ldn global markets 2025 Review: Everything You Need To Know

Summary

LDN Global Markets is a mixed bag in the offshore forex brokerage industry. It presents both advantages and significant concerns that traders should consider carefully. In this ldn global markets review, the broker offers impressive maximum leverage of up to 1:500 and a wide range of tradable asset classes. These include forex, metals, cryptocurrencies, commodities, indices, and stocks, making it attractive for traders seeking diverse opportunities. However, its regulatory status raises questions about client protection. The broker is registered in Saint Vincent and the Grenadines, which provides limited oversight compared to major financial centers. User feedback has been notably divided on this platform. Some praise the broad market access while others express concerns about slow customer support and fund safety. Overall, LDN Global Markets targets active traders who seek versatility and higher risk-reward profiles. The broker has carved a niche among those willing to accept less rigid regulation in exchange for more flexible trading options.

Notice

It is important to note that LDN Global Markets operates under a relaxed regulatory regime. This is due to its registration in Saint Vincent and the Grenadines, which means oversight on forex trading is limited compared to stricter jurisdictions. The assessment in this review is based on publicly available information and user feedback. It aims to provide potential investors with a balanced perspective on what to expect. Users should be aware that while the broker offers high leverage and various assets, the weak regulatory framework might impact client protection. Information from industry reports and user experiences has been carefully analyzed for this review. However, prospective traders should conduct further research to ensure the broker's conditions align with their risk tolerance.

Scoring Framework

Broker Overview

LDN Global Markets was established in 2015. Since then, it has tried to make its mark in the competitive realm of offshore forex brokers, though with mixed results. The company is registered in Saint Vincent and the Grenadines and employs an operating structure typical of many offshore entities. It primarily targets traders who are looking for high leverage and a diverse array of trading options. Despite its limited regulatory protection, LDN Global Markets has managed to attract users who appreciate the flexibility of its trading conditions. Historical data shows that the broker focuses on creating an accessible trading environment, particularly for individuals with smaller starting capital who are willing to engage with high-leverage trading risks.

In terms of trading infrastructure, LDN Global Markets relies heavily on the MetaTrader 5 platform. This includes its web-based version, MT5 WebTrader, ensuring traders can access markets through both desktop and browser interfaces. The broker offers a wide spectrum of asset classes, from forex and precious metals to cryptocurrencies, commodities, indices, and stocks. However, the primary regulatory body for the firm is the Saint Vincent and the Grenadines International Financial Services Authority, which offers oversight that may not satisfy traders used to stricter regulatory environments. This ldn global markets review shows that while the broker's platform and asset diversity are advantages, the limited regulatory framework remains a fundamental concern.

-

Regulatory Region:

LDN Global Markets is regulated by the Saint Vincent and the Grenadines International Financial Services Authority. This implies more lenient oversight compared to major international regulators like the FCA or ASIC.

