Is MES safe?

Business

License

Is MES Safe or a Scam?

Introduction

In the ever-evolving landscape of the forex market, MES has emerged as a broker that claims to offer innovative trading solutions. Positioned as a platform for both novice and seasoned traders, MES promotes itself as a gateway to the world of forex trading. However, the rise of numerous fraudulent brokers in recent years necessitates a cautious approach for traders evaluating potential partners. This article aims to provide an objective analysis of whether MES is safe or a potential scam by investigating its regulatory status, company background, trading conditions, client security measures, customer experiences, and overall risk profile.

To arrive at a comprehensive conclusion, this investigation utilizes a blend of qualitative and quantitative research methods. By analyzing various reports, user reviews, and regulatory information, we aim to paint a clear picture of MES's operations and reputation in the forex trading community.

Regulatory Status and Legitimacy

The legitimacy of any forex broker largely hinges on its regulatory status. Regulatory bodies are essential for ensuring that brokers adhere to strict standards, providing a layer of protection for traders. In the case of MES, the broker claims to operate under various licenses. However, scrutiny reveals a more complex picture.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Not Available | United States | Suspicious Clone |

| FCA | Not Available | United Kingdom | Not Registered |

| ASIC | Not Available | Australia | Not Registered |

The above table showcases that MES lacks proper licensing from reputable regulatory bodies such as the NFA, FCA, or ASIC. This absence of regulatory oversight raises significant concerns about the broker's legitimacy. Moreover, reports suggest that MES may be operating as a "suspicious clone," a term used to describe brokers that impersonate legitimate firms to deceive traders. Given these findings, it is crucial for prospective traders to consider the implications of dealing with a broker that lacks robust regulatory backing.

The quality of regulation varies significantly across jurisdictions, with top-tier regulators enforcing stringent compliance measures. The absence of a regulatory framework for MES not only compromises the safety of traders' funds but also raises questions about the broker's operational integrity. Historical compliance issues and a lack of transparency further exacerbate concerns about whether MES is safe or simply a facade for potential fraudulent activities.

Company Background Investigation

An in-depth look at the company history and ownership structure of MES reveals a lack of transparency that is often associated with dubious operations. The broker's website provides minimal information regarding its founding, development trajectory, or any identifiable ownership. This opacity is alarming, as reputable brokers typically offer detailed insights into their corporate structure, management team, and operational history.

The management team behind MES is another area of concern. Without publicly available information about their professional backgrounds and expertise, it is challenging to assess their qualifications. The absence of identifiable leadership may indicate a lack of accountability, which is crucial for maintaining trust in the financial services industry.

Moreover, the company's transparency and information disclosure levels are alarmingly low. Traders typically expect brokers to provide comprehensive information about their services, fees, and operational practices. However, MES's reluctance to share critical details further fuels skepticism about its legitimacy. Given these factors, it becomes increasingly difficult to conclude that MES is safe for potential investors, as the lack of transparency often correlates with higher risks.

Trading Conditions Analysis

A broker's trading conditions and fee structures play a pivotal role in determining its attractiveness to traders. MES claims to offer competitive trading conditions; however, a closer examination reveals a more nuanced picture.

The overall fee structure of MES appears to be convoluted, with various hidden fees that may not be immediately apparent to traders. This lack of clarity can lead to unexpected costs, which can significantly impact trading profitability. Below is a comparative overview of MES's core trading costs against industry averages:

| Fee Type | MES | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (up to 3 pips) | 1-2 pips |

| Commission Model | Not Clearly Defined | $5 per lot |

| Overnight Interest Range | 0.5% - 1% | 0.5% |

The table indicates that MES's spread on major currency pairs can be as high as 3 pips, significantly above the industry average. Such elevated costs can erode traders' profits, particularly for those employing high-frequency trading strategies. Additionally, the ambiguity surrounding their commission structure raises red flags. Without a clear understanding of how commissions are applied, traders may find themselves facing unexpected charges.

Furthermore, any unusual or problematic fee policies can be indicative of a broker's overall integrity. The lack of transparency regarding commissions and spreads is a common tactic employed by unscrupulous brokers to exploit traders. Therefore, it is prudent for potential clients to question whether MES is safe given its unclear trading conditions.

Client Funds Security

The security of client funds is a paramount concern for any trader. MES claims to implement various measures to ensure the safety of its clients' investments. However, the effectiveness of these measures is questionable given the broker's overall lack of transparency.

An analysis of MES's fund safety measures reveals the following:

- Fund Segregation: It is unclear whether MES maintains segregated accounts for client funds, a practice that protects traders' investments in the event of the broker's insolvency.

