eXcentral 2025 Review: Everything You Need to Know

Executive Summary

eXcentral is a relatively new forex broker established in 2019. It operates under the regulation of the Cyprus Securities and Exchange Commission. This excentral review reveals a broker with mixed credentials in the competitive forex market. The company offers over 160 CFD instruments across multiple asset classes, including forex, stocks, commodities, indices, and cryptocurrencies. Their trading infrastructure includes the popular MetaTrader 4 platform alongside their proprietary eXcentral trading platform.

The broker targets small to medium-sized investors seeking diversified trading opportunities. With a minimum deposit requirement of $250, eXcentral positions itself as accessible to beginner traders. However, user feedback presents a mixed picture, with some traders expressing concerns about service quality and professionalism. The broker's relatively short operational history and varied user experiences suggest that potential clients should approach with careful consideration. They should weigh their trading needs and risk tolerance before choosing this broker.

Important Notice

eXcentral operates across different jurisdictions. It may be subject to varying regulatory requirements depending on the trader's location. Users should familiarize themselves with the legal and regulatory framework applicable in their region before engaging with the broker's services. Different regional entities may offer different terms, conditions, and protections.

This review is based on publicly available information and user feedback collected from various sources. The assessment has not involved direct testing of the broker's services. Traders are advised to conduct their own due diligence and consider multiple sources of information before making investment decisions.

Rating Framework

Broker Overview

eXcentral emerged in the forex market in 2019 as part of OM Bridge PTY, an investment company headquartered in South Africa. The broker operates as a CFD provider, offering trading services across multiple asset classes including foreign exchange, equities, commodities, market indices, and cryptocurrency derivatives. Despite its relatively recent establishment, the company has attempted to position itself within the competitive retail trading space. It provides access to popular trading platforms and a diverse range of financial instruments.

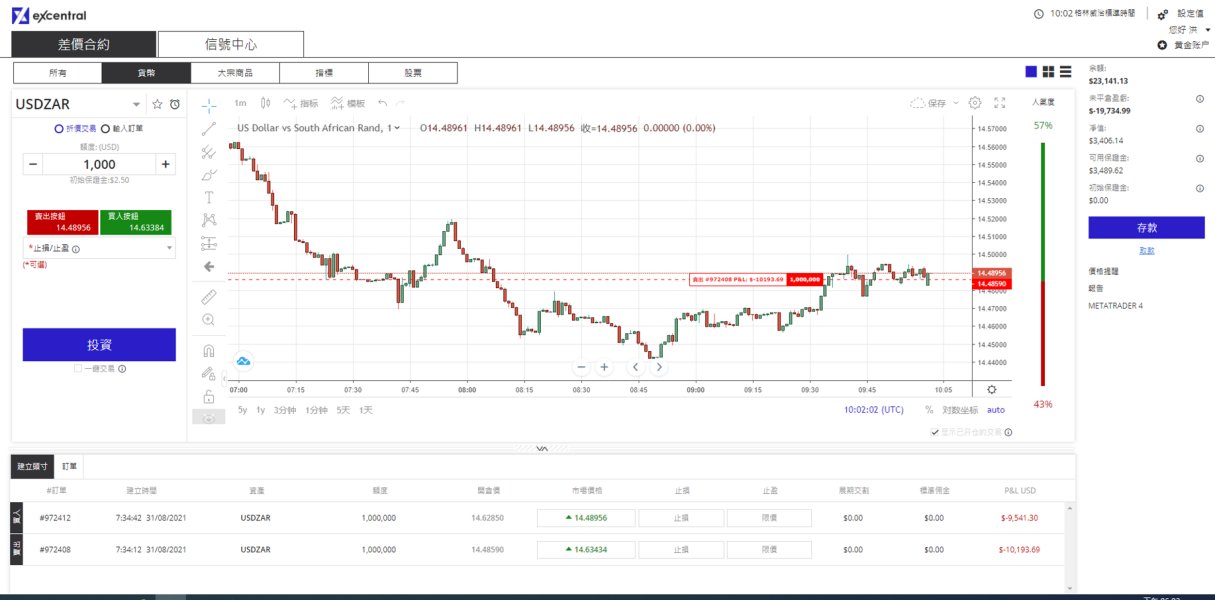

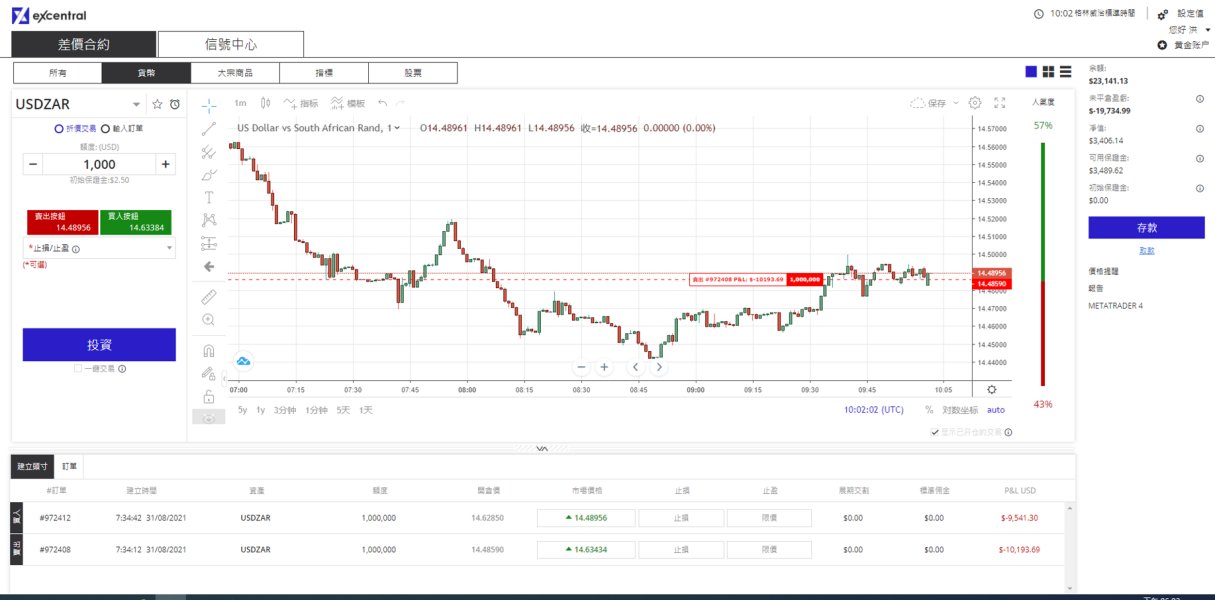

The broker's business model centers on CFD trading. This allows clients to speculate on price movements without owning the underlying assets. This approach enables traders to access various markets through a single platform while utilizing leverage to potentially amplify their trading positions. The company has structured its offerings to appeal to both novice and experienced traders. However, user feedback suggests varying levels of satisfaction with the overall service delivery.

