Admiral TRADERS Review 5

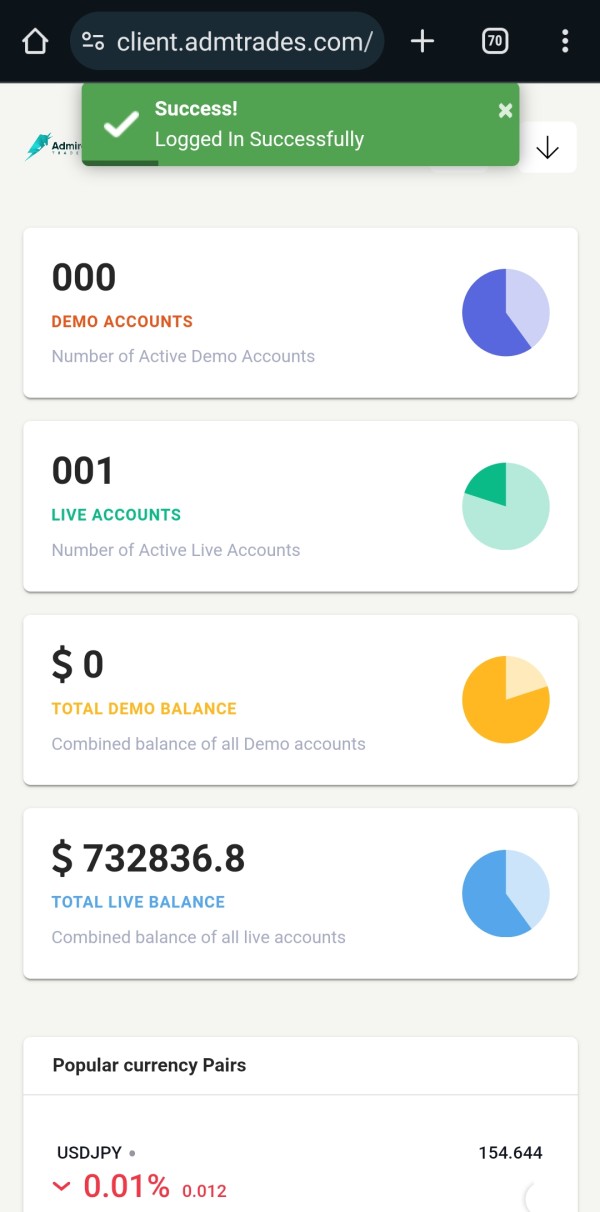

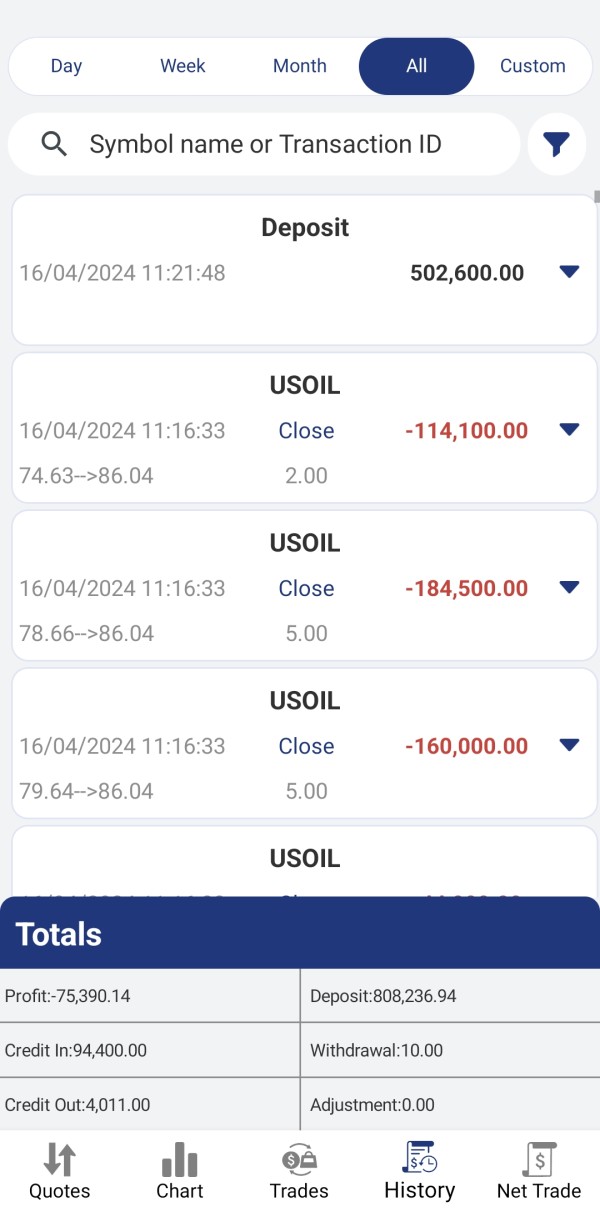

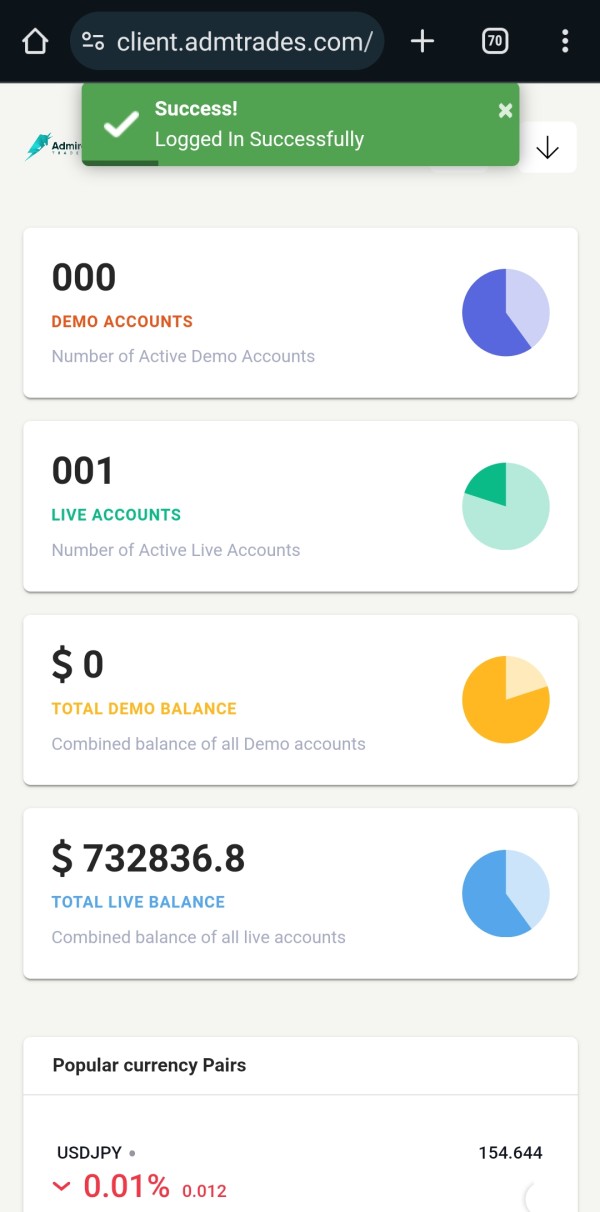

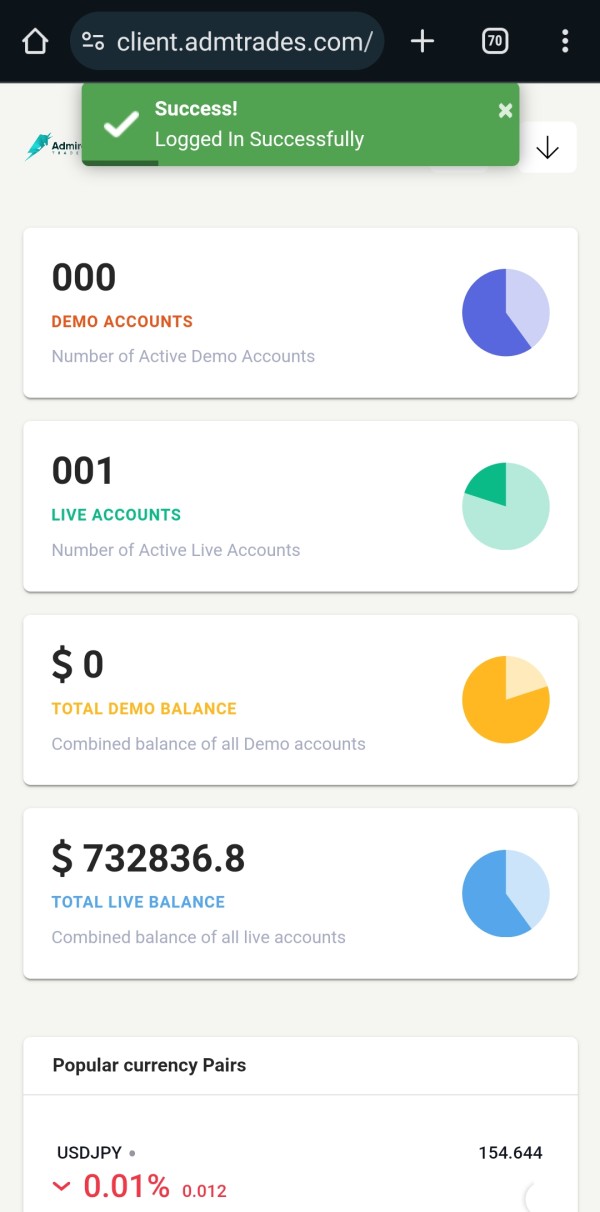

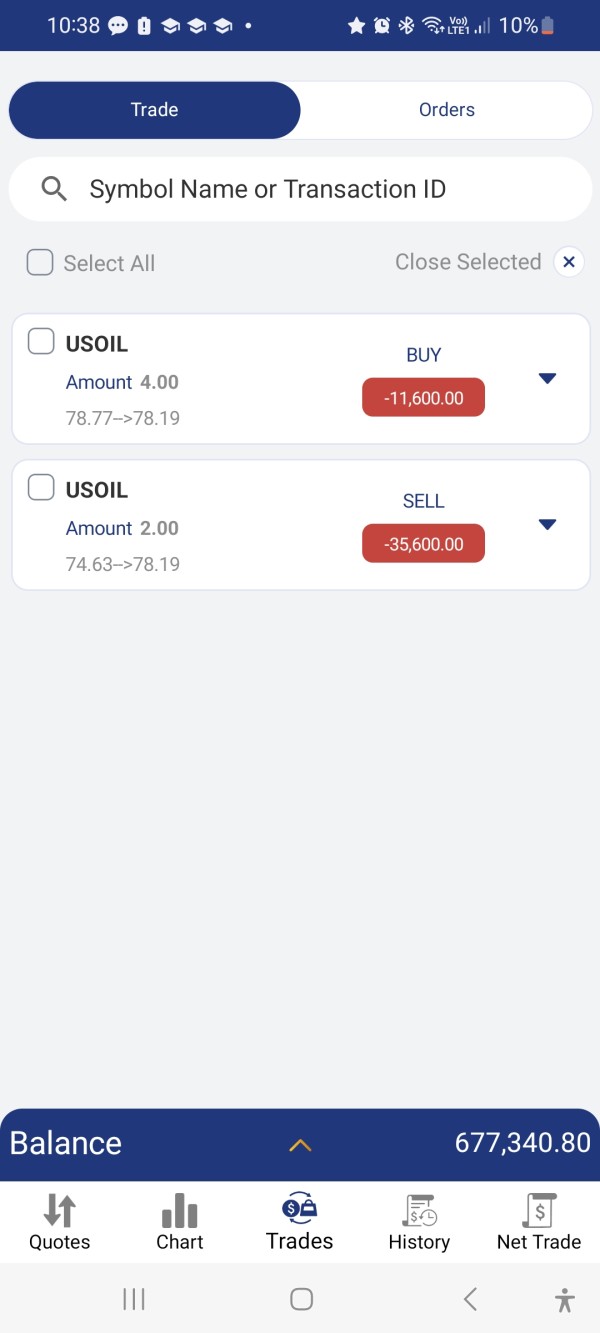

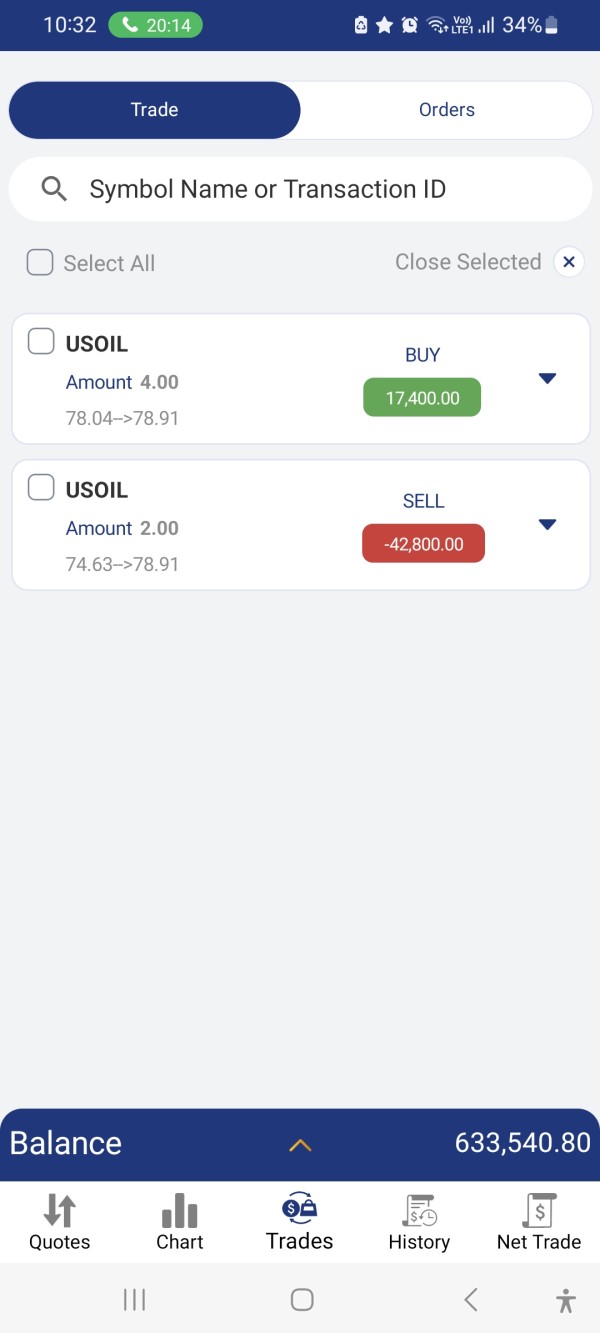

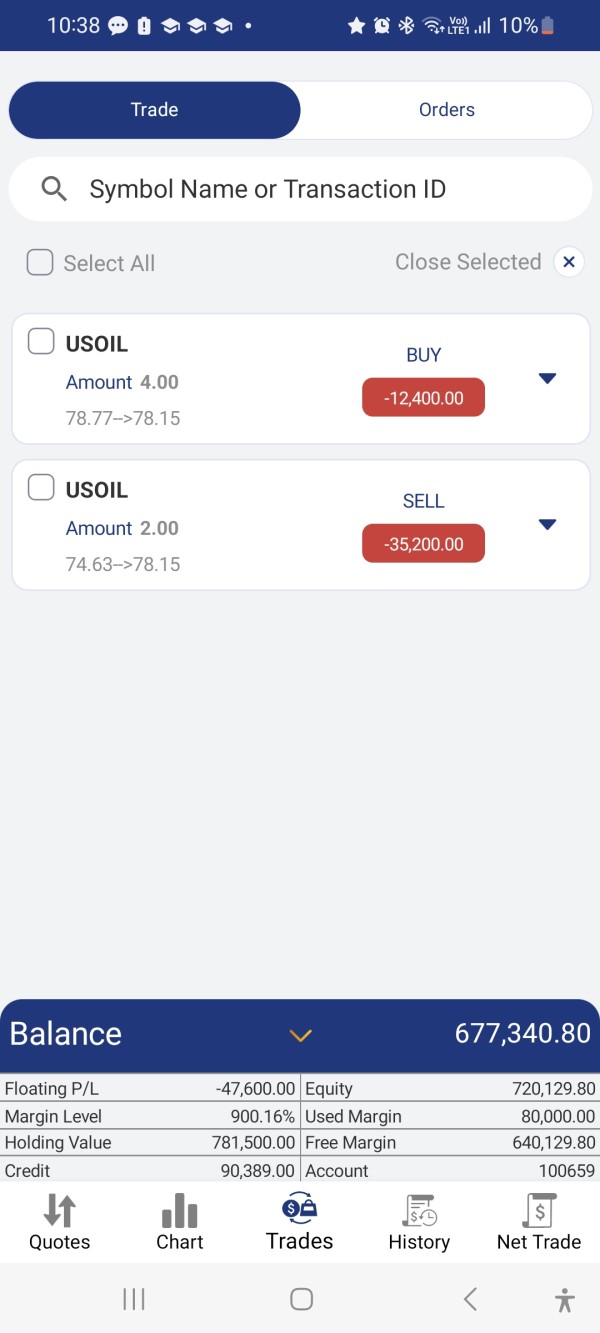

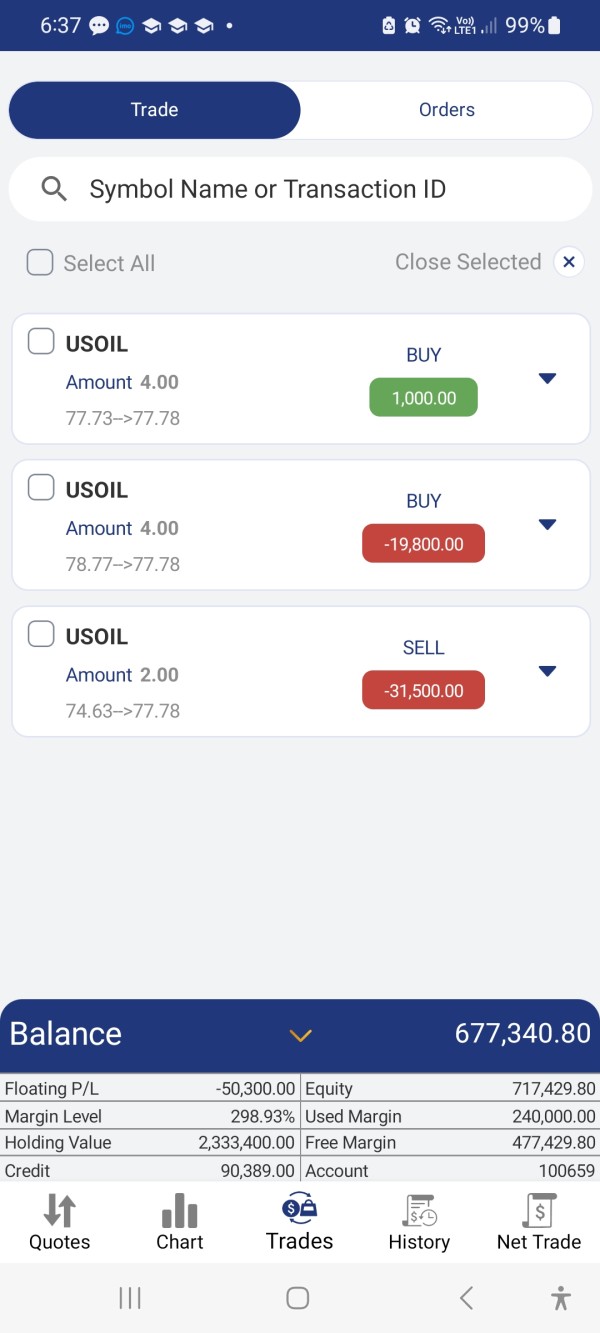

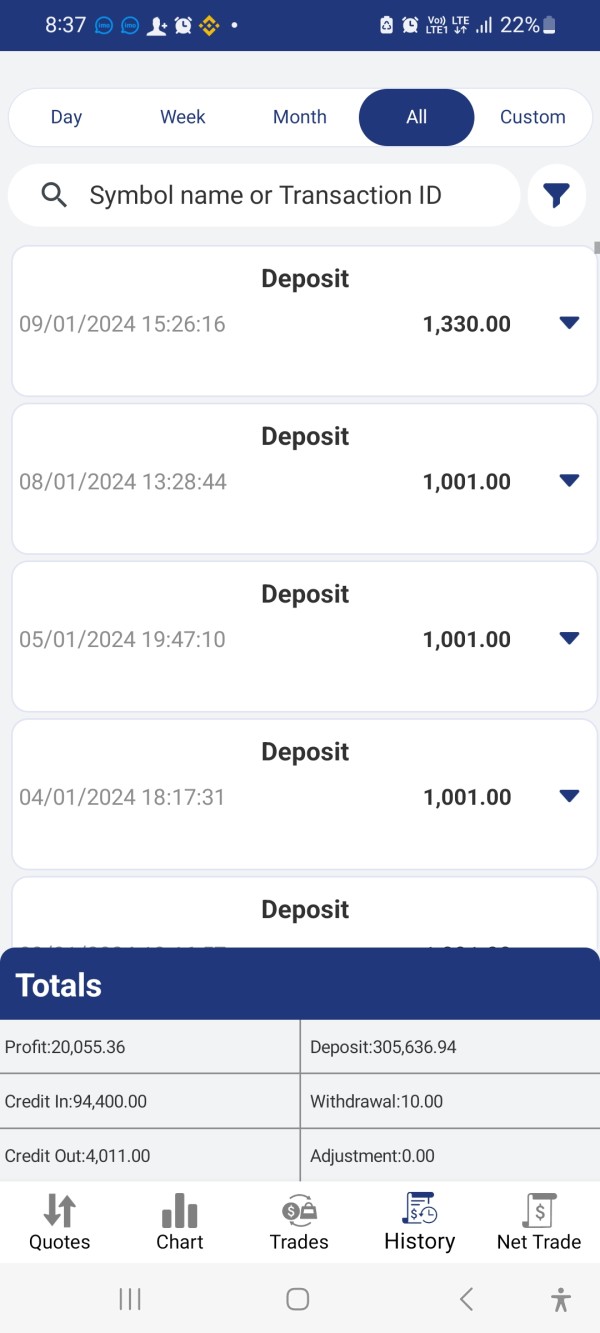

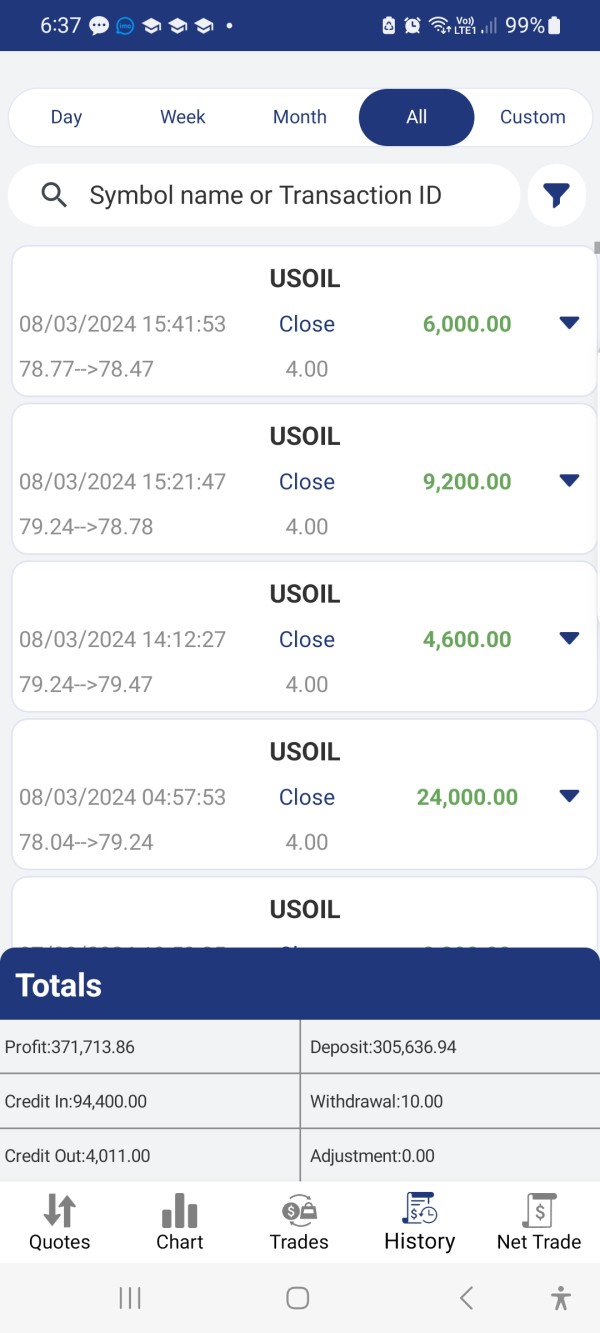

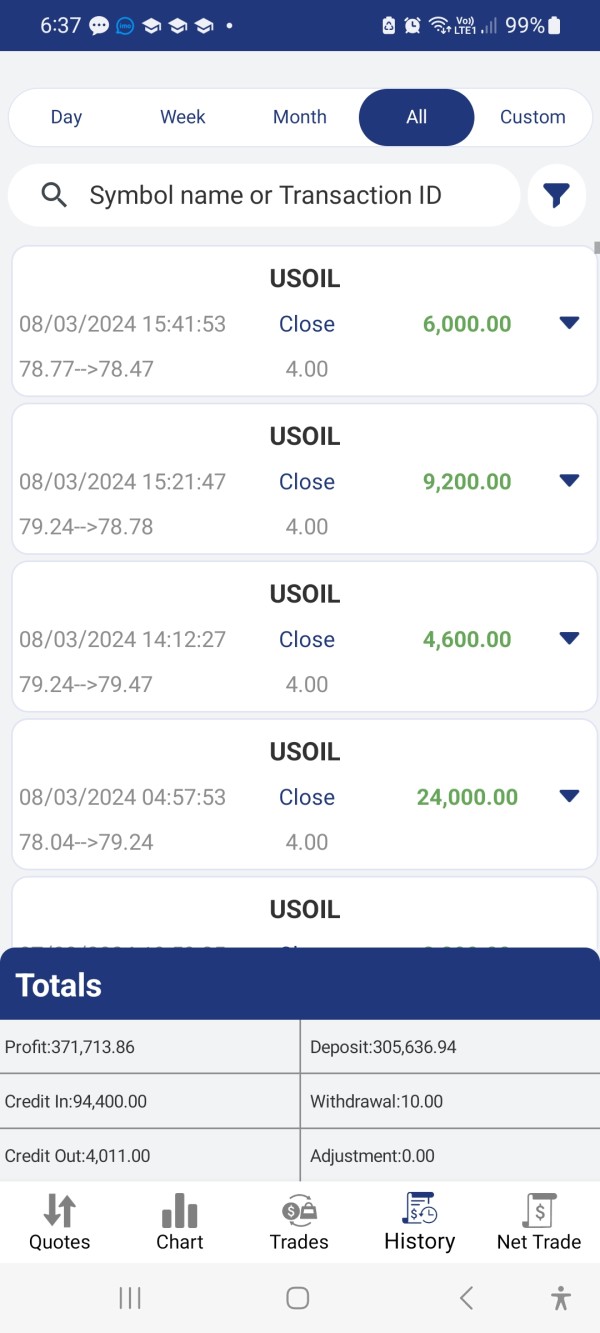

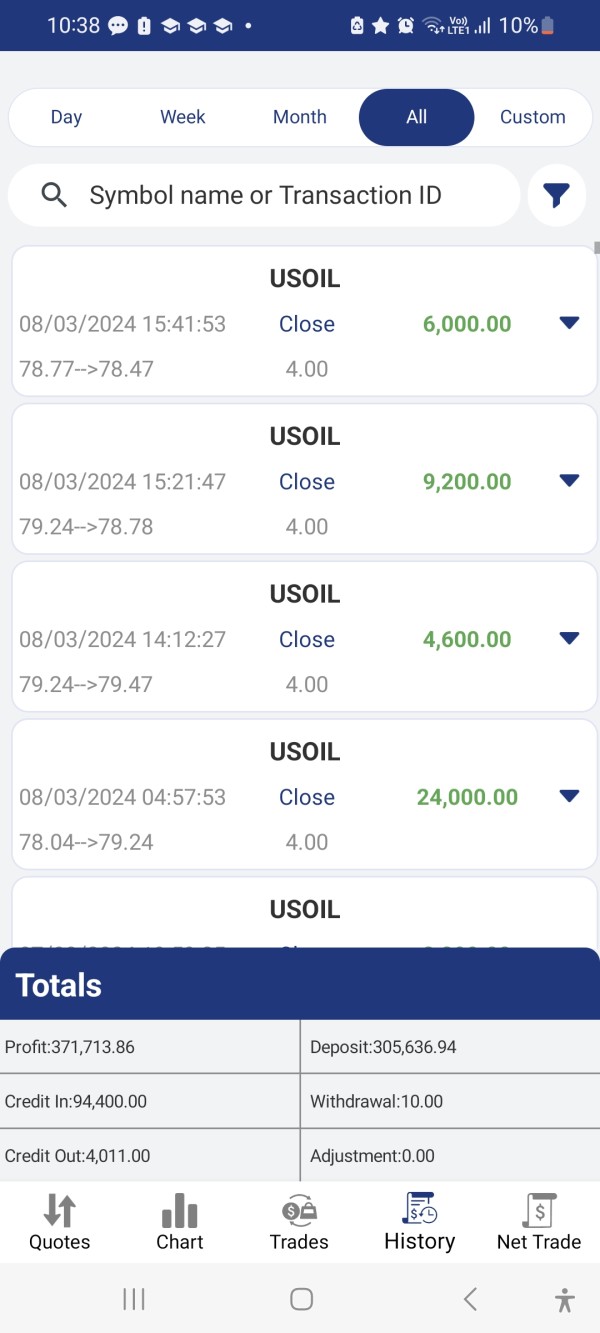

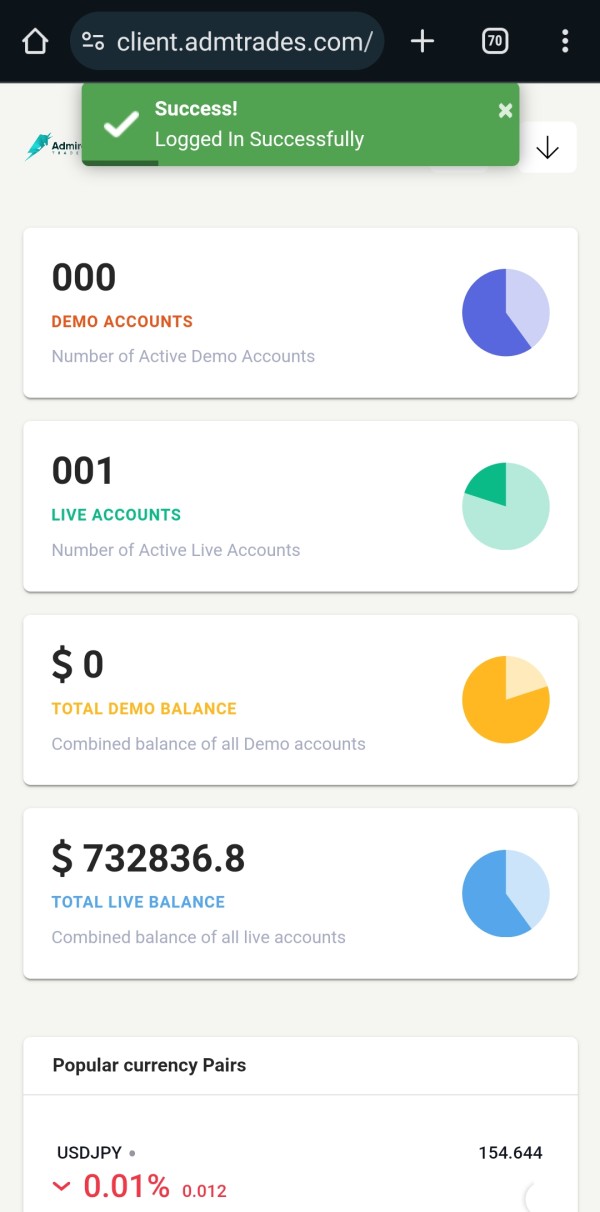

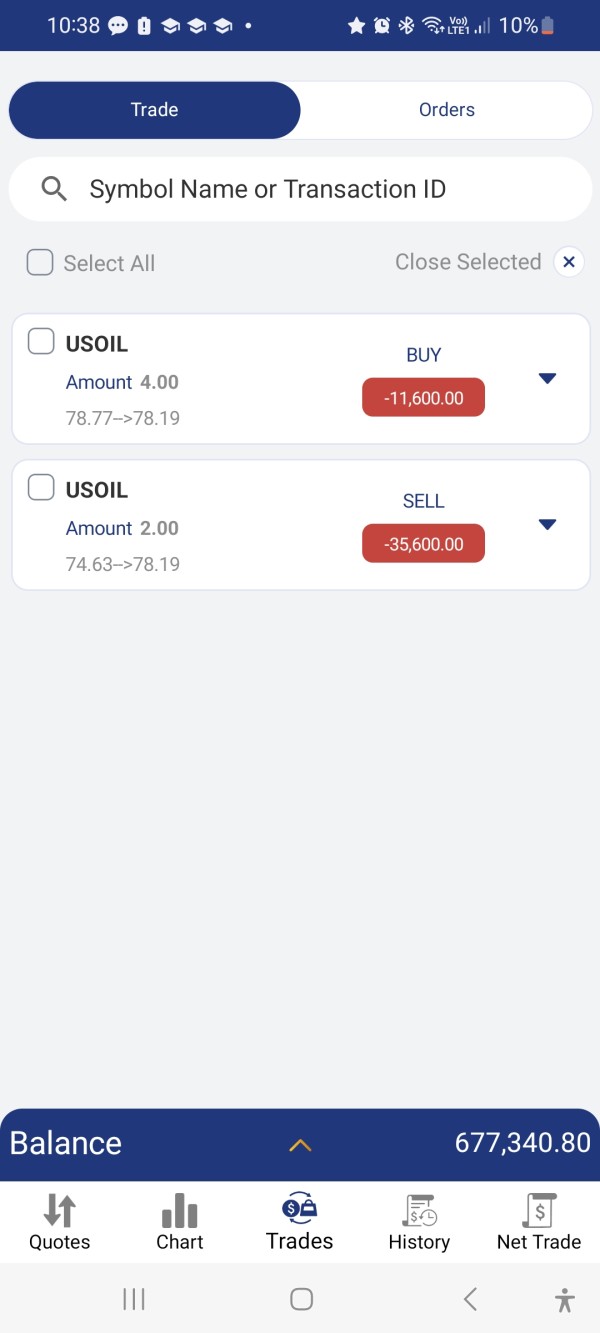

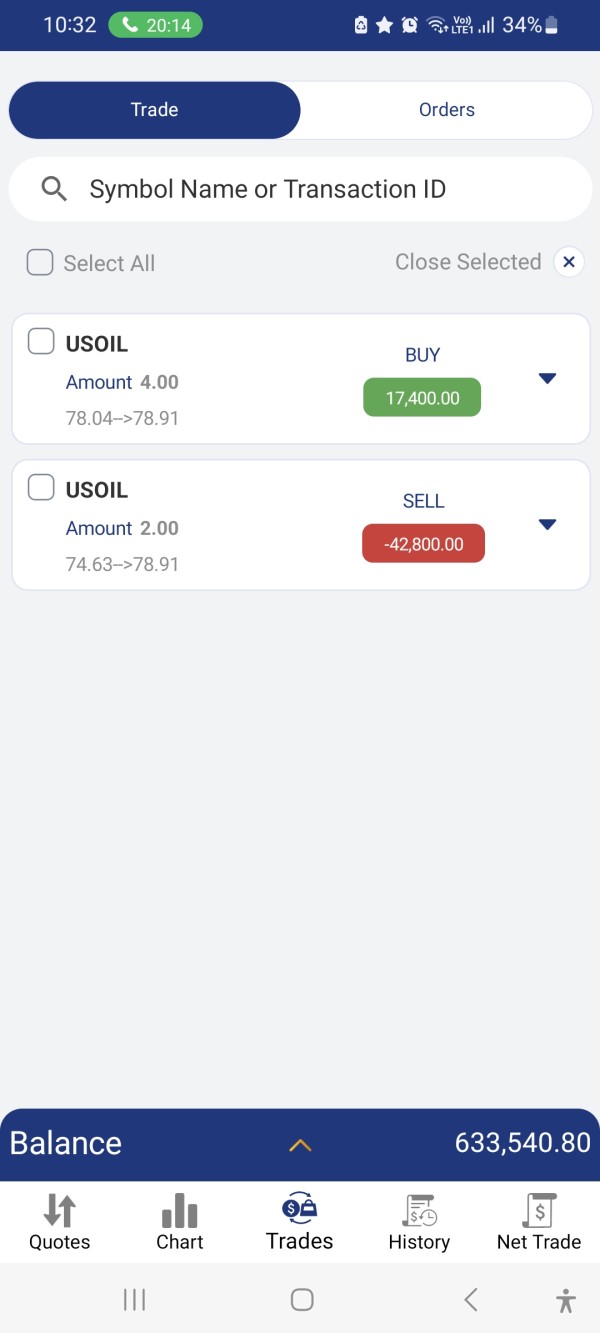

