Paxos 2025 Review: Everything You Need to Know

Executive Summary

This paxos review looks at a special digital asset trading platform that has found its own spot in the cryptocurrency brokerage space. Paxos works as a technology-focused company that gives institutional-grade infrastructure for digital asset trading through its advanced API platform. The company's main strength is its Paxos API v2 trading system, which offers advanced liquidity management capabilities and secure digital asset custody solutions.

The platform mainly targets cryptocurrency investors, institutional traders, and developers who need strong API integration for their trading operations. Paxos sets itself apart by focusing on the technical infrastructure needed for professional-grade digital asset trading, rather than offering traditional forex or CFD products. The company's approach focuses on security, compliance, and technological innovation in the rapidly changing digital asset ecosystem.

Based on available information, Paxos appears well-positioned for users seeking advanced cryptocurrency trading tools and reliable digital asset custody services. However, potential users should note that detailed information about certain operational aspects remains limited in publicly available sources.

Important Notice

This review is based on publicly available information and industry reports about Paxos. As regulatory frameworks for digital asset trading vary significantly across different jurisdictions, users should independently verify the applicable legal requirements and compliance standards in their respective regions before engaging with the platform.

The evaluation presented in this article reflects information available at the time of writing and has not involved direct testing of the platform's services. Users are advised to conduct their own due diligence and consider their individual trading requirements when evaluating Paxos as a potential trading partner.

Rating Framework

Broker Overview

Paxos represents a specialized approach to digital asset trading, positioning itself as a technology-driven solution provider in the cryptocurrency space. The company has developed a comprehensive ecosystem focused on solving the complex challenges associated with digital asset trading, custody, and liquidity management. While specific founding details are not extensively documented in available sources, Paxos has established itself as a significant player in the institutional cryptocurrency trading infrastructure market.

The company's business model centers around providing sophisticated API-based trading solutions that enable clients to access cryptocurrency markets with institutional-grade security and reliability. This approach sets Paxos apart from traditional retail-focused cryptocurrency exchanges, as it primarily serves clients who require programmatic trading capabilities and enterprise-level asset management solutions.

Paxos operates through its flagship Paxos API v2 platform, which serves as the primary interface for all trading and asset management activities. The platform specializes exclusively in digital assets, particularly cryptocurrencies, rather than traditional financial instruments like forex pairs or commodities. This paxos review finds that the company's focused approach allows it to develop specialized expertise in the unique challenges of cryptocurrency trading, including regulatory compliance, security protocols, and liquidity optimization.

The regulatory landscape for Paxos remains somewhat unclear based on available public information, which is not uncommon in the rapidly evolving digital asset sector where regulatory frameworks continue to develop across different jurisdictions.

Regulatory Jurisdiction: Available sources do not specify the primary regulatory authorities overseeing Paxos operations, reflecting the complex and evolving nature of cryptocurrency regulation globally.