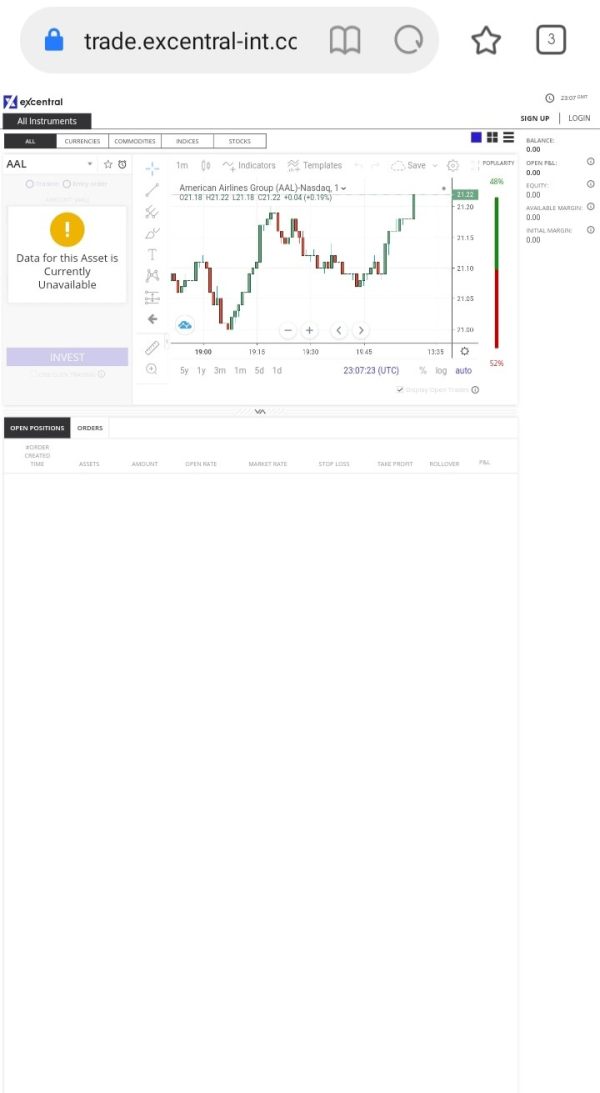

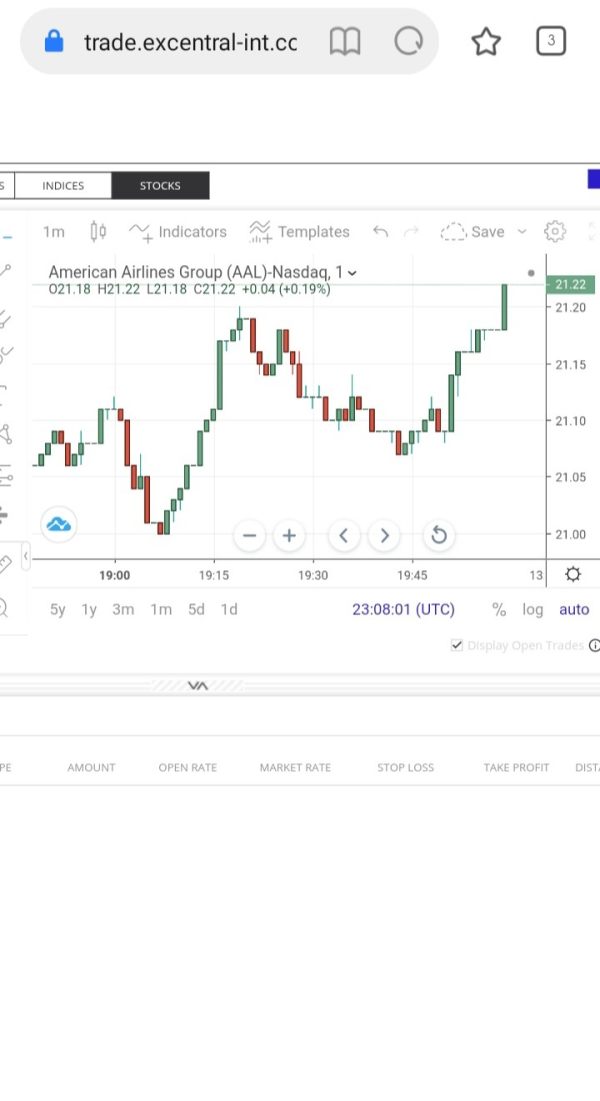

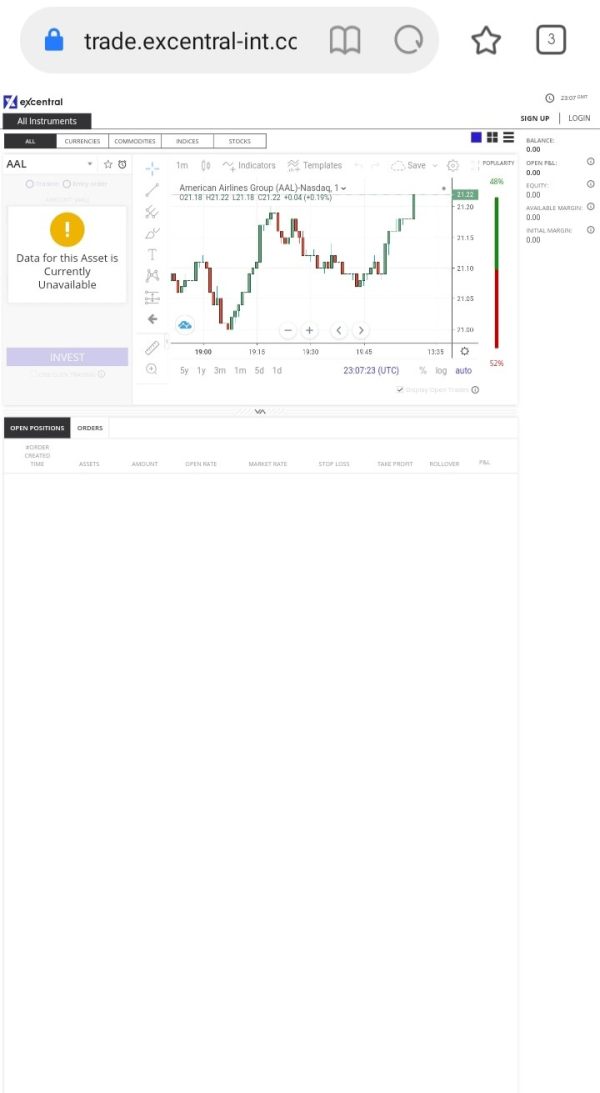

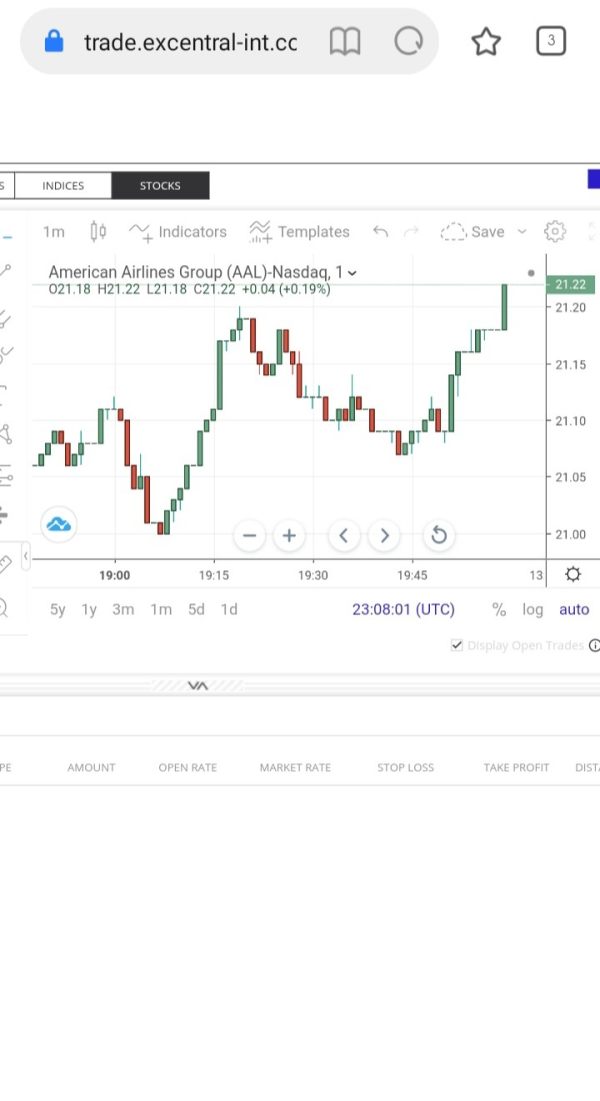

eXcentral's trading infrastructure supports both the industry-standard MetaTrader 4 platform and their proprietary eXcentral trading platform. This dual-platform approach aims to cater to different trader preferences, with MT4 appealing to those familiar with its extensive features. The proprietary platform potentially offers unique functionalities. The broker provides access to over 160 CFD instruments, spanning major and minor currency pairs, global stock indices, individual company shares, precious metals, energy commodities, and popular cryptocurrencies. Regulatory oversight comes from the Cyprus Securities and Exchange Commission, which provides a framework for operational compliance within European Union standards.

Regulatory Jurisdiction: eXcentral operates under the supervision of the Cyprus Securities and Exchange Commission. This regulatory status ensures certain compliance standards and client protection measures are maintained.