My self Noor Hasan Lodi watsapp no 9007046722 From , joined admtrades.com for trading under professional gold account of $20200 USDT on 13/11/2024 and complete my deposit via Binanance app within time after having lot of loan from bank , solded all golds, and under trading my account 100659and got major profits of $732836 and I apply withdrawal of $732836 on 23/12/2023 but I couldn't get withdrawal till now as information given to me that I have to again invevest $19000. Which was impossible for me. As my account manager He and Finance Director Mr Benjamin pressurize me to deposit another $19000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in soo many loans from bajaj loan Gold loan and and asked from friend approx like 26 Lakhs of my all my hard work money scammed by admiraltrades their misguided people to by showing good trade to scam our money. I am continuously requesting them pls give my withdrawal but they are not responding as they are scammer , so I lost my deposited money my hard work money and lost earned profits , so admtrades.com is totally scamer company who initially talk with very sweet and good relation words and show godd advantage protective deal and at the time withdrawal they ask more money , it is totally trapped to scam money from us , so you all are requested to pls be away from Admiraltrades.com. website and caught scammers

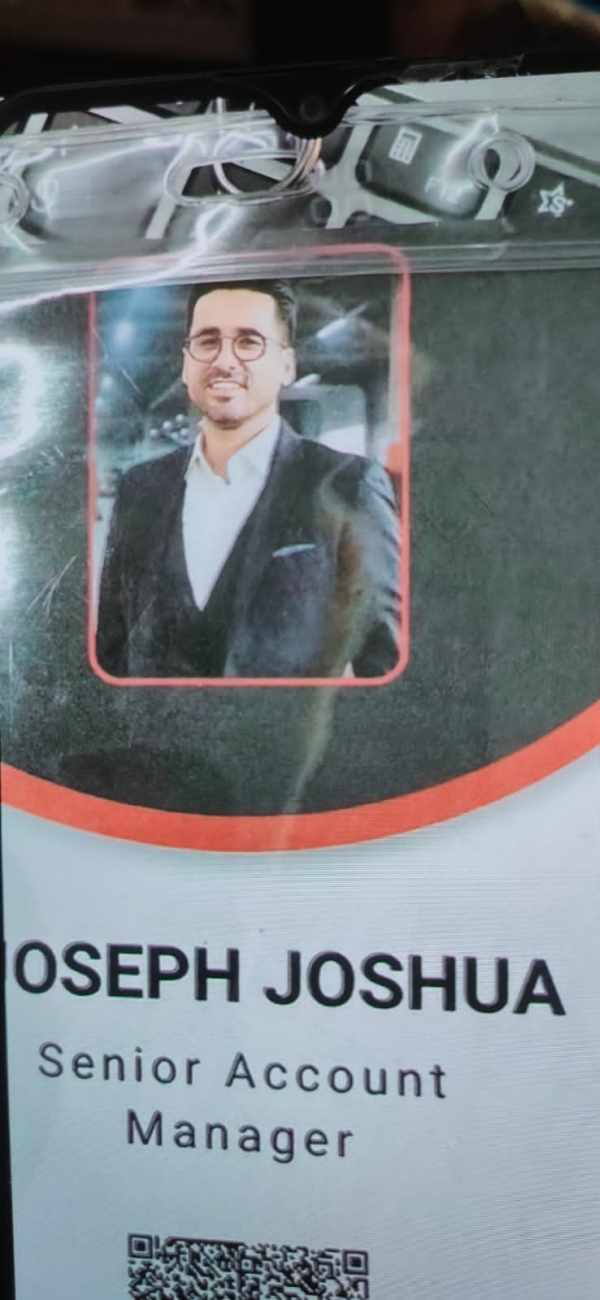

This is to inform you that m y self Noor Hasan Lodi from Sunny Park Malda On Dated between 02-Nov-23 14-02-Nov-2013Mr Krish Aaryan contacted Admiral Trades company and convinced for Education and training of Trading Purpose . For which they asked $200 for the registration and created my Live Trading Account Id:- 100659. And he said that you Profillio Manager will be Joseph Juha Started for the trading then he asked me to update the Account for better good plans and provided 4 No of plans. In which i asked for the lowest minimum plan of $5000 and paid after in a very difficult way by borrowing with my friends. After paying my trade went in profit and latter on somehow it went to loss in which Joseph Said on Dated 14.Dec.2023 that to recovery the loss and profit I have to upgrade the plan for $20000 Plan then all they can recovery all the loss & Profit and gave me huge peruser for arrange another $1

