Is MIA safe?

Pros

Cons

Is MIA Safe or Scam?

Introduction

MIA is an online trading platform that positions itself in the forex market, claiming to offer a variety of financial instruments, including foreign exchange, precious metals, and commodities. As the popularity of forex trading continues to rise, so does the number of brokers vying for traders' attention. However, with this increase comes the necessity for traders to exercise caution and thoroughly evaluate the legitimacy of these brokers. In an industry where scams are prevalent, understanding the regulatory status, company background, trading conditions, and customer experiences is crucial for making informed trading decisions. This article aims to analyze MIA's credibility by examining its regulatory framework, company history, trading conditions, and customer feedback, ultimately answering the question: Is MIA safe?

Regulation and Legitimacy

The regulation of forex brokers is a pivotal factor in determining their trustworthiness. Regulatory bodies enforce standards that protect traders from fraud and ensure fair trading practices. MIA claims to be regulated by the Australian Securities and Investments Commission (ASIC), but there are significant concerns regarding the authenticity of this claim.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 224022 | Australia | Suspicious Clone |

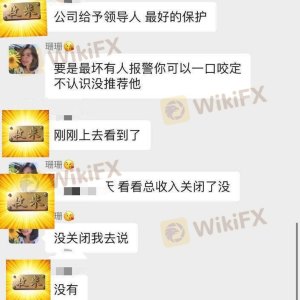

MIA's regulatory status raises red flags. The license number provided corresponds to a suspicious entity, Money Cat Group Pty Ltd, which has been linked to multiple complaints and negative reviews. Furthermore, there are indications that MIA operates as a clone of a legitimate ASIC-regulated broker. This lack of credible oversight suggests that MIA may not adhere to the regulatory standards that protect traders, leading to heightened risks associated with trading on this platform. Regulatory compliance is essential; without it, traders may find themselves vulnerable to potential fraud or mismanagement of funds. Hence, the question remains: Is MIA safe? The evidence points to significant concerns regarding its regulatory legitimacy.

Company Background Investigation

MIA's history and ownership structure are vital components in assessing its credibility. Established in 2017, the company claims to have developed a robust trading platform. However, details about its founders, management team, and operational history remain vague. The lack of transparency surrounding the company's background raises concerns about its integrity and reliability.

MIA is associated with two names: My Group Fintech Co Pty Ltd and Money Cat Group Pty Ltd. Both entities have been flagged as suspicious clones with dubious regulatory licenses. The management team behind MIA has not been clearly identified, leaving traders without information on the qualifications and expertise of those running the platform. This opacity in leadership can be detrimental, as a trustworthy broker should have a transparent and experienced management team guiding its operations.

Moreover, the level of information disclosure is critical. MIA's website lacks comprehensive details about its services, fees, and trading conditions, which can leave potential clients feeling uncertain. Transparency in operations is crucial for building trust, and MIAs failure to provide this information further complicates its legitimacy. Therefore, when considering the company's background, it is essential to ask: Is MIA safe? The evidence suggests that the lack of transparency and questionable ownership raises significant concerns.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is paramount. MIA claims to provide competitive trading fees, but a closer examination reveals a lack of clarity regarding its fee structure. Traders must be wary of hidden costs that could erode their profits.

| Fee Type | MIA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | $5-10 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

The absence of clearly defined spreads and commissions raises questions about the fairness of MIA's trading conditions. Traders typically expect transparency regarding fees, and without this, they may face unexpected costs that could significantly impact their trading performance. Furthermore, the lack of information on overnight interest rates and commission structures suggests that MIA may not operate with the same level of transparency as more established brokers. Given these factors, potential traders should carefully consider: Is MIA safe? The unclear fee structure could lead to unfavorable trading experiences.

Customer Funds Safety

The safety of customer funds is a critical concern for any trader. MIA claims to implement various measures to protect client funds, including fund segregation and investor protection policies. However, the effectiveness of these measures remains uncertain.

