Dollars Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive dollars markets review examines one of the newer players in the forex brokerage landscape. Dollars Markets was established in 2020. The company has its headquarters in Port-Louis, Mauritius, and operates as a forex and CFD broker under the regulation of the Mauritius Financial Services Commission (FSC). The company offers trading services across multiple asset classes. These include forex, commodities, indices, cryptocurrencies, stocks, energies, and Exchange Traded Funds (ETFs) through the popular MetaTrader 4 and MetaTrader 5 platforms.

The broker stands out with very high leverage ratios reaching up to 1:2000. This makes it particularly attractive to traders seeking amplified market exposure. However, user feedback presents a mixed picture, with some clients praising the platform's user-friendly interface and responsive customer service. Other users have raised serious concerns about the broker's legitimacy, with some reviews labeling it as potentially fraudulent.

This mixed reception requires careful evaluation for potential clients. The broker appears to target traders who prioritize high leverage options and diverse asset trading opportunities. However, the conflicting user experiences suggest that thorough research is essential before committing funds to this platform.

Important Notice

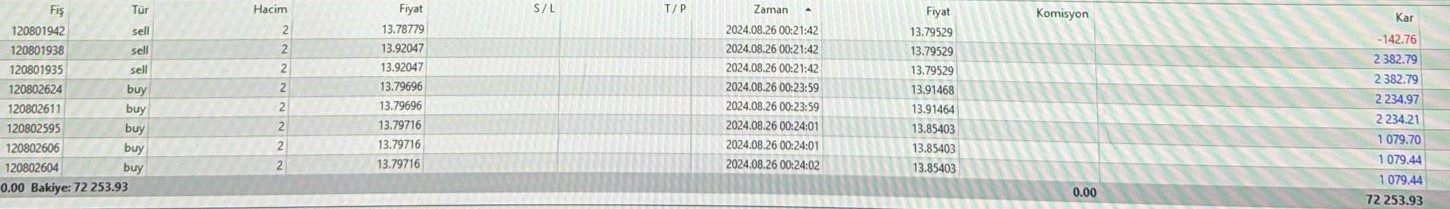

Dollars Markets operates through multiple registered entities across different jurisdictions. These include incorporation in both Mauritius (registration number 179703) and Saint Vincent and the Grenadines (registration number 25859 BC 2020). These varying regulatory environments may impact the level of trader protection and regulatory oversight available to clients depending on their geographic location and the specific entity they trade with.

This review is compiled based on available user feedback, official company information, and publicly accessible regulatory data. We strive to provide an objective and comprehensive analysis. However, we acknowledge that individual trading experiences may vary significantly. Potential clients should conduct their own thorough research and consider their risk tolerance before engaging with any forex broker.

Rating Framework

Broker Overview

Dollars Markets entered the forex brokerage market in 2020. The company established its primary operations from Port-Louis, Mauritius. As a subsidiary of the Dollars Markets Group, the company has positioned itself as a multi-asset broker specializing in forex and Contract for Difference (CFD) trading services. The broker's business model focuses on providing retail traders with access to global financial markets through electronic trading platforms. It emphasizes high leverage ratios and diverse asset selection to attract active traders.

According to WikiFX reporting, Dollars Markets has been operational for between 2 and 5 years. This places it firmly in the category of newer market entrants. The company's regulatory framework centers around its Mauritius Financial Services Commission license (number GB21026297). Its registered address is at 33 Edith Cavell Street, C/o IQ EQ Fund Services (Mauritius) Ltd, Port-Louis, 11324. The broker offers access to an extensive range of tradeable instruments including major and minor forex pairs, precious metals, global stock indices, leading cryptocurrencies, individual company shares, energy commodities, and Exchange Traded Funds.

The trading infrastructure is built around the industry-standard MetaTrader 4 and MetaTrader 5 platforms. These provide clients with familiar and robust trading environments equipped with comprehensive charting tools, technical indicators, and automated trading capabilities.

Regulatory Status: Dollars Markets operates under the supervision of the Mauritius Financial Services Commission (FSC) with license number GB21026297. The broker maintains dual registration with entities in both Mauritius and Saint Vincent and the Grenadines. However, the primary regulatory oversight appears to be centered in Mauritius.