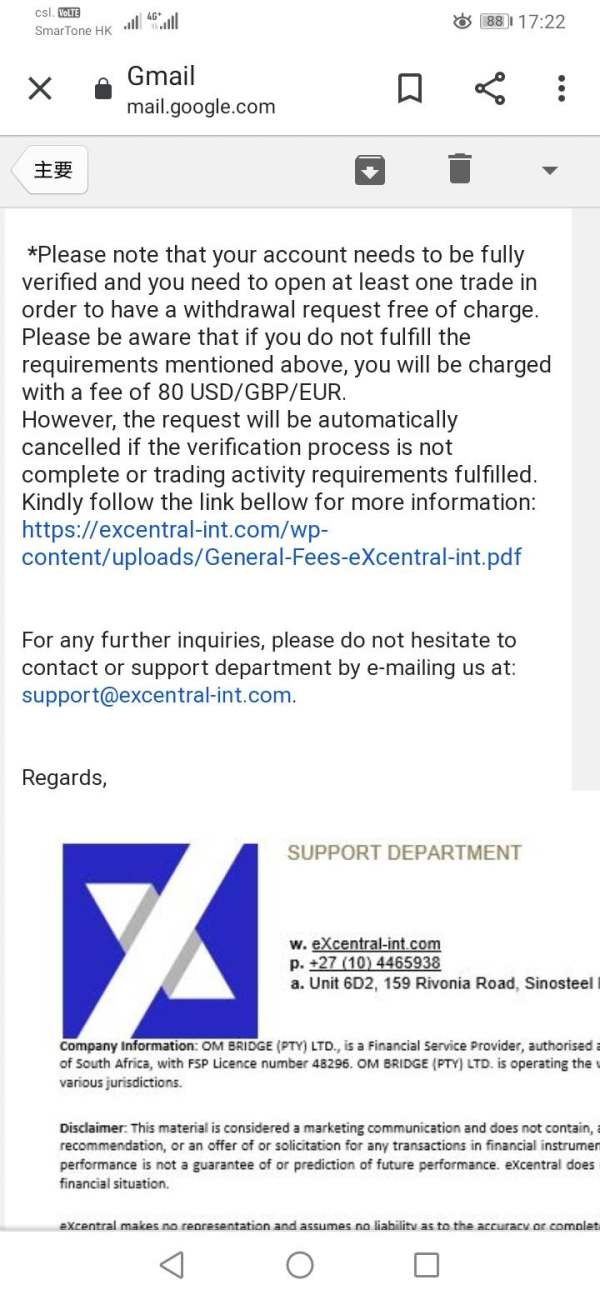

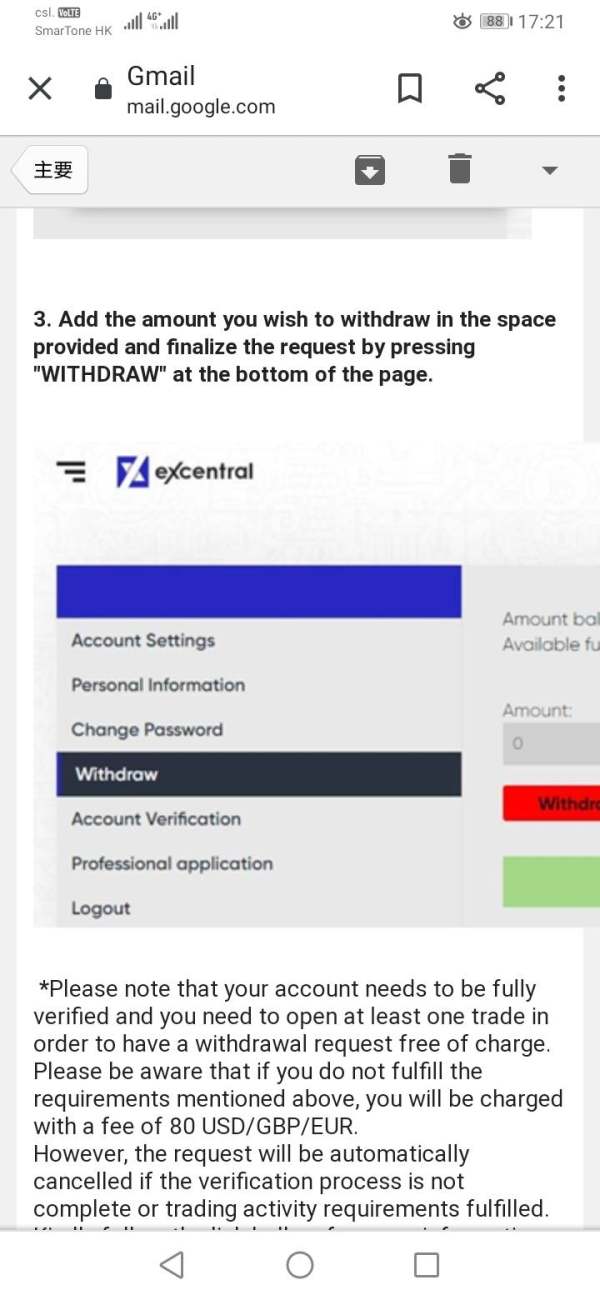

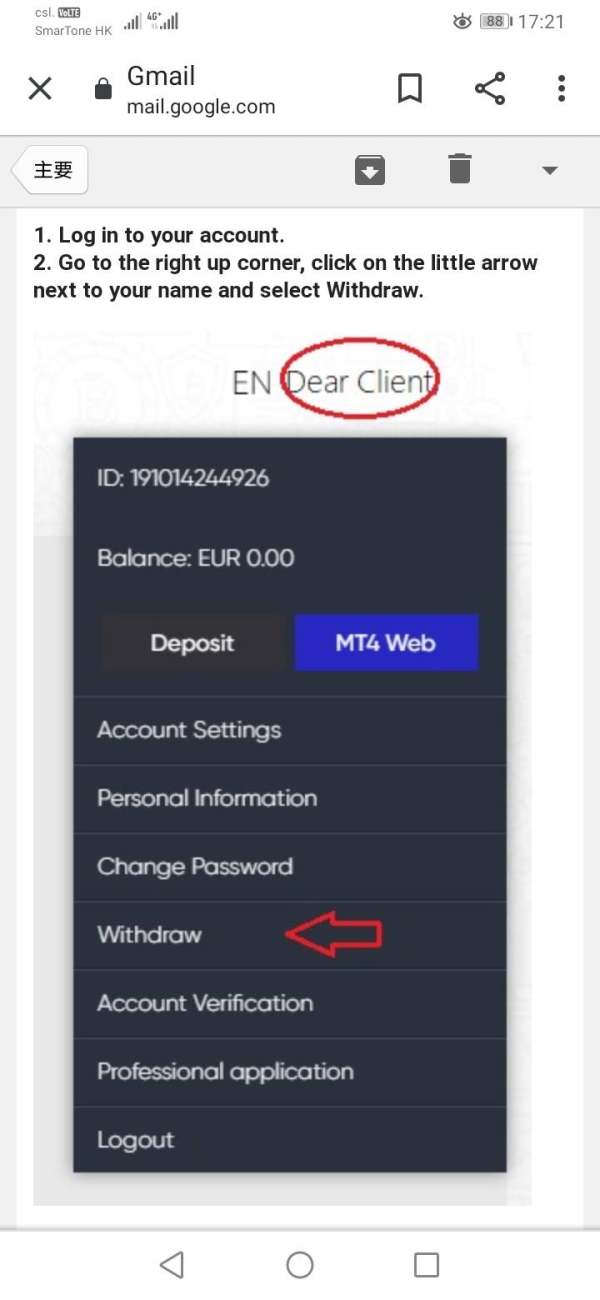

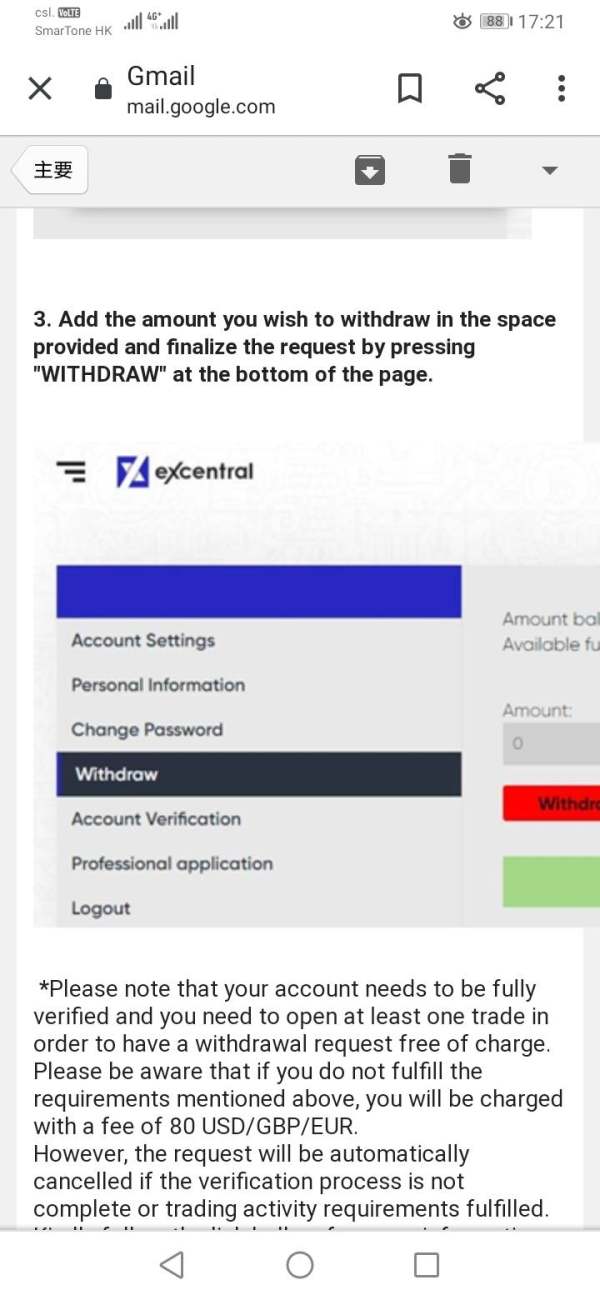

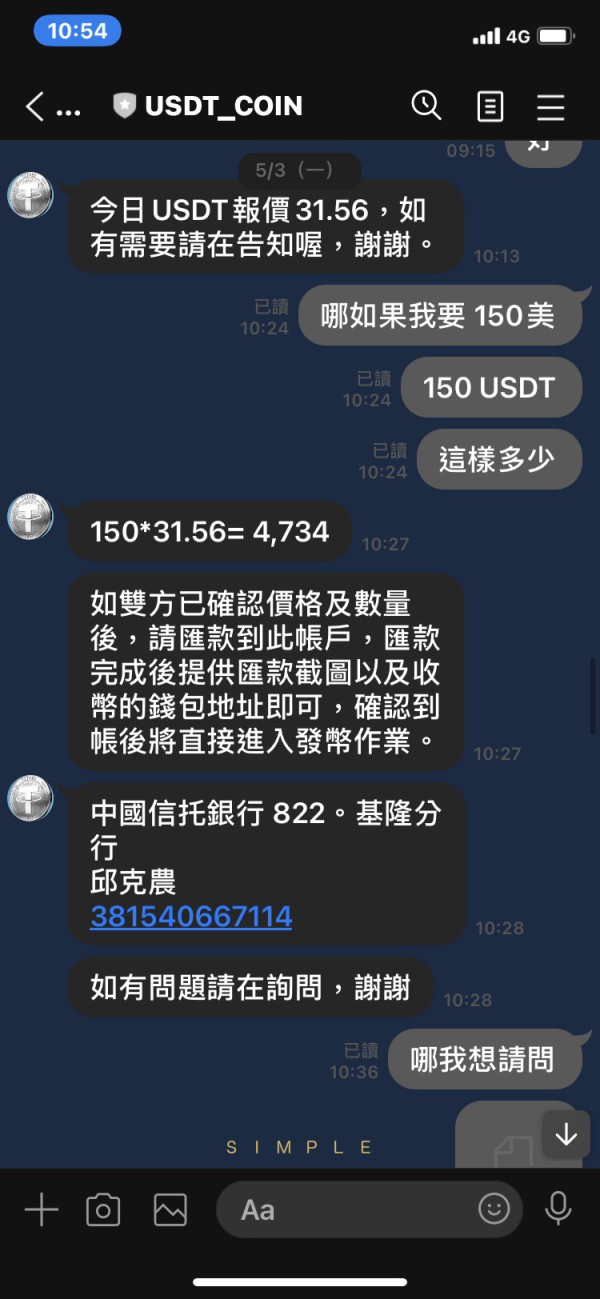

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available sources. Traders should contact the broker directly to confirm available payment options and processing procedures.

