BAK, registered as Bakaal Worldwide Limited and based in the UK since 2017, has become a focal point for scrutiny due to its questionable operational legitimacy. Despite the favorable founding timeline, the broker is plagued by severe trust issues highlighted by a WikiFX score of only 1.53/10, suggesting a precarious market position among more reputable and compliant players in the financial industry.

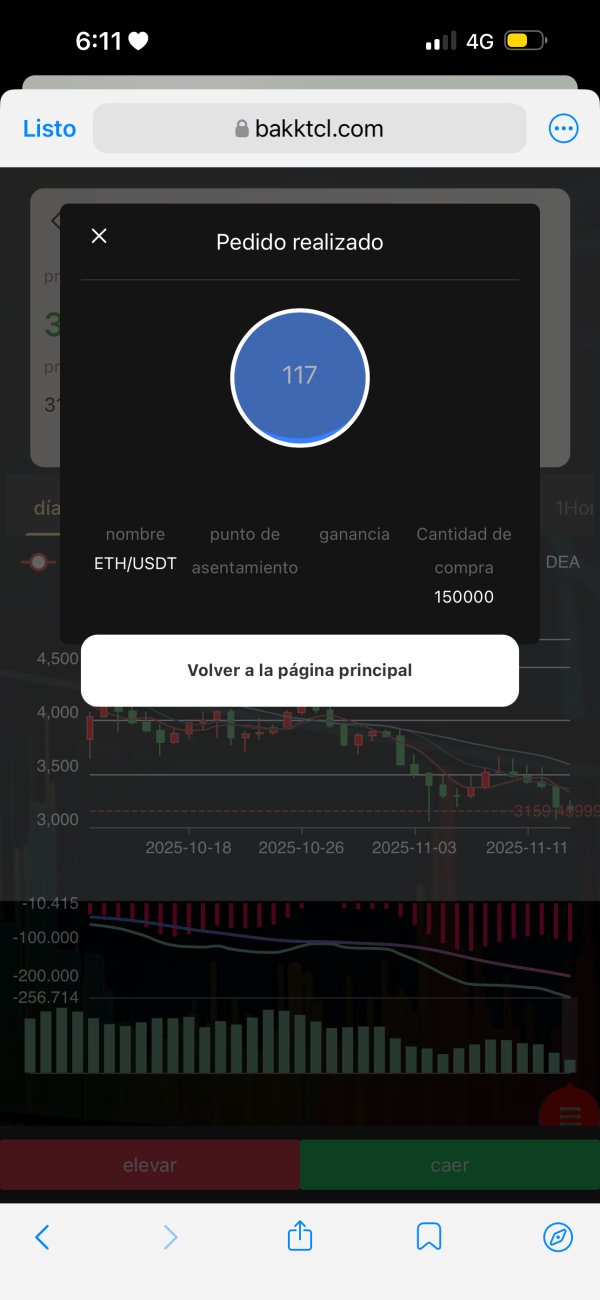

BAK primarily operates in the forex and CFDs market, offering trading through the widely popular MetaTrader 4 (MT4) platform. However, this platform only supports PC, with mobile and other operating system functionalities notably absent. Of significant concern, BAK claims to be a part of the FCA regulatory framework, yet user reports and independent evaluations frequently categorize it as a suspicious entity, potentially functioning as a clone of FCA-regulated firms, emphasizing the necessity for caution among prospective traders.

