Is Explore safe?

Business

License

Is Explore Safe or Scam?

Introduction

Explore is a forex and cryptocurrency broker that has recently gained attention in the trading community. Positioned as a platform for both novice and experienced traders, it claims to offer competitive trading conditions and a user-friendly interface. However, the influx of new brokers in the forex market has raised concerns among traders, making it imperative to evaluate the legitimacy and safety of these platforms thoroughly. This article aims to investigate whether Explore is a scam or a safe trading option by assessing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory environment is a crucial aspect in determining the safety of any forex broker. A well-regulated broker is typically subject to stringent oversight, which can provide traders with a layer of protection. As for Explore, it is essential to note that there is no clear evidence of regulation from recognized financial authorities. This absence of regulatory oversight raises significant red flags about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The lack of a regulatory framework means that traders using Explore may have limited recourse in the event of disputes or financial losses. Regulatory bodies like the FCA (UK), ASIC (Australia), and CySEC (Cyprus) provide essential protections for traders, including compensation schemes and strict operational guidelines. Without such oversight, the risk of encountering fraud or mismanagement increases significantly. Furthermore, past complaints about unregulated brokers often highlight issues such as difficulty in withdrawing funds, which is a critical concern for potential investors. Thus, it is prudent for traders to exercise caution and consider these regulatory aspects when evaluating if Explore is safe.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its reliability. Explores history is somewhat opaque, with limited information available regarding its establishment, ownership structure, and operational history. This lack of transparency can be alarming, as reputable brokers typically provide detailed information about their management teams and corporate governance.

The management teams background is another critical factor. A broker led by experienced professionals with a proven track record in finance and trading is generally more trustworthy. Unfortunately, Explore does not provide sufficient information about its team, which raises questions about the expertise and reliability of its leadership.

In terms of transparency, Explore has not made available comprehensive details about its operations, financial health, or any affiliations with established financial institutions. This opacity can be a significant warning sign, as it often indicates a lack of accountability. Therefore, potential traders should consider these factors seriously when asking, "Is Explore safe?"

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Explore claims to provide competitive spreads and low fees; however, the absence of clear and transparent pricing structures makes it challenging to evaluate its trading conditions accurately.

| Fee Type | Explore | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific data regarding spreads and commissions is concerning. Industry standards typically indicate that regulated brokers provide clear information about their fees and commissions, allowing traders to make informed decisions. The absence of this information on Explore's platform may suggest hidden fees or unfavorable trading conditions that could adversely affect traders' profitability.

Moreover, any unusual fee policies, such as excessive withdrawal fees or inactivity charges, should also be scrutinized. If Explore implements such policies, it could be a tactic to limit traders' ability to access their funds, further raising concerns about its safety and reliability. Therefore, when considering if Explore is safe, potential traders should be wary of these ambiguous trading conditions.

Client Fund Security

The security of client funds is paramount when evaluating a forex broker. Traders need assurance that their money is protected and that the broker has robust measures in place to safeguard their investments. Explore's website lacks detailed information about its fund security protocols, which is a significant concern.

In many reputable brokers, client funds are kept in segregated accounts, separate from the company's operational funds. This practice ensures that in the event of insolvency, client funds remain protected. Additionally, many regulated brokers offer investor protection schemes that cover a certain amount of losses in the event of a broker failure. Unfortunately, Explore has not provided any evidence of such measures.

Moreover, the absence of negative balance protection is another critical point of concern. This policy protects traders from losing more than their initial investment, a feature that is standard among regulated brokers. Without this safeguard, traders using Explore could face significant financial risks.

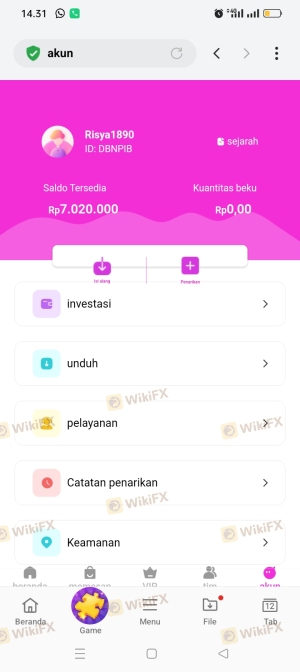

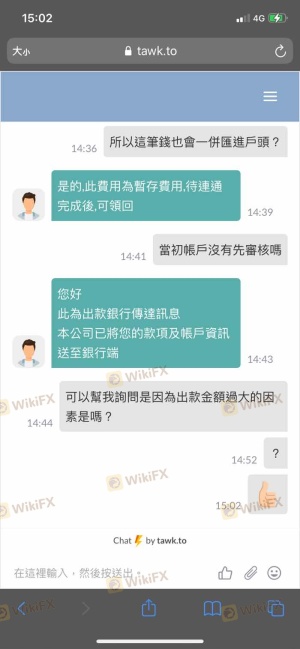

Customer Experience and Complaints

Customer feedback often provides valuable insights into a broker's reliability and service quality. In the case of Explore, a review of user experiences reveals a pattern of complaints regarding withdrawal issues and unresponsive customer service. Many users have reported difficulties in accessing their funds after making requests, which is a common red flag associated with potentially fraudulent brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Platform Issues | Low | Average |

For example, several users have shared experiences where their withdrawal requests were delayed for weeks, and customer support provided vague responses. Such complaints are serious and indicate that Explore may not prioritize customer satisfaction or transparency.

Additionally, the lack of a robust support system can exacerbate issues for traders, leaving them frustrated and uncertain about their investments. Therefore, when asking, "Is Explore safe?" it is essential to consider these negative experiences and the potential risks they pose to traders.

Platform and Execution

The performance of a trading platform is crucial for a smooth trading experience. Explore claims to offer a user-friendly interface; however, user reviews suggest that the platform may suffer from stability issues and slow execution speeds. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

A reliable trading platform should provide fast execution, minimal slippage, and a seamless user experience. If Explore fails to meet these standards, it could hinder traders' ability to execute their strategies effectively. Furthermore, any signs of platform manipulation, such as frequent disconnections during volatile market conditions, could indicate deeper issues within the broker's operations.

Risk Assessment

Using Explore as a trading platform involves several risks that potential traders should be aware of. The absence of regulation, combined with customer complaints and unclear trading conditions, raises the overall risk profile of this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation from recognized authorities |

| Financial Risk | High | Unclear fund security measures |

| Operational Risk | Medium | Platform stability and execution issues |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should consider starting with a small investment, conducting thorough research, and exploring alternative brokers with a proven track record. Engaging with well-regulated brokers can provide a safer trading environment and reduce exposure to potential scams.

Conclusion and Recommendations

In conclusion, the investigation into Explore raises significant concerns regarding its legitimacy and safety. The absence of regulatory oversight, coupled with negative customer experiences and unclear trading conditions, suggests that this broker may not be a safe option for traders.

For those looking to engage in forex or cryptocurrency trading, it is advisable to consider more established and regulated brokers with transparent operations and positive customer feedback. Options such as Fidelity, Charles Schwab, and TD Ameritrade are recommended alternatives that provide a safer trading environment and robust customer support.

Ultimately, when evaluating "Is Explore safe?" the evidence suggests that potential traders should proceed with caution and consider alternative options to safeguard their investments.

Is Explore a scam, or is it legit?

The latest exposure and evaluation content of Explore brokers.

Explore Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Explore latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.