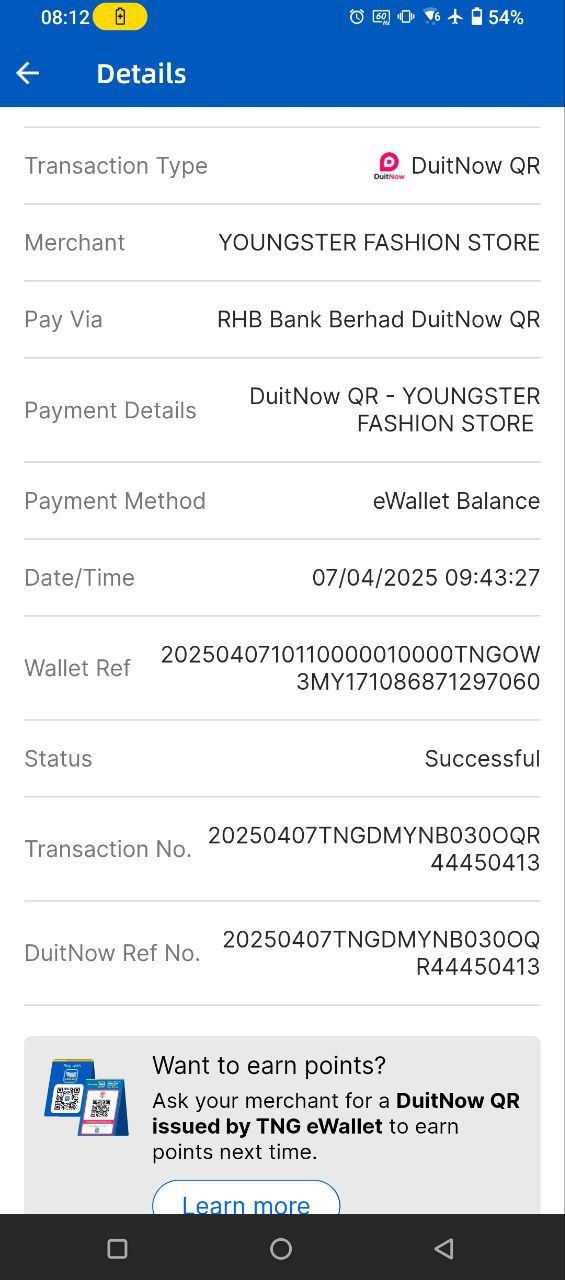

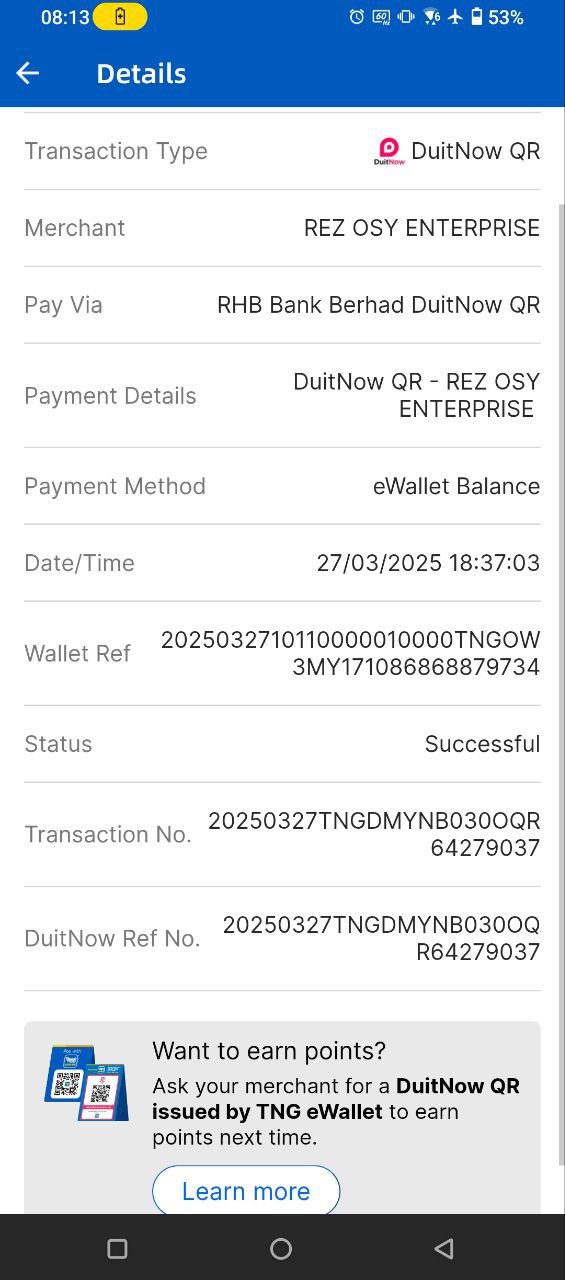

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees for deposits and withdrawals was not detailed in available sources. This represents a transparency gap that potential clients should clarify directly with the broker.

Minimum Deposit Requirements: The minimum initial deposit requirement is not specified in available documentation. This may create uncertainty for prospective traders planning their account funding strategies.

Promotional Offers: Details regarding welcome bonuses, deposit incentives, or ongoing promotional campaigns were not found in the reviewed materials. This suggests either limited promotional activity or insufficient disclosure of such programs.

Asset Coverage: The broker provides trading access across seven major asset categories: foreign exchange pairs, commodity markets, global indices, cryptocurrency markets, individual equity shares, energy sector instruments, and Exchange Traded Funds. This offers substantial diversification opportunities for traders.

Cost Structure: Dollars Markets operates with variable spread pricing. However, specific spread ranges and commission structures remain unclear from available sources. This lack of detailed cost information may complicate trading cost calculations for potential clients.

Leverage Options: The broker offers maximum leverage ratios of up to 1:2000. This is significantly higher than many competitors and particularly attractive to traders seeking amplified market exposure. However, such high leverage also substantially increases risk.

Platform Selection: Trading services are delivered through MetaTrader 4 and MetaTrader 5 platforms. These provide clients with industry-standard trading environments known for their reliability, extensive technical analysis tools, and support for automated trading strategies.

Geographic Restrictions: Specific information about restricted countries or regional limitations was not available in the reviewed sources. This requires direct inquiry with the broker for clarity on service availability.

Customer Support Languages: The range of supported languages for customer service was not specified in available materials. This potentially impacts accessibility for international clients.

This dollars markets review highlights several areas where additional transparency would benefit potential clients in making informed decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions offered by Dollars Markets present a mixed picture that reflects both opportunities and concerning gaps in transparency. The broker provides access to high leverage ratios up to 1:2000 and supports trading across multiple asset classes. However, critical information about account types, minimum deposit requirements, and fee structures remains notably absent from publicly available sources.

The lack of clear information regarding different account tiers or specialized account options such as Islamic accounts creates uncertainty for traders with specific requirements. Most established brokers typically offer tiered account structures with varying benefits, minimum deposits, and trading conditions. However, Dollars Markets' approach in this area is not well-documented. This transparency gap particularly affects new traders who need clear guidance on entry requirements and ongoing costs.

User feedback suggests that while some clients appreciate the platform's accessibility, others have expressed concerns about unexpected fees or unclear terms. The absence of comprehensive account condition disclosure on public platforms may indicate either limited marketing transparency or a preference for direct client communication regarding terms.

When compared to industry standards, most reputable brokers provide detailed account specifications including minimum deposits ranging from $10 to $500, clear fee schedules, and multiple account types catering to different trader profiles. Dollars Markets' approach appears less transparent in this regard. This contributes to the moderate rating in this category.

This dollars markets review emphasizes the importance of directly contacting the broker to clarify account terms before funding any trading account. This is especially important given the limited publicly available information about basic account conditions.

Dollars Markets demonstrates solid performance in the tools and resources category. This is primarily through its offering of both MetaTrader 4 and MetaTrader 5 platforms. These industry-standard platforms provide traders with comprehensive charting capabilities, extensive technical indicator libraries, and robust automated trading support through Expert Advisors (EAs). The dual platform approach allows clients to choose based on their preferred interface and feature requirements.

The broker's asset diversity represents another strength, with seven major categories including forex, commodities, indices, cryptocurrencies, stocks, energies, and ETFs. This broad selection enables portfolio diversification. It also provides opportunities for traders to capitalize on various market conditions across different sectors and geographic regions.

However, the evaluation is limited by the absence of information regarding proprietary research tools, market analysis resources, educational materials, or additional trading utilities that many modern brokers provide. Advanced features such as economic calendars, market sentiment indicators, news feeds, or educational webinars are not documented in available sources.