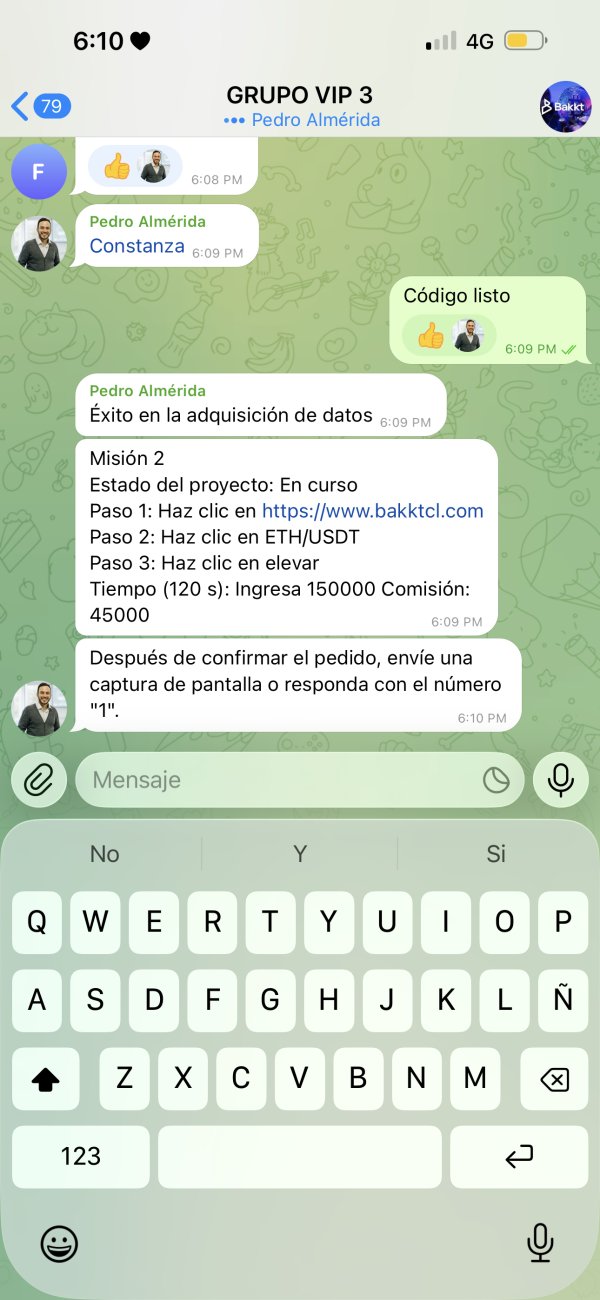

BAK's regulatory information is fraught with ambiguity, with no clear indication of formal registration with recognized financial authorities. Investors must be cautious, as the site operates under a low trust score and has been labeled a suspicious clone of FCA-regulated entities.

- Regulatory Websites: Visit official regulatory bodies such as the FCA or the NFA to verify BAK's claimed license status.

- Research User Reviews: Independent review sites like WikiFX can offer insights into customer experiences and overall trustworthiness.