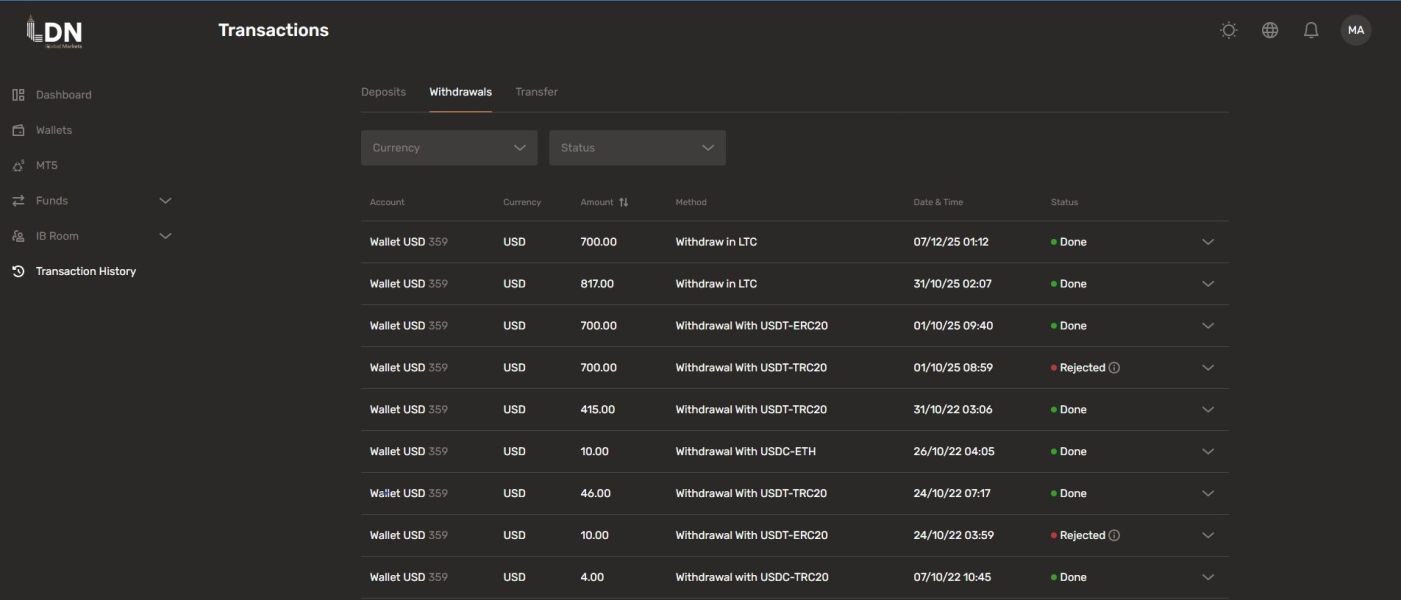

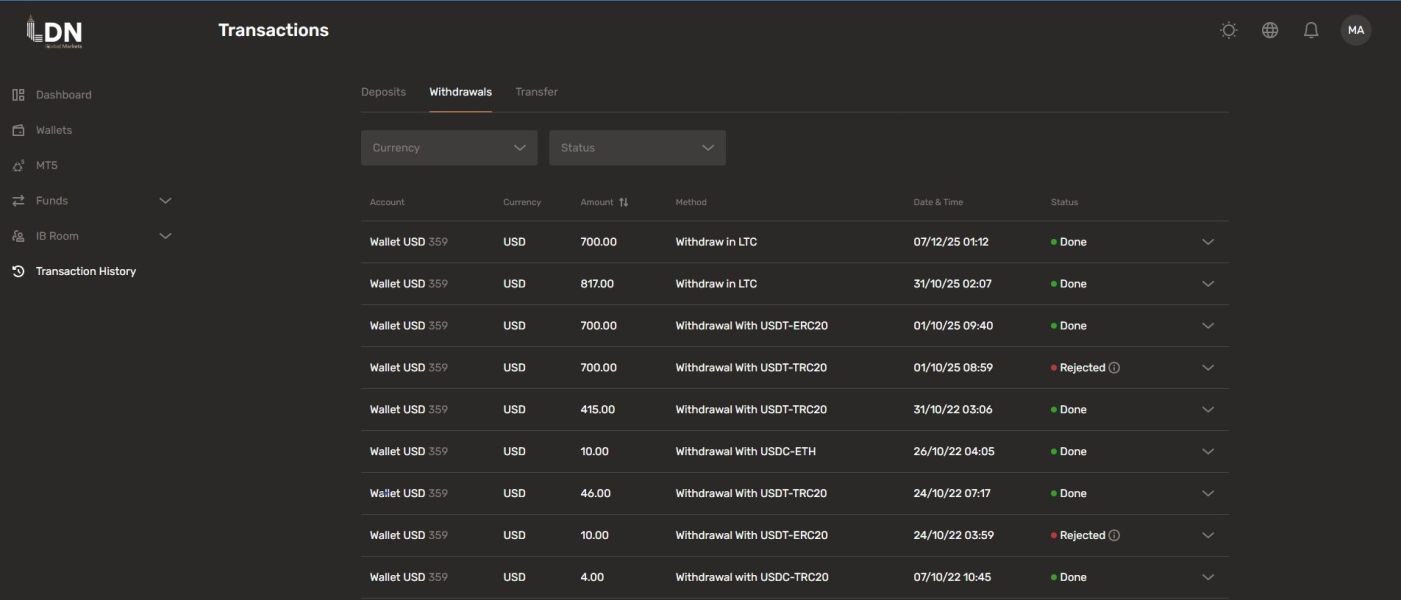

Deposit and Withdrawal Methods:

Specific details regarding deposit and withdrawal methods were not thoroughly detailed in available resources. This lack of transparency may concern potential clients who want clear information about funding their accounts.