MIA's website does not provide sufficient information on how it safeguards client funds. Traders should expect brokers to have robust security protocols, including segregated accounts, which keep client funds separate from the broker's operational funds. This practice is essential for ensuring that client funds are not misused. Additionally, the absence of information regarding negative balance protection raises further concerns. Negative balance protection is crucial as it prevents traders from losing more than their initial investment, providing an additional layer of security.

There have been reports of clients experiencing difficulties in withdrawing their funds, which is a significant red flag. Such issues can indicate potential mismanagement or fraudulent activities. Therefore, when assessing whether MIA is safe, the lack of transparency regarding fund safety measures and the history of withdrawal issues present considerable risks to potential investors.

Customer Experience and Complaints

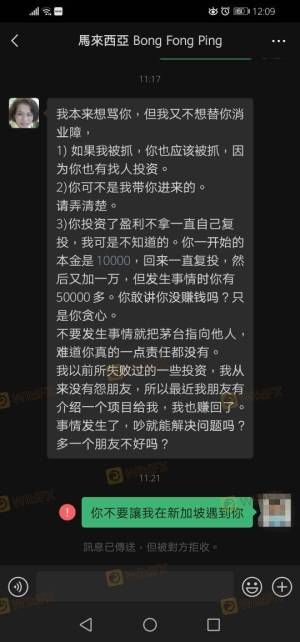

Analyzing customer feedback is vital for understanding a broker's reliability. MIA has accumulated numerous negative reviews, with many clients expressing dissatisfaction with their experiences. Common complaints include issues with fund withdrawals, lack of customer support, and allegations of fraudulent practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Allegations of Fraud | High | No response |

One notable case involved a trader, Mr. Li, who reported losing over $170,000 due to misleading practices by MIA's analysts. He was persuaded to increase his investments under the promise of high returns, only to find himself unable to withdraw his funds. This case exemplifies the risks associated with trading on platforms with questionable reputations.

Given the volume of negative feedback and the company's inadequate response to complaints, it is reasonable to question: Is MIA safe? The evidence suggests that MIA's poor customer service and history of complaints significantly undermine its credibility.

Platform and Trade Execution

The performance of a trading platform is crucial for traders. MIA claims to offer a user-friendly platform, but reviews indicate otherwise. Users have reported issues with platform stability, order execution, and instances of slippage.

The quality of order execution is particularly important in forex trading, where milliseconds can make a difference in profitability. Reports of high slippage and rejected orders raise concerns about the platform's reliability. Additionally, the lack of advanced trading tools and features typically offered by reputable brokers can hinder traders' ability to perform effectively.

Given these factors, the question arises: Is MIA safe? The platform's performance issues and reports of poor execution quality suggest that traders may face challenges when using MIA for their trading activities.

Risk Assessment

When considering the overall risk of trading with MIA, several factors must be evaluated. The lack of regulatory oversight, questionable company background, unclear trading conditions, and negative customer experiences all contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspected clone of a regulated broker |

| Fund Safety | High | Lack of transparency in fund protection measures |

| Customer Support | Medium | Poor response to complaints and issues |

| Platform Reliability | High | Reports of execution issues and slippage |

To mitigate these risks, potential traders should conduct thorough research and consider alternative brokers with solid regulatory backgrounds and positive customer reviews. It is crucial to prioritize safety and transparency when selecting a trading platform.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding MIA's legitimacy and safety. The questionable regulatory status, lack of transparency, negative customer experiences, and platform performance issues suggest that MIA may not be a trustworthy broker. Therefore, it is essential for traders to exercise caution and consider alternative options.

For those seeking reliable trading platforms, it is advisable to explore brokers with verified regulatory credentials, transparent fee structures, and positive customer feedback. Some reputable alternatives include brokers such as IG, OANDA, or Forex.com, which have established track records and regulatory oversight.

Ultimately, the question remains: Is MIA safe? Based on the available evidence, the consensus leans towards caution, and potential traders are strongly advised to seek safer options.

Is MIA a scam, or is it legit?

The latest exposure and evaluation content of MIA brokers.

MIA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MIA latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.