Carlton 2025 Review: Everything You Need to Know

Executive Summary

Carlton Brokers presents itself as a financial services provider with claimed decades of industry experience. The company positions itself as a multi-generational family business focused on delivering quality financial services to its clients. However, this carlton review reveals significant transparency challenges that potential traders should carefully consider before making any decisions. While the company markets itself as an award-winning organization committed to providing superior service to all clients, our analysis finds substantial gaps in publicly available information regarding crucial trading conditions, regulatory oversight, and operational details that traders need to know.

The broker appears to target traders seeking established, experienced financial service providers. These traders particularly value the stability associated with long-standing family businesses that have weathered various market conditions over time. However, the lack of detailed information about trading platforms, account types, regulatory compliance, and fee structures raises important questions about transparency and accessibility for modern retail traders who expect comprehensive disclosure.

Based on available information, Carlton Brokers may appeal to clients who prioritize relationship-based service delivery over detailed technical specifications. Though this approach may not suit traders who require comprehensive disclosure of trading conditions and regulatory protections before committing to a broker relationship that could last for years.

Important Notice

This evaluation is based on limited publicly available information. Significant details about Carlton's operations, regulatory status, and trading conditions remain unclear from accessible sources that we could review. Traders should be aware that the absence of comprehensive regulatory information and detailed trading specifications may impact the reliability assessment of this broker, particularly for international clients seeking transparent regulatory oversight and protection for their investments.

Our review methodology relies on available public information and industry feedback. But it may be limited by information gaps that could affect the completeness of this assessment in ways that potential clients should understand. Potential clients are strongly advised to conduct independent verification of regulatory status and trading conditions before engaging with this broker for any financial services or trading activities.

Rating Framework

Broker Overview

Carlton Brokers markets itself as an established financial services provider with purported decades of industry experience. The company operates as what they describe as a third-generation family business that has served clients across multiple market cycles and economic conditions. The company positions itself in the market as an award-winning organization dedicated to delivering quality financial services to traders and investors who value experience and stability over flashy marketing campaigns.

Though specific details about these awards and recognition remain unspecified in available documentation that we could access during our research. The broker's business model appears to emphasize relationship-based service delivery, leveraging claimed long-term industry experience to attract clients who value stability and established market presence over newer fintech alternatives. However, the lack of specific founding dates, detailed company history, or verifiable operational milestones makes it challenging to independently confirm the scope and duration of their market presence in the competitive financial services industry.

According to available information, Carlton operates in the financial services sector with a focus on providing trading and investment services. Though specific details about trading platforms, asset coverage, and regulatory jurisdictions remain unclear from publicly accessible sources that potential clients can review. This carlton review finds that while the company promotes itself as experienced and client-focused, the absence of detailed operational information may limit its appeal to traders who require comprehensive disclosure before selecting a broker for their trading activities.

Regulatory Oversight: Specific regulatory information is not clearly detailed in available materials. This represents a significant transparency gap for potential clients seeking verified regulatory protection and oversight from recognized financial authorities.

