Is GLO safe?

Business

License

Is GLO Safe or Scam?

Introduction

GLO is a forex broker based in the United Kingdom, established in 2021. It positions itself in the financial market as a provider of various trading instruments, including forex pairs, commodities, indices, and precious metals. As the forex market has become increasingly accessible, the need for traders to evaluate the safety and legitimacy of their brokers has never been more crucial. With numerous reports of scams and fraudulent activities, potential investors must exercise caution and due diligence before committing their funds.

This article aims to provide a comprehensive assessment of GLO, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The evaluation draws on various sources, including user reviews, financial regulatory databases, and expert analyses, to determine whether GLO is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory environment for forex brokers is vital for ensuring the safety of traders' funds and the integrity of trading practices. GLO claims to be regulated by the National Futures Association (NFA) in the United States, but its current status is reported as unauthorized. This raises significant concerns regarding the legitimacy of its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0546995 | United States | Unauthorized |

The lack of valid regulatory oversight is alarming, as it indicates that GLO may not adhere to the stringent requirements set by recognized financial authorities. Regulatory bodies like the NFA enforce rules to protect investors, such as maintaining segregated accounts for client funds and ensuring transparency in trading conditions. The absence of these protections means that traders may be at risk of losing their investments without recourse. Furthermore, the history of compliance for GLO remains questionable, as there have been numerous complaints and negative reviews from users regarding their experiences with the broker.

Company Background Investigation

GLO was established in 2021, making it a relatively new player in the forex market. However, its ownership structure remains opaque, with no publicly available information regarding its management team or key stakeholders. This lack of transparency is a red flag, as reputable brokers typically provide clear information about their leadership and operational history.

The absence of a well-defined company background raises concerns about the broker's stability and reliability. Traders often rely on the experience and qualifications of a broker's management team to gauge the firm's credibility. In GLO's case, the inability to verify the expertise of its leadership only adds to the skepticism surrounding its operations.

Furthermore, the broker's website is currently reported as unavailable, which further complicates the ability to assess its legitimacy. A transparent and accessible online presence is essential for fostering trust among potential clients. In summary, the lack of clear information regarding GLO's ownership and management, combined with its short history, makes it difficult to ascertain whether it is a trustworthy trading platform.

Trading Conditions Analysis

GLO advertises a competitive trading environment, claiming to offer various account types, high leverage, and low spreads. However, the lack of clarity regarding its fee structure raises concerns for potential traders.

| Fee Type | GLO | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Structure | $4 per lot | $5-10 per lot |

| Overnight Interest Range | Not Specified | Varies |

While GLO claims to provide spreads as low as 0.0 pips, the lack of specific details for individual instruments creates uncertainty. Additionally, the commission structure does not align with industry standards, as it lacks transparency regarding the lot sizes and conditions under which these fees apply.

The absence of clear information about overnight interest rates and other potential fees further complicates the trading environment. Traders often face unexpected costs that can erode their profits, particularly if they are not adequately informed beforehand. Overall, the unclear fee structure and potential hidden costs associated with trading on GLO's platform pose significant risks for traders.

Customer Fund Safety

The safety of customer funds is a primary concern for any forex trader. GLO claims to implement measures to secure client funds; however, the effectiveness of these measures is questionable given its unauthorized regulatory status.

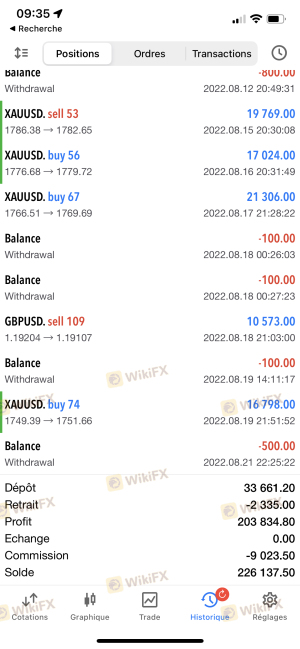

Traders should expect brokers to provide clear policies on fund segregation, investor protection, and negative balance protection. Unfortunately, GLO's lack of regulatory oversight means that these protections may not be in place. Historical complaints indicate that users have experienced difficulties in withdrawing their funds, which raises alarms about the broker's financial practices and the security of traders' investments.

Moreover, without a solid regulatory framework, GLO may not be compelled to adhere to best practices for safeguarding client funds. The absence of investor protection mechanisms means that traders could potentially lose their entire investment without any recourse. In light of these concerns, it is imperative for traders to approach GLO with caution, as the safety of their funds cannot be guaranteed.

Customer Experience and Complaints

User feedback plays a crucial role in evaluating the reliability of any broker. Reviews of GLO reveal a pattern of negative experiences, particularly concerning withdrawal issues and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Customer Service Delays | Medium | Poor |

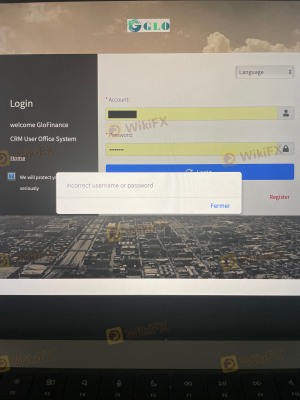

| Account Access Issues | High | Poor |

Many users have reported being unable to withdraw their funds, describing GLO as a potential scam. Complaints highlight frustrating experiences with customer support, where users often encountered long wait times and inadequate responses to their inquiries.

For instance, one user mentioned that despite achieving substantial profits, they faced obstacles when trying to access their funds. Such experiences contribute to a growing sentiment that GLO may not be a trustworthy broker. The frequency and severity of these complaints underscore the need for potential traders to consider alternative options with better reputations.

Platform and Execution

Evaluating the performance of a trading platform is essential for traders seeking a reliable trading experience. GLO claims to offer a robust trading platform compatible with various devices, but user feedback suggests that there may be significant issues with stability and execution quality.

Reports of slippage and order rejections have surfaced, raising concerns about the broker's execution practices. Traders expect to have their orders filled at the requested prices, and any deviation can lead to unexpected losses. Additionally, there are indications that the platform may not be as user-friendly as advertised, which can hinder the trading experience for both novice and experienced traders.

Risk Assessment

Engaging with GLO presents several risks that potential traders must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of authorization raises concerns about legitimacy. |

| Fund Safety Risk | High | Unclear fund protection measures increase the risk of loss. |

| Execution Risk | Medium | Reports of slippage and rejections may affect trading outcomes. |

| Customer Support Risk | High | Poor responsiveness can exacerbate issues faced by traders. |

To mitigate these risks, traders should conduct thorough research and consider using alternative brokers that offer better regulatory oversight and customer support. It is essential to prioritize brokers with transparent operations and a solid reputation in the market.

Conclusion and Recommendations

Based on the analysis presented, it is clear that GLO raises significant concerns regarding its legitimacy and safety. The combination of unauthorized regulatory status, opaque company background, unclear trading conditions, and a pattern of negative user experiences suggests that GLO may not be a safe trading option.

For traders seeking reliable forex brokers, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers with strong regulatory oversight, transparent fee structures, and positive user feedback should be prioritized. In conclusion, potential traders should approach GLO with caution, as the risks associated with trading on this platform appear to outweigh the potential benefits.

Is GLO a scam, or is it legit?

The latest exposure and evaluation content of GLO brokers.

GLO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GLO latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.