Vorbex 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive vorbex review examines a broker that has gained attention in the trading community. The attention isn't for positive reasons, though. Based on detailed analysis of user feedback and third-party reviews, Vorbex's legitimacy stays questionable, with mostly negative user experiences reported across multiple review platforms.

Trustpilot data shows that Vorbex has collected 720 user reviews but keeps an extremely low rating of 1.1 out of 5 stars. This indicates widespread dissatisfaction among its user base. Also, discussions on InvestReviews and Scamadviser have raised concerns about whether Vorbex operates as a legitimate brokerage or potentially fraudulent scheme.

The broker appears to target risk-tolerant investors seeking high-return opportunities. However, the evidence suggests caution is needed. Multiple review platforms have documented user complaints about various aspects of the service, from withdrawal difficulties to questionable business practices.

Given the overwhelmingly negative feedback and ongoing discussions about the company's legitimacy across multiple review platforms, potential clients should exercise extreme caution when considering Vorbex for their trading activities.

Important Notice

Due to the limited regulatory information available in public sources, users must independently assess the legal risks associated with trading through Vorbex in their respective jurisdictions. The regulatory framework governing this broker's operations remains unclear based on available documentation.

This evaluation is based on user feedback, market analysis, and third-party assessments from sources including Trustpilot, InvestReviews, Scamadviser, and WikiBit. The analysis reflects information available as of late 2024, and prospective users should conduct their own due diligence before making any trading decisions.

Rating Framework

Broker Overview

Vorbex operates in the online trading space. Specific details about its founding date and corporate background are not clearly documented in available public sources. The company's business model and operational structure remain somewhat unclear, which has contributed to the ongoing discussions about its legitimacy within the trading community.

The broker's exact operational history and corporate governance structure are not well-documented in available materials. This lack of transparency has become a point of concern for many users and industry observers, as reputable brokers typically maintain clear corporate disclosure practices.

According to WikiBit's 2025 analysis, Vorbex offers forex and CFD trading services. However, the specific range of tradeable assets and platform specifications are not comprehensively detailed in publicly available information. The company appears to operate primarily through online channels, targeting individual retail traders rather than institutional clients.

The regulatory oversight governing Vorbex's operations remains unclear based on available documentation. This regulatory ambiguity has become a significant factor in the negative assessments found across multiple review platforms, as traders typically prefer brokers with clear regulatory compliance frameworks.

Regulatory Jurisdiction: Specific regulatory information is not clearly documented in available sources. This raises concerns about oversight and compliance standards.

Deposit and Withdrawal Methods: Available documentation does not provide comprehensive details about supported payment methods or processing procedures.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in the available information sources.

Bonus and Promotions: Current promotional offerings and bonus structures are not documented in accessible public materials.

Tradeable Assets: While forex and CFD trading are mentioned in some sources, the complete asset catalog remains unclear from available documentation.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not comprehensively available in public sources. This lack of pricing transparency has been noted as a concern in user feedback.

Leverage Ratios: Specific leverage offerings are not detailed in the available information. This is typically a crucial factor for forex traders, though.

Platform Options: The specific trading platforms offered by Vorbex are not clearly documented. This includes whether popular options like MT4 or MT5 are available.

Regional Restrictions: Geographic limitations and availability are not clearly specified in available documentation.

Customer Support Languages: Multilingual support capabilities are not detailed in accessible sources.

This vorbex review highlights the significant information gaps that potential users should consider when evaluating the broker.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Vorbex remain largely undocumented in publicly available sources. This itself represents a significant concern for potential traders. Reputable brokers typically provide comprehensive information about account types, minimum deposits, and special features to help clients make informed decisions.

Based on user feedback patterns observed across review platforms, there appear to be substantial issues with account management and conditions. Multiple users have reported difficulties with account verification processes and unclear terms of service, though specific details about account tiers or Islamic account availability are not documented.

The lack of transparent information about account opening procedures has been cited as a red flag by several industry observers. Professional traders typically expect clear documentation of account requirements, funding procedures, and operational guidelines before committing to a trading platform.

User testimonials suggest that the account setup process may involve unexpected complications or requirements not clearly disclosed upfront. This opacity in account conditions contributes to the overall negative perception reflected in the extremely low Trustpilot ratings.

The absence of detailed account condition information in this vorbex review reflects the broader transparency issues that have concerned users and industry analysts alike.

Information about Vorbex's trading tools and educational resources is notably absent from available public documentation. Professional trading platforms typically offer comprehensive suites of analytical tools, market research, and educational materials to support trader success.

The lack of documented trading tools raises questions about the platform's capability to serve serious traders who require advanced charting, technical analysis, and automated trading features. Most reputable brokers provide detailed information about their platform capabilities and analytical resources.

Educational resources, which are crucial for new traders, do not appear to be prominently featured or documented in available materials about Vorbex. This absence of learning materials may indicate a focus on attracting experienced traders only, or potentially suggests limited investment in trader education and support.