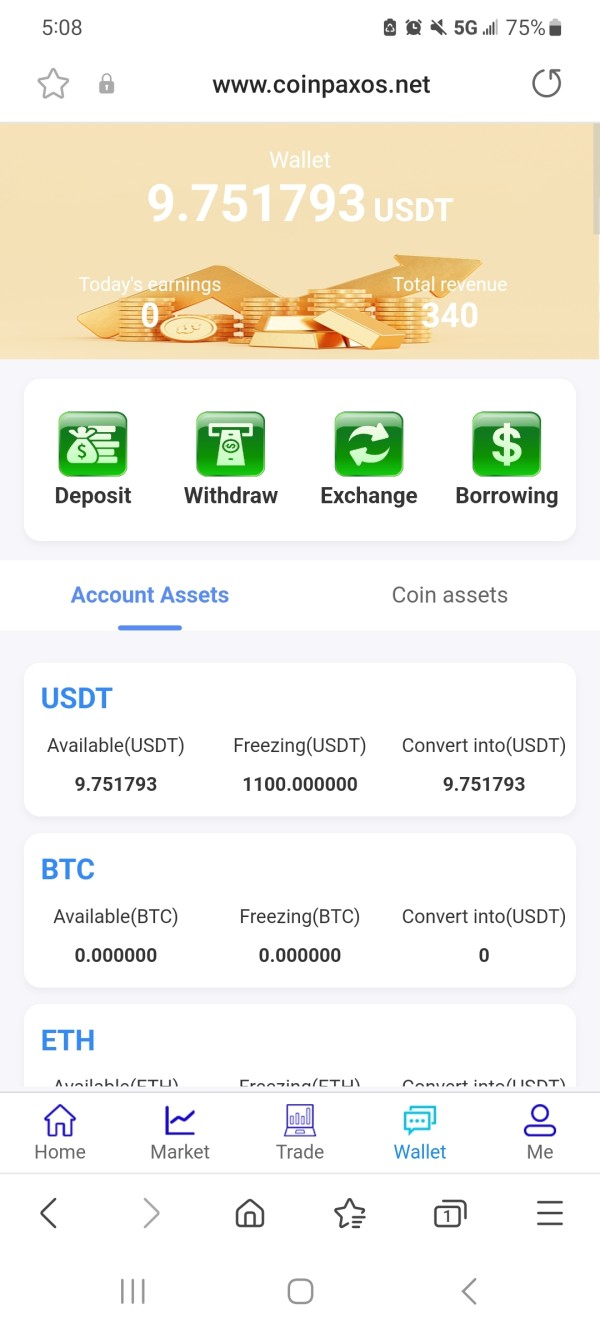

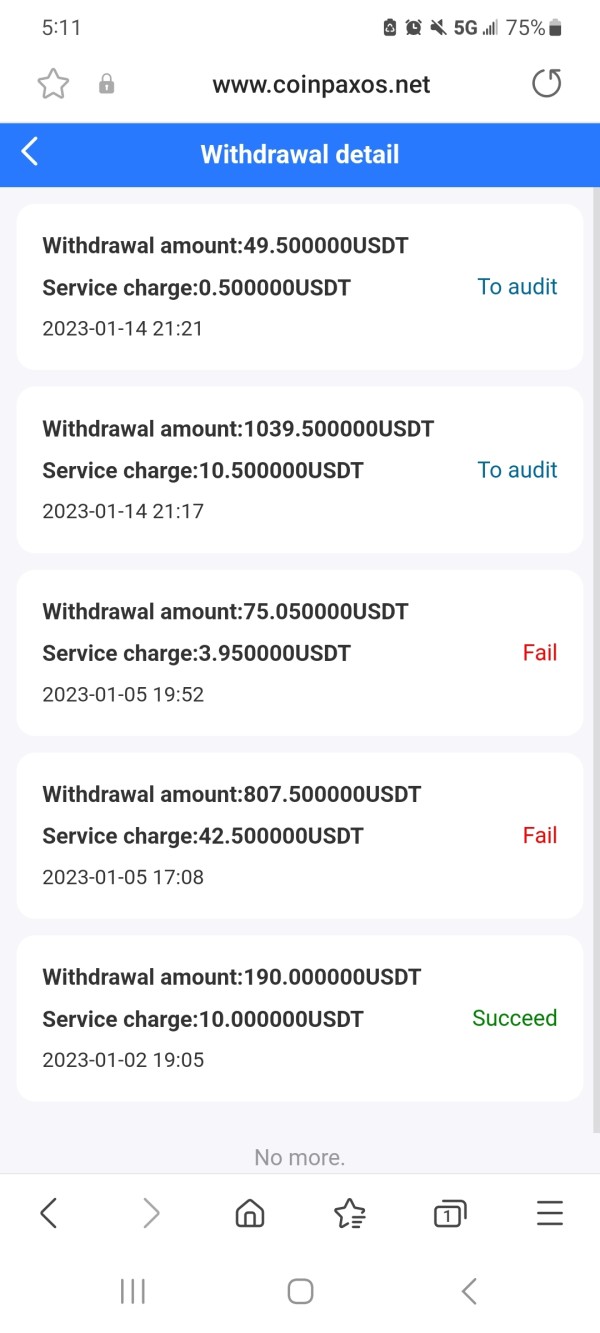

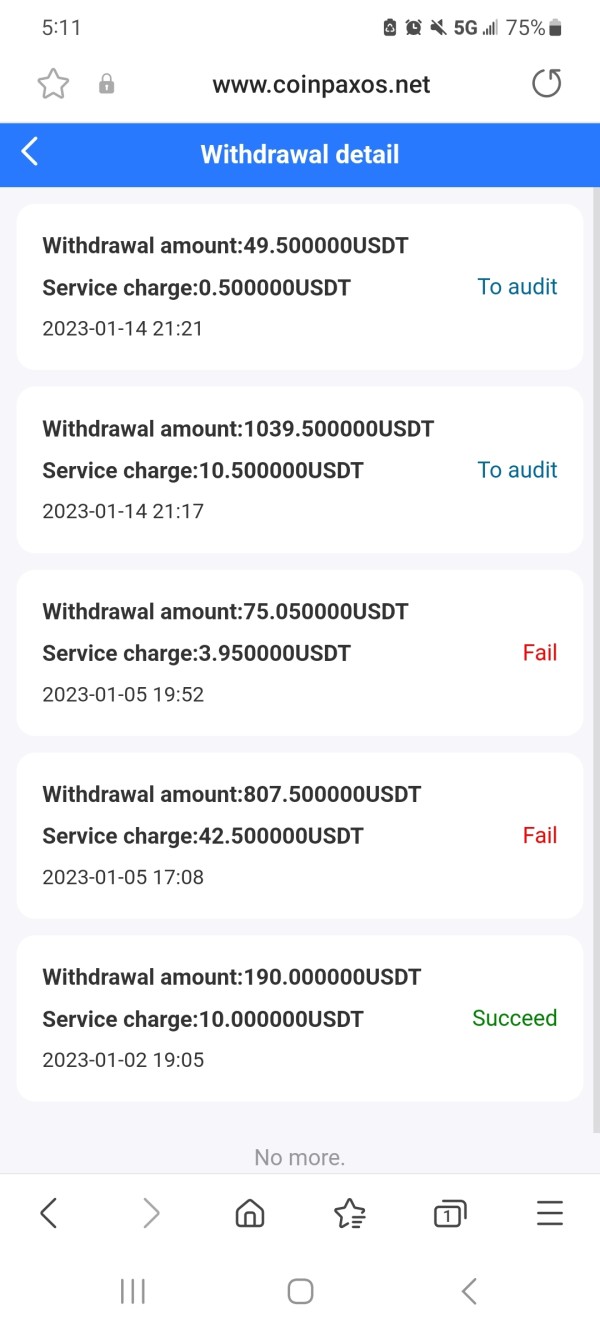

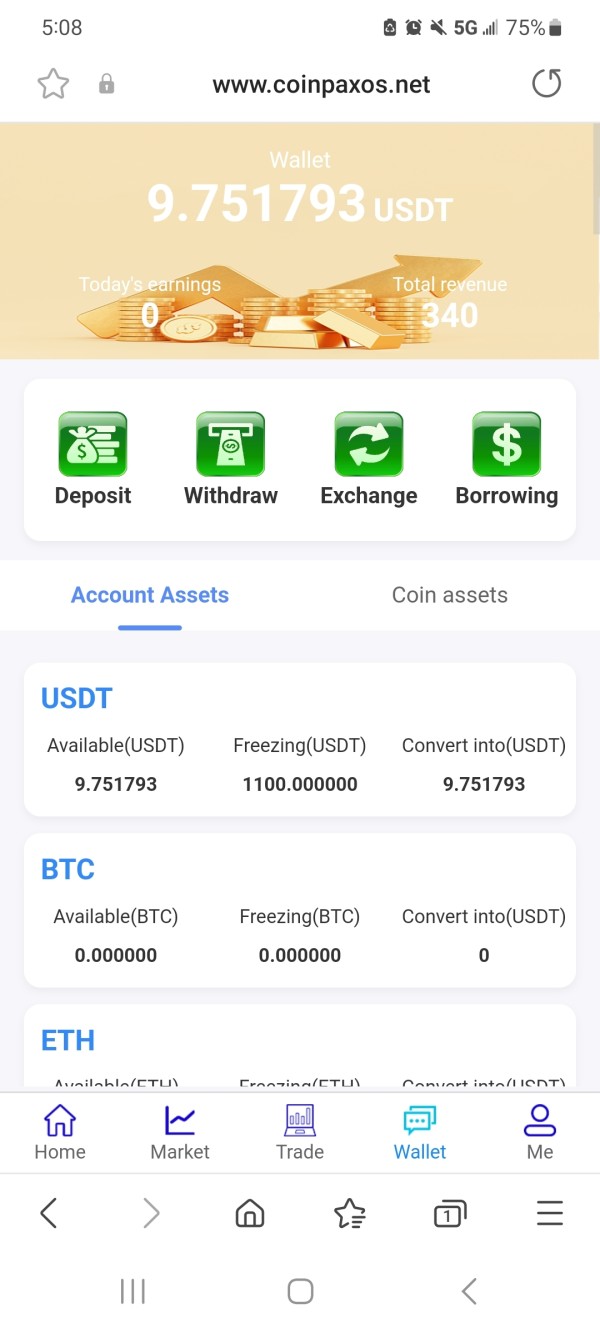

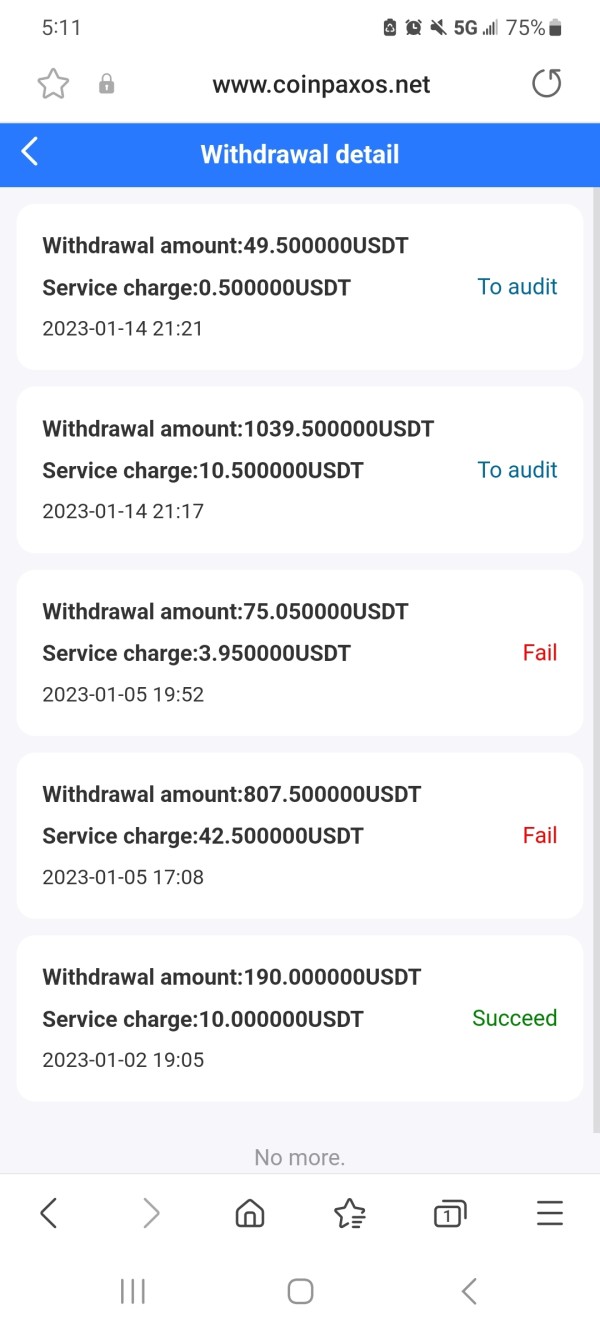

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal processes is not detailed in accessible documentation, though digital asset platforms typically support cryptocurrency deposits and various fiat currency options.

Minimum Deposit Requirements: Minimum funding requirements are not specified in available sources, which may indicate that such details are provided during the account setup process or vary based on client type.

Bonuses and Promotions: Current promotional offerings are not mentioned in available materials, suggesting that Paxos may focus on service quality rather than promotional incentives to attract clients.