User feedback indicates general satisfaction with the platform functionality and tool availability. Several traders note the familiar MetaTrader environment as a positive factor. The platforms' support for automated trading strategies and custom indicators provides flexibility for both discretionary and systematic trading approaches.

The moderate-to-good rating reflects the solid foundation provided by MetaTrader platforms and diverse asset access. However, the lack of documented additional resources prevents a higher score. Traders seeking comprehensive research and educational support may need to supplement with third-party resources.

Customer Service and Support Analysis (Score: 6/10)

Customer service quality at Dollars Markets presents a notably mixed picture based on available user feedback. This results in significant variability in client experiences. Some users report responsive and helpful support interactions, praising quick response times and effective problem resolution. However, these positive experiences are counterbalanced by reports of inadequate support and slow issue resolution from other clients.

The polarized nature of customer service feedback suggests potential inconsistencies in support quality. This may depend on factors such as inquiry complexity, communication channels used, or specific support representatives involved. Some users have specifically mentioned that while initial responses may be prompt, follow-up support and resolution of complex issues can be lacking.

Available information does not specify the range of customer support channels offered, such as live chat, email, phone support, or ticket systems. Similarly, details about support availability hours, response time commitments, or multilingual support capabilities are not documented in reviewed sources. This lack of transparency about support infrastructure makes it difficult for potential clients to set appropriate expectations.

The absence of clear information about support protocols, escalation procedures, or specialized support for different account types further complicates the assessment. Most established brokers provide detailed support information including guaranteed response times, multiple contact methods, and 24/5 or 24/7 availability during market hours.

Given the mixed user experiences and limited transparency about support infrastructure, potential clients should test customer service responsiveness during the account opening process. This will help gauge support quality before committing significant funds.

Trading Experience Analysis (Score: 7/10)

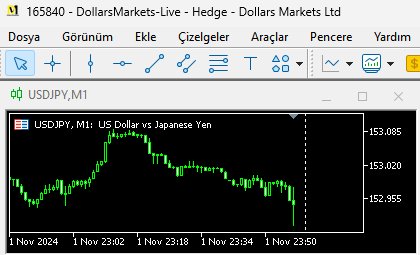

The trading experience provided by Dollars Markets generally receives positive feedback from users. This is particularly regarding platform stability and interface usability. Clients commonly report that both MetaTrader 4 and MetaTrader 5 platforms operate smoothly with good connectivity and minimal technical disruptions during normal market conditions.

Users have specifically praised the platform's intuitive interface design and the comprehensive range of technical analysis tools available through the MetaTrader environments. The familiarity of these platforms reduces the learning curve for experienced traders while providing sufficient functionality for newcomers to develop their trading skills. The availability of both MT4 and MT5 allows traders to select the platform that best matches their specific needs and preferences.

However, some concerns have been raised regarding execution quality, with occasional reports of slippage during high-volatility market periods. While such issues are not uncommon across the industry, the frequency and magnitude of slippage reports warrant attention from potential clients. This is particularly true for those employing scalping or high-frequency trading strategies.

The variable spread structure mentioned in available sources suggests that trading costs may fluctuate with market conditions. However, specific spread ranges and typical execution speeds are not well-documented. This lack of detailed execution statistics makes it challenging for traders to accurately assess total trading costs or compare execution quality with other brokers.

The platform's support for automated trading through Expert Advisors receives positive mention from users engaging in algorithmic trading strategies. The stability of automated system operation appears satisfactory based on available feedback.

This dollars markets review indicates that while the core trading experience is generally solid, traders should monitor execution quality closely. They should also consider testing with smaller position sizes initially.