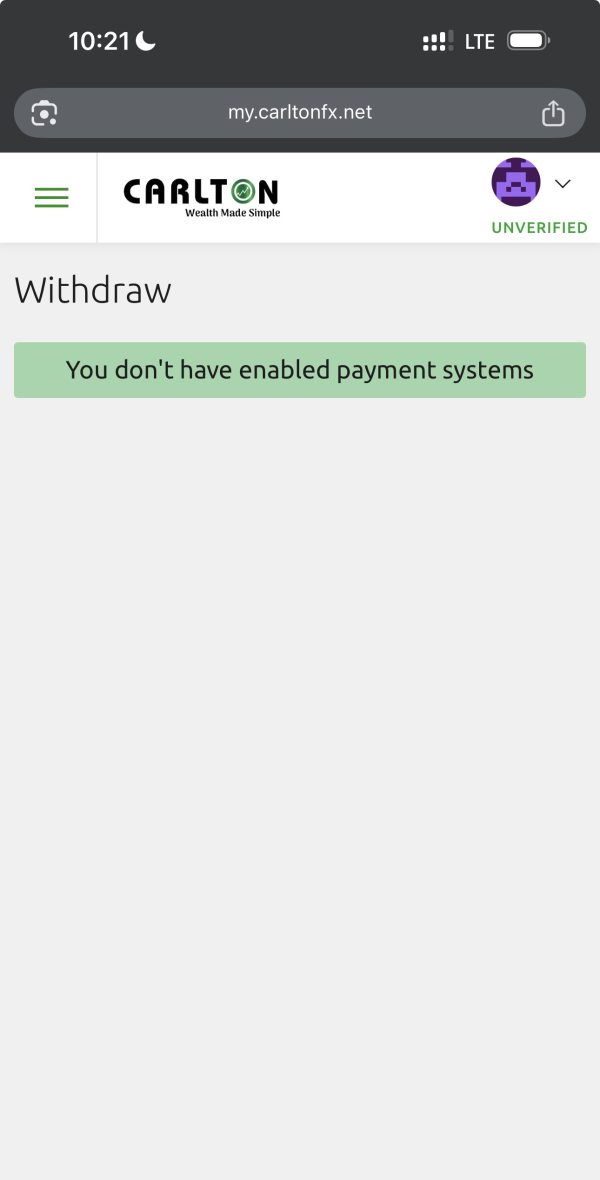

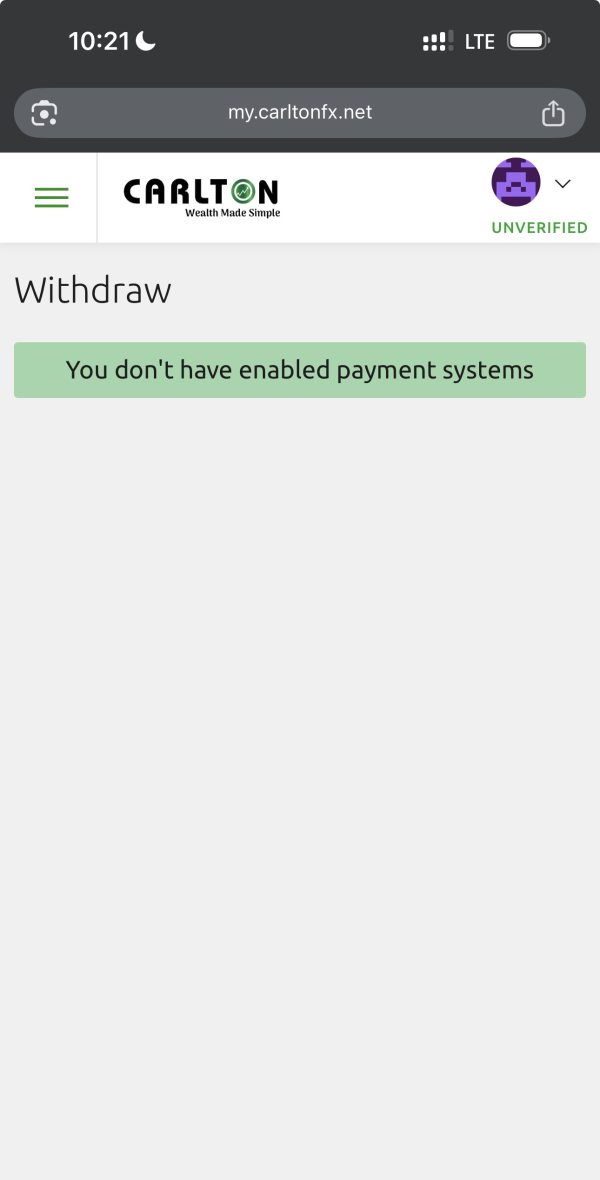

Deposit and Withdrawal Methods: Information about supported payment methods, processing times, and associated fees is not comprehensively detailed in accessible documentation. This potentially limits client planning capabilities and creates uncertainty about transaction processes that traders need to understand.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not clearly specified in available materials. This makes it difficult for potential clients to assess accessibility and plan their initial investment amounts accordingly.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional programs are not extensively covered in available information. This limits insight into potential client benefits and competitive advantages that Carlton might offer to new traders.