Minimum Deposit Requirement: The broker sets its minimum deposit at $250. This makes it accessible to entry-level traders and those looking to start with smaller capital allocations.

Bonus and Promotional Offers: Information regarding bonus structures and promotional campaigns was not specified in available materials. Potential clients should inquire directly about any current promotional offerings.

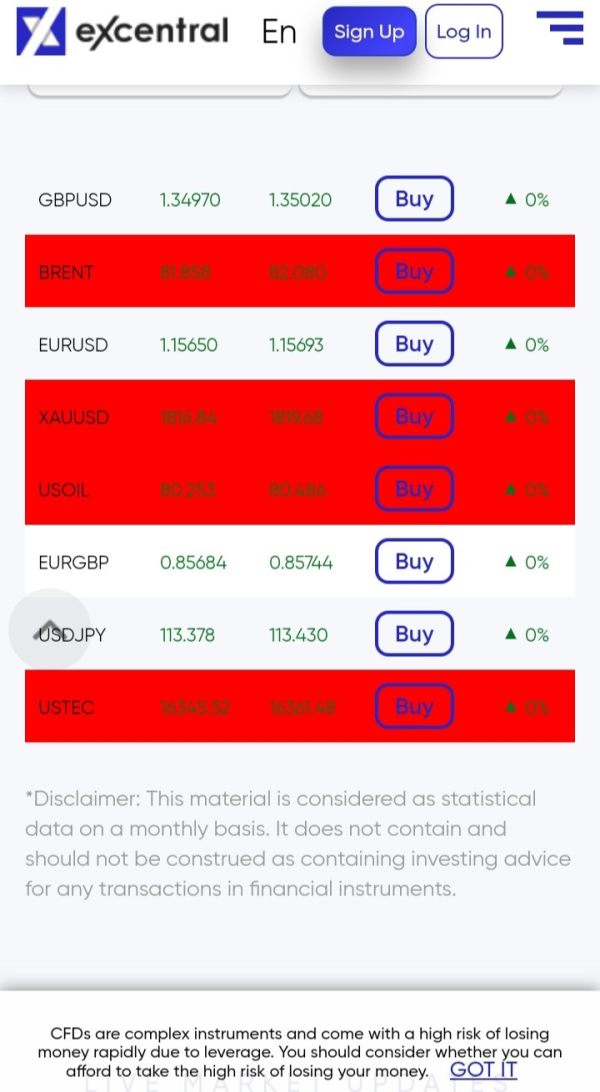

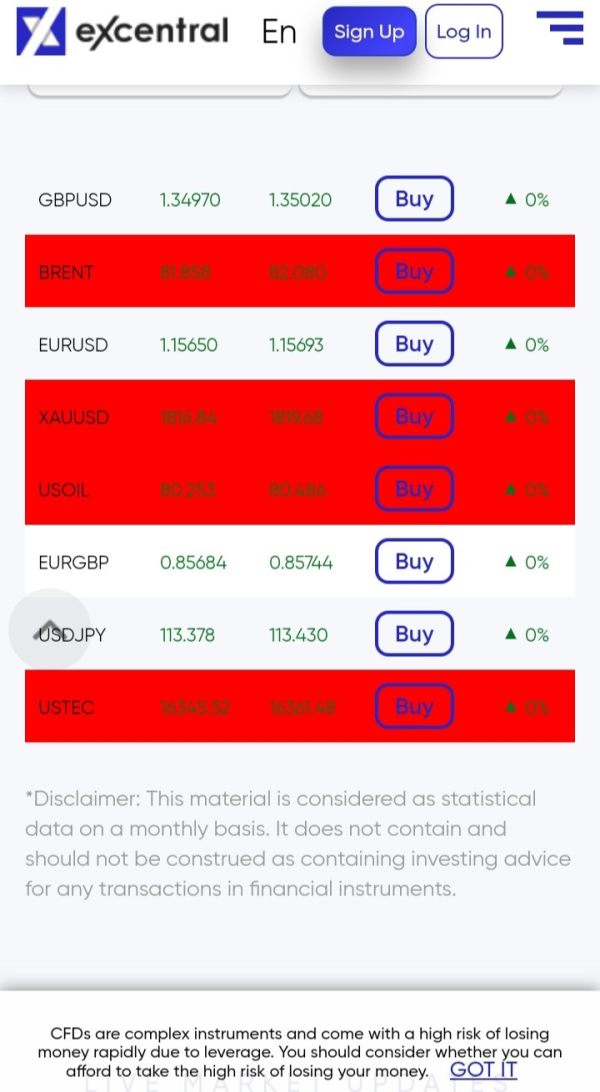

Tradeable Assets: eXcentral provides access to over 160 CFD instruments across five major asset categories. These include foreign exchange pairs, stock indices, individual company shares, commodities including precious metals and energy products, and cryptocurrency derivatives.

Cost Structure: Specific details regarding spreads, commissions, and other trading costs were not clearly outlined in available sources. Traders should request detailed pricing information directly from the broker to understand the complete cost structure.

Leverage Ratios: Information about maximum leverage ratios and margin requirements was not specified in the available materials. This should be confirmed directly with the broker.

Platform Options: The broker offers two primary trading platforms: MetaTrader 4 and their proprietary eXcentral platform. These provide options for different trader preferences and requirements.

Geographic Restrictions: Specific information about geographic limitations and restricted jurisdictions was not detailed in available sources.

Customer Support Languages: Available customer support languages were not specified in the reviewed materials.

This excentral review highlights the importance of directly verifying specific terms and conditions with the broker. Many operational details require direct confirmation from the company.

Detailed Rating Analysis

Account Conditions Analysis

eXcentral's account structure presents a mixed picture for potential traders. The broker's $250 minimum deposit requirement positions it competitively for entry-level traders, removing significant barriers to market access. However, the lack of detailed information about different account tiers and their respective features creates uncertainty. Traders cannot easily assess what they can expect as their capital and trading volume grow.

The absence of clearly defined account types in available materials suggests either a simplified account structure or insufficient transparency. Traditional brokers often provide multiple account levels with varying spreads, commissions, and additional services based on deposit amounts. Without this clarity, traders cannot easily assess whether eXcentral's account conditions will meet their evolving needs.

