Regarding the legitimacy of DSY forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is DSY safe?

Pros

Cons

Is DSY markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港高地集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://thegoldenholdings.comExpiration Time:

--Address of Licensed Institution:

香港港灣道26號華潤大廈29樓2907-08室Phone Number of Licensed Institution:

24960066Licensed Institution Certified Documents:

Is DSY Safe or a Scam?

Introduction

DSY, a Hong Kong-based forex broker established in 2018, positions itself within the competitive landscape of the foreign exchange market, primarily targeting clients in China. As the forex trading environment becomes increasingly saturated with numerous brokers, traders must exercise caution and perform thorough evaluations of any broker they consider. This is essential not only to safeguard their investments but also to ensure that they are not falling victim to potential scams or fraudulent schemes.

In this article, we will investigate the credibility of DSY by analyzing its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. Our evaluation will be based on a comprehensive review of available data, including user feedback, regulatory information, and industry benchmarks.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor that determines its legitimacy and the safety of client funds. DSY claims to be regulated by the Hong Kong Gold Exchange (HK GX), but there are significant concerns regarding the quality and reliability of this regulation. A deeper investigation reveals that DSY has received a low score of 1.54 out of 10 from WikiFX, indicating multiple user complaints and overall dissatisfaction.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong Gold Exchange (HK GX) | 192 | Hong Kong | Suspicious Clone |

The lack of recognition from more reputable regulatory bodies, such as the FCA (UK) or ASIC (Australia), raises red flags regarding DSY's operational transparency and adherence to stringent financial regulations. Furthermore, the presence of numerous complaints against DSY suggests potential issues with compliance and customer service, making it imperative for prospective traders to carefully consider the risks associated with this broker.

Company Background Investigation

DSY's history is relatively short, having been established in 2018. While the company claims to have a solid foundation, the lack of detailed information regarding its ownership structure and management team raises concerns about its transparency. The absence of publicly available data on the qualifications and backgrounds of key personnel adds to the uncertainty surrounding DSY's operations.

A thorough background check on the management team is essential, as experienced leadership can significantly impact a broker's reliability and customer service. However, DSY's opacity in this regard is troubling, as it leaves traders without a clear understanding of who is managing their investments. This lack of transparency may indicate underlying issues that could affect the broker's trustworthiness and operational integrity.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. DSY's fee structure and trading conditions appear to be competitive at first glance, but a closer examination reveals potential pitfalls. Traders should be aware of any hidden fees or unusual policies that could impact their overall trading experience.

| Fee Type | DSY | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information on spreads, commissions, and other trading costs can lead to confusion and unexpected charges for traders. It is essential for potential clients to seek clarity on these aspects before committing to trade with DSY. Moreover, if the broker's fees significantly deviate from industry standards, it could be a sign of underlying issues or unfair practices.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. DSY claims to implement various safety measures to protect client deposits, including fund segregation and negative balance protection. However, the effectiveness of these measures is contingent upon the broker's regulatory status and operational transparency.

A critical analysis of DSY's fund safety policies reveals a lack of detailed information on how client funds are managed and safeguarded. Traders should be wary of any broker that does not provide comprehensive details regarding fund protection mechanisms, as this could indicate potential risks to their investments. Furthermore, the historical context of any past fund safety issues or disputes involving DSY should be carefully considered.

Customer Experience and Complaints

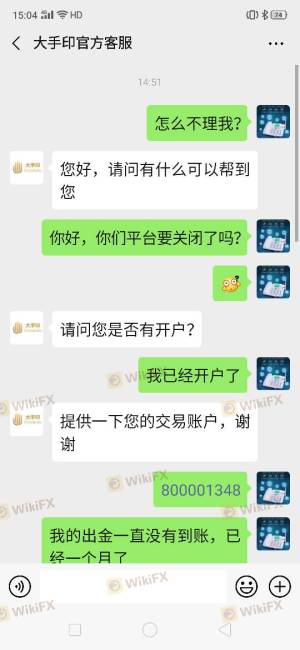

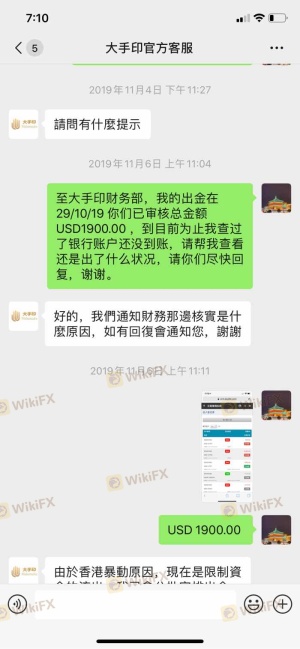

Customer feedback is a vital component in assessing a broker's reliability and overall service quality. In the case of DSY, numerous complaints have been reported, particularly regarding withdrawal issues and poor customer service. This trend raises serious concerns about the broker's commitment to client satisfaction and operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

Two notable cases highlight the concerns surrounding DSY. In one instance, a trader reported being unable to withdraw funds after experiencing significant losses due to adverse trading recommendations from the broker. In another case, clients expressed frustration over unresponsive customer service, leading to a lack of resolution for their issues. These examples illustrate the potential risks associated with trading through DSY and emphasize the importance of considering user experiences when evaluating a broker's credibility.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders aiming to execute their strategies effectively. DSY's platform has faced scrutiny regarding its stability and user experience. Traders have reported issues with order execution quality, including slippage and high rejection rates, which can significantly impact trading outcomes.

A broker's ability to provide a seamless trading experience is essential for maintaining trust and ensuring client satisfaction. Any signs of platform manipulation or consistent execution problems should be taken seriously, as they could indicate deeper operational issues within the brokerage.

Risk Assessment

Using DSY as a trading platform presents several risks that potential clients should consider. The combination of regulatory concerns, customer complaints, and platform performance issues creates a challenging environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of reputable regulation and numerous complaints. |

| Operational Risk | Medium | Issues with platform stability and execution quality. |

| Customer Service Risk | High | Poor response to client complaints and withdrawal issues. |

To mitigate risks associated with trading through DSY, traders should conduct thorough research, utilize risk management strategies, and consider diversifying their investments across multiple brokers to minimize exposure.

Conclusion and Recommendations

In conclusion, the evidence suggests that DSY may not be a safe option for forex trading. The combination of regulatory concerns, numerous customer complaints, and operational transparency issues raises significant red flags. While DSY may offer competitive trading conditions, the potential risks associated with this broker make it essential for traders to exercise caution.

For those considering trading with DSY, we recommend conducting further research and exploring alternative brokers with reputable regulatory oversight and positive client feedback. Reliable options may include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a more secure trading environment. Ultimately, traders should prioritize their safety and ensure they are making informed decisions when selecting a forex broker.

Is DSY a scam, or is it legit?

The latest exposure and evaluation content of DSY brokers.

DSY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DSY latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.