Is ROCK safe?

Pros

Cons

Is Rock Safe or a Scam?

Introduction

In the ever-evolving world of forex trading, Rock has emerged as a notable player, primarily focusing on cryptocurrency exchange and trading services. Established in 2011, Rock has positioned itself as one of the oldest cryptocurrency exchanges in Europe. However, with the rapid growth of online trading platforms, it has become increasingly important for traders to exercise caution and thoroughly evaluate the legitimacy and safety of their chosen brokers. This article aims to provide an objective analysis of whether Rock is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. Our investigation incorporates data from multiple credible sources and user feedback to ensure a well-rounded assessment.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining the safety and legitimacy of any trading platform. Rock operates under the jurisdiction of Malta, where it is registered as a limited liability company. While it is important to note that Rock is not regulated by any specific financial authority, the lack of oversight raises questions about the level of protection afforded to its users.

Here is a summary of Rock's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Malta | Unregulated |

The absence of a regulatory body overseeing Rock means that users may not benefit from the same protections that regulated brokers offer, such as investor compensation schemes and strict compliance with financial standards. Moreover, while Rock has operated without any reported security breaches, the lack of regulation could expose users to higher risks, particularly in terms of fund security and operational transparency.

Company Background Investigation

Rock was founded in 2011 by Davide Barbieri and Andrea Medri, initially starting as a digital insurance company before pivoting to cryptocurrency trading. Over the years, the company has expanded its services and offerings, becoming a key player in the European crypto market. However, the absence of detailed information regarding its ownership structure and management team raises concerns about transparency.

The management team‘s background is crucial in assessing the company’s credibility. Unfortunately, there is limited public information available about the professional experience and qualifications of the individuals behind Rock. This lack of transparency can be a red flag for potential investors, as it may indicate a lack of accountability.

Trading Conditions Analysis

When evaluating a trading platform, understanding the fee structure is essential. Rock's trading fees are relatively competitive compared to other exchanges, with transaction fees starting at 0.02% per trade. However, the platform does not provide a clear breakdown of all potential fees, which can lead to unexpected costs for traders.

Heres a comparison of Rock's core trading costs:

| Fee Type | Rock | Industry Average |

|---|---|---|

| Spread for Major Pairs | Varies | 1.0 - 3.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.01% | 0.5% - 2.0% |

While the fees may appear low, the lack of transparency regarding other potential charges can pose a risk to traders, especially for those who are not well-versed in the intricacies of trading costs. Furthermore, the absence of a commission model may suggest that Rock relies on spreads to generate revenue, which can lead to conflicts of interest if not managed properly.

Customer Fund Security

Customer fund security is a paramount concern when selecting a trading platform. Rock claims to implement various security measures, including two-factor authentication and secure socket layer (SSL) encryption. However, without regulatory oversight, it is challenging to ascertain the effectiveness of these measures.

The platform does not provide clear information on fund segregation, investor protection, or negative balance protection policies. This lack of clarity raises concerns about the safety of user funds, particularly in the event of financial difficulties or operational issues within the company.

Historically, there have been no significant reports of fund security breaches at Rock, but the absence of regulation and transparency in their security protocols leaves potential users with unanswered questions.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing the reliability of a trading platform. Reviews of Rock are mixed, with some users praising the platform's user-friendly interface and trading features, while others have reported issues with customer service and fund withdrawals.

Heres a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Limited support |

| Account Verification Delays | Medium | Slow process |

One notable case involved a user who experienced significant delays in withdrawing funds, leading to frustration and dissatisfaction with Rock's customer support. While the platform does offer 24/7 support through various channels, the quality of responses has been criticized, which could hinder users' trading experiences.

Platform and Trade Execution

The performance of a trading platform is critical for traders seeking to execute orders efficiently. Rock provides a web-based platform that is generally regarded as user-friendly. However, some users have reported issues with order execution, including slippage and order rejections, which can significantly impact trading outcomes.

The platform does not provide specific data on execution quality or slippage rates, making it difficult to assess the overall performance of the trading environment. Additionally, the absence of a demo account limits the ability of potential users to test the platform before committing funds, which is a common practice among reputable brokers.

Risk Assessment

Using Rock for trading comes with inherent risks, primarily due to its unregulated status and lack of transparency. The following risk assessment summarizes the key risk areas associated with trading on this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | Medium | Unclear security measures |

| Customer Support Risk | Medium | Mixed reviews on response quality |

| Trading Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trades, and be prepared for potential challenges in customer support and fund withdrawals.

Conclusion and Recommendations

In conclusion, while Rock has established itself as a long-standing player in the cryptocurrency trading space, several factors raise concerns about its safety and reliability. The lack of regulatory oversight, mixed customer feedback, and transparency issues suggest that traders should exercise caution when considering this platform.

If you are contemplating trading with Rock, it is essential to assess your risk tolerance and consider alternative platforms that offer better regulatory protection and customer support. For those seeking reliable trading options, brokers such as eToro or IG Markets, which are well-regulated and have a strong track record, may be preferable.

Ultimately, while Rock may not be outright fraudulent, the potential risks associated with trading on this platform warrant careful consideration. In summary, is Rock safe? The answer leans towards caution, and it is advisable for traders to remain vigilant and informed.

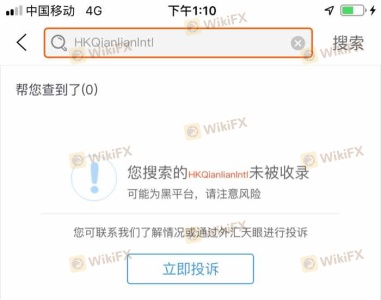

Is ROCK a scam, or is it legit?

The latest exposure and evaluation content of ROCK brokers.

ROCK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROCK latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.