Regarding the legitimacy of JKV forex brokers, it provides FSC and WikiBit, .

Is JKV safe?

Pros

Cons

Is JKV markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

JKV GLOBAL CAPITAL MARKET SERVICES LTD

Effective Date:

2023-06-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Hotel Avenue Ebene 11th Floor, Bramer House, Mauritius, Bagatelle Office Park The Gardens, Ground Floor, Bagatelle Office Park Bagatelle, Moka, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is JKV Global A Scam?

Introduction

JKV Global is a brokerage firm that has made a name for itself in the forex market since its inception in 2020. Positioned as an offshore broker, it offers a variety of trading instruments, including forex, cryptocurrencies, and CFDs. However, the rise of online trading has also led to an increase in fraudulent schemes, making it crucial for traders to thoroughly evaluate the legitimacy of any broker they consider. This article aims to provide an objective analysis of JKV Global, focusing on its regulatory status, company background, trading conditions, customer safety, client experiences, platform performance, and associated risks. The findings are based on an extensive review of online resources, user feedback, and regulatory databases to present a comprehensive overview.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in assessing its legitimacy. JKV Global claims to be regulated by the Financial Services Commission (FSC) in Mauritius. However, the quality of regulation and whether it provides adequate protection for clients is a matter of concern. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB 23201820 | Mauritius | Unverified |

While JKV Global presents itself as a licensed entity, the lack of robust regulatory oversight from more recognized authorities such as the FCA (UK) or ASIC (Australia) raises red flags. The FSC is often criticized for its lenient regulatory framework, which may not provide sufficient investor protection. Furthermore, there is no evidence of a strong historical compliance record, making potential investors wary of the broker's legitimacy.

Company Background Investigation

JKV Global Markets Ltd. is registered in Mauritius, a jurisdiction often associated with offshore brokers that may lack stringent regulatory practices. The company's ownership structure and management team are not well-documented, contributing to concerns about transparency. The absence of detailed information about the founders and key executives limits the ability to assess their qualifications and expertise in the financial sector.

Moreover, the company's website lacks comprehensive disclosures regarding its operational history, which is essential for building trust among potential clients. Transparency in operations is vital, as it allows traders to gauge the reliability and integrity of the broker. Without clear information about the management team and their backgrounds, it is difficult to ascertain whether JKV Global is a trustworthy entity.

Trading Conditions Analysis

JKV Global offers a variety of trading conditions, but potential clients should be aware of its fee structure and any unusual policies. The broker's trading costs appear competitive, with spreads starting from 0.0 pips on major currency pairs. However, the minimum deposit requirement is relatively high, set at $1,000 for a standard account, which may deter novice traders.

Heres a comparison of the core trading costs:

| Cost Type | JKV Global | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.0 pips | 1.0-2.0 pips |

| Commission Model | No commission | $4-$10 per lot |

| Overnight Interest Range | Varies | Varies |

While the absence of commissions may seem attractive, traders should be cautious of hidden fees or unfavorable terms that could affect their overall profitability. It is crucial to read the fine print and understand the complete fee structure before committing funds to any trading platform.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. JKV Global claims to implement various safety measures, including segregated accounts for client funds. However, the effectiveness of these measures is questionable given the broker's regulatory status. The lack of a solid investor protection scheme raises concerns about what would happen in the event of insolvency or other financial issues.

Additionally, there have been no documented incidents of fund security breaches or significant disputes reported by clients, but the absence of such information does not guarantee safety. Traders should always conduct thorough due diligence to ensure their funds are protected.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews about JKV Global are mixed, with some users praising the platform's usability and customer service, while others report difficulties in withdrawing funds.

Heres a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

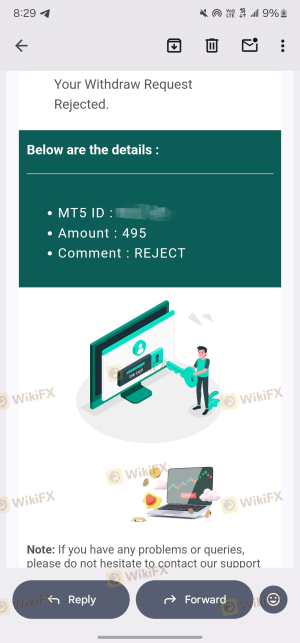

| Withdrawal Issues | High | Slow to respond |

| Customer Support | Medium | Generally helpful |

| Platform Stability | Low | Occasional issues |

One notable case involved a trader who experienced delays in withdrawing funds, leading to frustration and a lack of trust in the broker. While JKV Global has a customer support team available 24/7, the effectiveness of their responses has been called into question, particularly regarding urgent issues like fund withdrawals.

Platform and Trade Execution

The trading platform offered by JKV Global is MetaTrader 5 (MT5), a widely recognized platform known for its advanced features. However, the overall performance, including order execution speed, slippage, and rejection rates, has varied according to user experiences. Some traders report satisfactory execution speeds, while others have encountered issues, particularly during high volatility periods.

The platform's stability is crucial for traders, especially those employing automated trading strategies. Any signs of manipulation or frequent downtimes could indicate deeper issues within the broker's operational framework.

Risk Assessment

Using JKV Global comes with several risks that potential clients should consider. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight from FSC in Mauritius. |

| Fund Safety Risk | Medium | Lack of robust investor protection mechanisms. |

| Withdrawal Risk | High | Reports of difficulties in withdrawing funds. |

To mitigate these risks, traders should only invest what they can afford to lose, diversify their trading activities, and consider using regulated alternatives with a proven track record of client protection.

Conclusion and Recommendations

In conclusion, while JKV Global presents itself as a legitimate forex broker, significant concerns regarding its regulatory status, transparency, and client experiences suggest that it may not be a safe choice for all traders. The high minimum deposit, mixed customer feedback, and reports of withdrawal issues warrant caution.

For novice traders or those seeking a more secure trading environment, it is advisable to consider regulated alternatives with established reputations. Brokers such as Fortrade or eToro offer more robust regulatory oversight and a wider range of educational resources, making them suitable options for both beginners and experienced traders.

Ultimately, thorough due diligence is essential when selecting a broker, and potential investors should remain vigilant to avoid falling victim to scams or unreliable trading platforms.

Is JKV a scam, or is it legit?

The latest exposure and evaluation content of JKV brokers.

JKV Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JKV latest industry rating score is 6.00, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.00 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.