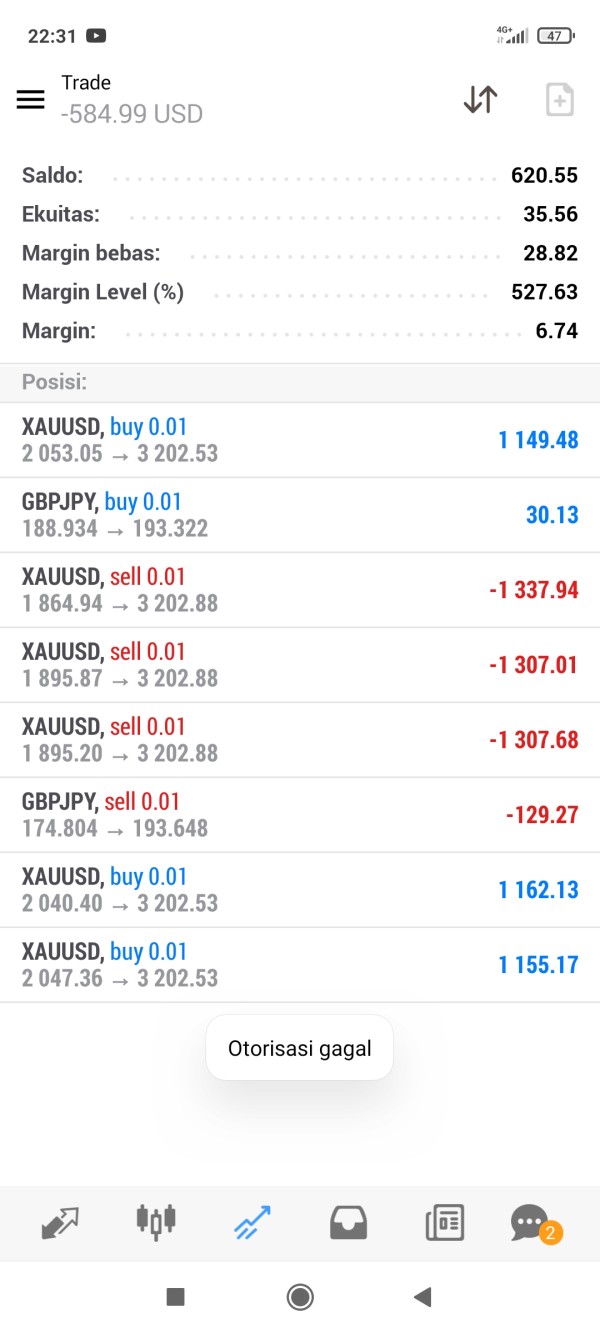

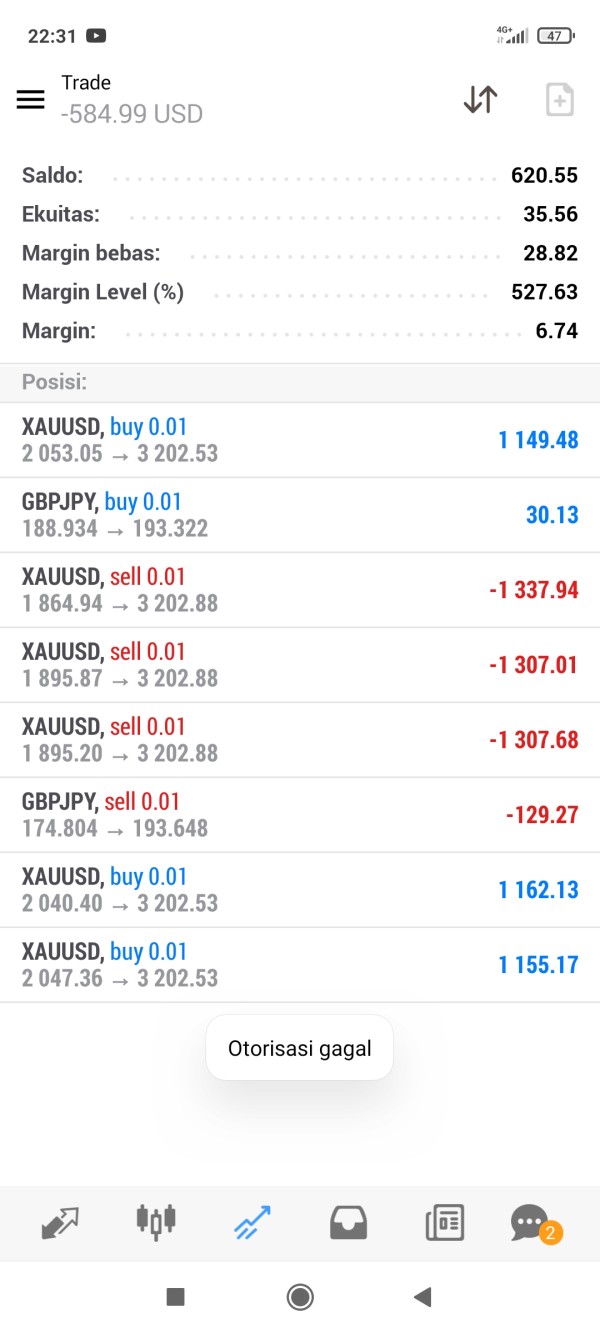

Trust and Reliability Analysis (Score: 5/10)

The trust and reliability assessment for Dollars Markets reveals significant concerns that potential clients must carefully consider. The broker maintains regulatory oversight from the Mauritius Financial Services Commission (FSC), which provides some level of institutional credibility. However, user feedback presents troubling allegations that cannot be ignored.