Tradable Assets: The platform specializes in digital assets, with cryptocurrency trading being the primary focus. The specific range of supported cryptocurrencies is not detailed in current sources.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in public documentation, which is common for institutional-focused platforms that may offer customized pricing structures.

Leverage Options: Leverage availability and ratios are not specified in accessible sources, though this may reflect regulatory compliance considerations in the digital asset space.

Platform Options: The primary trading interface is the Paxos API v2 platform, designed for programmatic trading and integration with client systems.

Geographic Restrictions: Specific regional limitations are not detailed in available information, though digital asset platforms typically face varying restrictions based on local regulations.

Customer Support Languages: The range of supported languages for customer service is not specified in current documentation.

This paxos review notes that many operational details appear to be provided through direct consultation with the platform, which is typical for institutional-focused trading solutions.

Detailed Rating Analysis

Account Conditions Analysis

The account structure and conditions for Paxos remain largely undocumented in publicly available sources, which presents challenges for potential users seeking to understand the platform's accessibility and requirements. This lack of detailed account information may reflect the platform's focus on institutional clients, where account terms are often customized based on individual client needs and trading volumes.

Without specific information about account types, minimum deposit requirements, or account opening procedures, it becomes difficult to assess how accessible the platform is to different categories of traders. The absence of standardized account information suggests that Paxos may operate on a more consultative basis, where potential clients engage directly with the company to determine appropriate account structures.