- Investor Protection: Without proper regulation, it is unlikely that MES offers any investor protection schemes, which are typically mandated by regulatory bodies to safeguard client assets.

- Negative Balance Protection: There is no evidence to suggest that MES provides negative balance protection, a critical feature that prevents traders from losing more than their initial investment.

The absence of robust fund security measures raises significant concerns about the safety of trading with MES. Historical issues related to fund safety and disputes with clients further complicate the picture. Traders should approach any broker that lacks comprehensive security protocols with caution, as the potential for loss is considerably higher. Thus, the question remains: is MES safe for trading?

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. In the case of MES, reviews from users reveal a mixed bag of experiences, with a notable number of complaints surfacing.

Common complaint patterns include:

- Withdrawal Issues: Many users have reported difficulties in withdrawing funds, a red flag that often indicates deeper issues within a broker's operational practices.

- Unresponsive Customer Support: Clients have expressed frustration over the lack of timely responses from MES's customer support team, which can exacerbate problems when issues arise.

- Misleading Marketing Practices: Some traders have accused MES of employing deceptive marketing tactics that promise unrealistic returns.

The severity of these complaints can be summarized in the following table:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Lacking |

| Marketing Practices | High | No Acknowledgment |

Two typical case analyses highlight the concerns surrounding MES:

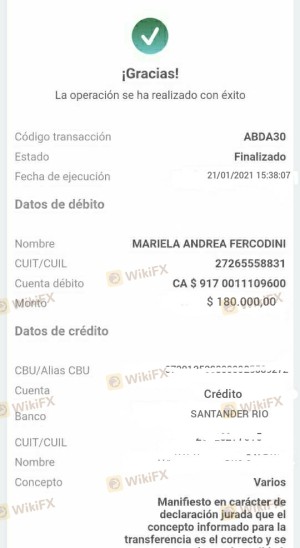

Case A: A trader deposited funds and successfully executed trades but encountered significant delays when attempting to withdraw profits. After multiple attempts to contact customer support, the trader received vague responses, leading to frustration and distrust.

Case B: Another user reported being lured by MES's marketing promises of high returns, only to find that the trading conditions were significantly different from what was advertised. This discrepancy led to losses and a feeling of betrayal.

- Conduct Thorough Research: Before engaging with MES, traders should assess the broker's reputation and seek feedback from existing users.

- Start Small: If traders choose to proceed, they should start with a small deposit to gauge the broker's reliability before committing larger sums.

- Evaluate Alternatives: Traders may want to consider alternative brokers with stronger regulatory backing and better customer reviews.

These complaints underscore the importance of conducting thorough research before engaging with any broker. The recurring issues with withdrawals and customer service raise serious questions about whether MES is safe for traders.

Platform and Execution

The performance and reliability of a trading platform are crucial for traders, as they directly impact execution quality and overall trading experience. MES claims to offer a robust trading platform; however, user experiences paint a different picture.

Users have reported several issues regarding platform stability, including unexpected downtime and slow execution speeds. These problems can severely hinder trading performance, particularly in volatile market conditions where timely execution is vital. Furthermore, instances of slippage and order rejections have been noted, which can lead to significant losses for traders.

The absence of any evidence suggesting platform manipulation is a positive, but the overall execution quality remains a concern. Traders should be cautious when considering MES as their broker, given the reported issues with platform performance.

Risk Assessment

Engaging with any broker carries inherent risks, and MES is no exception. A comprehensive risk assessment of MES reveals several key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of proper regulation raises significant concerns. |

| Fund Security | High | Unclear fund segregation and protection measures. |

| Customer Support | Medium | Reports of slow responses and unhelpful support. |

| Trading Conditions | High | Unclear fees and high spreads may impact profitability. |

To mitigate these risks, potential traders should consider the following recommendations:

Conclusion and Recommendations

In conclusion, the investigation into MES raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, transparency issues, and numerous customer complaints suggest that MES may not be a safe option for traders. The broker's ambiguous trading conditions and history of withdrawal issues further exacerbate these concerns.

For traders seeking a reliable forex broker, it is advisable to consider alternatives with robust regulatory frameworks, transparent practices, and positive user experiences. Brokers such as [Alternative Broker 1] and [Alternative Broker 2] offer stronger reputations and regulatory backing, making them safer choices for trading in the forex market.

Ultimately, the evidence suggests that potential traders should exercise caution when considering MES and prioritize their safety and security in the trading environment.

Is MES a scam, or is it legit?

The latest exposure and evaluation content of MES brokers.

MES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MES latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.