Is IDEAL safe?

Business

License

Is Ideal Safe or a Scam?

Introduction

Ideal is a forex brokerage that has positioned itself in the competitive landscape of online trading, primarily targeting traders looking for accessible and diverse trading options. As the forex market continues to attract both novice and experienced traders, it's crucial for individuals to carefully evaluate the brokers they choose to work with. The risk of falling victim to scams or unregulated entities is a growing concern in the financial sector. This article aims to provide a comprehensive analysis of Ideal, focusing on its regulatory status, company background, trading conditions, and customer experiences. The investigation employs a blend of qualitative assessments and quantitative data to arrive at a well-rounded conclusion regarding whether Ideal is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a brokerage is a key indicator of its legitimacy and reliability. In the case of Ideal, it has been reported that the broker operates without proper regulation, which raises significant red flags. A broker that is not regulated by a recognized financial authority may lack the necessary oversight to ensure fair trading practices and safeguard client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0505628 | United States | Not Registered |

The absence of a valid license from a top-tier regulator such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) is concerning. Regulatory bodies impose strict standards on brokers, ensuring they adhere to ethical practices and maintain transparency. The lack of oversight means that traders using Ideal may be exposed to unfair trading conditions and potential fraud. Furthermore, Ideal's historical compliance issues and lack of transparency only add to the skepticism surrounding its operations. Therefore, it is essential for traders to approach Ideal with caution, as the absence of regulation is a significant indicator that Ideal may not be safe.

Company Background Investigation

Ideal was established in 2017, and while it claims to offer a range of trading services, its ownership structure and management team remain opaque. The companys website provides limited information about its founders or key personnel, making it challenging to assess the expertise and credibility of those at the helm. A brokerage with a transparent ownership structure and experienced management team is often more trustworthy, as it indicates a commitment to ethical practices.

In terms of operational transparency, Ideal has been criticized for its lack of clear communication regarding its services and policies. Traders often seek brokers that provide detailed information about their operations, including disclosures about fees, trading conditions, and risk factors. Unfortunately, Ideals failure to disclose such information raises concerns about its commitment to client welfare. Given these factors, it is prudent for potential clients to be wary, as the lack of transparency may suggest that Ideal is not safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is crucial. Ideal's fee structure has been a point of contention among users, with many reporting unexpected charges and unclear commission policies. A typical fee structure should be straightforward and transparent, allowing traders to calculate their potential costs accurately.

| Fee Type | Ideal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Structure | Unclear | 0-0.5% |

| Overnight Interest Range | 3-5% | 1-3% |

The spread on major currency pairs can vary significantly, which may lead to higher trading costs than anticipated. Additionally, the unclear commission structure raises questions about potential hidden fees that could further erode a trader's profits. Traders should always be aware of the total cost of trading, as excessive fees can diminish returns over time. The lack of clarity in Ideals trading conditions could be a sign of underlying issues, suggesting that traders should approach with caution.

Client Fund Security

The security of client funds is paramount when choosing a brokerage. Ideal's practices regarding fund protection have been scrutinized, with reports indicating that client funds may not be adequately segregated from the company's operational funds. This poses a significant risk, as it could lead to clients losing their investments if the broker faces financial difficulties.

Moreover, the absence of investor protection schemes, which are typically mandated by regulatory authorities, further exacerbates the risk. In regulated environments, clients often benefit from compensation funds that can reimburse them in cases of broker insolvency. Ideal's lack of such protections raises serious concerns about the safety of clients' investments. Therefore, it is vital for potential clients to consider whether Ideal is safe for their trading activities, given the potential risks associated with inadequate fund security.