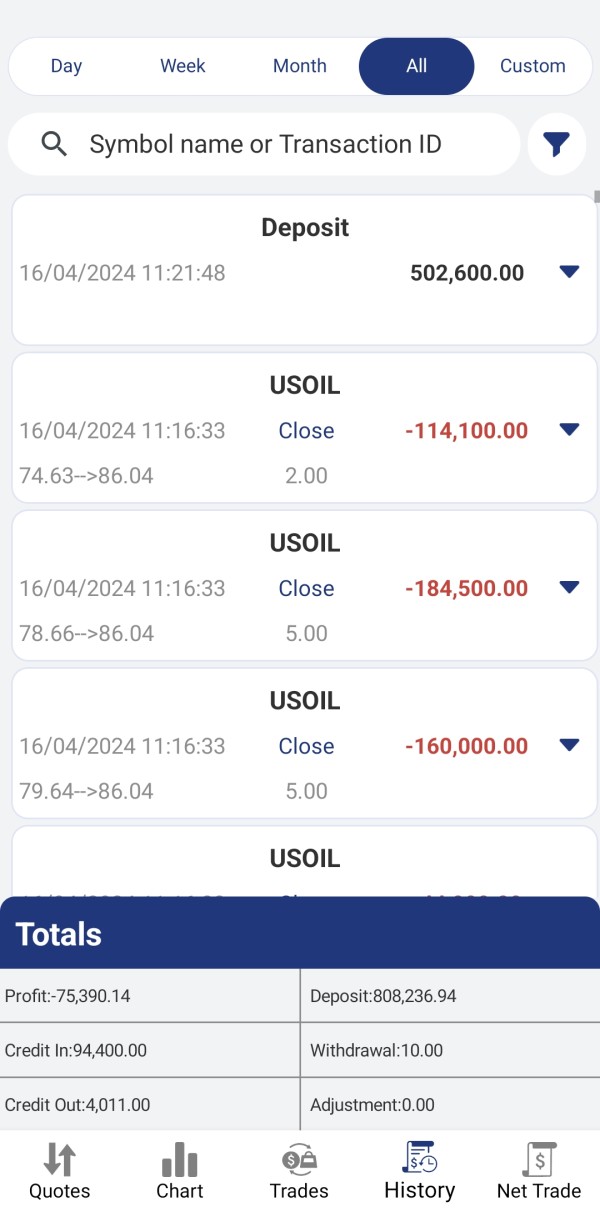

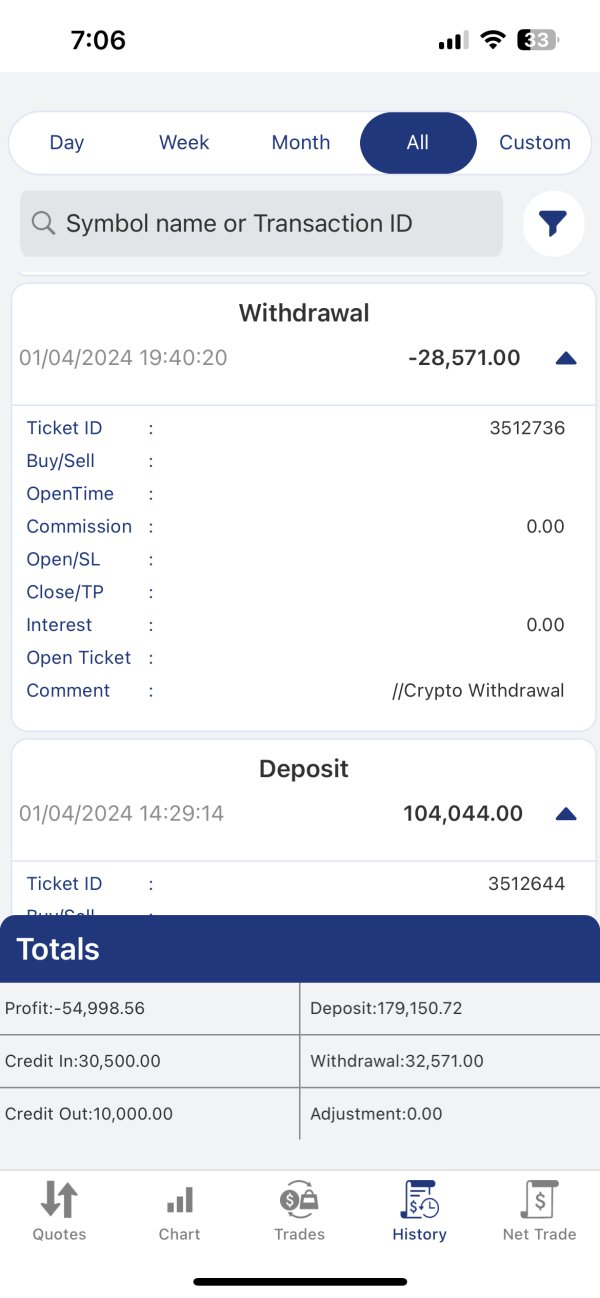

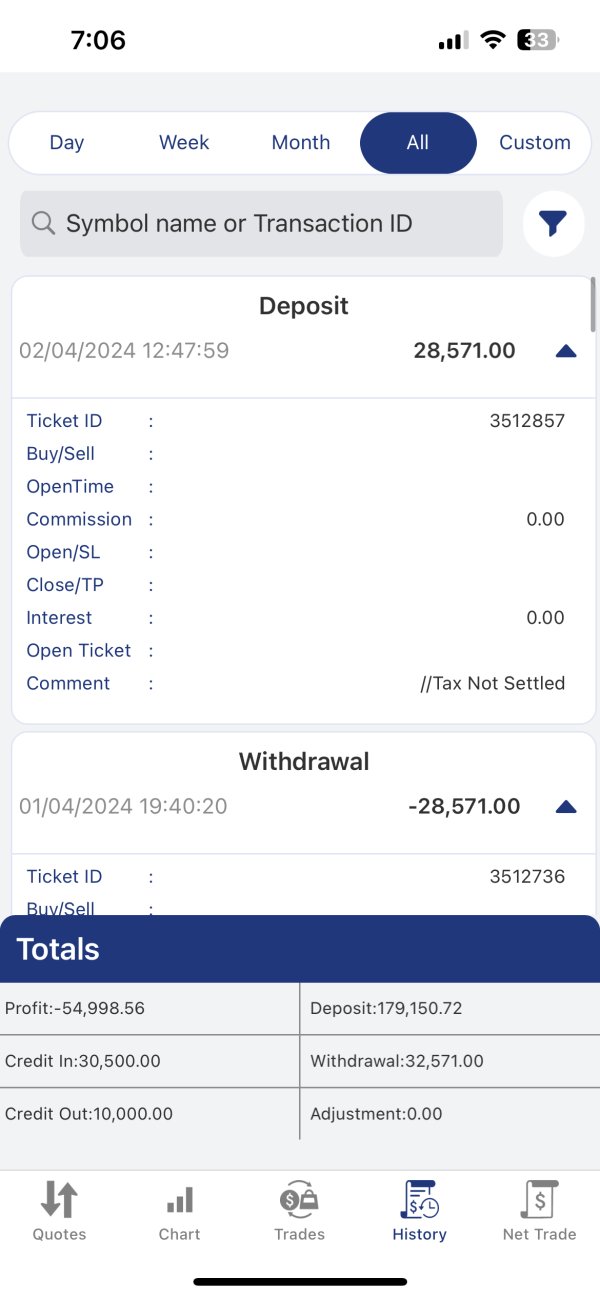

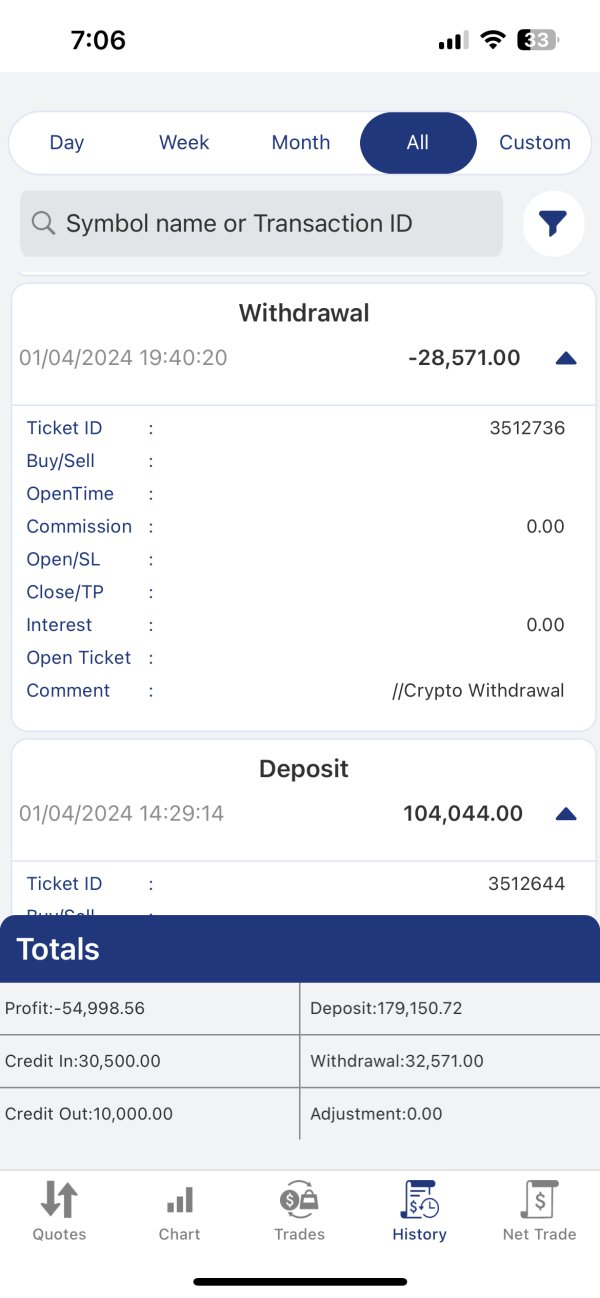

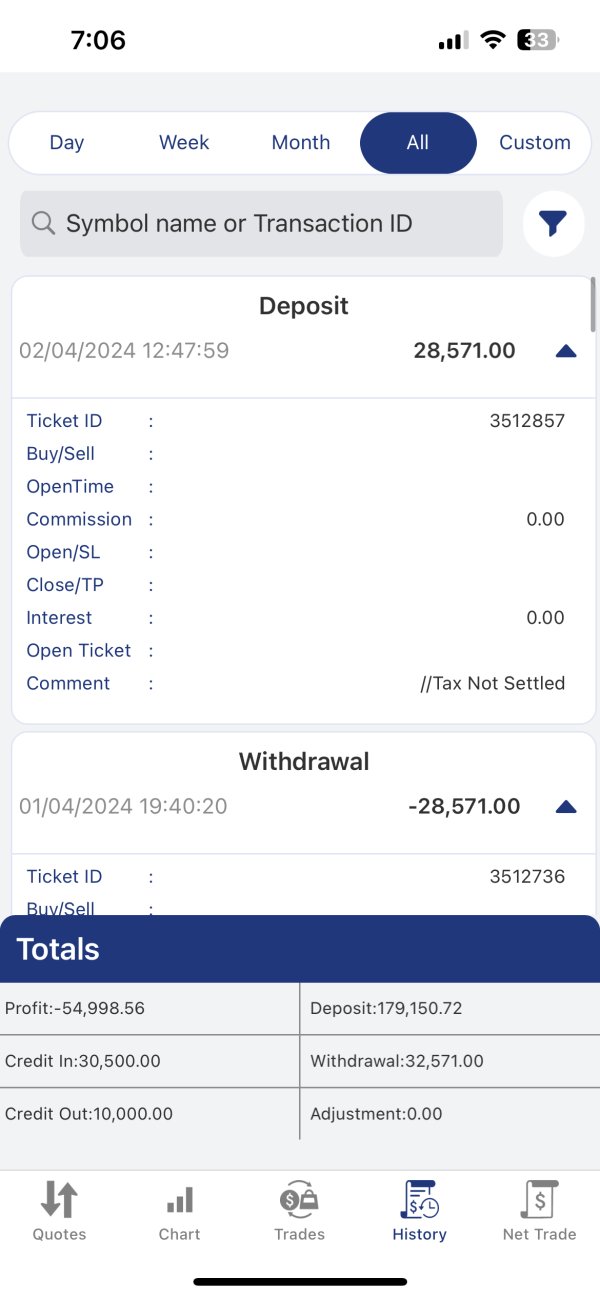

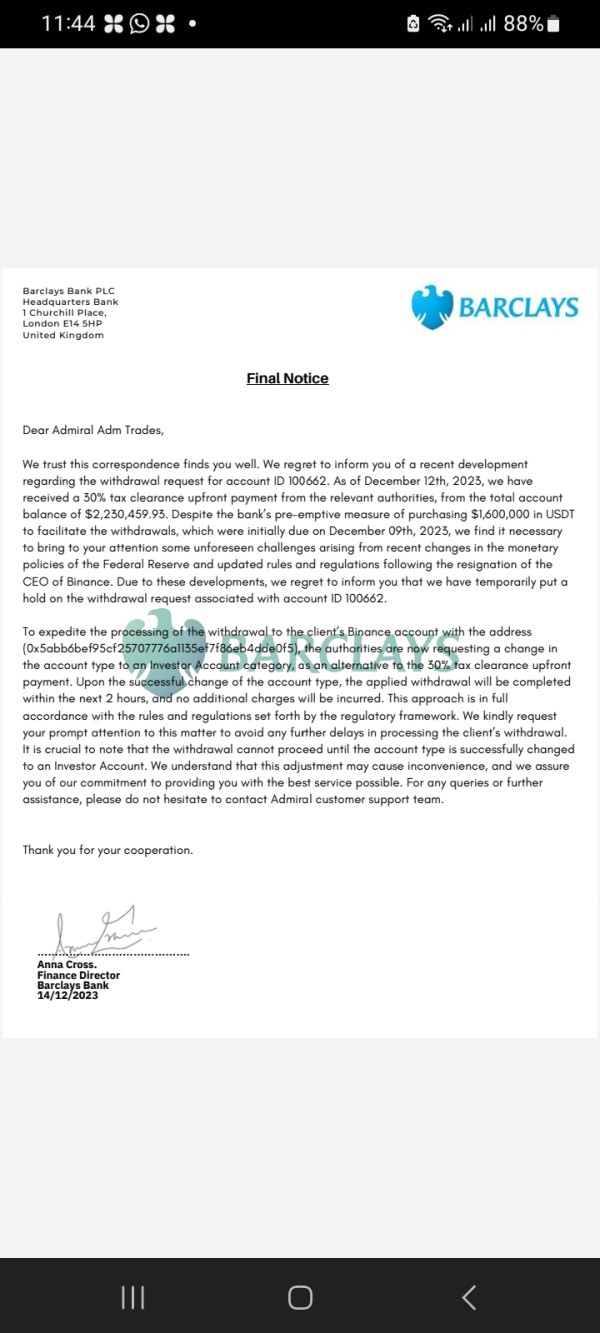

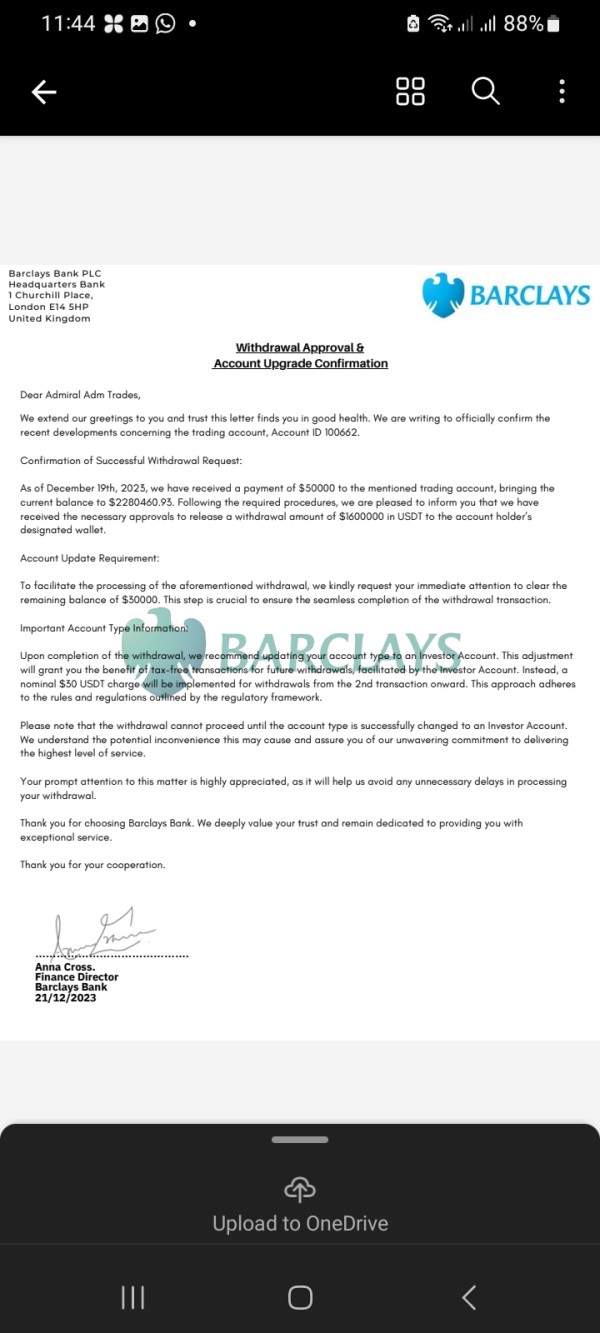

joined admtrades.com for trading under professional gold account of $10000 usdt on 28/02/2024 and complete my deposit via Binanance app within time after taken loan from friend of 8 percent , under trading my account 101119 and got major profits of $86581 and I apply withdrawal of $28571 on 1/04/2024 but I couldn't get withdrawal till now . In this regard Barkley bank given letter to admiral and want 30% upfront tax of crypto currency tax from Admiral but they informed to me that I have to switch in investor account .But as agreement clause no more money I have to deposit. As my account manager mr Kris Aaryan on my behalf he is deposited 10000$ but remaining 28571 $ is balance , He and Finance Director to deposit at least $20000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in loan so they sent my account in auction on 04/04/2024 . I am continuously requesting them ple give my withdrawal then i will deposit remaining balance, but they don't agree and my account sent to auction, so I lost my deposited money and earned profits , so admtrades.com is scamer company who initially talk very sweet and give protective deal bla bla and at the time withdrawal ask more money , it is totally trapped to scam money from us , so ple give away from it. In indian government should block website and caught scammers. If they are not scamer they can withdrawal to me and take again from me, but they will ñot give because they are scamer, my amount I very low against my profits

