Regarding the legitimacy of Real Time Futures forex brokers, it provides BAPPEBTI and WikiBit, (also has a graphic survey regarding security).

Is Real Time Futures safe?

Pros

Cons

Is Real Time Futures markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. DELAPAN BELAS BERJANGKA

Effective Date: Change Record

--Email Address of Licensed Institution:

info@rrfx.co.idSharing Status:

No SharingWebsite of Licensed Institution:

https://rrfx.co.idExpiration Time:

--Address of Licensed Institution:

Ruko Soho Rodeo Drive Blok A No.20, Kel. Kamal Muara, Kec. Penjaringan, Jakarta Utara - DKI Jakarta 14470Phone Number of Licensed Institution:

021 - 50322008Licensed Institution Certified Documents:

Is Real Time Futures Safe or Scam?

Introduction

Real Time Futures is an online trading platform that positions itself in the forex and futures markets, primarily catering to traders in Indonesia. Established in 2017, the broker aims to provide access to various financial instruments, including currency pairs and commodities. However, the forex trading environment is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities in this sector necessitates a thorough evaluation of any trading platform before committing funds. This article investigates the safety and legitimacy of Real Time Futures by analyzing its regulatory status, company background, trading conditions, customer experiences, and other critical factors.

Regulation and Legitimacy

The regulatory environment is a cornerstone of any broker's credibility. Real Time Futures claims to operate under the oversight of the Indonesian regulatory body, Bappebti (Badan Pengawas Perdagangan Berjangka Komoditi). However, the broker has received a low score of 1.54 out of 10 from WikiFX, a platform that evaluates forex brokers based on various metrics, including regulatory compliance and user feedback.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | 192/Bappebti/SI/II/2003 | Indonesia | Suspicious Clone |

While Bappebti is a recognized regulatory authority, concerns have been raised about Real Time Futures' compliance with regulations. The low score and numerous complaints suggest that the broker may not be adhering to the necessary legal standards. This raises a red flag regarding the safety of trading with Real Time Futures, as regulatory oversight is essential for protecting traders from fraud and ensuring fair trading practices.

Company Background Investigation

Real Time Futures was founded in 2017, positioning itself as a relatively new entrant in the forex market. The company's ownership structure and management team remain somewhat opaque, with limited information available regarding their professional backgrounds and experience in the trading sector. This lack of transparency can be concerning, as it raises questions about the broker's commitment to ethical practices and accountability.

The absence of detailed information on the management team makes it difficult to assess their qualifications and expertise. A well-informed management team is crucial for a broker's success and integrity. Furthermore, the company's history, including any previous regulatory issues or financial difficulties, is not readily available, which adds to the uncertainty surrounding its operations.

Trading Conditions Analysis

Real Time Futures offers various trading conditions, including leverage and spreads, which are critical factors for traders. However, the broker's fee structure has come under scrutiny. While the platform advertises competitive spreads, user reviews indicate that there may be hidden fees or unfavorable trading conditions that can significantly impact profitability.

| Fee Type | Real Time Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Unknown | $0 - $10 per trade |

| Overnight Interest Range | High | 1.0% - 3.0% |

The lack of clarity regarding the commission model and the potential for high overnight interest rates may deter traders from engaging with Real Time Futures. If traders are unaware of the exact costs involved, they may face unexpected losses. This ambiguity further complicates the question of whether Real Time Futures is safe for trading.

Client Fund Security

Ensuring the safety of client funds is paramount for any broker. Real Time Futures claims to implement various security measures to protect traders' investments. However, the specifics of their fund segregation policies and investor protection mechanisms remain unclear. The absence of clear information regarding these safety measures raises concerns about the broker's commitment to safeguarding client funds.

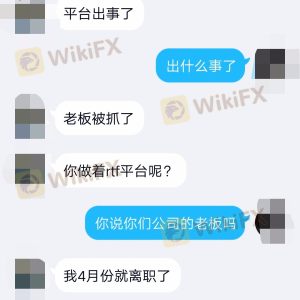

Moreover, there have been reports of users facing difficulties in withdrawing their funds, which is a significant red flag in assessing the safety of a trading platform. Historical issues related to fund security can have long-lasting implications for a broker's reputation and trustworthiness.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's credibility. Real Time Futures has accumulated a number of complaints, with users citing issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Complaints | Medium | Unresolved |

The prevalence of withdrawal issues and the slow response from customer service indicate potential operational shortcomings. A broker's ability to address client concerns effectively is vital for maintaining trust and ensuring a positive trading experience. The negative feedback suggests that traders may face challenges when dealing with Real Time Futures, further questioning its safety.

Platform and Trade Execution

The performance of the trading platform is crucial for a successful trading experience. Real Time Futures claims to provide a user-friendly interface and reliable execution. However, user reviews indicate that the platform may experience instability, leading to slippage and order rejections.

The quality of order execution is essential for traders, as delays or errors can result in significant financial losses. If there are indications of platform manipulation or consistent issues with trade execution, it would further affirm concerns about the broker's reliability.

Risk Assessment

Engaging with Real Time Futures comes with inherent risks that potential traders must consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Low score and suspicious regulatory status. |

| Fund Security | High | Reports of withdrawal difficulties. |

| Customer Service | Medium | Slow response times to complaints. |

| Trading Conditions | Medium | Ambiguous fee structure and potential hidden costs. |

To mitigate these risks, traders should conduct thorough research and consider using a demo account before committing real funds. Understanding the specific risks associated with trading with Real Time Futures is essential for making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should exercise caution when considering Real Time Futures. The low regulatory score, numerous complaints, and lack of transparency raise significant concerns about the broker's legitimacy. While it operates under the oversight of Bappebti, the overall safety of trading with Real Time Futures is questionable.

For traders seeking reliable alternatives, it is advisable to consider more established brokers with strong regulatory oversight and positive user feedback. Brokers such as Interactive Brokers and NinjaTrader offer robust trading conditions, transparent fee structures, and a proven track record of client satisfaction. Ultimately, choosing a reputable broker is critical for ensuring a safe and successful trading experience in the complex world of forex and futures trading.

Is Real Time Futures a scam, or is it legit?

The latest exposure and evaluation content of Real Time Futures brokers.

Real Time Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Real Time Futures latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.