Minimum Deposit Requirement:

The broker requires a minimum deposit of 100 USD. This makes it accessible to beginners who want to start trading with a relatively small amount.

Bonuses and Promotions:

Information regarding bonuses or promotional offers was not clearly detailed in available documentation. Traders looking for welcome bonuses or ongoing promotions may need to contact the broker directly.

Tradable Assets:

Traders can access various tradable assets including forex, precious metals, cryptocurrencies, commodities, indices, and stocks. This diversity allows for portfolio diversification across multiple markets and asset classes.

Cost Structure:

Detailed information on spreads and commissions was not provided in public information. This leaves uncertainty regarding overall cost structures, which is important for calculating potential profits and losses.

Leverage Ratio:

The broker offers maximum leverage of up to 1:500. This is among its major selling points, though it comes with significant risks that traders must understand.

Platform Options:

Trading is facilitated on the MetaTrader 5 platform and the MT5 WebTrader. This allows for both desktop and browser-based trading, giving users flexibility in how they access the markets.

Regional Restrictions:

Specific regional restrictions were not detailed in available information. Potential clients should verify whether their country of residence is accepted before opening an account.

Customer Service Language:

Detailed information regarding languages supported by customer service was not explicitly mentioned. This could be a barrier for non-English speaking traders who need support in their native language.

Detailed Scoring Analysis

2.6.1 Account Conditions Analysis

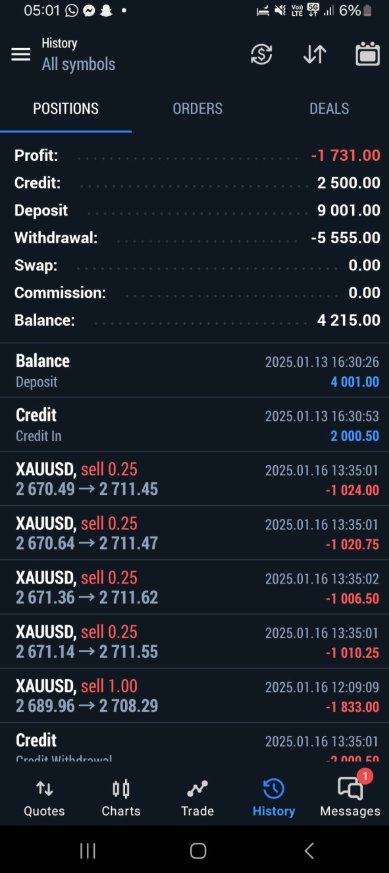

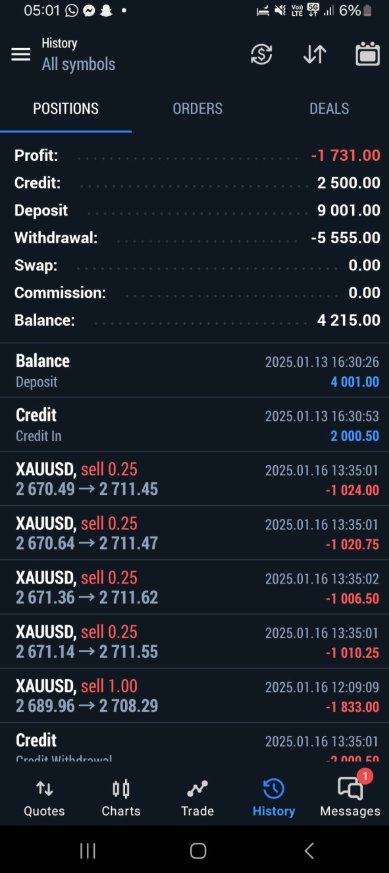

In our analysis of account conditions, LDN Global Markets offers an accessible entry point through a low minimum deposit requirement of 100 USD. This is particularly attractive to novice traders who want to start with limited capital. The broker's account conditions are further strengthened by high leverage up to 1:500, allowing traders to maximize their positions with relatively small deposits. However, the review shows that detailed information on spreads, commission structures, and potential additional fees is not provided clearly. This creates uncertainty about the true cost of trading with this broker. The simplicity of the account opening process remains unclear as data on registration and verification procedures are not detailed in public resources. Moreover, some users have expressed concerns over fund safety and overall account security, particularly given the offshore status of the firm. Compared to other brokers that provide transparent information on fee structures and account maintenance, LDN Global Markets' account conditions might seem less competitive to informed traders. This ldn global markets review highlights that while the low starting deposit is a significant advantage, the lack of detailed account-related information remains a notable drawback for potential investors.