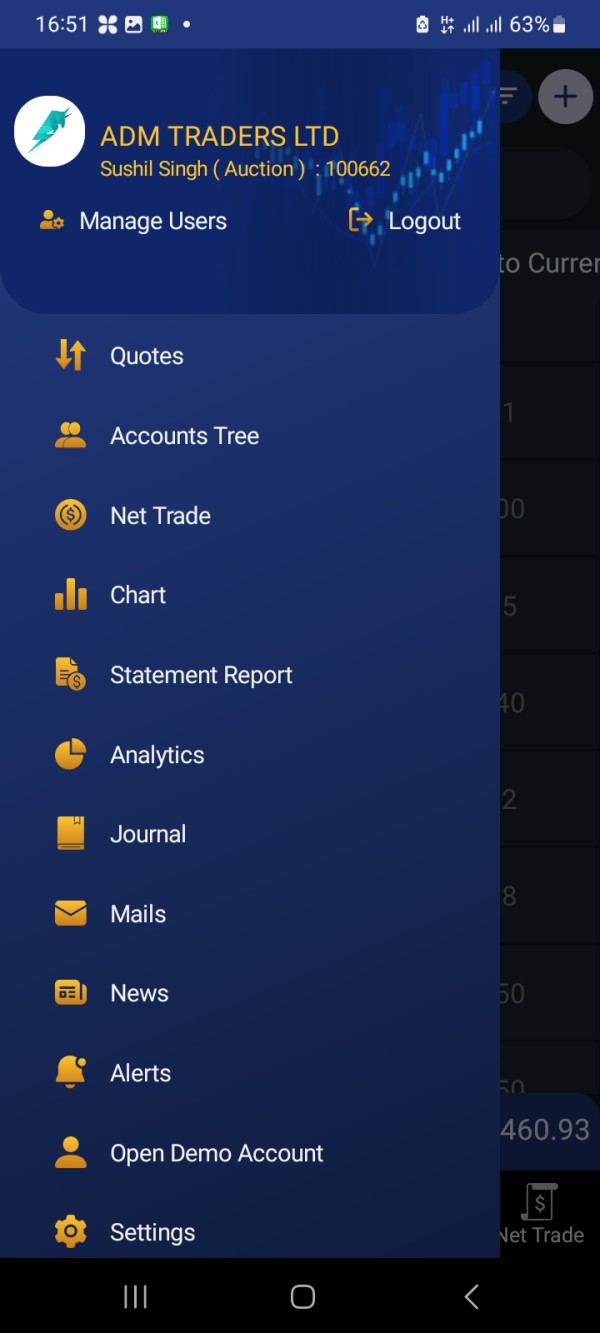

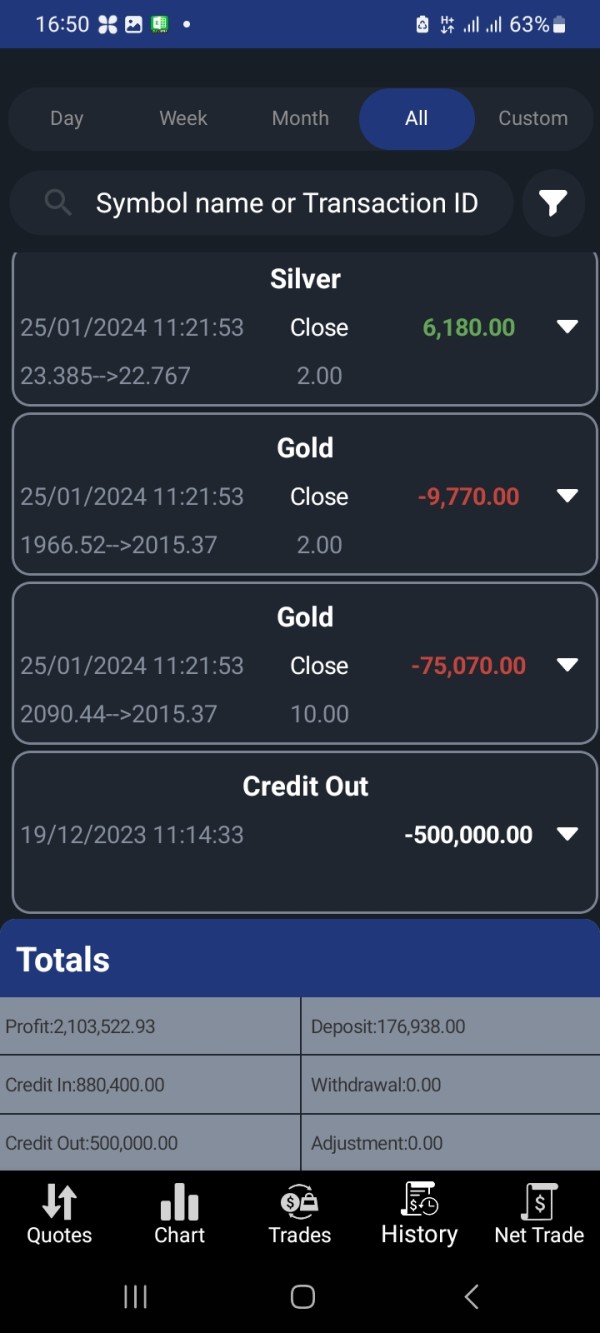

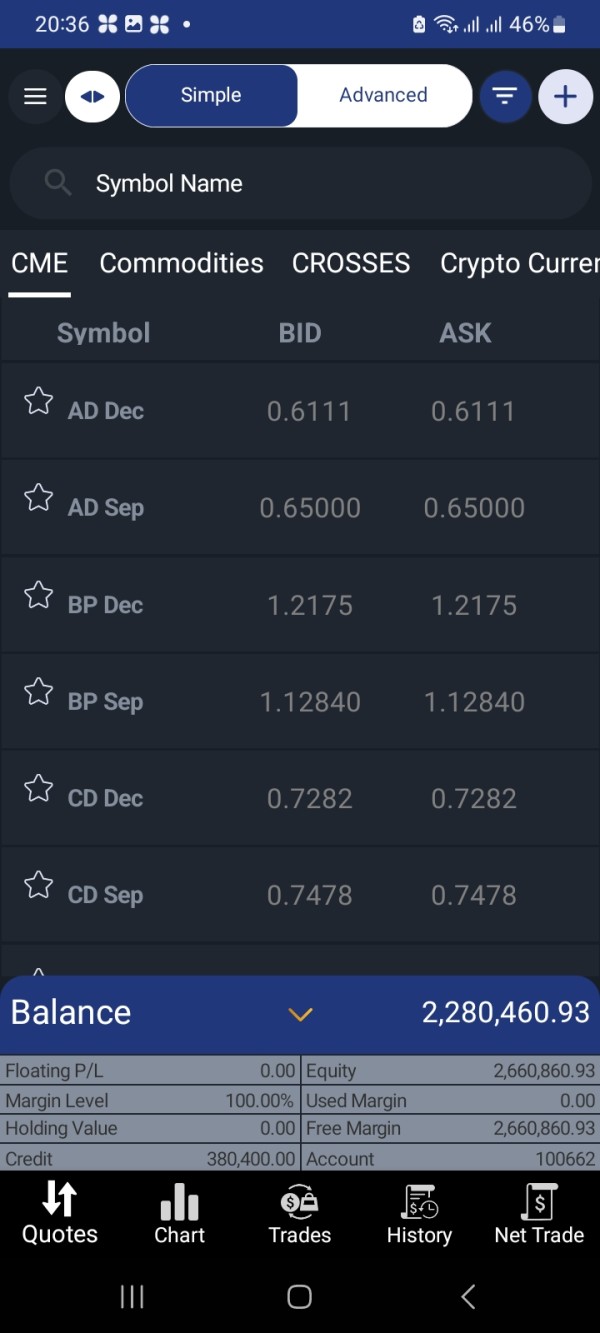

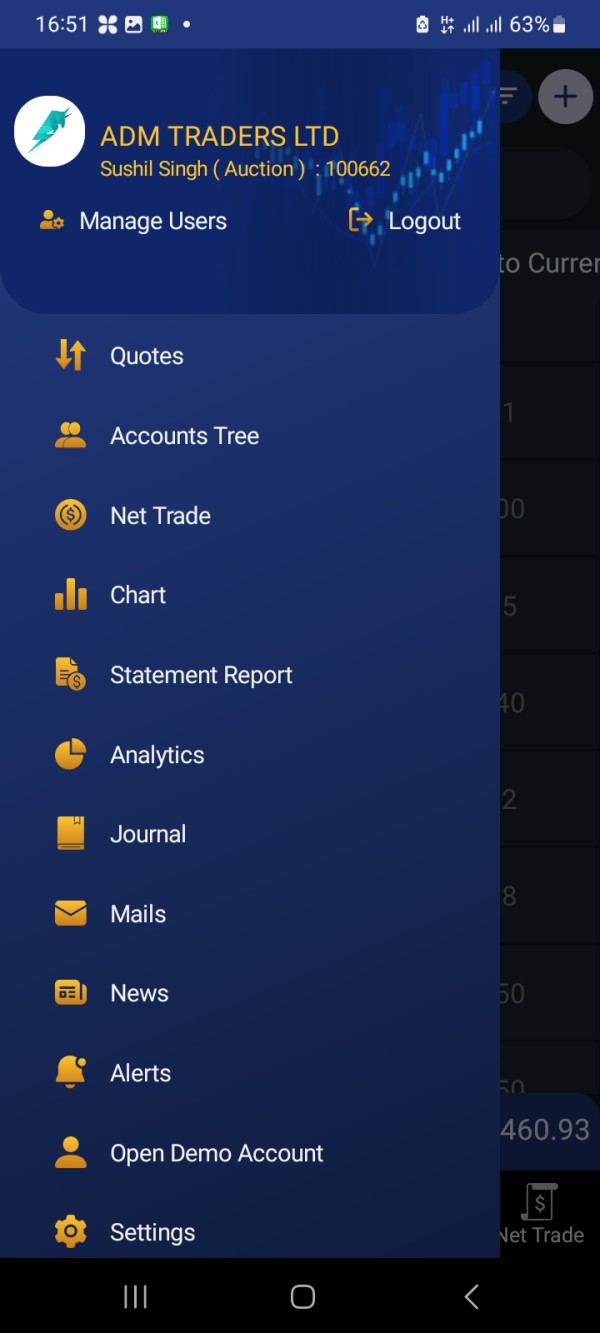

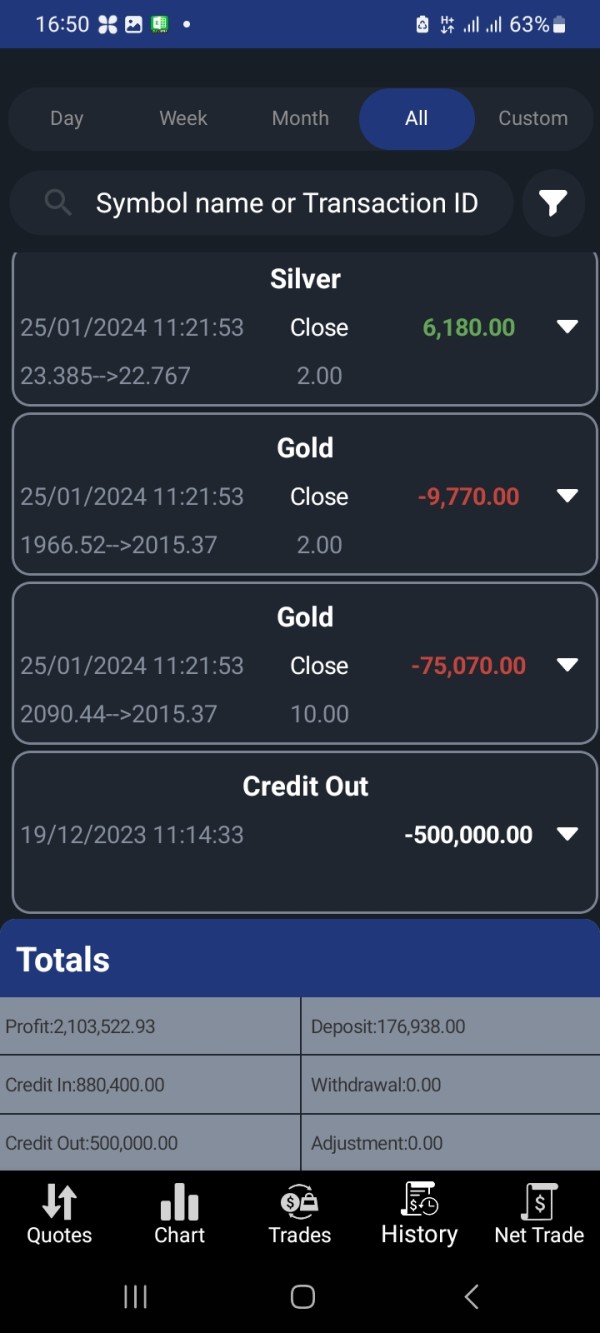

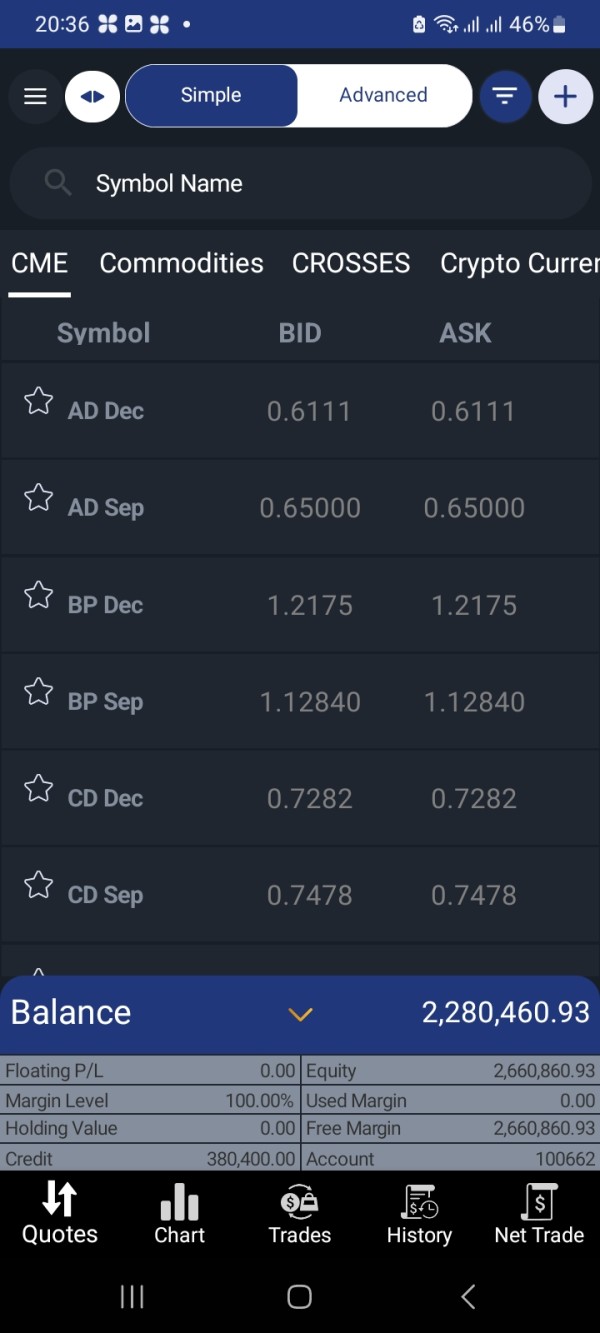

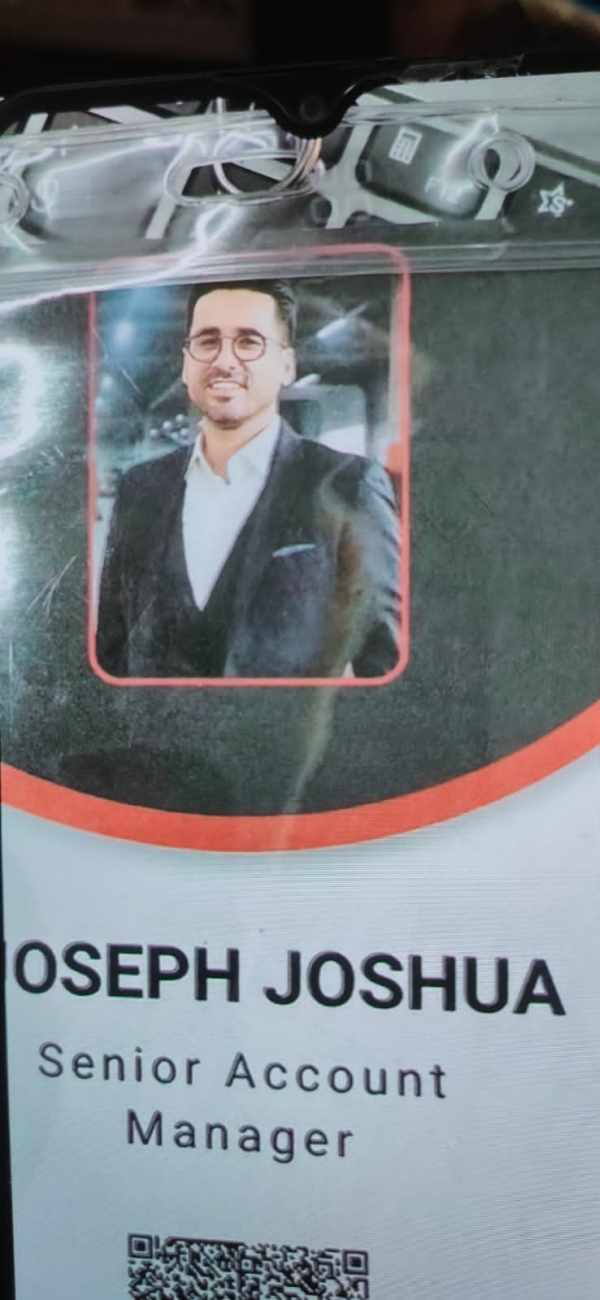

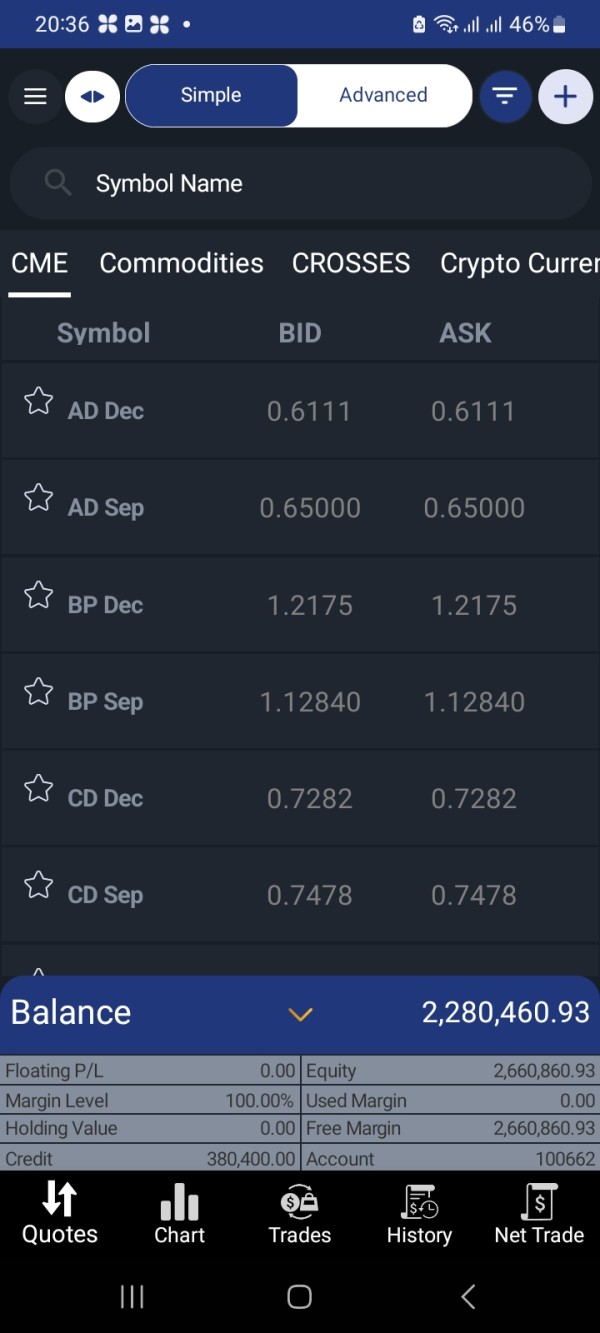

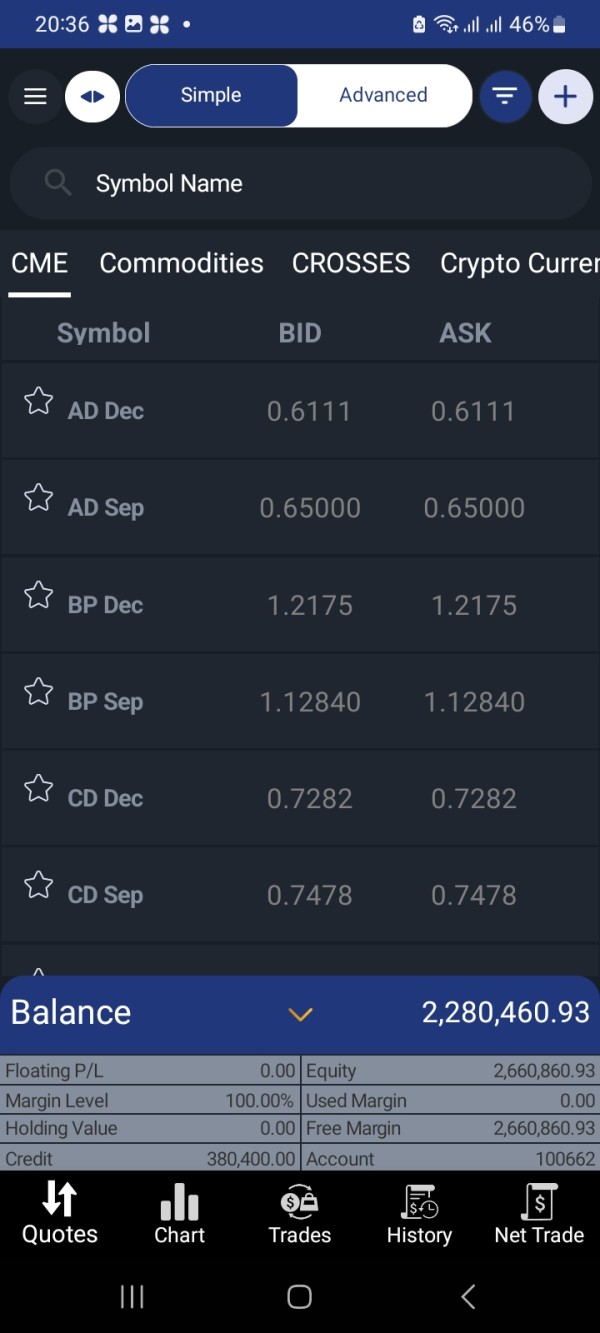

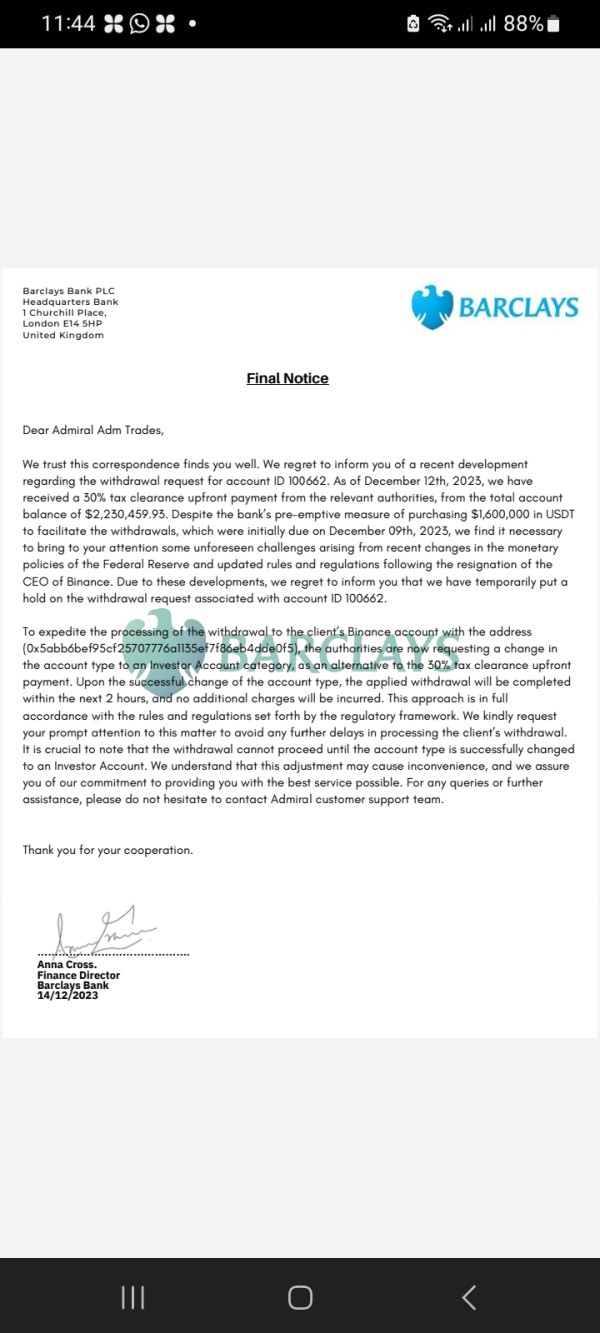

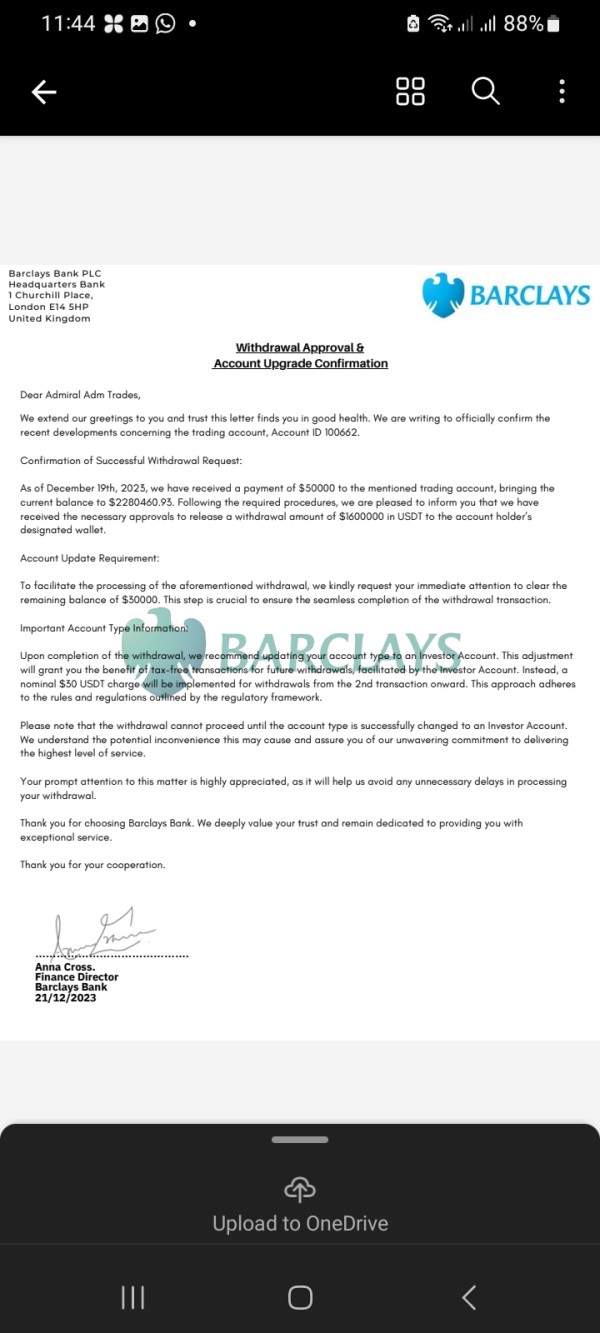

I sushil Kumar Singh 917587208558 From India, email: sushil27061975@gmail.com , joined admtrades.com for trading under professional gold account of $20000 usdt on 3/11/2023 and complete my deposit via Binanance app within time after taken loan from Bank , under trading my account 100662 and got major profits of $2280460.93 and I apply withdrawal of $1600000 on 9/12/2023 but I couldn't get withdrawal till now . In this regard Barkley bank given letter to admiral and want 30% upfront tax of crypto currency tax from Admiral but they informed to me that I have to switch in investor account because my account is minor and i got major profit But as agreement clause no more money I have to deposit. As my account