User feedback has not specifically highlighted exceptional tools or resources. This contrasts with positive reviews typically seen for brokers that invest heavily in platform development and trader education. The silence on this front may be telling about the platform's actual capabilities.

Without clear documentation of available tools and resources, potential users cannot adequately assess whether Vorbex meets their trading requirements and sophistication needs.

Customer Service and Support Analysis

Customer service quality emerges as one of the most significant concerns in user feedback about Vorbex. The extremely low Trustpilot rating of 1.1 strongly suggests widespread dissatisfaction with support responsiveness and problem resolution capabilities.

Multiple review platforms indicate that users have experienced difficulties reaching customer support representatives and obtaining timely responses to urgent trading-related inquiries. In the fast-paced forex market, delayed customer support can result in significant financial losses for traders.

The availability of multilingual support and 24/7 service coverage is not clearly documented. This may indicate limitations in global customer service capabilities. Professional forex brokers typically maintain round-the-clock support given the international nature of currency markets.

User complaints patterns suggest that when support is available, the quality of assistance may not meet industry standards. Issues with problem escalation and resolution appear to be recurring themes in negative feedback about the platform.

The customer service challenges documented across multiple review platforms represent a critical weakness that potential users should carefully consider before engaging with Vorbex.

Trading Experience Analysis

The trading experience offered by Vorbex appears to fall short of industry standards based on available user feedback and platform assessments. Users have reported various technical issues that can significantly impact trading performance and profitability.

Platform stability and execution speed are crucial factors for successful forex trading. User reports suggest potential deficiencies in these areas. Slow order execution or platform downtime can result in missed opportunities and unexpected losses for active traders.

The mobile trading experience, which is increasingly important for modern traders, is not well-documented in available sources. Most professional traders require reliable mobile access to manage positions and respond to market movements throughout the day.

User interface design and functionality appear to be areas of concern based on indirect feedback patterns. Traders typically expect intuitive, professional-grade interfaces that facilitate efficient market analysis and trade execution.

The overall trading environment provided by Vorbex seems to generate significant user dissatisfaction, as reflected in the consistently negative reviews across multiple platforms. This vorbex review emphasizes these experience-related concerns as major decision factors.

Trust Level Analysis

Trust represents perhaps the most critical concern regarding Vorbex based on available evidence. The combination of extremely low user ratings and ongoing legitimacy discussions across multiple review platforms creates substantial doubt about the broker's reliability and integrity.

The Trustpilot rating of 1.1 from 720 reviews represents an exceptionally poor trust score that is rarely seen among legitimate financial service providers. Such widespread negative feedback typically indicates systemic issues with business practices or service delivery.

Discussions on Scamadviser and InvestReviews have specifically questioned whether Vorbex operates as a legitimate brokerage or potentially represents fraudulent activity. These concerns are particularly serious in the financial services sector where client fund safety is paramount.

The absence of clear regulatory information compounds trust concerns. Reputable brokers typically maintain transparent regulatory compliance and client protection measures. Without proper oversight, traders have limited recourse in case of disputes or problems.

Third-party verification of the company's legitimacy and operational standards appears to be lacking, which represents a significant red flag for potential clients considering the platform for their trading activities.

User Experience Analysis

Overall user satisfaction with Vorbex is extremely poor based on comprehensive review platform analysis. The Trustpilot score of 1.1 indicates that the vast majority of users who have engaged with the platform report negative experiences.

The user interface design and ease of use are not positively highlighted in available feedback. This suggests potential deficiencies in platform usability and trader experience design. Modern traders expect intuitive, efficient interfaces that support their trading strategies.

Registration and account verification processes appear to be sources of user frustration based on feedback patterns. Complicated or unclear onboarding procedures can create immediate negative impressions and operational difficulties for new users.