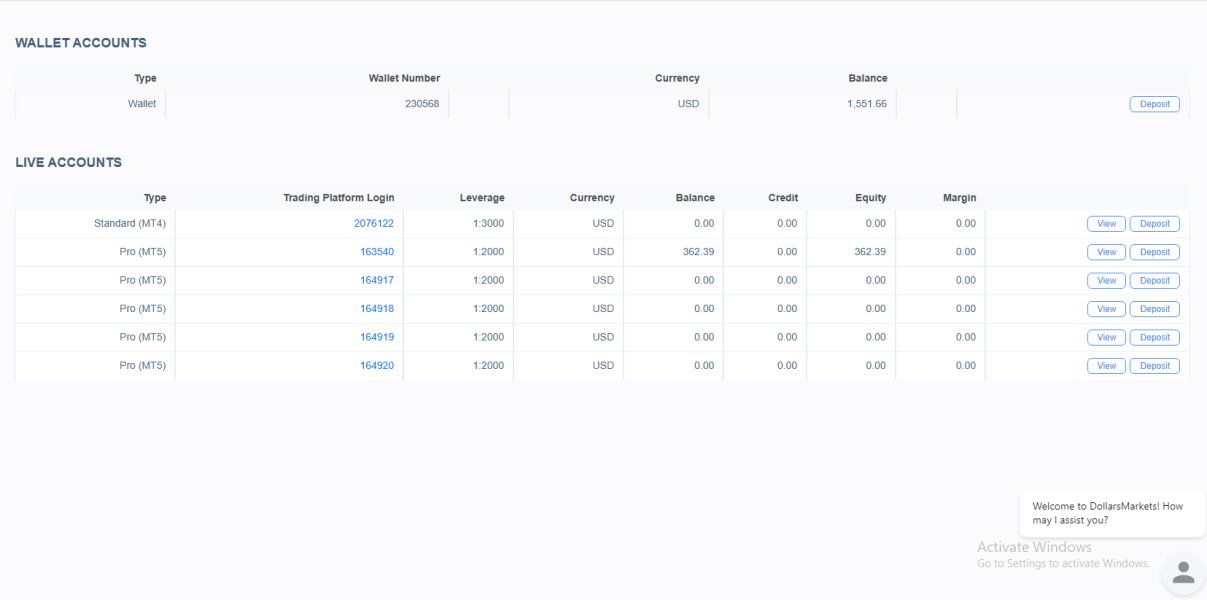

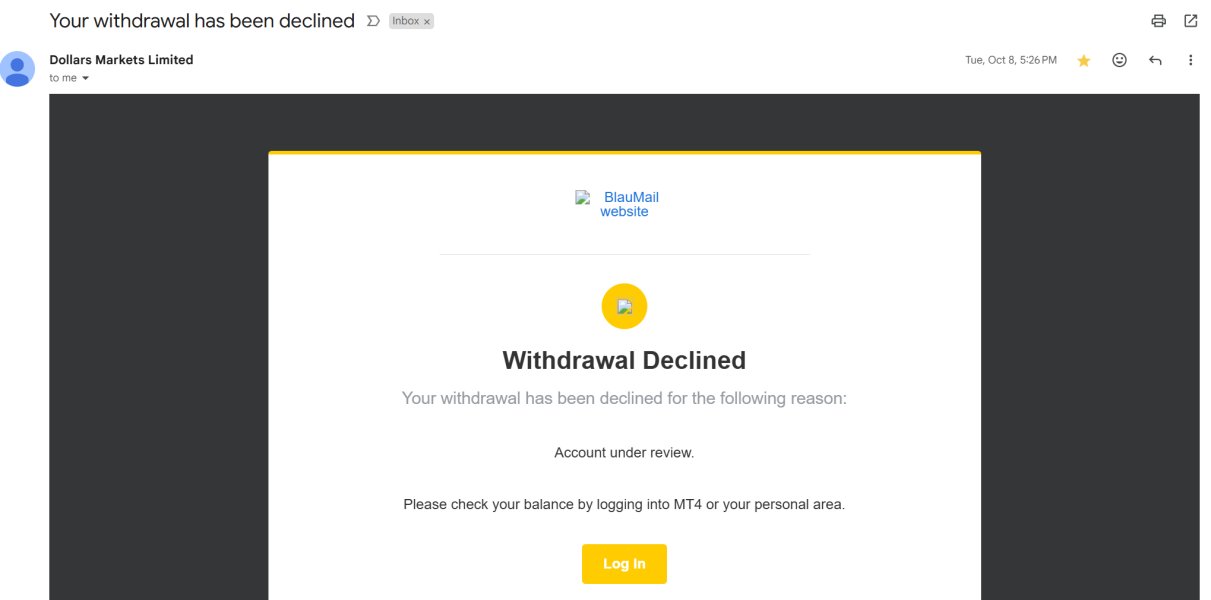

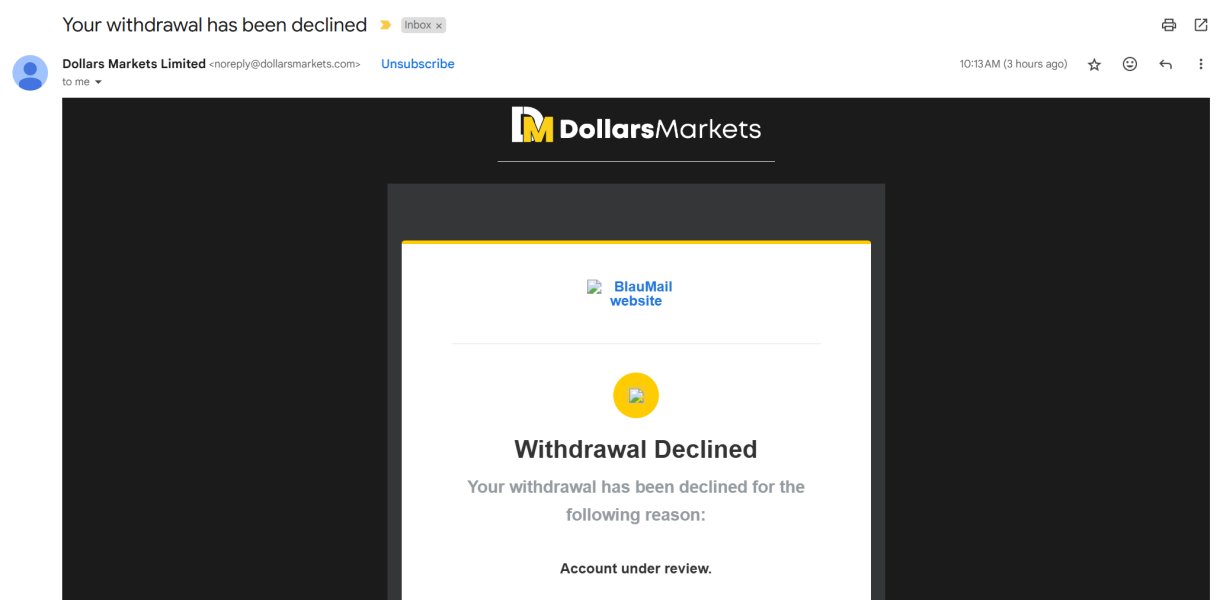

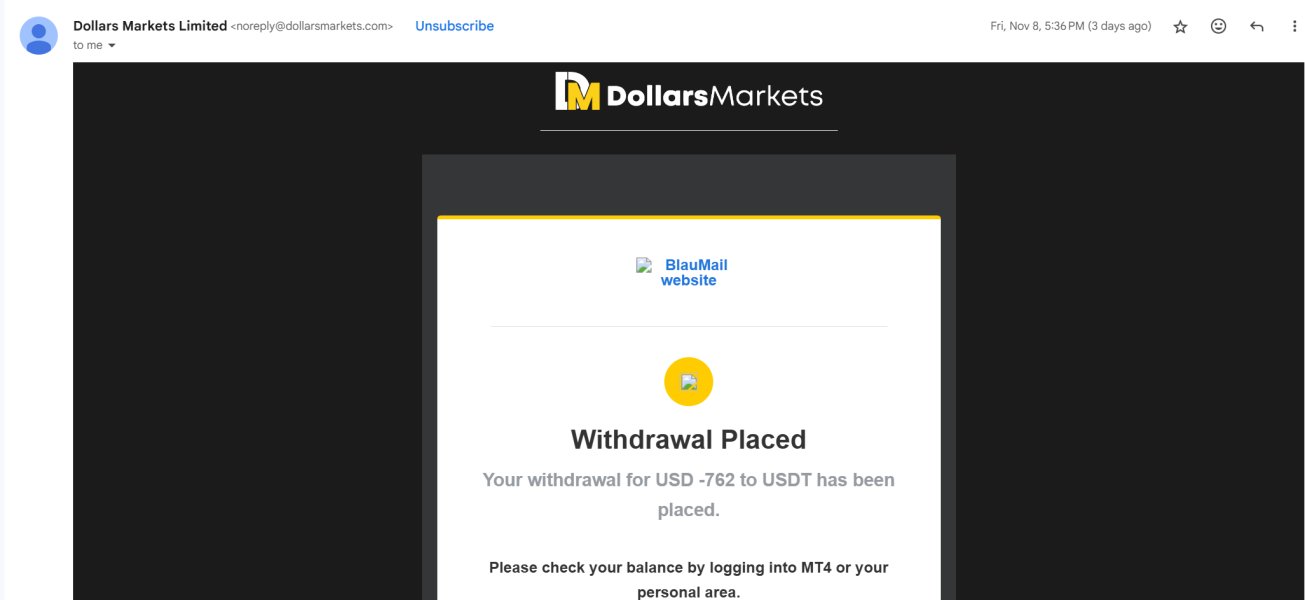

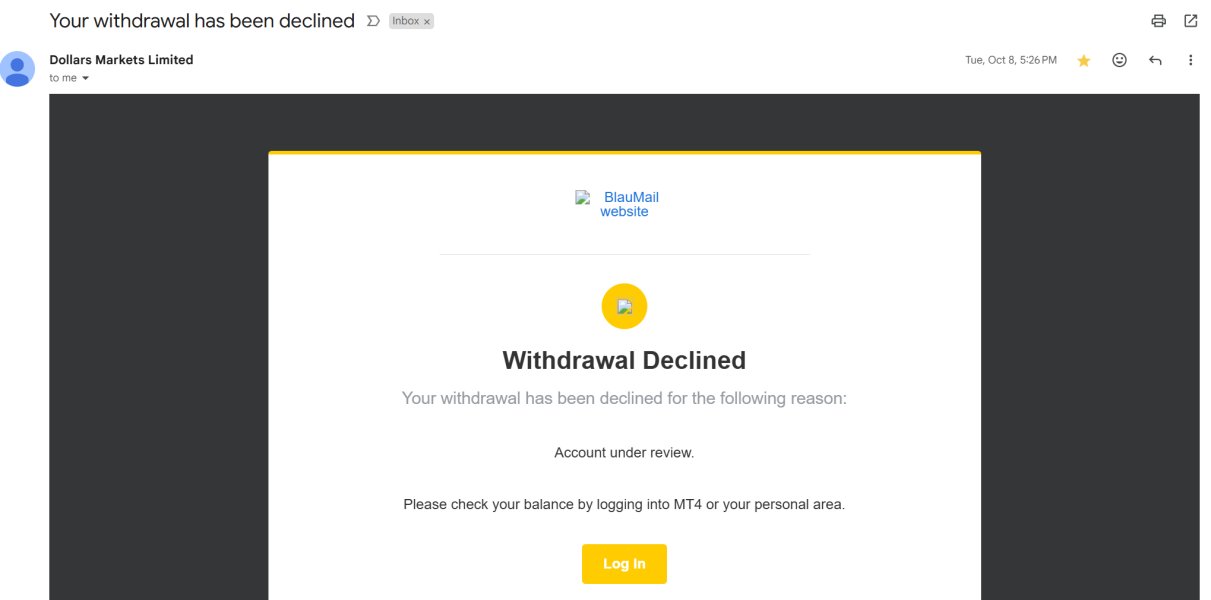

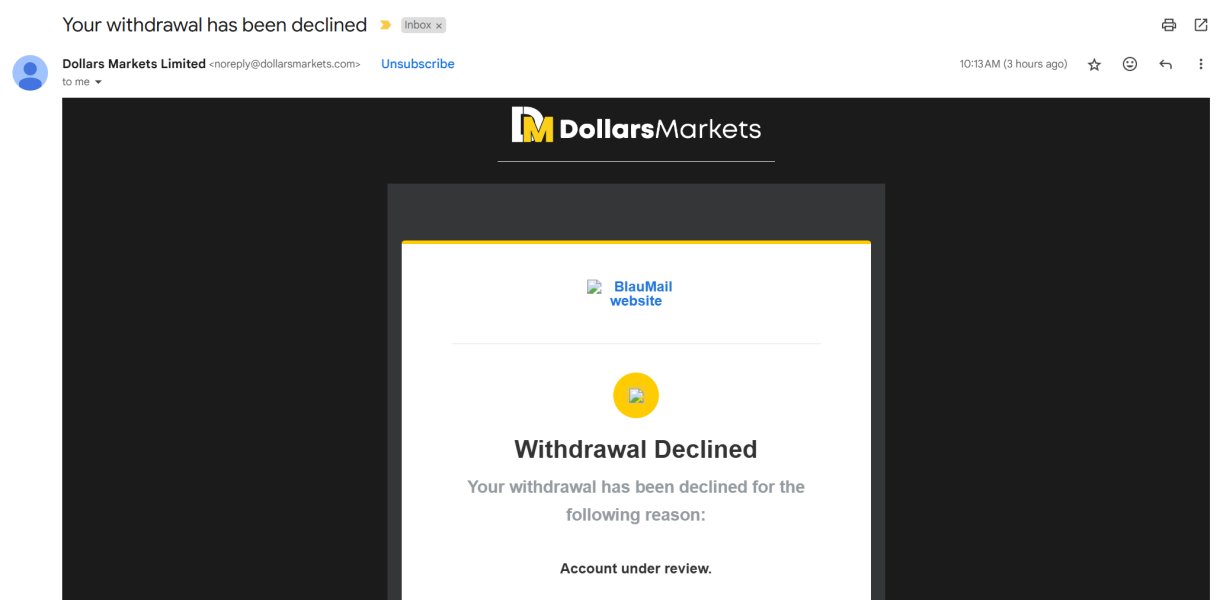

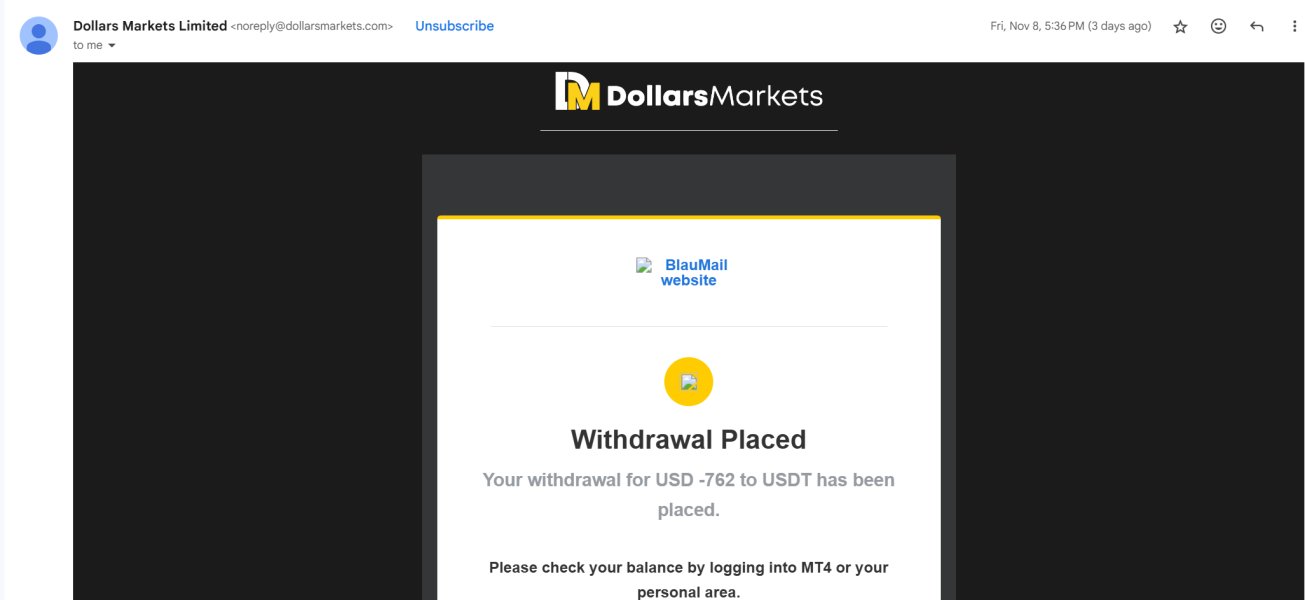

Several user reviews have explicitly labeled Dollars Markets as potentially fraudulent. Some clients claim difficulties in fund withdrawals or suspicious business practices. These serious allegations, while not independently verified, represent red flags that warrant extreme caution. The polarized nature of user feedback - ranging from positive experiences to fraud accusations - creates substantial uncertainty about the broker's reliability.

The regulatory framework provided by the Mauritius FSC, while legitimate, may not offer the same level of investor protection as more stringent regulatory environments. These include those provided by the FCA, ASIC, or CySEC. Mauritius regulation, though improving, has historically been viewed as less rigorous than top-tier financial centers.

The broker's relatively short operational history of 2-5 years provides limited track record for assessment. This is particularly true during market stress periods or economic downturns when broker reliability is most tested. Newer brokers inherently carry higher uncertainty regarding long-term stability and crisis management capabilities.

Available information does not detail specific client fund protection measures such as segregated account requirements, insurance coverage, or compensation schemes that would enhance client security. The absence of transparent information about fund safety measures further compounds trust concerns.

Given these substantial reliability questions, potential clients should exercise extreme caution. They should consider limiting exposure until more definitive information about the broker's legitimacy becomes available.

User Experience Analysis (Score: 6/10)

User experience with Dollars Markets demonstrates significant variability. This reflects the broader pattern of polarized feedback that characterizes this broker across multiple evaluation dimensions. While some clients report satisfactory overall experiences, others have encountered substantial difficulties that raise serious concerns about service consistency.

Positive user feedback typically centers on the platform interface design and ease of navigation within the MetaTrader environments. Several users have noted that the account setup process, when successful, is relatively straightforward. They also report that the trading platform functionality meets basic expectations for order placement and position management.