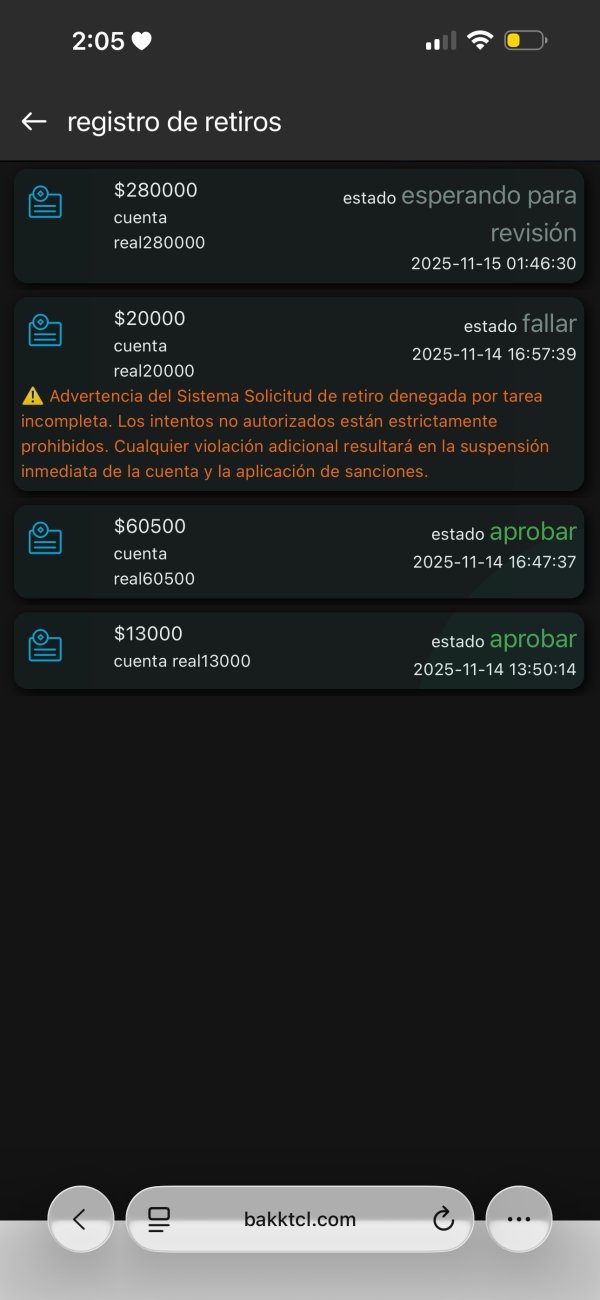

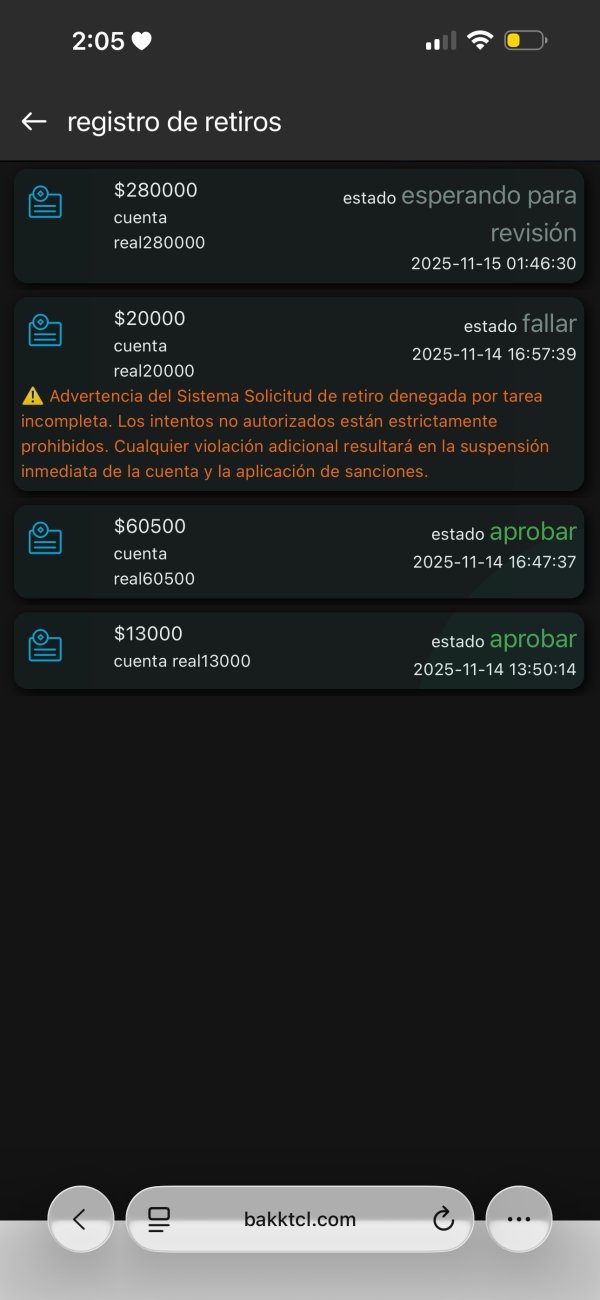

- Watch for Red Flags: Look for repeated complaints about withdrawal issues or negative customer service experiences.

"Many traders have reported unresolved withdrawal issues with BAK, emphasizing the need for due diligence before engaging." - WikiFX User Comments

Industry Reputation and Summary

BAK lacks a positive reputation in the industry, as reflected in multiple user feedback logs reporting concerns over fund safety, withdrawal issues, and poor customer support. The need for self-verification cannot be overstated when dealing with low-scoring entities like BAK.

Trading Costs Analysis

Advantages in Commissions

BAK touts a low-cost commission structure, which may attract traders looking for budget-friendly options. However, specific details regarding commissions are unavailable, raising questions about transparency.

The "Traps" of Non-Trading Fees

Reports indicate that BAK imposes high fees on withdrawals, with complaints of $30 withdrawal fees being common among users. Such fees can significantly erode trading profits, making it crucial for potential users to carefully assess the cost structures associated with BAK.

"The withdrawal fee of $30 took me by surprise, as I believed I was signing up for an affordable trading experience." - Anonymous User Review on WikiFX

Cost Structure Summary

While BAK's commission rates might be favorable for frequent traders, the hidden costs associated with withdrawals can turn a seemingly excellent deal into an expensive affair. New traders, especially, should be wary of the potential pitfalls embedded in BAK's price structure.

BAK's trading experience is primarily facilitated through the MetaTrader 4 (MT4) platform, which, while popular, is showing its age. Many traders critique the platform's outdated features and user experience deficiencies.

The tools available through BAK mainly hinge on the capabilities of MT4, which lacks advanced integration seen in modern platforms. Resources for trading analysis and education are limited, potentially disadvantaging novice traders.

Users have expressed frustration with MT4s lack of intuitive features. For instance, setting up watchlists and price alerts can be cumbersome, detracting from the overall trading experience.

"Navigating the MT4 interface felt dated and clunky, which can be frustrating, especially for new traders." - User feedback on Forum XYZ

User Experience Analysis

User Interface and Experience

Reviews point to a mixed user experience within BAK's interface, describing it as customizable but often difficult for novice traders to navigate.

User Accessibility

While MT4 allows for multiple languages, user feedback indicates that the accessibility and intuitiveness of operation remain barriers for effective trading.

User Feedback Summary

Customer feedback is generally unfavorable, citing conflicts in expectations versus real experiences with BAKs trading platform.

Customer Support Analysis

Reports of poor customer service abound, with users reporting extended wait times for responses and inadequate support options. Such shortcomings can lead to frustration among traders, particularly those needing immediate help with withdrawal or technical issues.

Response Time and Quality

Response times have been noted as significantly longer than industry standards, complicating the trader's journey to resolve pressing issues effectively.

Support Channels Evaluation

BAK offers limited channels for customer support, primarily through email and phone, which might not suffice for urgent matters.

Account Conditions Analysis

Conditions Overview

Uncertainty surrounds BAKs account conditions, especially regarding the minimum deposit and withdrawal process, which has fed skepticism among potential users.

Risk Factors

With no clear disclosure about account conditions, traders are urged to tread carefully, knowing that initial deposits could become challenging to recover.

Conclusion on Conditions

The ambiguity in account conditions coupled with reports of withdrawal difficulties point to significant risks, suggesting that traders should have a clear understanding before committing funds.

Final Observations

In summary, while BAK may present itself as an attractive low-cost trading option, numerous red flags, including a low trust score, regulatory ambiguities, high non-trading fees, inadequate customer support, and limited trading tools serve as critical warning signs. Traders are urged to conduct thorough due diligence and consider alternative brokers that offer more reliable service and regulatory compliance. Overall, engagement with BAK should be approached with caution, particularly by novice traders seeking a secure trading environment.