This approach, while potentially offering more flexibility for institutional users, may create barriers for individual traders or smaller organizations seeking clear, upfront information about account requirements. The lack of transparency in account conditions could also reflect the evolving nature of regulatory compliance in the digital asset space, where platforms may need to adjust their offerings based on changing legal requirements.

For this paxos review, the absence of clear account condition information represents a significant limitation in evaluating the platform's suitability for different user types. Potential clients would need to engage directly with Paxos representatives to understand the specific requirements and conditions applicable to their situation.

Paxos shows significant strength in its technological infrastructure, particularly through its Paxos API v2 platform. This advanced trading interface represents the core of the company's value proposition, offering programmatic access to digital asset markets with enterprise-grade reliability and security features. The API-focused approach indicates that Paxos has invested heavily in creating tools that meet the needs of institutional traders and developers who require seamless integration capabilities.

The platform's focus on API-based trading tools suggests that users can access advanced order management, real-time market data, and automated trading capabilities. This technological approach aligns with the needs of sophisticated traders who require more than basic web-based trading interfaces. The emphasis on digital asset custody and liquidity management tools further enhances the platform's appeal to institutional users managing significant cryptocurrency portfolios.

However, the availability of research resources, educational materials, and analytical tools remains unclear based on current information sources. Traditional trading platforms often provide market analysis, educational content, and research reports to support trader decision-making, but such resources are not prominently featured in available Paxos documentation.

The absence of detailed information about automated trading support, backtesting capabilities, or third-party integration options limits the ability to fully assess the platform's technological ecosystem. While the API foundation suggests strong automation potential, specific features and capabilities require direct platform evaluation to understand fully.

Customer Service and Support Analysis

Customer service and support capabilities for Paxos are not extensively documented in available public sources, which creates uncertainty about the quality and accessibility of user assistance. For a platform targeting institutional clients and sophisticated traders, robust customer support becomes particularly critical given the complexity of digital asset trading and the potential for significant financial impact from technical issues or trading problems.

The absence of information about support channels, response times, and service availability hours makes it difficult to assess how well Paxos serves its client base when issues arise. Institutional trading platforms typically offer dedicated account management, technical support, and potentially 24/7 availability given the global nature of cryptocurrency markets, but such details are not confirmed in current documentation.

Multi-language support capabilities remain unspecified, which could be a significant consideration for international clients operating in different linguistic environments. The global nature of cryptocurrency trading often requires support teams capable of communicating effectively across different languages and time zones.

Without specific examples of problem resolution processes or user feedback about support quality, it becomes challenging to evaluate whether Paxos maintains the high service standards typically expected by institutional clients. The lack of publicly available support information may reflect a preference for direct client relationships rather than standardized support documentation.

Trading Experience Analysis

The trading experience on Paxos cannot be fully evaluated based on available public information, as specific details about platform performance, user interface design, and operational reliability are not extensively documented. For an API-focused platform, the trading experience largely depends on the technical implementation quality, system uptime, and the efficiency of order execution processes.

Platform stability and speed are crucial factors for any trading system, particularly in the volatile cryptocurrency markets where rapid price movements can significantly impact trading outcomes. However, specific performance metrics, uptime statistics, or user feedback about system reliability are not available in current sources, making it difficult to assess the platform's operational quality.

Order execution quality represents another critical aspect of the trading experience, particularly for institutional users who may be executing large transactions that could be significantly impacted by slippage or delays. The absence of detailed information about execution algorithms, liquidity sourcing, or trade settlement processes limits the ability to evaluate this crucial aspect of the platform.

Mobile trading capabilities and user interface design are not detailed in available documentation, though the API-focused approach suggests that users may primarily interact with the platform through custom applications rather than standardized mobile or web interfaces. This paxos review notes that the technical nature of the platform may require users to have significant technical expertise to fully utilize its capabilities.

Trust and Security Analysis

Trust and security represent fundamental concerns for any digital asset trading platform, given the irreversible nature of cryptocurrency transactions and the significant security risks inherent in digital asset management. However, specific information about Paxos's regulatory compliance, security protocols, and risk management procedures is not extensively detailed in publicly available sources.

The absence of clear regulatory information creates uncertainty about the oversight and compliance standards governing Paxos operations. Digital asset platforms operate in a complex regulatory environment where compliance requirements vary significantly across jurisdictions, and the lack of specific regulatory details makes it difficult for potential users to assess the platform's legal standing.