LDN Global Markets provides a robust suite of trading tools primarily centered around the MetaTrader 5 platform. The platform is available both as a downloadable application and a web-based version called MT5 WebTrader. These tools include a wide array of technical indicators and charting capabilities that appeal to both beginner and advanced traders who rely on technical analysis. The platform also supports algorithmic trading via Expert Advisors and signal services, facilitating automated trading strategies for those who prefer systematic approaches. Despite these strengths, specifics regarding additional research and educational materials were not explicitly detailed in public resources. User feedback indicates that while the basic functionality of the MT5 platform is well-regarded, there remains room for improvement in overall research and analysis resources. The absence of in-depth educational content and regular market analysis from the broker limits its appeal to those seeking comprehensive trading support beyond just platform access. Nevertheless, the variety of asset classes available for trading and the overall flexibility of the tools provided contribute positively to the trading environment. This analysis in the ldn global markets review reflects a balanced view—solid platform functionality paired with a noticeable gap in supplementary educational and research resources.

2.6.3 Customer Service and Support Analysis

A critical area of concern for LDN Global Markets lies in its customer service and support capabilities. Users have repeatedly indicated that response times are slower than industry standards, which can be frustrating during urgent trading situations. Many complaints revolve around the perceived lack of proactive support and difficulty reaching representatives when needed. The absence of detailed information on communication channels, including specific contact methods and available languages, further complicates the customer support landscape for international clients. While some clients have reported satisfactory interactions when they eventually receive assistance, the overall sentiment suggests that support is inconsistent and occasionally unresponsive. Moreover, the broker does not provide clear documentation regarding the operational hours of its customer service team. This leaves traders uncertain about when they can expect help, which is particularly problematic for those trading in different time zones. Such deficiencies in customer support are especially concerning given the inherent risks associated with high-leverage trading environments where quick assistance may be crucial. This ldn global markets review underlines that unless significant improvements are made in the responsiveness and clarity of the support structure, potential clients may face serious issues during critical trading moments.

