Is AAX safe?

Pros

Cons

Is AAX a Scam?

Introduction

AAX, short for Atom Asset Exchange, is a cryptocurrency exchange that aims to bridge the gap between traditional finance and the digital asset world. Founded in 2018 and launched in 2019, AAX claims to offer a robust trading platform powered by technology from the London Stock Exchange Group. However, the rapid growth of cryptocurrency exchanges has led to an influx of both reputable and dubious platforms, making it crucial for traders to carefully evaluate the legitimacy of any exchange they consider. This article seeks to provide an objective analysis of AAX, focusing on its regulatory status, company background, trading conditions, and customer experiences. The evaluation will be based on a thorough review of multiple sources, including user testimonials, expert analyses, and regulatory information.

Regulation and Legitimacy

The regulatory framework surrounding cryptocurrency exchanges is vital for ensuring the safety and security of traders' funds. AAX operates under a Seychelles-based company, Atom International Technology Ltd. However, it lacks a valid regulatory license, which raises significant concerns regarding its legitimacy. Below is a summary of AAX's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unverified |

The absence of a regulatory license means that AAX is not subject to the stringent oversight that licensed exchanges must adhere to. This lack of regulation can expose traders to various risks, including the potential for fund mismanagement and withdrawal issues. Furthermore, AAX has faced scrutiny following the collapse of other exchanges, such as FTX, which has heightened concerns about its operational integrity. Reports of abrupt withdrawal suspensions and allegations of mismanagement have led many to question whether AAX is safe for trading.

Company Background Investigation

AAX was established in 2018, with its operational headquarters located in Seychelles. The exchange claims to leverage advanced technology from the London Stock Exchange Group, which is intended to provide users with a reliable trading experience. However, the companys ownership structure remains somewhat opaque, with limited information available about its executives and their qualifications. The CEO, Thor Chan, has a background in technology and finance, but the overall transparency of the organization is lacking.

In terms of information disclosure, AAX does not provide comprehensive details about its operations, which can be a red flag for potential users. A transparent company typically shares its financial statements, regulatory compliance details, and operational history. The limited information available about AAX raises questions about its commitment to transparency and accountability, further contributing to the skepticism surrounding whether AAX is a scam.

Trading Conditions Analysis

AAX offers a range of trading options, including spot and futures trading, with leverage options reaching up to 100x. The fee structure is designed to be competitive, but there are concerns about hidden costs and unusual policies that could negatively impact traders. A summary of AAX's trading fees compared to industry averages is provided below:

| Fee Type | AAX | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.06% (Maker) | 0.10% |

| Commission Model | Maker/Taker Fees | Varies (0.10%-0.25%) |

| Overnight Interest Range | N/A | Varies by Broker |

While AAX advertises low trading fees, the lack of clarity regarding additional costs, such as withdrawal fees or inactivity charges, can lead to unexpected expenses for traders. The absence of a demo account also limits users' ability to familiarize themselves with the platform before committing real funds. Given these factors, potential users should carefully consider whether AAX is safe for their trading activities.

Customer Fund Security

The safety of customer funds is paramount in the cryptocurrency space, and AAX's security measures warrant close examination. Currently, AAX does not provide segregated accounts for client funds, which means that users' assets may not be kept separate from the company's operational funds. This lack of segregation raises the risk of fund misappropriation in the event of financial instability.

Moreover, AAX has not established a robust investor protection scheme, which is typically a hallmark of regulated exchanges. The absence of negative balance protection also means that traders could potentially lose more than their initial investment. Historical incidents involving withdrawal suspensions and allegations of fund mismanagement further exacerbate concerns about whether AAX is a scam or if it can genuinely safeguard investors' assets.

Customer Experience and Complaints

Customer feedback is a crucial indicator of an exchange's reliability, and AAX has received mixed reviews from users. While some traders report positive experiences regarding the platform's functionality and trading options, others have raised serious complaints about withdrawal issues and customer support responsiveness. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Limited Channels |

| Account Access Problems | High | Unresolved |

Several users have reported being unable to withdraw their funds, with allegations that AAX imposes unreasonable conditions or fees on withdrawals. In some cases, customers have described a frustrating experience with customer support, citing long response times and inadequate resolutions. These patterns raise significant concerns about user trust and whether AAX is safe for trading.

Platform and Execution

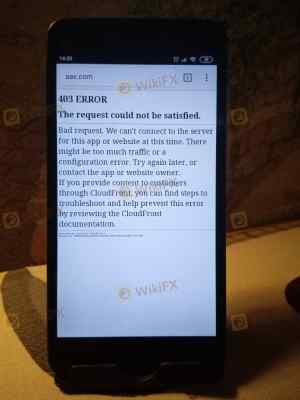

The performance and reliability of a trading platform are essential for a positive trading experience. AAX's platform is web-based and offers a mobile app, but user reviews indicate that it may not be as robust as competitors' offerings. Issues related to order execution, such as slippage and order rejections, have been reported by users, leading to questions about whether the platform can handle high trading volumes effectively.

Additionally, there are concerns about potential market manipulation or unfair practices, which can severely impact traders' experiences. Without clear evidence of effective oversight or regulatory compliance, users may wonder if AAX is a scam or if they are exposing themselves to unnecessary risks.

Risk Assessment

Trading with AAX involves several risks that potential users should be aware of. Below is a summary of key risk areas associated with using the platform:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Fund Security Risk | High | Lack of segregated accounts and investor protection. |

| Customer Service Risk | Medium | Reports of slow support and unresolved complaints. |

To mitigate these risks, traders should conduct thorough research before engaging with AAX. It is advisable to start with a small investment, remain informed about market conditions, and remain vigilant regarding any changes in the exchange's operational policies.

Conclusion and Recommendations

In conclusion, AAX presents several red flags that warrant caution. The lack of regulatory oversight, mixed customer feedback, and historical issues related to fund withdrawals raise significant concerns about whether AAX is a scam. While the platform offers competitive trading conditions and advanced technology, the risks associated with using AAX may outweigh the potential benefits.

For traders seeking a more secure trading environment, it may be prudent to consider alternative exchanges that are fully regulated and offer robust customer protection measures. Some reputable alternatives include Binance, Kraken, and Coinbase, which provide a more transparent and secure trading experience. Ultimately, traders should prioritize safety and due diligence when selecting a trading platform.

Is AAX a scam, or is it legit?

The latest exposure and evaluation content of AAX brokers.

AAX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AAX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.