Is Admiral TRADERS safe?

Business

License

Is AdmiralTraders A Scam?

Introduction

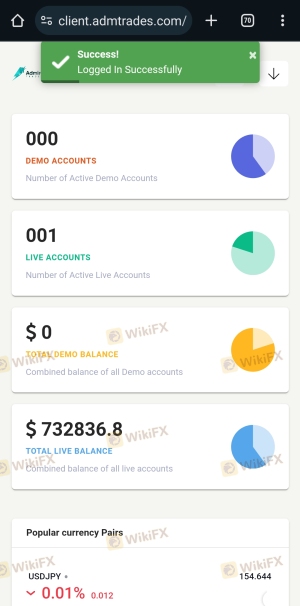

AdmiralTraders is a forex brokerage that has emerged in the competitive landscape of online trading, positioning itself as a platform for various financial instruments, including forex, indices, CFDs, metals, and cryptocurrencies. As the forex market continues to attract traders globally, the importance of selecting a reliable and safe broker cannot be overstated. Traders must exercise due diligence, as the market is rife with unregulated entities that may jeopardize their investments. This article aims to provide a thorough investigation into AdmiralTraders, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our analysis is based on a review of multiple online sources and user feedback to form a comprehensive understanding of whether AdmiralTraders is safe or potentially a scam.

Regulation and Legitimacy

The regulatory environment is a crucial aspect when assessing the safety and legitimacy of any forex broker. A well-regulated broker must adhere to strict guidelines designed to protect investors and ensure fair trading practices. Unfortunately, AdmiralTraders operates without valid regulation from any recognized financial authority. The lack of oversight raises significant concerns about the broker's legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that AdmiralTraders does not have to comply with the stringent requirements set forth by regulatory bodies, such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This lack of regulatory compliance can expose traders to various risks, including potential fraud and mismanagement of funds. Historical compliance issues or lack thereof often indicate a broker's commitment to ethical practices, and AdmiralTraders' unregulated status is a red flag that potential investors should consider seriously.

Company Background Investigation

AdmiralTraders was founded relatively recently, with its domain registered in late 2022. While the company claims to be based in the United Kingdom, its operations appear to lack transparency regarding ownership and management structure. The company's website provides limited information about its history, which raises concerns about its credibility.

The management team behind AdmiralTraders has not been clearly identified, and there is a noticeable absence of professional experience or qualifications presented. This lack of transparency can lead to skepticism about the broker's intentions and reliability. A company that does not disclose its management team or offers vague information about its operations may not prioritize accountability, which is critical in the financial services sector.

Furthermore, the absence of a clear corporate structure and ownership information can make it challenging for traders to seek recourse in case of disputes or issues. A broker's transparency is a significant factor in determining its legitimacy, and AdmiralTraders falls short in this regard.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall value. AdmiralTraders presents a range of trading instruments and account types, but the lack of regulation raises questions about the fairness of its trading conditions. The broker claims to offer competitive spreads and leverage options, but the absence of transparency regarding fees and commissions is concerning.

| Fee Type | AdmiralTraders | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.5 pips | From 0.5 pips |

| Commission Model | Not specified | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies by broker |

The spreads offered by AdmiralTraders start from 1.5 pips, which is relatively high compared to industry averages that often begin at around 0.5 pips. Additionally, the lack of clarity on commission structures and overnight interest rates adds to the uncertainty regarding the total trading costs. Traders should be cautious of hidden fees that could erode their profits, particularly when dealing with an unregulated broker.

The absence of detailed information on trading costs can lead to unexpected expenses, making it difficult for traders to accurately assess their potential profits and losses. This lack of transparency is a significant concern for anyone considering trading with AdmiralTraders.

Customer Funds Safety

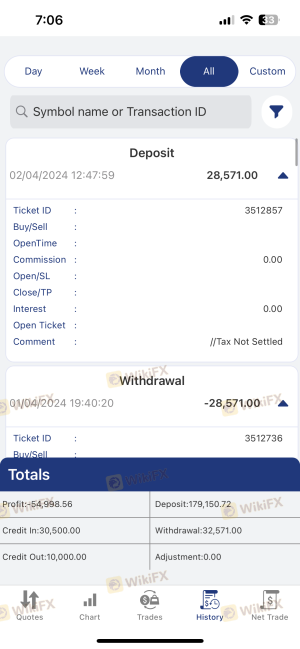

The safety of customer funds is paramount when selecting a forex broker. AdmiralTraders has not provided sufficient information regarding its fund security measures. The broker claims to employ various security protocols, but without regulation, there is no guarantee of fund protection.