Account opening procedures and verification requirements were not detailed in available sources. This makes it difficult to assess the efficiency and user-friendliness of the onboarding process. Modern traders expect streamlined digital verification processes, and any delays or complications in account setup can significantly impact user satisfaction.

The absence of information about specialized account features may limit the broker's appeal to specific trader segments. These might include Islamic accounts for Sharia-compliant trading or professional accounts for qualified investors. These specialized offerings have become standard expectations in the contemporary forex market.

Overall, while the low minimum deposit requirement provides accessibility, the lack of comprehensive account information creates uncertainty. This raises questions about the broker's ability to serve traders across different experience levels and capital ranges. This excentral review suggests that potential clients should seek detailed account specifications directly from the broker before making commitments.

eXcentral's trading infrastructure demonstrates both strengths and areas for improvement in terms of tools and resources. The broker's decision to offer both MetaTrader 4 and a proprietary platform provides flexibility for traders with different preferences and experience levels. MT4's inclusion is particularly valuable, as it remains the industry standard with extensive charting capabilities, technical indicators, and automated trading support.

The availability of over 160 CFD instruments across multiple asset classes represents a solid foundation for diversified trading strategies. This range allows traders to explore opportunities across forex, stocks, commodities, indices, and cryptocurrencies from a single account. It potentially reduces the need for multiple broker relationships.

However, available sources lack detailed information about additional trading tools. These might include economic calendars, market analysis, research reports, or advanced charting packages beyond the standard platform offerings. Modern traders increasingly expect comprehensive market intelligence and analytical resources to support their decision-making processes.

Educational resources and training materials were not specifically mentioned in available information. This could represent a significant gap for novice traders. Quality educational content has become a differentiating factor among brokers, helping clients develop their trading skills and understanding of market dynamics.

The absence of information about automated trading support, copy trading features, or social trading capabilities may limit appeal. These functionalities are increasingly popular among traders. Additionally, details about mobile trading applications and their feature sets were not available for assessment.

While the basic trading infrastructure appears adequate, the lack of comprehensive information about additional tools and resources is concerning. This suggests that eXcentral may not offer the full suite of services that contemporary traders expect from their broker relationships.

Customer Service and Support Analysis

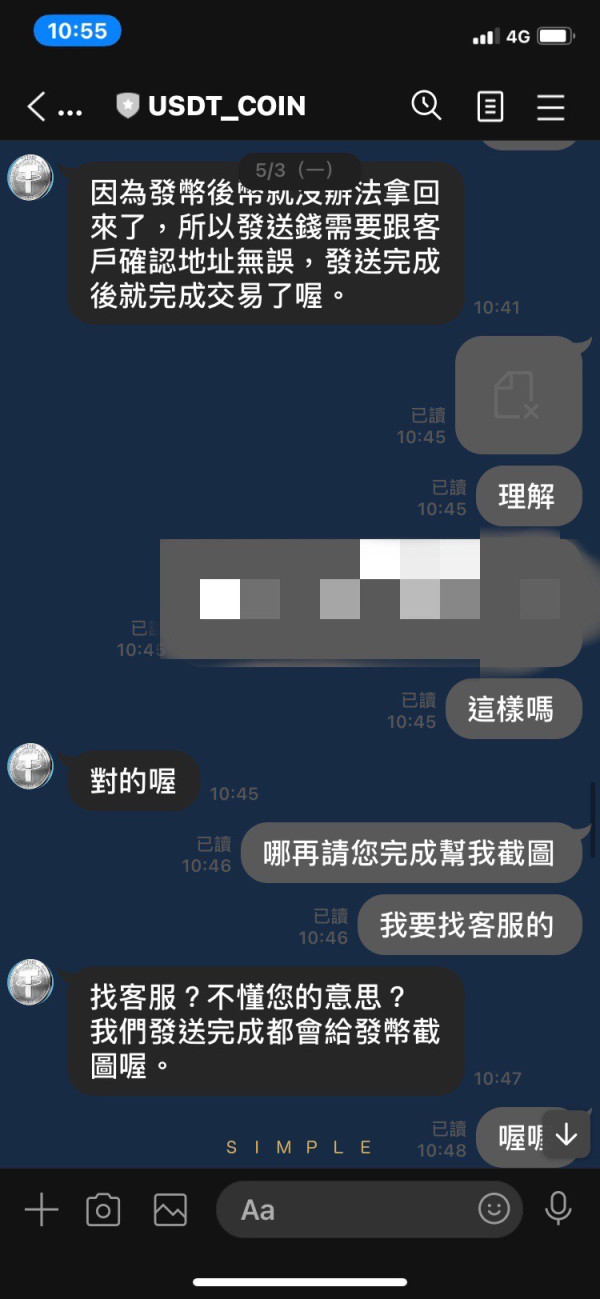

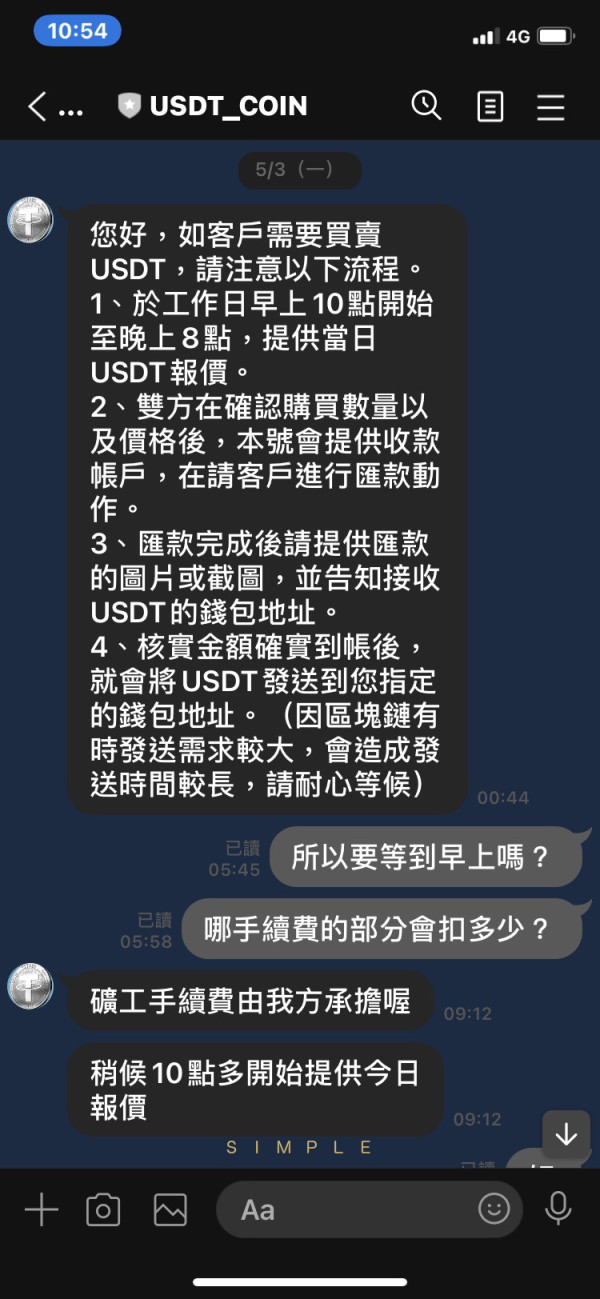

Customer service represents one of eXcentral's most concerning areas based on available user feedback. Multiple trader reports indicate dissatisfaction with the professionalism and quality of customer support interactions. These concerns range from inadequate response times to questions about the competency of support staff in addressing trading-related inquiries.