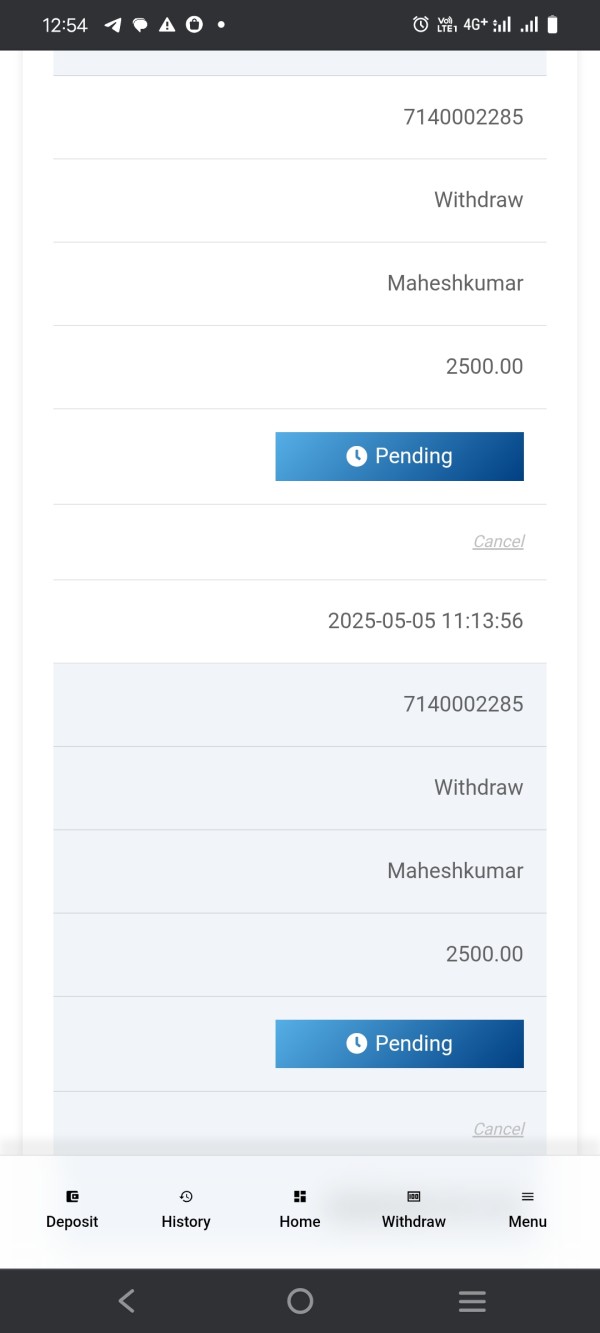

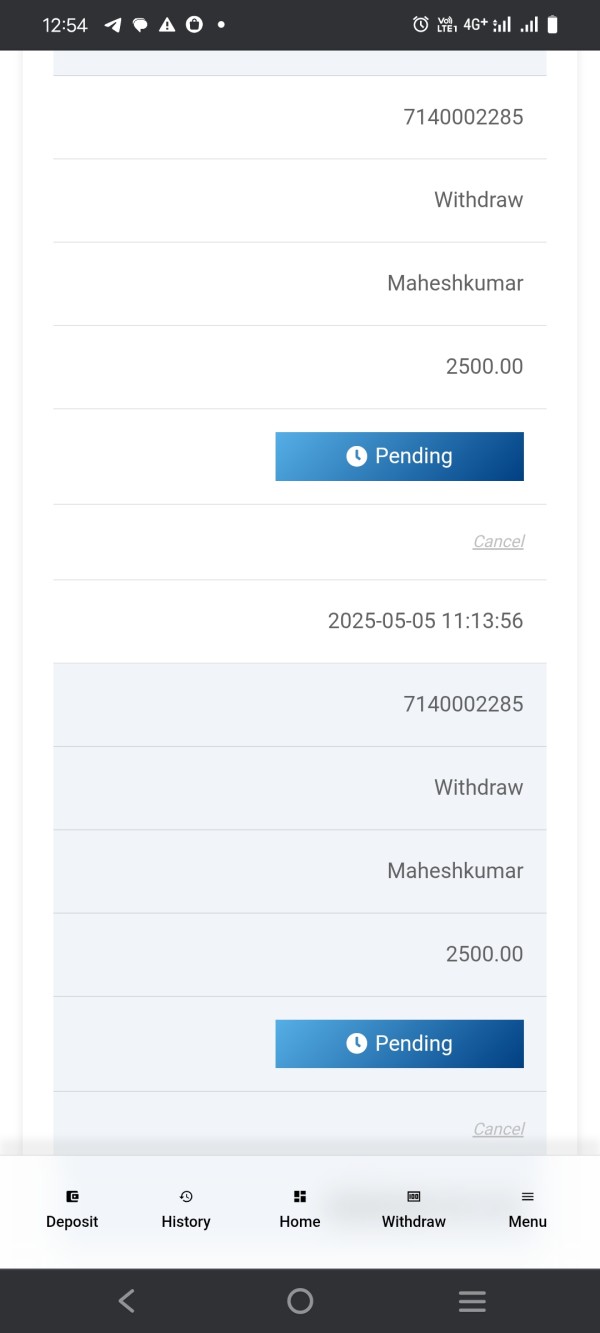

Fund management experiences, including deposits and withdrawals, seem to be particular pain points for users. Difficulties with accessing funds or unclear procedures for financial transactions represent serious concerns for any trading platform.

The pattern of user complaints suggests that Vorbex may not be suitable for traders who prioritize reliable service, transparent operations, and responsive support. The overwhelmingly negative user experience feedback serves as a strong warning signal for potential clients.

Conclusion

Based on comprehensive analysis of available information and user feedback, this vorbex review concludes that Vorbex presents significant risks and concerns for potential traders. The extremely low user satisfaction ratings, legitimacy questions, and lack of transparent operational information create a highly unfavorable assessment.

The broker appears unsuitable for risk-averse traders or those seeking reliable, professional-grade trading services. The documented user experience issues and trust concerns make it particularly inappropriate for new traders who require dependable support and clear operational procedures.

The primary disadvantages include exceptionally poor user ratings, legitimacy concerns raised by multiple review platforms, lack of regulatory transparency, and widespread reports of service quality issues. No significant advantages have been identified in available documentation or user feedback to offset these substantial concerns.