Is BAK safe?

Business

License

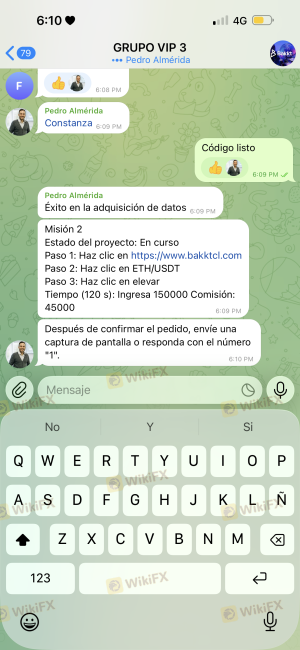

Is BAK A Scam?

Introduction

BAK is a foreign exchange broker established in 2017, based in the United Kingdom. It positions itself within the competitive forex market, offering trading services primarily through the widely used MetaTrader 4 platform. As the forex market continues to grow, the importance of evaluating brokers for safety and reliability has never been more critical. Traders often face the risk of scams, unregulated platforms, and poor service quality, making due diligence essential before committing funds. This article aims to provide an objective analysis of BAK's operations, regulatory standing, and overall trustworthiness, utilizing a combination of qualitative assessments and quantitative data.

Regulation and Legitimacy

The regulatory framework surrounding forex brokers is fundamental to ensuring that traders are protected against fraud and malpractice. BAK claims to be regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent oversight of financial institutions. However, there are concerns regarding the legitimacy of this claim, as some sources have labeled BAK as a "suspicious clone" of FCA-regulated firms. This raises questions about its actual compliance and operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 532055 | United Kingdom | Suspicious Clone |

The regulatory quality is significant as it dictates how brokers operate and interact with clients. A broker lacking proper regulation may engage in unethical practices, putting client funds at risk. BAK's history shows no negative regulatory disclosures, yet the ambiguous status of its FCA claims necessitates caution. This brings us to the question: Is BAK safe? The answer remains uncertain until further clarity on its regulatory compliance is achieved.

Company Background Investigation

BAK, operating under the name Bakaal Worldwide Limited, has a relatively brief history since its inception in 2017. The company's ownership structure is not transparently disclosed, which is a red flag for potential investors. A thorough examination of the management team reveals a lack of publicly available information regarding their professional backgrounds and expertise in the financial sector. This opacity can be concerning, as a strong management team is often indicative of a broker's reliability and operational integrity.

The company's transparency regarding its operations and financial practices is crucial for building trust with clients. However, the absence of detailed information about its ownership and management raises questions about its credibility. Traders are advised to be wary of companies that do not provide clear insights into their operational frameworks, as this may indicate a lack of accountability. Therefore, in assessing whether BAK is safe, one must consider the implications of its limited transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by BAK is essential for evaluating its attractiveness as a broker. BAK provides a relatively standard fee structure, but there are reports of hidden fees associated with withdrawals and trading commissions that may not be immediately apparent. This lack of clarity can lead to unexpected costs for traders, which is a common issue among less reputable brokers.

| Fee Type | BAK | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 2.0 pips | 1.5 pips |

| Commission Structure | Variable | Fixed or Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The comparison of BAK's trading costs with industry averages indicates that while it may not be the most expensive option, its spreads and commissions are higher than many competitors. This could be a significant factor for traders who are sensitive to costs. Moreover, any unusual fees or policies should be scrutinized closely, as they can be indicative of a broker's overall trustworthiness. Thus, it is imperative to ask: Is BAK safe? The answer hinges on the broker's transparency regarding its fee structure.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. BAK claims to implement measures to protect client deposits, including the segregation of funds and investor protection schemes. However, the effectiveness of these measures is contingent upon the broker's regulatory status and operational practices. Without clear evidence of robust fund protection policies, clients may be at risk.

BAK's approach to fund security includes maintaining separate accounts for client funds, which is a standard practice among reputable brokers. Additionally, the absence of reports concerning historical fund security issues is a positive sign. However, the lack of detailed information regarding specific policies, such as negative balance protection, is concerning. Traders must remain vigilant and inquire about these aspects to ensure their investments are safeguarded.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the operational quality of BAK. A review of online forums and customer testimonials reveals a mix of experiences, with some users praising the platform's usability while others express frustration over withdrawal issues and customer service responsiveness. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | Unresponsive |

These complaints highlight potential red flags regarding BAK's customer service and operational efficiency. The severity of withdrawal-related complaints is particularly alarming, as it directly impacts clients' access to their funds. In one notable case, a user reported waiting weeks for a withdrawal request to be processed, raising concerns about the broker's operational integrity. This leads to the pressing question: Is BAK safe? The evidence suggests that traders should approach with caution, particularly regarding the withdrawal process.

Platform and Trade Execution

The performance of BAK's trading platform is another critical factor in evaluating its reliability. BAK utilizes the MetaTrader 4 platform, which is known for its user-friendly interface and robust trading tools. However, there are reports of execution issues, including slippage and order rejections, which can adversely affect trading outcomes.

Users have noted instances of significant slippage during high volatility periods, which can lead to unexpected losses. The overall stability and reliability of the platform are crucial for traders who rely on timely executions. Any signs of platform manipulation or consistent execution failures can significantly diminish trust in the broker. Therefore, it is essential to assess whether BAK is safe based on its platform performance and execution quality.

Risk Assessment

Engaging with BAK involves inherent risks that traders must consider. The combination of regulatory ambiguity, customer complaints, and potential execution issues contributes to an overall risk profile that may not be suitable for all traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unclear regulatory status raises concerns. |

| Financial Risk | Medium | Higher spreads and fees may impact profitability. |

| Operational Risk | High | Withdrawal issues and customer complaints indicate potential operational failures. |

To mitigate these risks, traders should conduct thorough research, start with smaller investments, and consider alternatives if they encounter issues. Understanding the risks associated with BAK is crucial for making informed trading decisions, as the question of Is BAK safe? looms large.

Conclusion and Recommendations

In conclusion, the analysis of BAK reveals several concerning factors that potential traders should weigh carefully. While there are no outright signs of fraud, the ambiguous regulatory status, combined with customer complaints and operational issues, suggests that traders should exercise caution.

For those considering trading with BAK, it is advisable to start with a small amount and closely monitor the trading experience. Furthermore, traders may wish to explore alternative brokers with clearer regulatory oversight and better customer feedback. Some recommended alternatives could include brokers with established reputations and transparent operational practices. Ultimately, the question remains: Is BAK safe? The evidence suggests that potential traders should proceed with caution and conduct their due diligence before engaging with BAK.

Is BAK a scam, or is it legit?

The latest exposure and evaluation content of BAK brokers.

BAK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BAK latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.