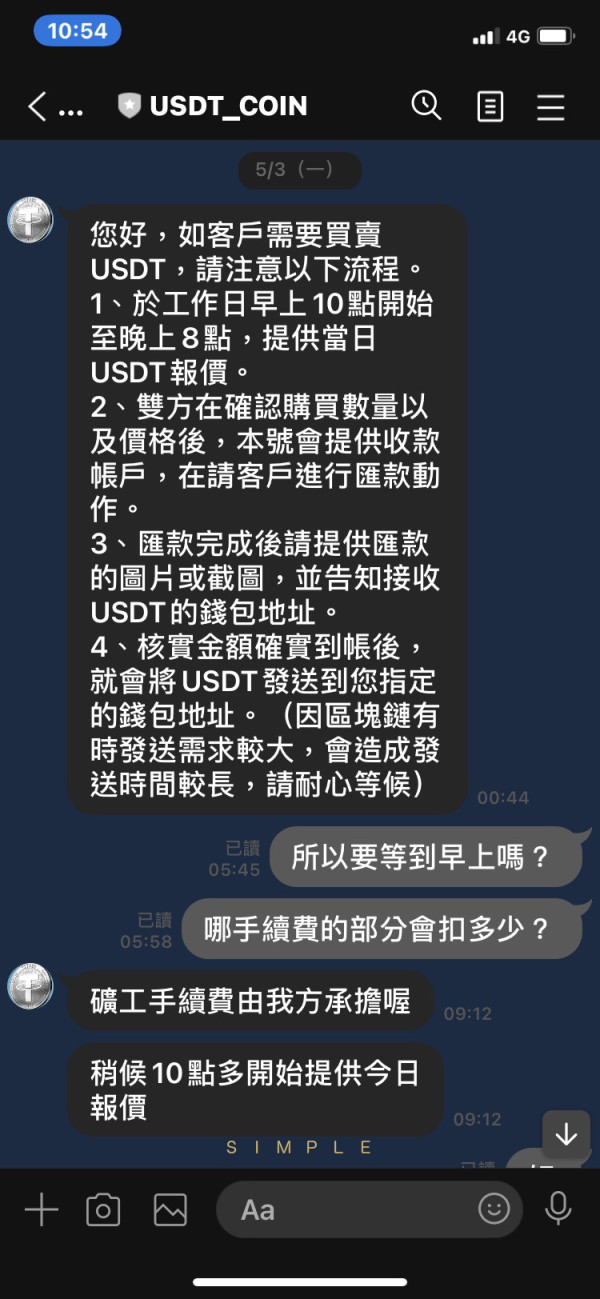

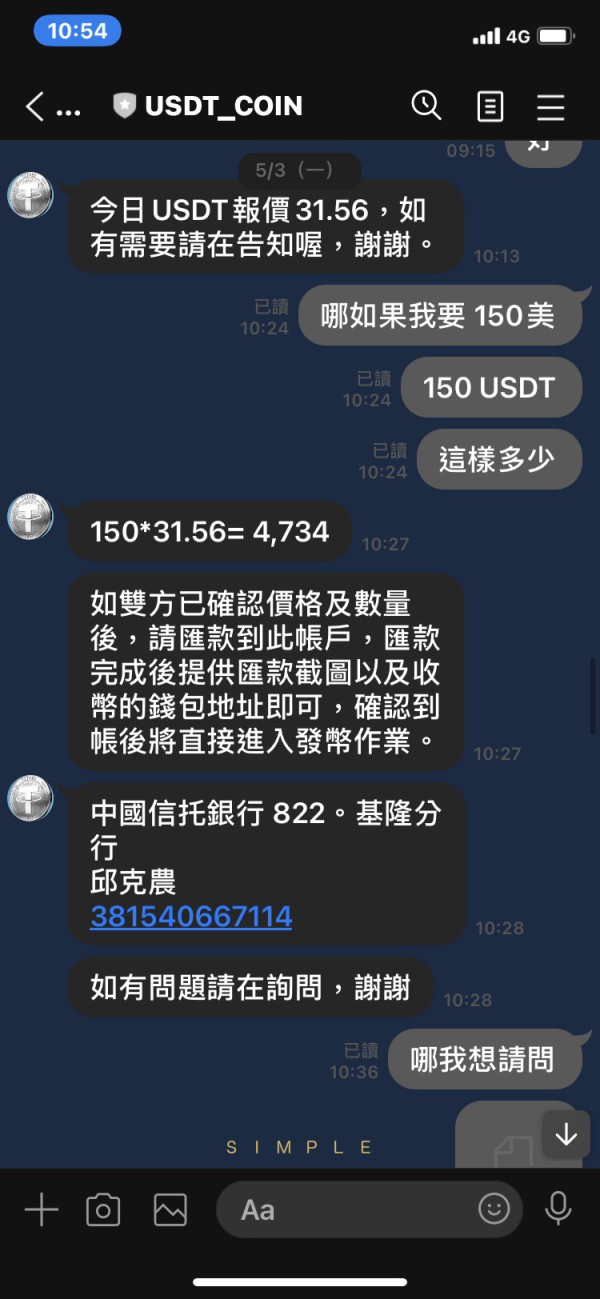

User feedback suggests that some clients have experienced persistent contact from account managers. This has been perceived as pressure tactics rather than genuine client service. This approach can create discomfort for traders who prefer more autonomous trading relationships and may indicate a sales-focused rather than service-focused organizational culture.

The lack of detailed information about available customer support channels, operating hours, and response time commitments makes assessment difficult. Modern traders expect multiple contact options including live chat, email, and telephone support with clearly defined availability schedules.

Language support capabilities were not specified in available materials. This could present barriers for international clients seeking assistance in their native languages. Multilingual support has become a standard expectation for brokers operating in global markets.

Some user reports suggest challenges in reaching knowledgeable support staff capable of addressing complex trading or technical issues effectively. This raises questions about staff training and the broker's investment in customer service infrastructure.

The overall picture suggests that customer service may be an area where eXcentral needs significant improvement. The broker must work to meet contemporary broker standards. Potential clients should consider their support needs carefully and perhaps test the responsiveness and quality of customer service before committing significant capital.

Trading Experience Analysis

The trading experience with eXcentral appears to offer both positive elements and areas of concern based on available information. The broker's provision of MetaTrader 4 ensures that experienced traders have access to a familiar and feature-rich trading environment. This includes robust charting tools, technical indicators, and automated trading capabilities.

Platform stability appears adequate based on user feedback. There are no widespread reports of significant system outages or technical failures that would severely disrupt trading activities. However, the lack of detailed performance metrics regarding execution speeds, slippage rates, and platform uptime makes objective assessment difficult.

