence of negative user experiences suggests that compliance does not always translate to customer satisfaction.

Company Background Investigation

DBG Markets has a complex ownership structure with multiple entities registered across various jurisdictions, including Australia, South Africa, and the UK. This multi-entity setup allows the broker to operate in different markets while adhering to local regulations. However, the lack of transparency regarding the company's exact ownership and management team raises concerns.

The management teams background is not prominently displayed on the broker's website, which is a common practice among reputable firms. An absence of detailed information about the team can lead to skepticism regarding the broker's operational integrity and commitment to customer service. Transparency is essential in fostering trust, and DBG Markets has not fully met this standard.

Trading Conditions Analysis

The trading conditions offered by DBG Markets are a crucial aspect of its appeal. The broker claims to provide competitive spreads and a variety of account types. However, the fee structure is an area of concern for potential traders.

Core Trading Cost Comparison

| Fee Type | DBG Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | $5 per lot | $6 per lot |

| Overnight Interest Range | Varies | Varies |

DBG Markets advertises spreads starting from 0.5 pips, which is competitive compared to the industry average. However, the commission structure, particularly for the ECN account, imposes a fee of $5 per lot, which is slightly below the industry average. Moreover, the broker's policies regarding overnight interest and other fees are not clearly outlined, raising red flags for potential hidden charges.

The lack of clarity surrounding fees can lead to unexpected costs, making it essential for traders to read the fine print before engaging with DBG Markets.

Customer Funds Security

Ensuring the safety of customer funds is paramount for any trading platform. DBG Markets claims to implement various security measures, including segregated accounts and negative balance protection.

The broker's funds are reportedly held in segregated accounts, which is a standard practice among regulated brokers to protect client funds in the event of financial difficulties. Additionally, negative balance protection means that traders cannot lose more than their deposited funds, a feature that adds a layer of security.

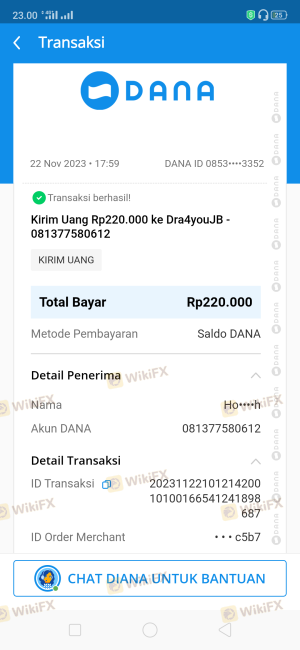

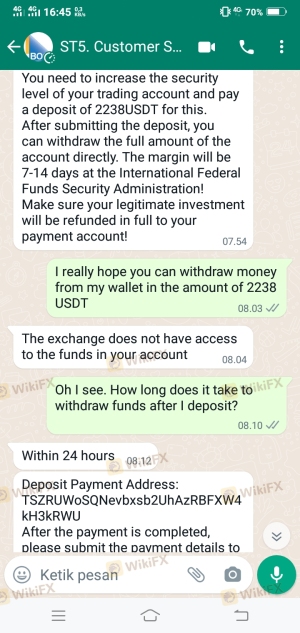

However, there have been reports of withdrawal delays and complications, which raises questions about the actual implementation of these protective measures. Traders should be cautious and consider the historical context of any broker's financial security claims.

Customer Experience and Complaints

User feedback is a critical component in assessing the reliability of any broker. A review of customer experiences with DBG Markets reveals a mixed bag of opinions.

Common Complaint Types

| Complaint Type | Severity Level | Company Response |

|---|---|---|

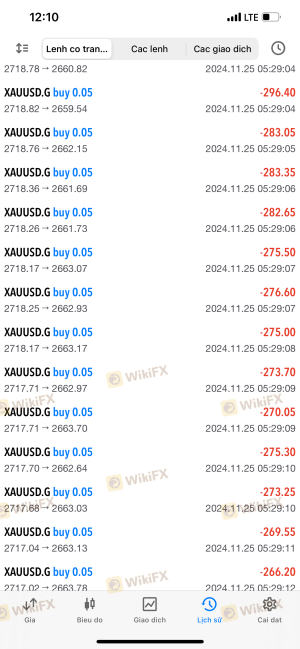

| Withdrawal Issues | High | Slow response |

| Customer Service Quality | Medium | Inconsistent |

| Account Restrictions | Medium | Vague explanations |

Common complaints about DBG Markets include withdrawal issues, where clients report delays and complications in accessing their funds. The overall quality of customer service has also been criticized, with users noting slow response times and inadequate support during critical situations.

One typical case involved a trader who faced significant delays in withdrawing funds, leading to frustration and a loss of trust in the platform. Such experiences highlight the importance of reliable customer service and prompt resolution of issues in maintaining trader confidence.

Platform and Trade Execution

The performance of a broker's trading platform is pivotal for user satisfaction. DBG Markets offers access to both MetaTrader 4 and MetaTrader 5, which are highly regarded platforms in the trading community.

Traders have reported that the platforms are generally stable and user-friendly, but there are concerns regarding order execution quality. Instances of slippage and rejections have been noted, particularly during volatile market conditions. This can be detrimental to traders who rely on precise execution for their strategies.

Risk Assessment

Engaging with DBG Markets comes with inherent risks, as with any trading platform.

Risk Scorecard

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Multiple regulations but mixed user feedback |

| Withdrawal Reliability | High | Reports of delays and complications |

| Customer Support Quality | Medium | Inconsistent response times |

The overall risk associated with trading through DBG Markets is elevated due to the mixed reviews regarding customer support and withdrawal processes. Traders are advised to approach this broker with caution, particularly if they plan on making significant investments.

Conclusion and Recommendations

In conclusion, while DBG Markets is regulated by reputable authorities such as ASIC and FCA, there are significant concerns regarding its customer service, withdrawal processes, and overall transparency. The mixed reviews from users suggest that while the broker may not be a scam in the traditional sense, potential traders should exercise caution.

For those considering trading with DBG Markets, it may be prudent to start with a demo account to gauge the platform's reliability before committing real funds. Additionally, traders may want to explore alternative brokers with better customer feedback and more transparent practices, such as FBS, IC Markets, or Pepperstone, which have established stronger reputations in the forex trading community.

Is DBG MARKETS a scam, or is it legit?

The latest exposure and evaluation content of DBG MARKETS brokers.

DBG MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DBG MARKETS latest industry rating score is 7.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.