Is Excellent safe?

Business

License

Is Excellent A Scam?

Introduction

In the ever-evolving world of forex trading, the choice of a broker can significantly impact traders' success and security. Excellent, a forex broker, has attracted attention for its offerings and market positioning. However, as with any financial service provider, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of Excellent before committing their funds. This article aims to provide an objective analysis of whether Excellent is a scam or a safe option for traders. The investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

A broker's regulatory status is a key indicator of its legitimacy and trustworthiness. Regulatory bodies enforce rules and standards that protect investors' interests, making it essential for traders to choose brokers that are well-regulated. Unfortunately, Excellent claims to be registered in the United Kingdom but lacks authorization from the Financial Conduct Authority (FCA), which is a significant red flag. Furthermore, Excellent asserts that it is regulated by the National Futures Association (NFA), but records show that it is not a member. This lack of regulation indicates that Excellent operates without oversight, putting investors' funds at risk.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Not Registered |

| NFA | 0541481 | USA | Not a Member |

The absence of regulatory oversight means that traders have little to no legal recourse if issues arise. Such a situation raises concerns about the safety of funds and the overall integrity of the trading environment offered by Excellent. In light of these findings, it is evident that Excellent is not a safe option for forex trading.

Company Background Investigation

Understanding a broker's history and ownership structure can provide valuable insights into its reliability. Excellent was incorporated in 2021, despite claims of operating since 2009. This discrepancy raises questions about its credibility and transparency. Additionally, the lack of information regarding its management team and their professional backgrounds further compounds these concerns. A reputable broker typically has a well-documented history and a transparent operational structure, which Excellent seems to lack.

The management team's experience is crucial in establishing trust. A strong leadership team with a proven track record in the financial industry can instill confidence in investors. Unfortunately, Excellent does not provide sufficient information about its management, which may indicate a lack of accountability. Transparency in operations and clear communication about the company's structure are essential for any broker to build trust with its clients. Given these factors, the overall transparency and information disclosure levels of Excellent are questionable.

Trading Conditions Analysis

A thorough analysis of a broker's trading conditions is essential for evaluating its overall reliability. Excellent's fee structure and trading conditions must be scrutinized to determine if they align with industry standards. The broker claims to offer competitive spreads and commissions; however, the lack of transparency regarding specific fees raises concerns. Traders should be wary of any hidden costs or unusual fee policies that could erode their profits.

| Fee Type | Excellent | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5%-1.5% |

The absence of clear information about spreads, commissions, and overnight interest rates is a significant issue. Traders need to understand the costs associated with trading to make informed decisions. If Excellent does not provide transparent information about its fees, it raises concerns about potential exploitation of traders. Overall, the trading conditions offered by Excellent appear to be less than favorable.

Customer Funds Security

The safety of customer funds is paramount when selecting a forex broker. Excellent's security measures must be evaluated to determine whether it prioritizes the protection of its clients' investments. A reputable broker should implement strict measures to ensure that client funds are kept secure and separate from company operational funds. In the case of Excellent, there is little information available regarding its security protocols, fund segregation practices, and negative balance protection policies.

Investors should be aware of the potential risks associated with trading with a broker that lacks transparent security measures. Any historical issues or controversies regarding fund safety should also be taken into account. Without a clear understanding of how Excellent safeguards client funds, traders may be exposing themselves to unnecessary risks.

Customer Experience and Complaints

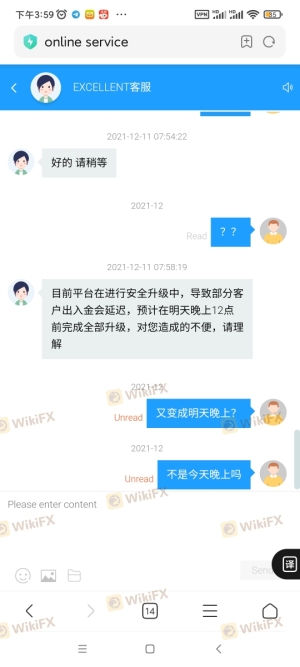

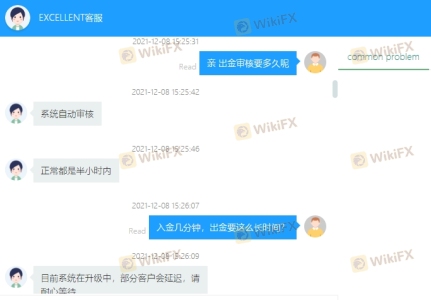

Analyzing customer feedback and experiences is crucial in assessing a broker's reputation. Reviews and testimonials can provide valuable insights into the quality of service and support offered by Excellent. However, a review of available customer feedback reveals a pattern of complaints regarding withdrawal issues, unresponsive customer service, and difficulties in accessing funds. Traders have reported frustration with the lack of timely communication from Excellent, which further exacerbates concerns about its reliability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Lack of Transparency | High | Poor |

A few case studies highlight the challenges faced by clients. For instance, one trader reported an inability to withdraw funds for several weeks, leading to heightened anxiety and distrust. Another user expressed frustration over the lack of clarity regarding fees and trading conditions. These experiences indicate a pattern of dissatisfaction among customers, which could signal deeper issues within the organization.

Platform and Execution

The performance and reliability of a trading platform are critical for successful trading. Traders expect a stable and efficient platform that allows for seamless order execution. However, reports from users indicate that Excellent's platform may be prone to technical issues, including slow execution times and occasional outages. Such problems can significantly impact traders' ability to capitalize on market opportunities.

Furthermore, the quality of order execution, including slippage and rejection rates, must be evaluated. If Excellent does not provide a robust trading environment, it could lead to traders missing out on profitable trades. The potential for platform manipulation also raises concerns, especially in an unregulated environment.

Risk Assessment

Using Excellent as a forex broker presents several risks that traders must consider. The lack of regulation, transparency, and customer support creates a high-risk environment for investors. Traders should be aware of the potential for financial loss and the challenges associated with recovering funds in the event of disputes.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Customer Support Risk | Medium | Poor response times to inquiries |

| Trading Platform Risk | High | Technical issues affecting execution |

To mitigate these risks, traders should conduct thorough research and consider alternatives. It is advisable to choose a broker with a solid regulatory framework, transparent fees, and a proven track record of customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Excellent is not a safe choice for forex trading. The lack of regulation, transparency issues, and negative customer feedback indicate potential risks that traders should avoid. Therefore, it is vital for traders to exercise caution and seek alternative brokers that prioritize regulatory compliance and customer support.

For those looking for reliable options, consider well-regulated brokers such as Fidelity, Charles Schwab, or Interactive Brokers. These firms have established reputations and provide robust trading environments that prioritize customer safety and satisfaction. Overall, conducting thorough research and due diligence is essential to ensuring a secure and successful trading experience.

Is Excellent a scam, or is it legit?

The latest exposure and evaluation content of Excellent brokers.

Excellent Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Excellent latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.