Tradeable Assets: The range of available instruments, including forex pairs, commodities, indices, and other financial products, is not comprehensively detailed in accessible materials. Traders need this information to determine if the broker supports their preferred trading strategies and market interests.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not clearly outlined in available documentation. This represents a significant transparency concern for cost-conscious traders who need to calculate potential trading expenses accurately.

Leverage Options: Maximum leverage ratios and margin requirements are not specifically detailed in accessible materials. This limits assessment of trading flexibility and risk management options available to different types of traders.

Platform Selection: Information about available trading platforms, mobile applications, and technical capabilities is not comprehensively covered in available sources. Modern traders typically require detailed platform specifications to evaluate whether the technology meets their trading needs and preferences.

Geographic Restrictions: Specific details about restricted territories and regional limitations are not clearly outlined in accessible documentation. International traders need this information to determine if they can legally access Carlton's services from their location.

Customer Support Languages: Information about multilingual support capabilities and communication options is not extensively detailed in available materials. Though this carlton review notes this as an important consideration for international clients who may require support in their native language.

Detailed Rating Analysis

Account Conditions Analysis

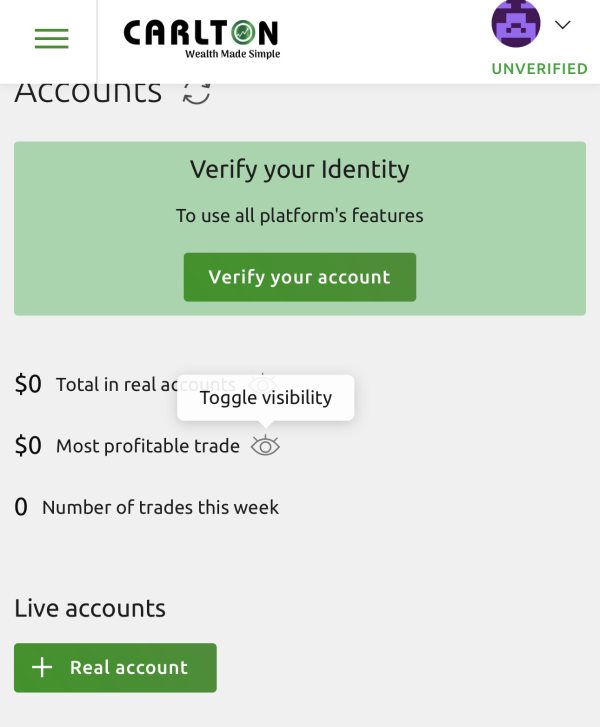

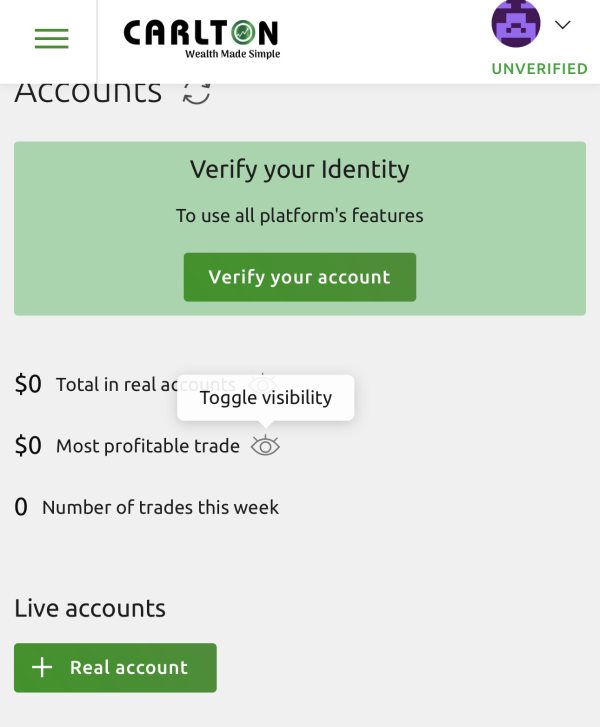

The assessment of Carlton's account conditions is significantly hampered by limited publicly available information about account types, minimum requirements, and specific features. Without clear details about different account tiers, their respective benefits, or qualification criteria, potential clients face substantial uncertainty when evaluating whether Carlton's offerings align with their trading needs and financial capabilities that vary widely among different types of traders.

