Is AssetsFX safe?

Pros

Cons

Is AssetsFX A Scam?

Introduction

AssetsFX is a forex broker that has positioned itself within the online trading landscape since its inception in 2013. Operating under the brand name AssetsFX Global Ltd, the broker claims to offer a range of trading services, including forex, commodities, and cryptocurrencies. Given the rapid growth of online trading, it is crucial for traders to carefully assess the credibility and reliability of brokers like AssetsFX. With numerous reports of scams and fraudulent activities in the forex market, traders must exercise caution when selecting a trading partner.

This article aims to provide a comprehensive evaluation of AssetsFX by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk profile. The analysis is based on data collected from various reputable sources, including user reviews, regulatory databases, and expert evaluations.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a key determinant of its legitimacy and trustworthiness. Regulated brokers are subject to stringent oversight, which helps protect traders from fraud and ensures fair trading practices. In the case of AssetsFX, the broker is registered in St. Vincent and the Grenadines, a jurisdiction known for its lenient regulatory requirements.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | St. Vincent and the Grenadines | Unregulated |

The lack of a valid regulatory license raises significant concerns about the broker's operational integrity. Brokers operating without regulation can impose unfair trading conditions, manipulate prices, or even deny withdrawals. Moreover, traders have no recourse to a regulatory body in case of disputes. The absence of oversight means that AssetsFX does not have to comply with industry standards for client fund protection or transparent business practices.

Company Background Investigation

AssetsFX was established in 2013, and its operations are based in St. Vincent and the Grenadines. The company claims to prioritize providing a user-friendly trading environment with competitive conditions. However, detailed information regarding its ownership structure and management team is sparse, which raises transparency concerns.

The lack of publicly available information about the management team can hinder traders' ability to assess the broker's credibility. A reputable broker usually provides information about its executives and their industry experience, which helps build trust among potential clients. In contrast, AssetsFX's limited disclosure may lead to skepticism about its operations and intentions.

Trading Conditions Analysis

AssetsFX offers a variety of trading accounts, including cent, standard, and ECN accounts, each tailored to different trading styles and capital requirements. However, the broker's trading fees and conditions warrant careful scrutiny.

Core Trading Cost Comparison Table

| Fee Type | AssetsFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1 pip | From 0.5 pips |

| Commission Model | $3 per lot (ECN) | $2 per lot |

| Overnight Interest Range | Varies by position | Varies by broker |

While AssetsFX claims to offer competitive spreads and low commissions, the actual trading costs may be higher than those of other brokers. Additionally, the presence of high overnight interest rates can significantly affect trading profitability. Traders should be wary of any hidden fees that may not be immediately apparent.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. AssetsFX claims to keep client funds in segregated accounts, which is a standard practice among reputable brokers. However, without regulatory oversight, there is no guarantee that these practices are being followed.

Traders should also consider the implications of negative balance protection, which ensures that clients do not lose more than their initial investment. AssetsFX does offer this feature, but its effectiveness is questionable in the absence of regulatory scrutiny.

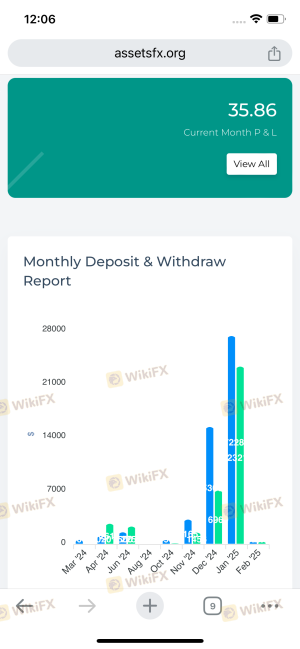

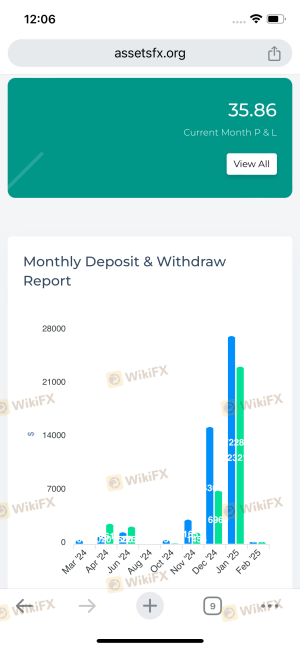

Customer Experience and Complaints

User feedback is an essential component of assessing a broker's reliability. Reviews of AssetsFX reveal a mixed bag of experiences, with some traders reporting satisfactory service, while others have raised serious concerns about withdrawal issues and account management.

