Is bebor safe?

Pros

Cons

Is Bebor Safe or a Scam?

Introduction

Bebor, a forex broker headquartered in Hong Kong, has emerged in the competitive landscape of online trading. Established in 2011, it claims to offer a range of financial instruments, including forex, CFDs, and commodities. As the forex market continues to expand, traders must exercise caution and conduct thorough assessments of brokers to avoid potential pitfalls. The importance of this due diligence cannot be overstated, as the regulatory environment is complex and rife with unregulated entities. In this article, we will explore whether Bebor is a safe trading option or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is crucial in assessing its legitimacy. Bebor claims to be regulated by the U.S. National Futures Association (NFA) under license number 0539545. However, investigations reveal that this license is not valid, and Bebor is not registered with any recognized regulatory authority, including the Hong Kong Securities and Futures Commission (SFC) and the UK Financial Conduct Authority (FCA). This lack of regulation raises significant concerns regarding the safety of clients' funds and the overall integrity of the broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0539545 | USA | Invalid |

| SFC | N/A | Hong Kong | Not Registered |

| FCA | N/A | UK | Not Registered |

The absence of oversight from reputable regulatory bodies means that traders using Bebor are exposed to higher risks. The lack of a regulatory framework also indicates that there are no safeguards in place to protect investors in the event of disputes or financial mismanagement, which makes it imperative for traders to question, "Is Bebor safe?"

Company Background Investigation

Bebor Limited presents itself as a global trading entity, but its true operational history raises red flags. The company claims to have been in business for over a decade, yet there is scant information available about its ownership structure and management team. The lack of transparency regarding the individuals behind the company and their qualifications is a significant concern.

Moreover, the company's website, which is crucial for providing vital information to potential clients, has been reported to be intermittently non-functional. This inconsistency in online presence further diminishes trust in Bebor and raises questions about its operational stability and commitment to client service. With no clear information about its management or corporate governance, it becomes increasingly difficult to ascertain whether Bebor is a trustworthy broker or a potential scam.

Trading Conditions Analysis

Bebor's trading conditions, including fees and spreads, are critical for evaluating its competitiveness within the market. The broker claims to offer various account types with different minimum deposits and leverage options. However, the absence of transparent pricing structures and detailed information about fees can lead to confusion among traders.

| Fee Type | Bebor | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.5% |

While Bebor does not explicitly state its spreads and commission rates, user reviews suggest that traders have faced unexpected fees, such as withdrawal charges and service fees, which are often red flags for potential scams. Furthermore, the lack of clear information about overnight interest rates can lead to unexpected costs for traders holding positions overnight. This ambiguity raises the question, "Is Bebor safe?" when it comes to trading conditions.

Client Fund Security

The security of client funds is paramount in the forex trading environment. Bebor's claims regarding fund protection measures, such as segregated accounts and negative balance protection, lack verification. Without regulatory oversight, there is no assurance that client funds are safeguarded against misappropriation or financial instability.

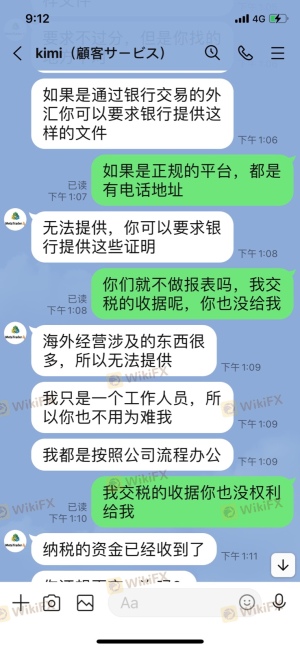

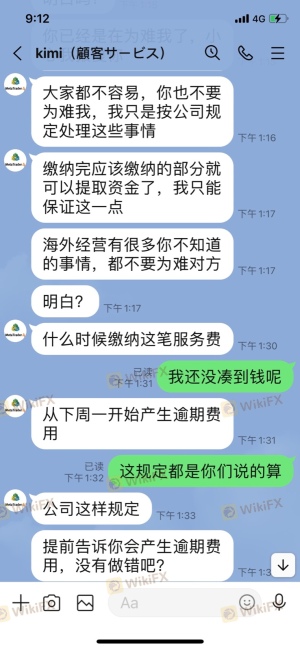

Many reviews indicate that clients have experienced difficulties when attempting to withdraw their funds, often citing claims of unexpected taxes or fees that must be paid before processing withdrawals. This pattern of complaints is concerning and suggests that Bebor may not prioritize the security and accessibility of client funds, leading to further questions about its legitimacy.

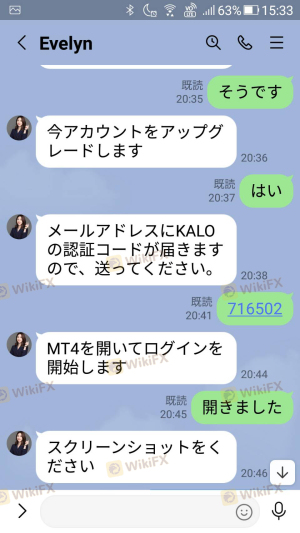

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. Analysis of user reviews for Bebor reveals a pattern of complaints primarily centered around withdrawal issues, lack of communication, and unexpected fees. Many clients report being unable to access their funds, which raises serious concerns about the broker's operational practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Unexpected Fees | High | Poor |

For instance, some users have reported being told that they must pay a service fee before they can withdraw their profits, a tactic often associated with scams. These recurring issues prompt a critical evaluation of whether Bebor is safe for traders, as the inability to withdraw funds is a significant red flag.

Platform and Execution

The performance of a trading platform is integral to a trader's experience. Bebor offers access to various trading platforms, but user reviews indicate mixed experiences regarding stability and execution quality. Reports of slippage and order rejections suggest that the platform may not perform reliably during high-volatility periods.

Additionally, the absence of detailed information about the execution model used by Bebor raises concerns about potential manipulation or unfair trading practices. Traders must consider these factors when questioning, "Is Bebor safe?" as they can significantly impact trading outcomes.

Risk Assessment

When evaluating the overall risk associated with trading through Bebor, several factors emerge. The lack of regulation, unclear trading conditions, and poor customer feedback collectively indicate a high-risk environment for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Stability | High | Poor fund security |

| Customer Service | High | Lack of support |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Bebor and consider starting with minimal investments. Additionally, diversifying trading activities across multiple regulated brokers can help reduce exposure to any single entity's risks.

Conclusion and Recommendations

In conclusion, the investigation into Bebor raises significant concerns about its legitimacy as a forex broker. The absence of regulatory oversight, coupled with a lack of transparency and persistent customer complaints, suggests that traders should exercise extreme caution.

For traders seeking reliable options, it is advisable to consider brokers that are regulated by top-tier authorities, such as the FCA or ASIC, which provide robust investor protections. Alternatives such as IG, OANDA, or Forex.com may offer safer trading environments with better customer service and clearer trading conditions.

Ultimately, the question remains: "Is Bebor safe?" Based on the evidence presented, it would be prudent for traders to avoid this broker and seek more reliable alternatives in the forex market.

Is bebor a scam, or is it legit?

The latest exposure and evaluation content of bebor brokers.

bebor Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

bebor latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.