Customer Experience and Complaints

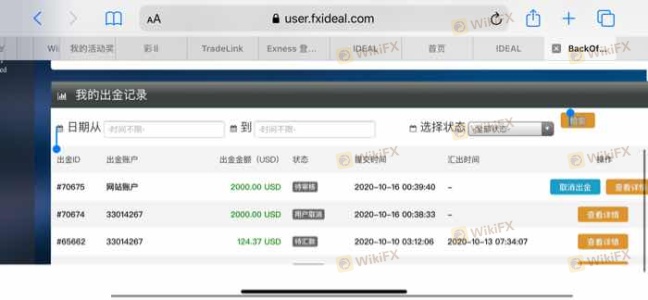

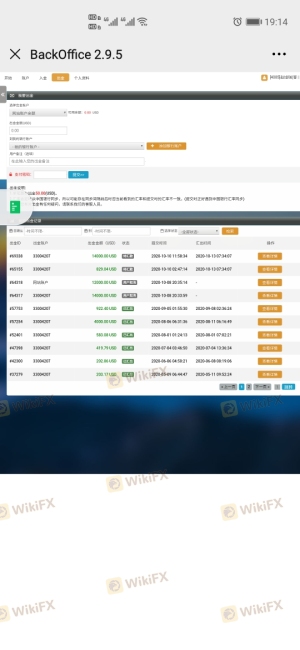

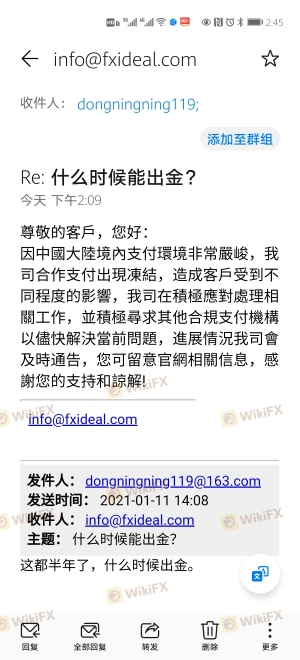

Customer feedback is an invaluable resource when assessing a broker's reliability. In Ideal's case, numerous complaints have surfaced, highlighting issues such as withdrawal difficulties and unresponsive customer service. These complaints are often indicative of broader systemic problems within the brokerage.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delay | Medium | Average |

| Transparency Concerns | High | Poor |

Common complaints include clients being unable to withdraw their funds, with many reporting delays of several months. Additionally, the quality of customer service has been criticized, with users often left without timely assistance. These issues not only reflect poorly on Ideal but also raise concerns about the broker's operational integrity. Given the severity of these complaints, it is essential for potential traders to be cautious and consider whether Ideal is a safe option for their trading needs.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Ideal utilizes the popular MetaTrader 4 platform, which is known for its user-friendly interface and advanced charting capabilities. However, user experiences regarding platform stability and execution quality have been mixed.

Reports of slippage and order rejections have emerged, indicating that traders may not always receive the execution quality they expect. A reliable broker should provide a seamless trading experience, with minimal disruptions and transparent order execution practices. The presence of issues such as slippage and rejections raises concerns about the overall reliability of Ideal's trading platform, suggesting that traders should be cautious in determining if Ideal is safe for their trading activities.

Risk Assessment

Using Ideal as a trading platform presents several risks that potential clients should carefully consider. The lack of regulation, inadequate fund protection, and poor customer service all contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No proper regulation, increasing fraud risk. |

| Fund Security | High | Client funds may not be adequately protected. |

| Customer Support | Medium | Poor response times and unresolved complaints. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with a smaller investment, and be prepared for the possibility of encountering difficulties. Seeking out alternatives that offer better regulatory oversight and customer service may also be advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ideal may not be a safe trading platform. The lack of regulation, inadequate fund protection measures, and numerous customer complaints point to significant risks associated with trading through this broker. Traders should exercise caution and consider whether they are comfortable with the potential for issues such as withdrawal difficulties and poor customer service.

For those seeking reliable alternatives, brokers regulated by top-tier authorities such as the FCA and ASIC should be prioritized. These brokers typically offer better protection for client funds, clearer fee structures, and more responsive customer service. Ultimately, ensuring a safe trading environment is paramount, and potential clients should carefully weigh their options before proceeding with Ideal or any unregulated broker.

Is IDEAL a scam, or is it legit?

The latest exposure and evaluation content of IDEAL brokers.

IDEAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IDEAL latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.