Is Maxpro365 safe?

Business

License

Is Maxpro365 Safe or Scam?

Introduction

Maxpro365 positions itself as an online trading platform within the forex market, aiming to attract traders with promises of lucrative returns and innovative trading solutions. In an industry rife with scams and unregulated brokers, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds to any platform. This article aims to investigate the legitimacy of Maxpro365 by assessing its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of online resources, user feedback, and regulatory databases, employing a structured framework to evaluate the broker's credibility.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Maxpro365 operates as an unregulated broker, which raises significant concerns about the safety and security of traders' funds. Without oversight from recognized financial authorities, traders are exposed to a higher risk of unfair practices and potential financial loss.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Maxpro365 is not subject to the stringent compliance requirements imposed by recognized authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This absence of oversight can lead to issues such as withdrawal difficulties, account manipulation, and unresponsive customer service, which have been reported by numerous users. The historical context of unregulated brokers shows that they often engage in practices that are detrimental to traders, making it imperative to approach such platforms with skepticism.

Company Background Investigation

Maxpro365's company history and ownership structure remain opaque, with little information available regarding its founding, management team, or operational history. The broker's website does not disclose essential details about its physical address or the identities of its key personnel, which is a significant red flag for potential investors. Transparency is a hallmark of reputable brokers, and the lack of such information raises questions about the company's legitimacy.

The management team's background is another critical aspect to consider when evaluating a broker's trustworthiness. In the case of Maxpro365, there is insufficient information available to assess the qualifications and experience of its management. This lack of transparency can be indicative of a broker that is not fully committed to maintaining a trustworthy and reliable trading environment.

Overall, the limited disclosure surrounding Maxpro365's company background further complicates the assessment of its safety, reinforcing the need for potential traders to exercise extreme caution.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Maxpro365 presents a range of trading opportunities, but its overall fee structure and policies raise concerns. Reports suggest that traders may encounter hidden fees or unfavorable terms that are not clearly outlined during the registration process.

| Fee Type | Maxpro365 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of transparent fee structures can lead to unexpected costs, making it difficult for traders to gauge the true cost of trading with Maxpro365. Furthermore, the broker's aggressive marketing tactics have been criticized for pressuring users to deposit significant amounts without providing adequate risk disclosures. This lack of clarity regarding fees and trading conditions is a significant concern for potential clients.

Client Funds Safety

Client funds' safety is a paramount consideration when assessing the reliability of a trading platform. Maxpro365 has been flagged for its lack of investor protection measures, such as segregated accounts and negative balance protection policies. These safeguards are crucial in ensuring that traders' funds are kept separate from the broker's operational funds, thereby providing an additional layer of security.