AdmiralTraders does not appear to offer investor protection mechanisms, such as segregated accounts or negative balance protection. The lack of these crucial safety measures means that traders' funds could be at risk in case of financial difficulties faced by the broker.

Historically, unregulated brokers have been associated with numerous fund security issues, including the misappropriation of client funds. Without a regulatory body overseeing its operations, AdmiralTraders may not have the same level of accountability as regulated brokers, making it imperative for traders to consider the risks involved.

Customer Experience and Complaints

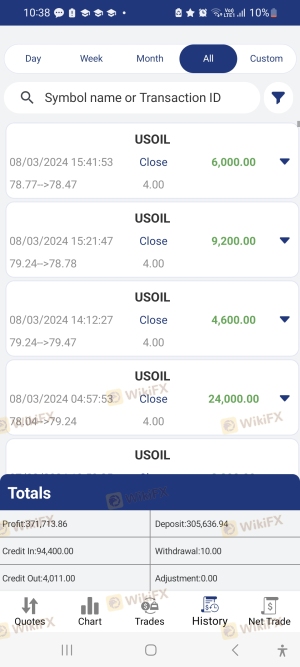

Customer feedback is a vital aspect of evaluating any broker's reliability. Reviews of AdmiralTraders reveal a concerning pattern of complaints from users, primarily focused on withdrawal issues and unresponsive customer support. Many users have reported difficulties in accessing their funds after making withdrawals, which raises alarms about the broker's trustworthiness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

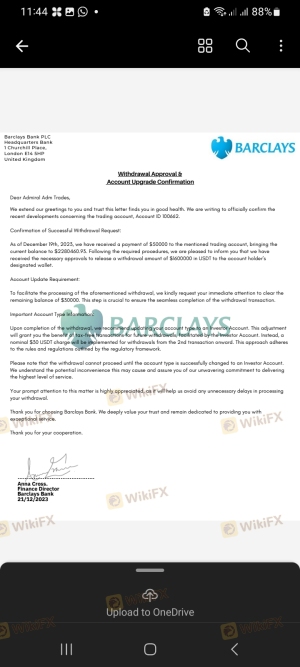

Many traders have expressed frustration over delayed or denied withdrawal requests, with some alleging that their accounts were blocked without explanation after they attempted to withdraw funds. Such complaints indicate a troubling trend that could suggest potential fraudulent practices.

For instance, one user reported investing a significant amount only to be told that they needed to deposit additional funds to access their earnings. This tactic is often employed by fraudulent brokers to trap clients into investing more money, raising serious concerns about the legitimacy of AdmiralTraders.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. AdmiralTraders claims to offer a user-friendly trading platform, but many users have reported issues with execution quality and platform stability.

Concerns have been raised about slippage and order rejections, which can significantly impact trading outcomes. Users have noted instances of excessive slippage during volatile market conditions, suggesting that the broker may not provide the execution quality expected from a reputable platform.

Moreover, the absence of regulatory oversight raises questions about the potential for platform manipulation. Traders should be wary of platforms that do not provide transparent execution practices, as this can lead to unfair trading conditions.

Risk Assessment

Using AdmiralTraders involves several risks, primarily due to its unregulated status and the associated lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from regulatory bodies increases fraud risk. |

| Fund Safety Risk | High | Lack of investor protection and fund segregation. |

| Withdrawal Risk | High | Reports of issues accessing funds raise concerns. |

The absence of regulation and investor protection mechanisms means that traders could face significant risks, including the potential loss of their funds without recourse. To mitigate these risks, potential investors should conduct thorough research and consider alternative brokers that offer better regulatory oversight and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that AdmiralTraders exhibits numerous red flags that warrant caution. The lack of regulation, coupled with negative customer feedback and concerns about fund safety, raises serious questions about the broker's legitimacy.

Traders should be particularly wary of AdmiralTraders, as the potential for fraud and mismanagement of funds is high. For those looking to engage in forex trading, it is advisable to consider regulated alternatives that prioritize transparency and investor protection. Brokers such as Admiral Markets and others with established regulatory frameworks can provide a safer trading environment.

In summary, potential investors should approach AdmiralTraders with extreme caution, weighing the risks against the potential benefits. The question of "Is AdmiralTraders safe?" leans heavily towards "no," making it crucial for traders to seek out more trustworthy options in the forex market.

Is Admiral TRADERS a scam, or is it legit?

The latest exposure and evaluation content of Admiral TRADERS brokers.

Admiral TRADERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Admiral TRADERS latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.