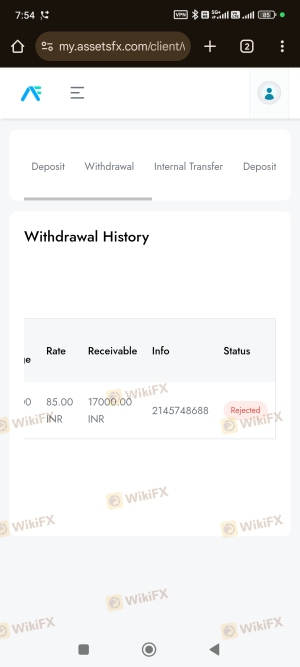

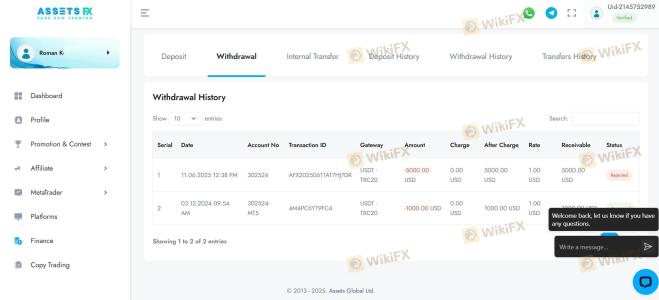

Major Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Closure | High | Poor |

| Customer Support Issues | Medium | Fair |

Typical complaints include accounts being closed without warning, withdrawal requests being delayed or denied, and poor customer service responses. These issues highlight potential operational deficiencies within AssetsFX and suggest a need for caution among prospective clients.

Platform and Execution

The trading platform offered by AssetsFX is primarily MetaTrader 4 (MT4), which is widely regarded for its user-friendly interface and robust trading features. However, the broker's execution quality, including slippage and order rejection rates, has been a point of contention among users.

Traders have reported instances of significant slippage during volatile market conditions, which can severely impact trading outcomes. Additionally, concerns about potential platform manipulation have arisen, further complicating the broker's reputation.

Risk Assessment

Trading with AssetsFX involves several risks that potential clients should be aware of before opening an account.

Risk Rating Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Safety | Medium | Lack of transparency regarding fund segregation. |

| Trading Cost | Medium | Higher spreads and commissions compared to industry averages. |

| Customer Support | High | Reports of poor response times and unresolved complaints. |

Given these risk factors, it is advisable for traders to proceed with caution when dealing with AssetsFX. Engaging with an unregulated broker can lead to significant financial losses, and traders should have contingency plans in place.

Conclusion and Recommendations

In summary, AssetsFX presents several red flags that suggest it may not be a reliable trading partner. The absence of regulation, coupled with numerous user complaints about withdrawal issues and account management, raises serious concerns about the broker's legitimacy. While some traders report positive experiences, the overall sentiment indicates a need for caution.

Prospective clients should carefully consider their risk tolerance and trading objectives before engaging with AssetsFX. For those seeking a more secure trading environment, it is advisable to explore regulated alternatives that offer robust consumer protections and transparent business practices. Recommended brokers include those with established regulatory oversight, such as IG, OANDA, or Saxo Bank, which provide a more trustworthy trading experience.

Is AssetsFX a scam, or is it legit?

The latest exposure and evaluation content of AssetsFX brokers.

AssetsFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AssetsFX latest industry rating score is 2.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.