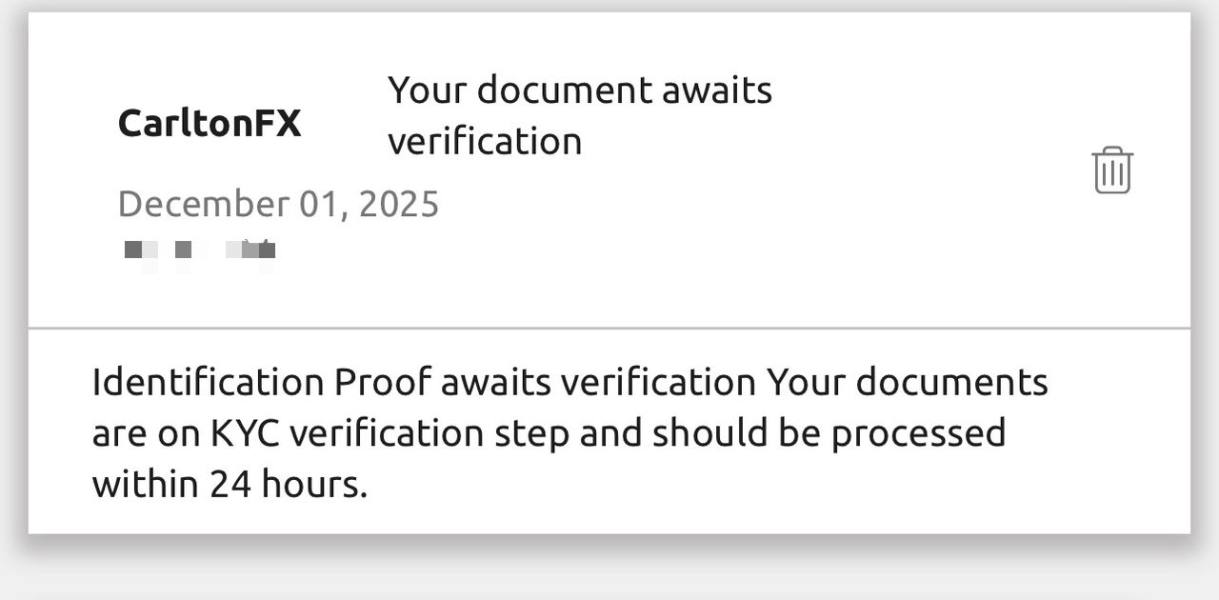

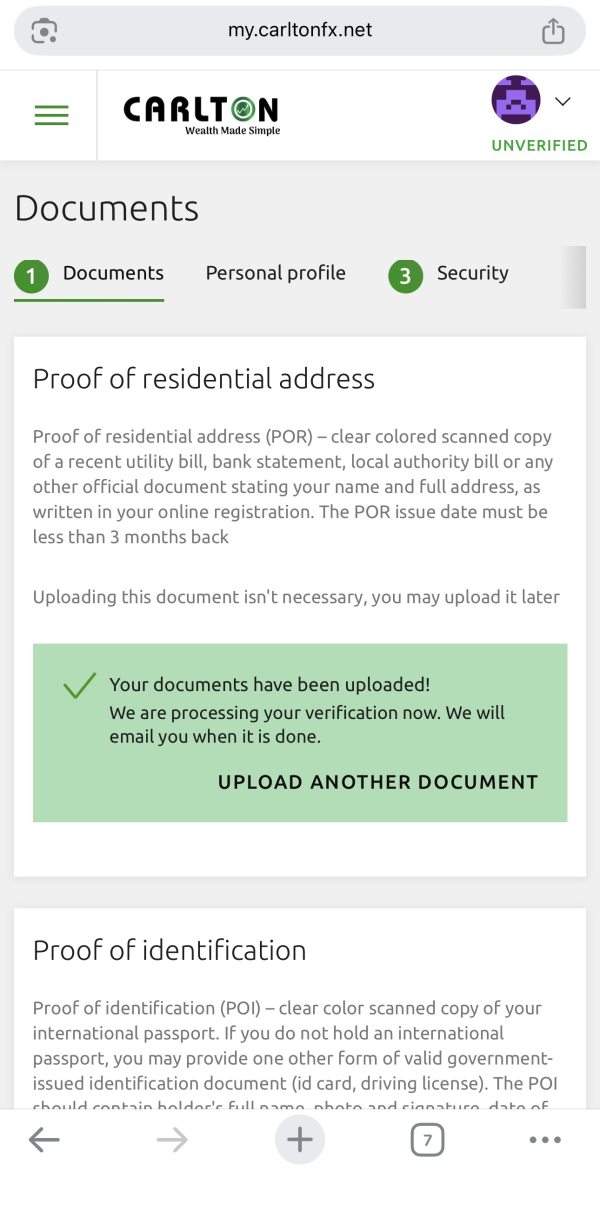

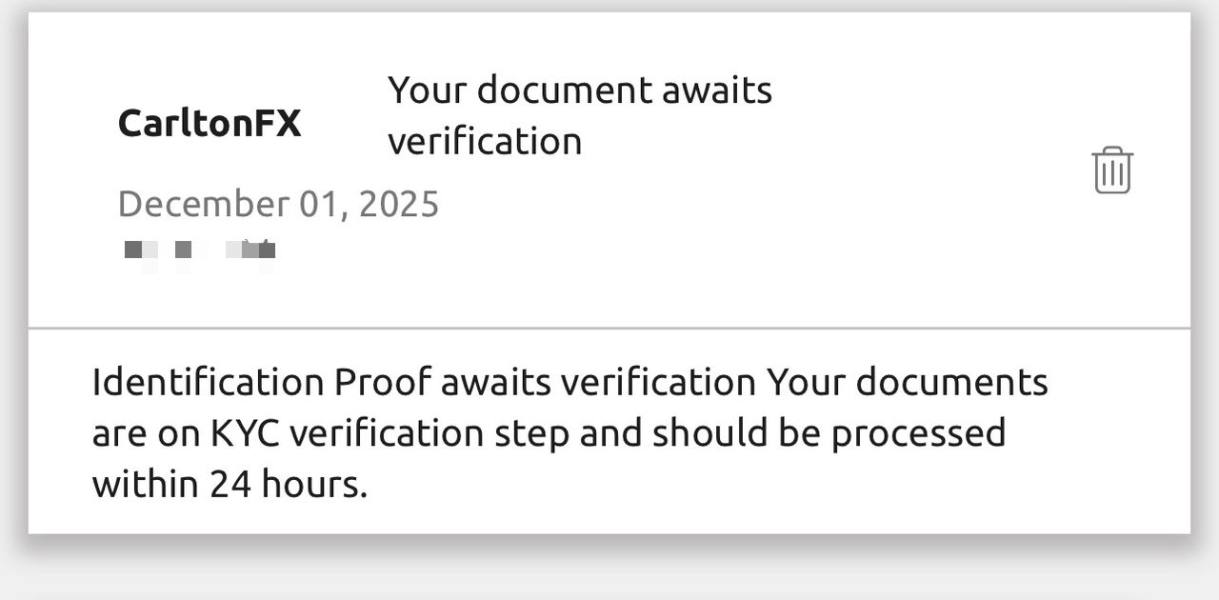

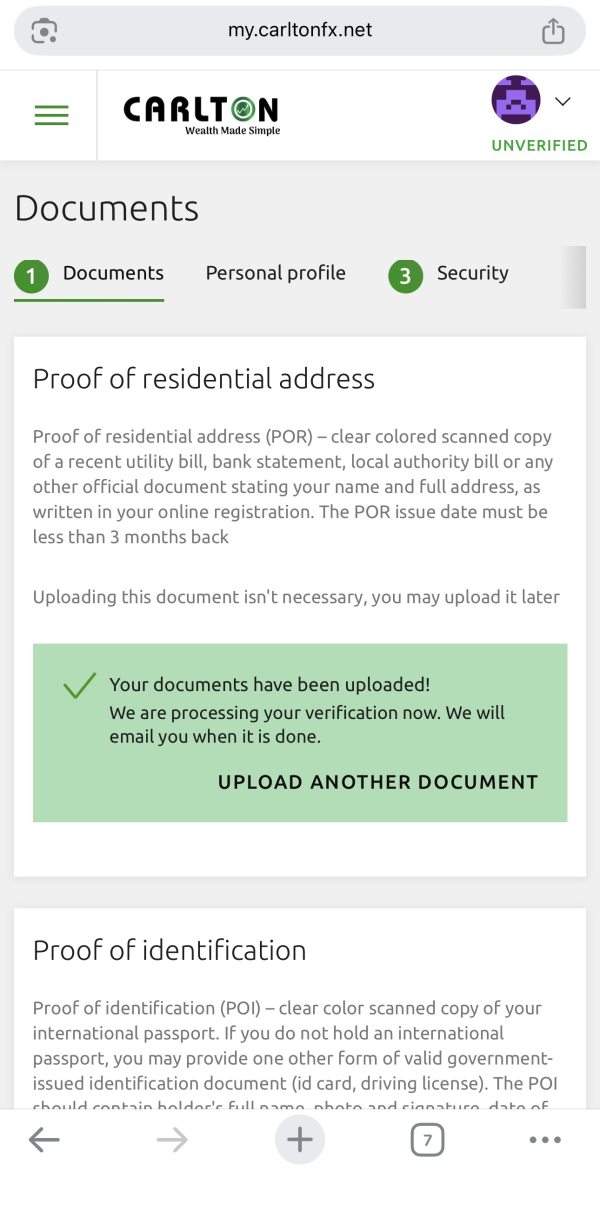

The absence of transparent information about account opening procedures, verification requirements, and documentation needs creates additional barriers for prospective clients seeking to understand the onboarding process. Furthermore, the lack of specific details about special account features, such as Islamic accounts for Muslim traders or professional accounts for qualified investors, limits the broker's apparent accessibility to diverse trader segments who have specific religious or regulatory requirements.

This carlton review finds that the opaque nature of account condition disclosure may deter modern retail traders who typically expect comprehensive information about account specifications before committing to a broker relationship. The limited transparency in this crucial area contributes to overall concerns about the broker's commitment to clear communication with potential clients who deserve full disclosure.