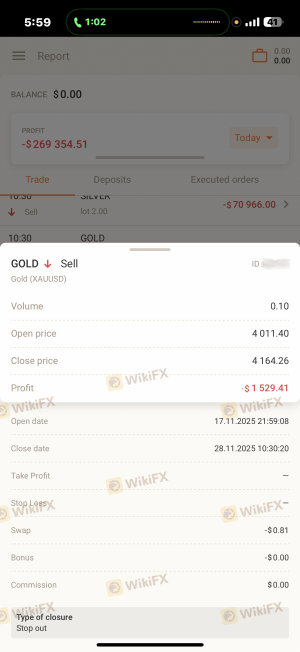

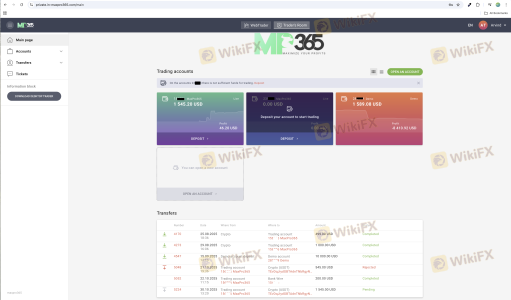

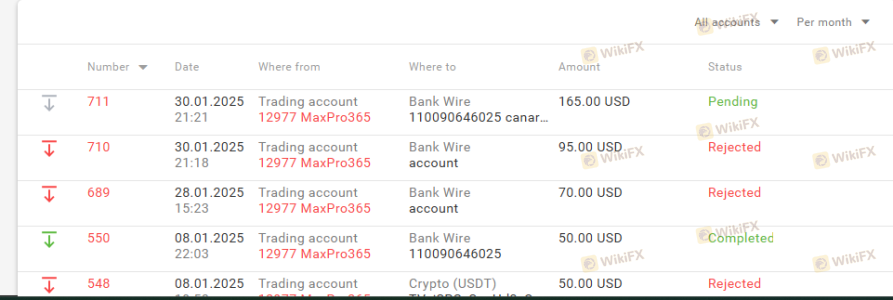

Historically, unregulated brokers like Maxpro365 have been associated with numerous complaints regarding fund withdrawals, with many users reporting difficulties in retrieving their money after making deposits. This pattern of behavior is a strong indicator that traders should be wary of engaging with such platforms, as the risk of losing their investments is significantly heightened.

Customer Experience and Complaints

Customer feedback is vital in assessing a broker's reputation and reliability. In the case of Maxpro365, user reviews reveal a troubling pattern of complaints, primarily centered around withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | High | Poor |

| Misleading Marketing | Medium | Poor |

Many users have reported being unable to access their funds, with some alleging that the platform's customer service is unresponsive or dismissive when addressing their concerns. These complaints highlight a concerning trend that suggests Maxpro365 may not prioritize the needs of its clients, further casting doubt on its legitimacy.

For instance, one user recounted their experience of being pressured to invest additional funds, only to find that their withdrawal requests were met with prolonged delays. Such accounts raise significant red flags and indicate that potential traders should approach Maxpro365 with caution.

Platform and Trade Execution

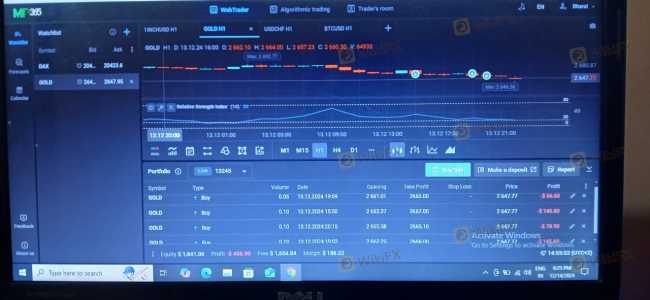

The performance and reliability of a trading platform are critical factors in a trader's success. Maxpro365's platform has been criticized for its stability and user experience, with reports of execution issues and slippage. Traders have expressed concerns about the platform's responsiveness and the quality of order execution, which can significantly impact trading outcomes.

In some instances, users have reported experiencing issues with order rejections and delays in trade execution, which can be detrimental in fast-moving markets. Additionally, any signs of platform manipulation or unfair trading practices further exacerbate the concerns surrounding Maxpro365.

Risk Assessment

Engaging with Maxpro365 presents several risks, primarily due to its unregulated status and the multitude of complaints from users.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Withdrawal Risk | High | Numerous complaints regarding fund retrieval. |

| Transparency Risk | Medium | Lack of information about company operations and fees. |

To mitigate these risks, potential traders are advised to conduct thorough research before committing funds, consider trading with regulated brokers, and remain vigilant about any unusual practices or demands from the broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that Maxpro365 exhibits several concerning traits that indicate it may not be a safe trading platform. The lack of regulation, transparency issues, and numerous complaints from users point to a higher risk of potential fraud or mismanagement. Therefore, traders should exercise extreme caution when considering engaging with Maxpro365.

For those seeking reliable trading options, it is advisable to explore regulated brokers that provide transparent fee structures, robust customer support, and a commitment to safeguarding client funds. Platforms regulated by authorities such as the FCA or ASIC are typically safer choices, offering a more secure trading environment.

In summary, traders should prioritize their safety and due diligence, ensuring they select brokers that are not only promising but also trustworthy and transparent in their operations.

Is Maxpro365 a scam, or is it legit?

The latest exposure and evaluation content of Maxpro365 brokers.

Maxpro365 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Maxpro365 latest industry rating score is 1.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.