Security measures, including asset custody protocols, encryption standards, and access controls, are not detailed in current documentation. For institutional clients managing significant digital asset portfolios, understanding the security infrastructure becomes crucial for risk assessment and compliance purposes. The absence of such information may reflect security considerations that limit public disclosure of specific protective measures.

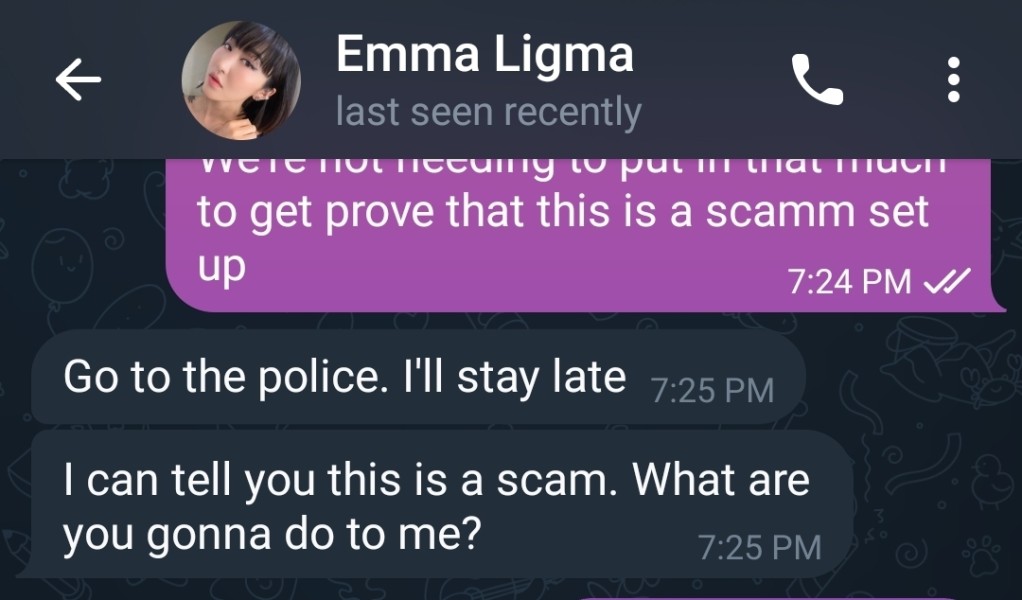

Company transparency and industry reputation cannot be fully assessed without more comprehensive public information about the organization's leadership, financial backing, and operational history. The limited availability of third-party evaluations or industry recognition makes it challenging to gauge the platform's standing within the digital asset trading community.

User Experience Analysis

User experience evaluation for Paxos faces significant limitations due to the absence of detailed user feedback and interface documentation in available sources. The platform's API-focused approach suggests that the user experience may differ significantly from traditional web-based trading platforms, potentially requiring users to have technical expertise to effectively utilize the system.

Interface design and usability considerations are not documented in current sources, making it difficult to assess how accessible the platform is to users with varying levels of technical sophistication. The emphasis on API integration suggests that many users may interact with Paxos through custom applications rather than standardized user interfaces, which could provide greater flexibility but may also require additional development resources.

Registration and verification processes are not detailed in available information, though digital asset platforms typically require extensive identity verification and compliance documentation. The absence of specific procedural information makes it difficult for potential users to understand the onboarding requirements and timeline.

User satisfaction metrics, common complaints, or improvement suggestions are not available in current sources, limiting the ability to understand how well the platform meets user expectations in practice. The lack of publicly available user feedback may reflect the institutional focus of the platform, where client relationships are managed more privately than in retail-focused trading environments.

Conclusion

This paxos review reveals a specialized digital asset trading platform that appears well-suited for institutional clients and technically sophisticated users seeking API-based cryptocurrency trading capabilities. Paxos shows strength in its technological infrastructure, particularly through its API v2 platform that offers advanced digital asset management and trading functionality.

The platform is most appropriate for cryptocurrency investors, institutional traders, and developers who require programmatic trading capabilities and enterprise-grade digital asset custody solutions. Organizations with technical expertise and significant cryptocurrency trading requirements may find Paxos's specialized approach particularly valuable.

However, the limited availability of detailed operational information represents a significant constraint in fully evaluating the platform's suitability for different user types. Potential users should engage directly with Paxos representatives to obtain comprehensive information about account conditions, pricing structures, and service capabilities before making platform decisions.