Carlton's trading tools and analytical resources remain largely unspecified in available documentation. This creates significant uncertainty about the technological capabilities offered to clients who rely on sophisticated analysis and trading tools. Without clear information about trading platforms, charting tools, technical indicators, or automated trading support, potential clients cannot adequately assess whether the broker's technological infrastructure meets their trading requirements and expectations for modern financial services.

The absence of detailed information about research provision, market analysis, educational resources, or economic calendars further limits the ability to evaluate Carlton's value proposition for traders who rely on comprehensive analytical support. Modern traders typically expect access to sophisticated tools and educational materials that help them make informed trading decisions, and the lack of transparency in this area may impact the broker's competitiveness in the current market environment.

Additionally, without specific details about mobile trading capabilities, API access, or third-party platform integration, technically oriented traders may find it difficult to determine whether Carlton's offerings support their preferred trading methodologies and technological requirements. These features have become standard expectations in the modern trading industry.

Customer Service and Support Analysis

Information about Carlton's customer service capabilities, including available communication channels, response times, and support quality, is not comprehensively detailed in accessible materials. This lack of transparency about support infrastructure creates uncertainty for potential clients who prioritize responsive and effective customer assistance when they encounter issues or have questions about their trading activities.

Without specific details about support availability hours, multilingual capabilities, or specialized assistance for different client segments, traders cannot adequately assess whether Carlton's service model aligns with their support expectations and requirements. The absence of information about problem resolution procedures or escalation processes further complicates service quality evaluation for clients who may need assistance with complex issues or disputes.