Order execution quality remains unclear due to insufficient detailed information. This includes questions about the broker's execution model, whether they operate as a market maker or use straight-through processing, and their relationships with liquidity providers. These factors significantly impact the quality of trade execution, particularly during volatile market conditions.

The proprietary eXcentral platform's features and performance characteristics were not detailed in available sources. This makes it impossible to assess how it compares to industry standards or whether it offers unique advantages over the MT4 option.

Mobile trading capabilities and their feature completeness were not specifically addressed. This represents a significant gap in understanding the complete trading experience. Mobile trading has become essential for many traders who need to monitor and manage positions while away from their primary trading setup.

User feedback regarding spread stability and overall trading costs was limited. This makes it difficult to assess the competitiveness of the trading environment. This excentral review suggests that potential clients should request detailed information about execution quality and trading conditions before committing to the platform.

Trust and Reliability Analysis

Trust and reliability present significant concerns for eXcentral based on available information and user feedback. While the broker operates under CySEC regulation, which provides some level of oversight and compliance framework, several factors raise questions about overall reliability.

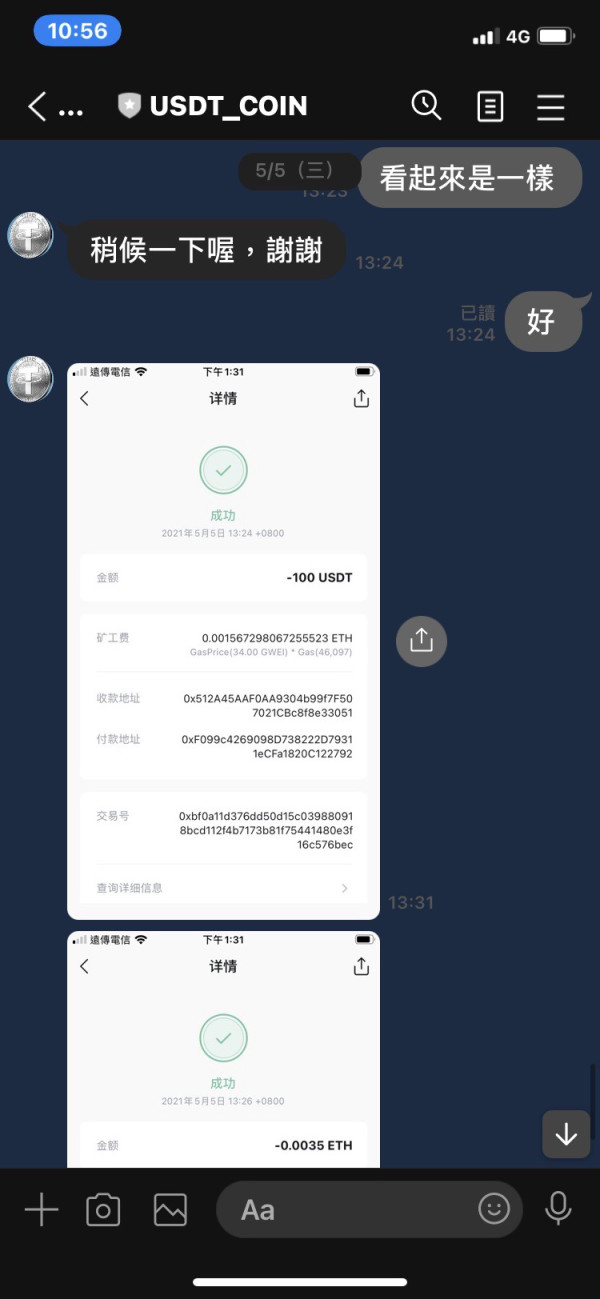

User feedback includes serious allegations questioning the broker's legitimacy. Some traders express concerns about potential fraudulent activities. These allegations, while unverified, represent red flags that potential clients should carefully consider when evaluating the broker.

The company's relatively short operational history since 2019 means there is limited long-term track record available. This makes it difficult to assess stability and reliability during various market conditions. Newer brokers often face challenges in building trust and demonstrating consistent service delivery over time.

Information about client fund protection measures was not detailed in available sources. These might include segregated accounts, insurance coverage, or compensation schemes. These protections are crucial for client confidence and represent standard expectations in regulated environments.

The broker's transparency regarding company ownership, financial statements, and operational procedures appears limited based on available information. Greater transparency typically correlates with higher trust levels and demonstrates commitment to accountability.

Negative user experiences contribute to concerns about the broker's overall reliability and client-focused approach. This is particularly true for those involving customer service and account management practices. The accumulation of such feedback suggests systematic issues rather than isolated incidents.

Potential clients should exercise significant caution and conduct thorough due diligence before engaging with eXcentral. This is particularly important given the mixed signals regarding trustworthiness and the serious nature of some user concerns.

User Experience Analysis

The overall user experience with eXcentral presents a complex picture with both positive and negative elements. User satisfaction appears highly variable, with experiences ranging from acceptable to deeply problematic. This suggests inconsistent service delivery across the client base.

Platform usability and interface design details were not comprehensively covered in available sources. This makes it difficult to assess the user-friendliness of the trading environment. However, the inclusion of MetaTrader 4 ensures that at least one platform option meets established industry standards for functionality and user experience.

Account opening and verification processes were not detailed in available materials. User feedback suggests potential issues with account management practices that may impact the overall onboarding experience. Smooth and efficient account setup is crucial for positive first impressions.

Some users report pressure from account managers regarding deposits and trading activity. This creates a negative experience for traders seeking autonomous control over their trading decisions. This approach can significantly impact user satisfaction and long-term client relationships.

The lack of detailed information about educational resources, market analysis, and trader development tools is concerning. This suggests that the overall user experience may not include the comprehensive support that many traders expect from their broker relationships.

User feedback indicates concerns about withdrawal processes and fund access. However, specific details about processing times and procedures were not available for objective assessment. Efficient and transparent fund management is crucial for positive user experiences.

The variability in user experiences and the presence of significant negative feedback suggest important limitations. eXcentral may not consistently deliver the level of service and support that contemporary traders expect from their broker relationships.

Conclusion

This comprehensive excentral review reveals a broker with mixed credentials and significant areas of concern. While eXcentral offers some positive elements such as CySEC regulation, access to popular trading platforms, and a diverse range of tradeable instruments, substantial issues create reservations. These problems regarding customer service, trust, and overall reliability make it difficult to recommend the broker without significant caveats.

eXcentral may be suitable for traders seeking basic access to multiple asset classes with a low minimum deposit requirement. However, potential clients should approach with considerable caution. The broker appears most appropriate for experienced traders who can navigate potential service issues and conduct their own comprehensive due diligence.

The primary advantages include regulatory oversight, multiple platform options, and competitive minimum deposit requirements. However, significant disadvantages include concerning user feedback regarding service quality, questions about trustworthiness, and limited transparency about operational procedures. Prospective clients should carefully weigh these factors and consider alternative brokers with stronger track records and more consistent user satisfaction. They should complete this evaluation before making their final decision.