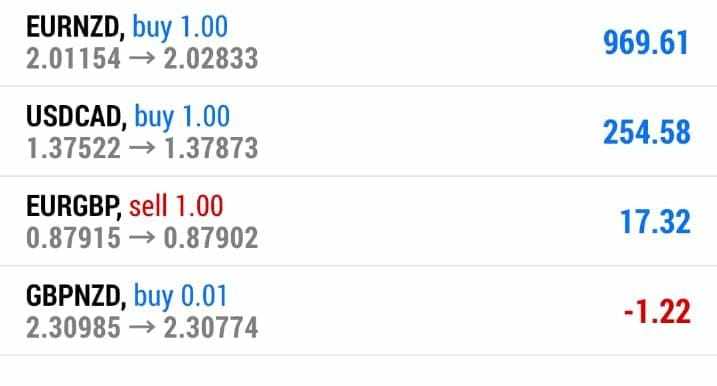

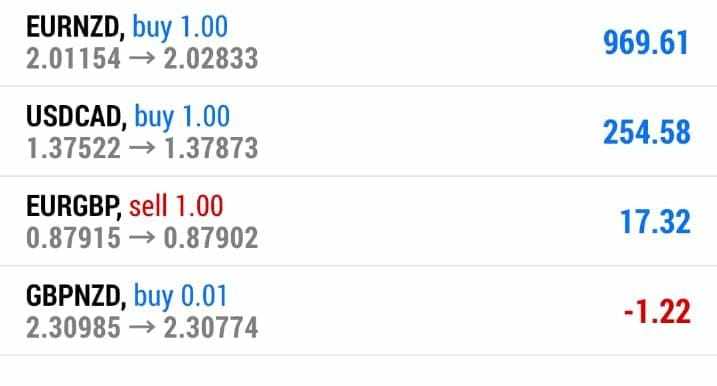

2.6.4 Trading Experience Analysis

The trading experience at LDN Global Markets is predominantly defined by its use of the MetaTrader 5 platform. This is a well-known and widely used platform in the forex industry that most traders find familiar. Users have noted that the overall functionality of the platform, including its technical analysis tools and execution speed, is solid yet not exceptional compared to premium brokers. While many traders appreciate the broad range of available assets and the ability to execute automated strategies via Expert Advisors, feedback regarding platform stability varies widely among users. Some users have reported smooth order execution and efficient trade management, whereas others have encountered issues such as occasional lags and unexpected technical glitches during volatile market conditions. Additionally, the missing details on cost structures, including spreads and slippage occurrences, contribute to uncertainty in the trading environment. The lack of transparency around these trading costs, combined with occasional platform performance issues, means that while the trading interface is familiar and user-friendly, it does not fully meet the expectations of those looking for premium trading experiences. This segment of the ldn global markets review clearly indicates that while the trading platform offers essential features that most traders need, significant enhancements in stability and cost transparency are needed to improve overall trading satisfaction.

2.6.5 Trustworthiness Analysis

Trustworthiness is arguably the most pressing concern when evaluating LDN Global Markets as a potential broker. Despite being regulated by the SVG FSA, the regulatory oversight is known to be limited, which inherently raises serious concerns about the robustness of investor protection and fund security. Many users have expressed apprehensions about the safety of their capital, with some reporting incidents of fund loss that have not been addressed transparently by the broker's management. The company's operational transparency—especially in terms of financial reporting and risk management practices—remains vague and insufficiently detailed for thorough evaluation. Compared to brokers operating under stricter regulatory bodies like the FCA, ASIC, or CySEC, LDN Global Markets lags significantly behind in offering the confidence that many experienced traders expect from their chosen broker. This ldn global markets review draws on multiple sources to suggest that while the broker's high leverage and diverse trading options might be appealing to some traders, the underlying trust issues and reported negative incidents are significant deterrents for risk-averse investors. The lack of a comprehensive and robust regulatory framework continues to be a critical red flag for those who prioritize financial security and regulatory compliance above all other considerations.

2.6.6 User Experience Analysis

User experience with LDN Global Markets presents a decidedly mixed picture that varies significantly among different types of traders. On one hand, the interface provided by the MT5 platform is regarded as intuitive and user-friendly, particularly for those already familiar with industry-standard trading software. The seamless integration of multiple asset classes and the availability of both desktop and web-based solutions enhance the overall appeal for technologically adept traders who value flexibility in their trading setup. However, many users have highlighted several areas that need substantial improvement to meet modern standards. The registration and account verification processes are not well-documented, leading to frustrations among new users who expect clear guidance through these initial steps. Moreover, the handling of funds—especially deposits and withdrawals—lacks transparency, which compounds existing issues when combined with slow customer support responses that leave users waiting for answers. Although some traders have successfully navigated these challenges and report overall satisfaction with the trading tools and execution quality, the prevailing negative feedback relating to service responsiveness and unclear operational protocols cannot be overlooked by potential new clients. This ldn global markets review underscores that while the visual and functional aspects of the platform are commendable and meet basic trading needs, substantial improvements in service delivery and process transparency would be essential for elevating the overall user experience to competitive industry standards.

Conclusion

In conclusion, LDN Global Markets offers certain attractive features that may appeal to specific types of traders. These include high leverage of up to 1:500 and access to diverse asset classes across multiple markets. However, as an offshore broker regulated by the SVG FSA, it suffers from notable drawbacks that cannot be ignored by prudent investors. These include a weak regulatory framework, slow and sometimes ineffective customer service, and serious concerns regarding transparency of cost structures and fund safety. This detailed ldn global markets review suggests that while the broker may appeal to traders seeking high-risk, high-reward environments, those who prioritize stringent regulatory protection and robust customer support should definitely explore alternative options with stronger oversight. Overall, it is best suited for experienced traders who can navigate the complexities of offshore brokerage operations while effectively managing the inherent risks that come with such arrangements.