The limited transparency about customer service capabilities may particularly concern international clients or those trading outside standard business hours. These traders require assurance about accessible and responsive support when needed, especially during volatile market conditions when quick assistance can be crucial.

Trading Experience Analysis

The evaluation of Carlton's trading experience is significantly limited by the absence of detailed information about platform stability, execution quality, order processing capabilities, and overall trading environment characteristics. Without access to specific performance metrics, latency data, or execution quality statistics, potential clients cannot adequately assess the technical quality of the trading experience that directly impacts their trading results and satisfaction.

The lack of information about available order types, execution methods, or trading tools further complicates the assessment of whether Carlton's trading environment supports sophisticated trading strategies or meets the requirements of active traders. Additionally, without details about mobile trading capabilities or platform accessibility, modern traders may find it difficult to evaluate convenience and flexibility that have become essential features in today's fast-paced trading environment.

This carlton review notes that the limited transparency about trading experience fundamentals may significantly impact Carlton's appeal to experienced traders who require detailed technical specifications and performance data when selecting a broker for active trading activities. These traders often compare multiple brokers based on specific technical criteria before making their final decision.

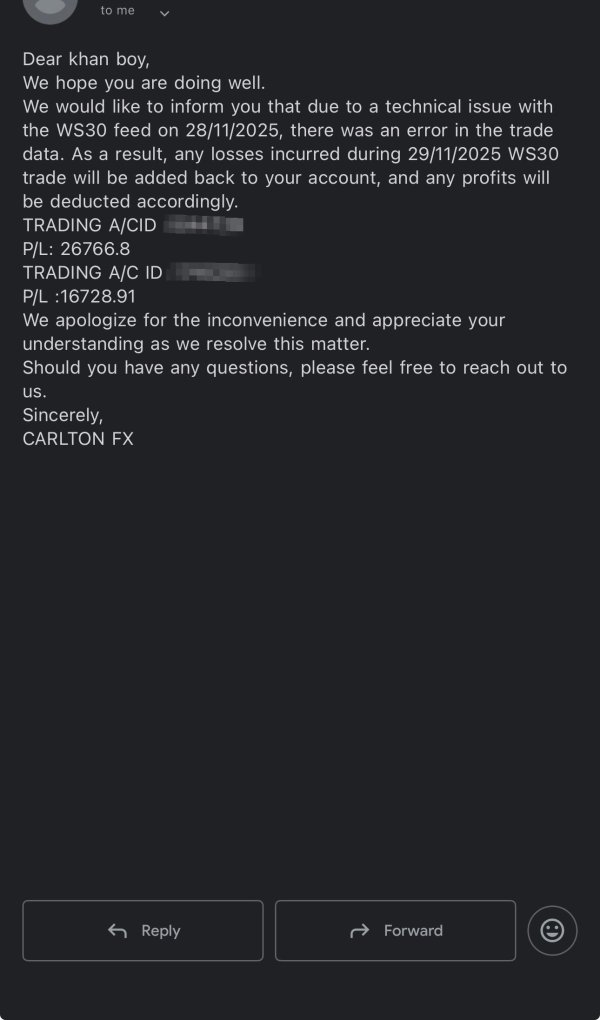

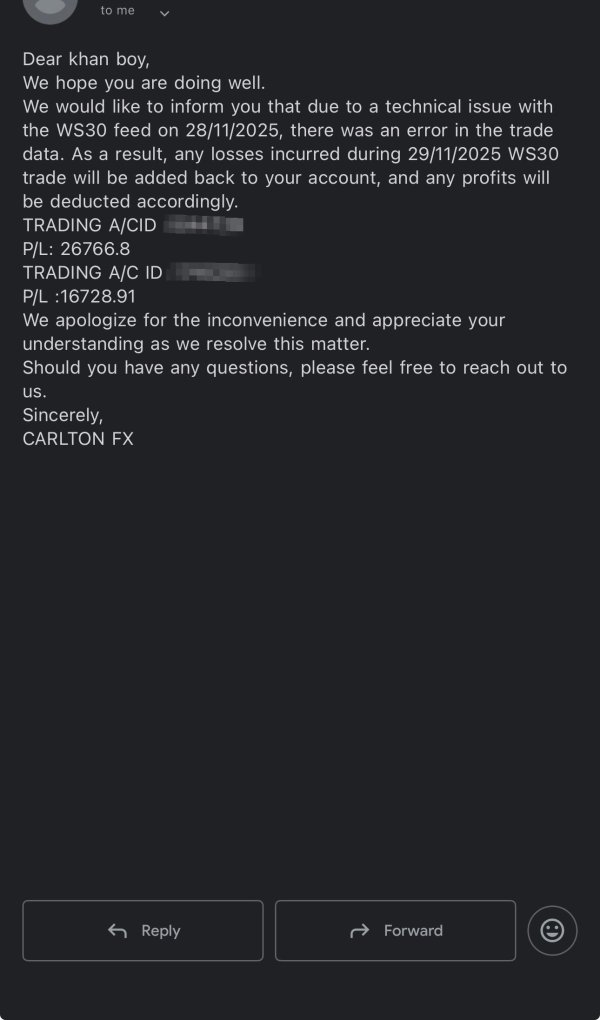

Trust and Reliability Analysis

Carlton's trust and reliability assessment faces significant challenges due to limited transparent information about regulatory oversight, compliance measures, and operational verification. While the company promotes itself as an award-winning organization with substantial industry experience, the absence of specific regulatory details, license numbers, or verifiable compliance information creates substantial uncertainty about oversight and protection levels that clients can expect.

The lack of clear information about client fund segregation, deposit protection schemes, or dispute resolution mechanisms further complicates the reliability assessment for potential clients seeking assured financial protection. Additionally, without access to detailed company financial information or third-party verification of operational claims, independent assessment of stability and reliability becomes challenging for clients who want to verify the broker's claims about their experience and capabilities.