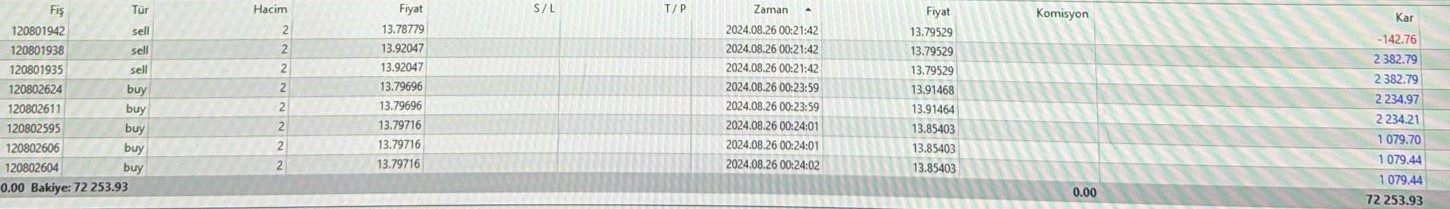

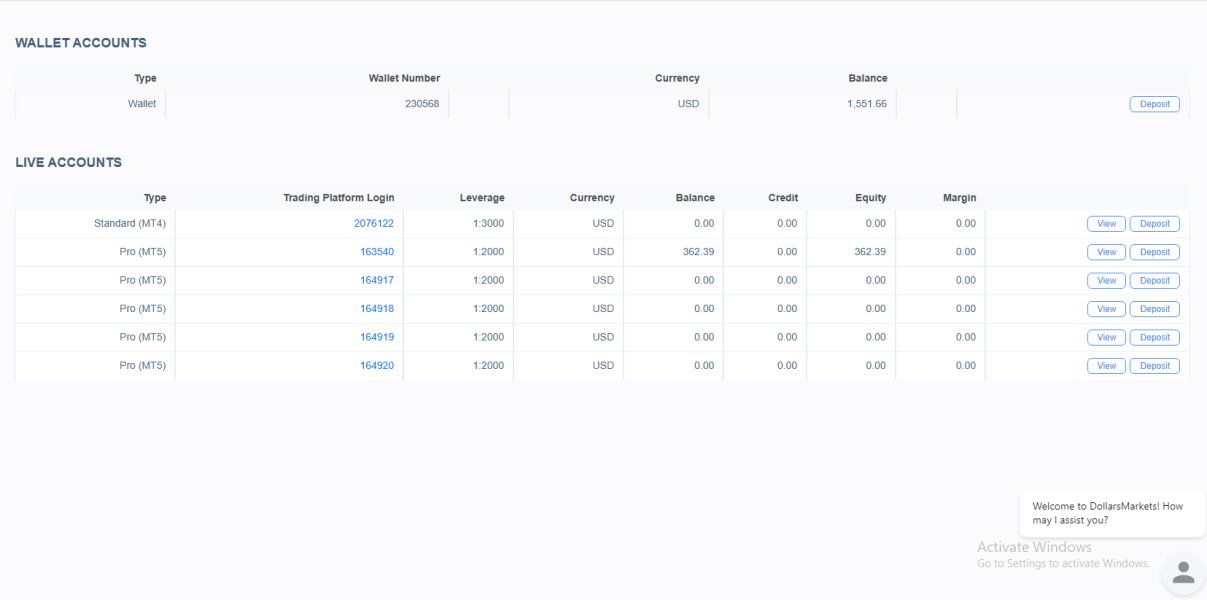

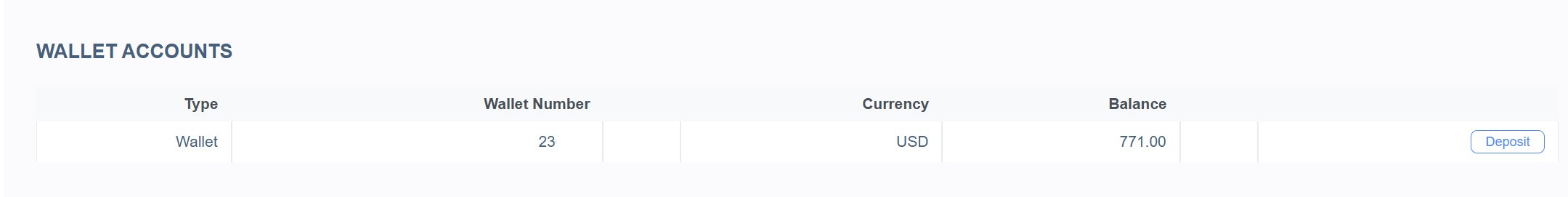

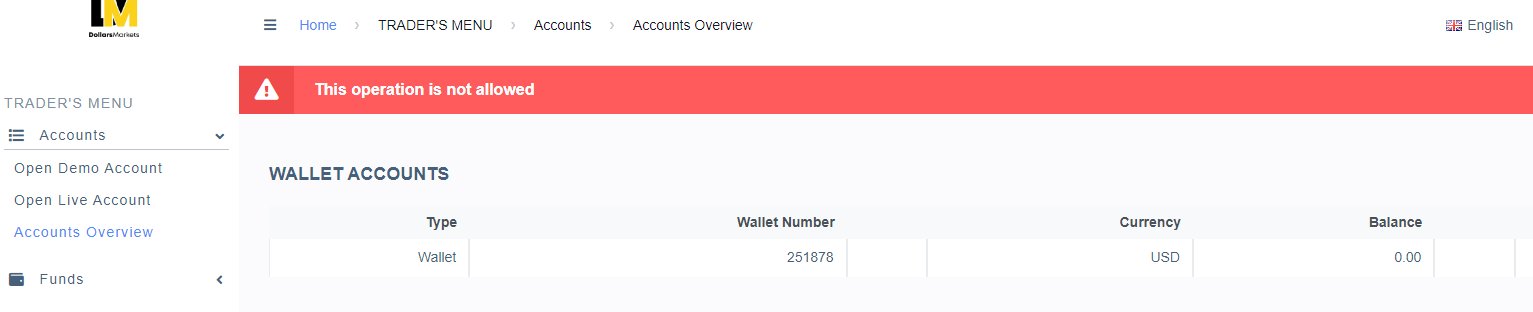

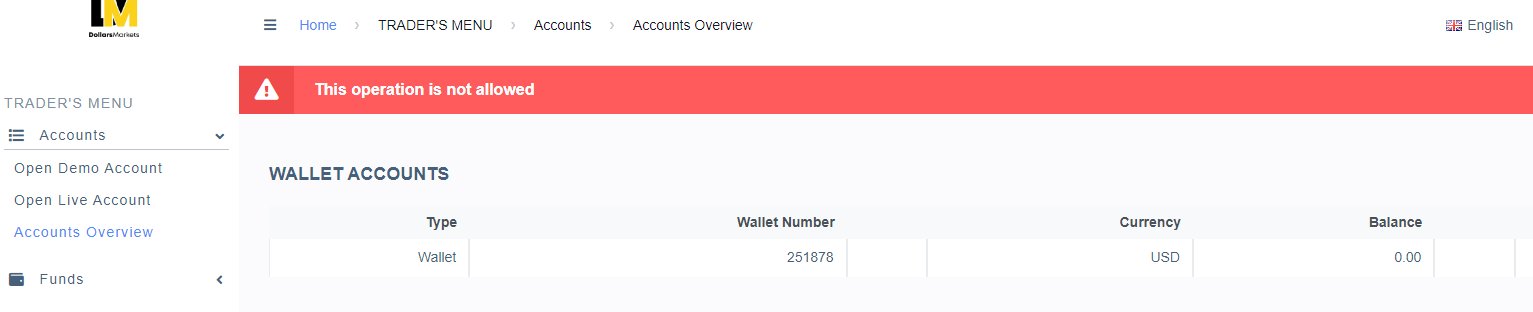

However, negative experiences reported by users include difficulties with account verification processes, unexpected restrictions on trading activities, and most concerning, problems with fund withdrawal requests. These issues represent fundamental operational concerns that directly impact the user experience and overall broker reliability.

The variability in user experiences suggests potential inconsistencies in operational procedures or customer treatment. This may depend on factors such as account size, trading volume, or geographic location. Some users report smooth operations while others encounter significant obstacles, indicating possible systemic issues in service delivery.

Interface usability receives generally positive feedback, with users appreciating the familiar MetaTrader environment and standard trading tools. However, the lack of detailed information about additional user experience features such as educational resources, account management tools, or mobile app functionality limits the comprehensive assessment of the overall user journey.

The moderate rating reflects the mixed nature of user experiences and the uncertainty created by the wide range of reported outcomes. Potential clients should carefully consider their risk tolerance. They should perhaps test the platform with minimal funds before committing to larger trading activities.

Conclusion

This comprehensive dollars markets review reveals a broker that presents both opportunities and significant concerns for potential clients. Dollars Markets offers attractive features including high leverage ratios up to 1:2000, access to diverse asset classes across seven major categories, and reliable MetaTrader 4 and MetaTrader 5 trading platforms. The broker's regulatory status with the Mauritius Financial Services Commission provides some institutional framework. However, this may offer less protection than more stringent regulatory environments.

However, the polarized user feedback and serious allegations raised by some clients create substantial uncertainty about the broker's reliability and trustworthiness. Reports ranging from positive experiences to fraud accusations represent significant red flags that cannot be overlooked. The lack of transparency regarding basic account conditions, fee structures, and operational procedures further compounds these concerns.

Dollars Markets appears most suitable for experienced traders who prioritize high leverage access and diverse asset trading opportunities, while fully understanding and accepting the elevated risks associated with a newer broker that has received mixed reviews. Such traders should consider limiting initial exposure, thoroughly testing withdrawal procedures with small amounts, and maintaining heightened vigilance regarding any operational irregularities.

For risk-averse traders or those new to forex trading, the concerns raised in this evaluation suggest that more established brokers with longer track records and stronger regulatory oversight may provide greater security and peace of mind. The fundamental principle of capital preservation should take precedence over potential trading advantages when significant reliability questions exist.