manager mr Joseph Joshua on my behalf he is deposited 50000$ but remaining 30000$ is balance , He and Finance Director Mr Benjamin walter pressurize to deposit at least $20000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in loan so they sent my account in auction on 12/01/2024 . I am continuously requesting them ple give my withdrawal then i will deposit remaining balance, but they don't agree and my account sent to auction, so I lost my deposited money and earned profits , so admtrades.com is scamer company who initially talk very sweet and give protective deal bla bla and at the time withdrawal ask more money , it is totally trapped to scam money from us , so ple give away from it. In indian government should block website and caught scammers. If they are not scamer they can withdrawal to me and take again from me, but they will ñot give because they are scamer, my amount I very low against my profits

I sushil Kumar Singh 917587208558 From India, email: sushil27061975@gmail.com , joined admtrades.com for trading under professional gold account of $20000 usdt on 3/11/2024 and complete my deposit via Binanance app within time after taken loan from bank , under trading my account 100662 and got major profits of $2280460.93 and I apply withdrawal of $1600000 on 9/12/2023 but I couldn't get withdrawal till now as information given I have to switch in investor account because my account is minor and i got major profit But as agreement clause no more money I have to deposit. As my account manager mr Joseph Joshua on my behalf he is deposited 50000$ but remaining 30000$ is balance , He and Finance Director Mr Benjamin walter pressurize to deposit at least $20000 more to get withdrawal otherwise account will go in auction, I tried very hard to arrange but could not arrange money because i already in loan so they sent my account in auction on 12/01/2024 . I am continuously requesting them ple give my withdrawal then i will deposit remaining balance, but they don't agree and my account sent to auction, so I lost my deposited money and earned profits , so admtrades.com is scamer company who initially talk very sweet and give protective deal bla bla and at the time withdrawal ask more money , it is totally trapped to scam money from us , so ple give away from it. In india government should block website and caught scammers.