The limited transparency in these fundamental trust areas may particularly concern risk-conscious traders who prioritize verified regulatory protection and clear operational oversight when selecting a financial services provider. These traders often require extensive documentation and verification before trusting a broker with their trading capital.

User Experience Analysis

The assessment of Carlton's overall user experience is constrained by limited available feedback, interface information, and detailed client journey documentation. Without access to comprehensive user testimonials, satisfaction surveys, or detailed descriptions of the client onboarding and ongoing service experience, it becomes difficult to evaluate how well Carlton meets modern trader expectations for service quality and user satisfaction.

The absence of detailed information about account management tools, client portal capabilities, or self-service options further limits the ability to assess convenience and accessibility for different user types. Additionally, without specific feedback about common user challenges or satisfaction levels, potential clients cannot adequately gauge likely experience quality that they might expect if they choose to trade with Carlton.

The limited transparency about user experience elements may impact Carlton's appeal to modern traders who typically expect detailed insight into service quality and client satisfaction levels before committing to a broker relationship. These traders often research extensively and read reviews from other clients before making their broker selection decision.

Conclusion

Carlton Brokers presents itself as an experienced financial services provider with claimed decades of industry experience. But this comprehensive evaluation reveals significant transparency gaps that potential clients should carefully consider before making any trading decisions. While the company markets itself as an established, award-winning organization focused on quality service delivery, the limited availability of crucial information about trading conditions, regulatory oversight, and operational details creates substantial uncertainty for prospective traders who need comprehensive information to make informed choices.

The broker may appeal to clients who prioritize relationship-based service and value claimed long-term industry experience over detailed technical specifications and transparent operational disclosure. However, modern retail traders who expect comprehensive information about trading costs, platform capabilities, regulatory protection, and service quality may find Carlton's limited transparency challenging and potentially concerning for their trading activities.

The primary advantages appear to be claimed industry experience and family business stability that some traders value highly. While significant disadvantages include insufficient transparency about regulatory status, trading conditions, and operational details that modern traders typically require for informed broker selection in today's competitive marketplace.