Is Vorbex safe?

Pros

Cons

Is Vorbex Safe or a Scam?

Introduction

Vorbex is a relatively new player in the forex market, offering a platform for trading various financial instruments, including currencies, commodities, and cryptocurrencies. As the forex market continues to grow, the number of brokers has surged, leading to an increased risk of encountering scams. Traders must exercise caution and conduct thorough research before selecting a broker. In this article, we will investigate whether Vorbex is safe or if it exhibits characteristics of a scam. Our evaluation will be based on regulatory compliance, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

Regulation is a critical aspect of any financial service provider, particularly in the forex industry, where the potential for fraud is significant. A regulated broker is subject to oversight by financial authorities, ensuring that they adhere to stringent standards designed to protect traders. Vorbex claims to operate from Australia, but there are concerns regarding its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Australia | Not Verified |

The absence of a valid regulatory license raises serious questions about the legitimacy of Vorbex. According to various sources, Vorbex has not provided any documentation to prove its compliance with regulatory requirements. This lack of oversight can expose traders to higher risks, as unregulated brokers are not held accountable for their actions. Furthermore, the absence of a regulatory framework means that traders have limited recourse in case of disputes or issues related to fund security.

Company Background Investigation

An examination of Vorbex's company history reveals that it is a relatively new entity in the forex trading arena. Established within the last year, Vorbex has not yet built a substantial reputation in the industry. The ownership structure of the company is unclear, and there is little information available about its management team. This lack of transparency is concerning, as a reputable broker typically provides detailed information about its founders and executive team.

Moreover, the absence of a comprehensive history raises doubts about the company's long-term viability. Established brokers often have a track record that can be evaluated by potential clients. In contrast, Vorbexs limited operational history may indicate a lack of experience in managing client funds and executing trades effectively.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Vorbex claims to provide competitive trading costs, but there are discrepancies in the information available regarding its fee structure.

| Fee Type | Vorbex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of transparency around fees can be a red flag. Traders should be wary of brokers that do not clearly outline their fee structures, as hidden costs can significantly impact profitability. Additionally, any unusual or excessive fees should raise concerns about the broker's integrity.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Vorbexs approach to fund security is still unclear. It is crucial for brokers to implement measures such as segregated accounts to protect client funds from operational risks. Furthermore, the presence of investor protection schemes can provide an additional layer of security.

However, without valid regulatory oversight, the assurance of fund safety is diminished. There have been no reported incidents of fund mismanagement or security breaches at Vorbex, but the lack of transparency in their operational practices makes it challenging to assess the true level of risk.

Customer Experience and Complaints

Customer feedback is an invaluable resource when evaluating a broker's reliability. Vorbex has received mixed reviews from its users. While some customers have praised the platform's user interface and customer service, there are also reports of issues related to withdrawals and account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

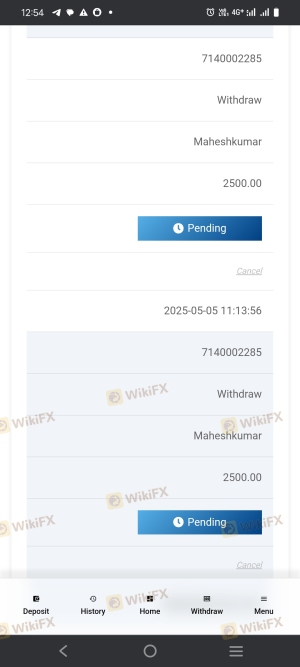

| Withdrawal Issues | High | Slow Response |

| Account Management | Medium | Average Response |

| Customer Service | Low | Positive Feedback |

Common complaints include delays in processing withdrawals and difficulties in reaching customer support. These issues can be indicative of a broker's operational inefficiencies, which could lead to larger problems down the line. Potential traders should weigh these experiences against their trading needs to determine if Vorbex is the right fit for them.

Platform and Trade Execution

The trading platform is a crucial component of the trading experience. Vorbex offers a trading platform that is reported to be stable and user-friendly. However, the quality of order execution, including slippage and rejection rates, remains a critical factor in evaluating the broker's performance.

While some users report satisfactory execution speeds, others have raised concerns about slippage during volatile market conditions. Such issues can significantly affect trading outcomes, especially for those employing high-frequency trading strategies.

Risk Assessment

Using Vorbex comes with its own set of risks. The lack of regulation, transparency regarding fees, and mixed customer feedback contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory license. |

| Financial Risk | Medium | Unclear fee structure and fund security measures. |

| Operational Risk | Medium | Mixed reviews regarding customer service and withdrawal issues. |

To mitigate these risks, potential traders should consider starting with a small deposit to test the platform's reliability before committing larger sums. Additionally, conducting ongoing research and monitoring customer feedback can help in making informed decisions.

Conclusion and Recommendations

In conclusion, while Vorbex presents itself as a viable option for forex trading, significant concerns about its regulatory status, transparency, and customer feedback suggest that traders should approach with caution. The absence of a valid regulatory license and mixed reviews from users raise red flags that cannot be overlooked.

For traders seeking a reliable broker, it may be prudent to consider alternatives that offer transparent operations and are regulated by recognized authorities. Brokers such as Orbex or OANDA, which have established reputations and regulatory oversight, may provide a safer trading environment.

In summary, is Vorbex safe? The evidence suggests that it may not be the most trustworthy choice for forex trading, and potential users should conduct thorough research and consider their risk tolerance before proceeding.

Is Vorbex a scam, or is it legit?

The latest exposure and evaluation content of Vorbex brokers.

Vorbex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vorbex latest industry rating score is 1.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.