Is Bitget safe?

Pros

Cons

Is Bitget A Scam?

Introduction

Bitget is a cryptocurrency exchange that has rapidly gained traction since its establishment in 2018. Positioned primarily as a platform for crypto derivatives trading, Bitget has attracted a substantial user base, boasting over 8 million registered users worldwide. The exchange is particularly noted for its innovative copy trading feature, which allows users to replicate the trades of seasoned investors. However, with the rise of cryptocurrency trading, the need for traders to carefully evaluate the legitimacy and reliability of exchanges has never been more critical. The crypto market is rife with scams and unregulated platforms, making due diligence essential for anyone looking to invest.

This article aims to provide a comprehensive assessment of Bitget, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The analysis is based on a review of multiple sources, including user feedback, regulatory filings, and expert evaluations, to present a balanced view of whether Bitget is a safe trading environment or a potential scam.

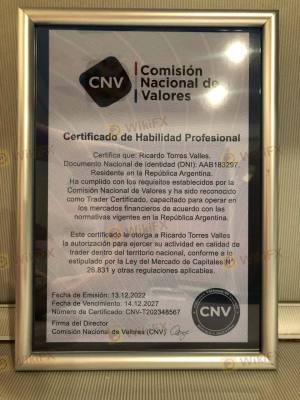

Regulation and Legitimacy

The regulatory landscape is a crucial aspect when evaluating the legitimacy of any trading platform. Bitget operates under various licenses, which provide a framework for its operations. However, the exchange has faced scrutiny regarding its regulatory status, particularly as it is not regulated by major financial authorities in many jurisdictions. This lack of oversight raises questions about the security and transparency of the platform.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | N/A | Vanuatu | Active |

| Financial Crimes Enforcement Network (FinCEN) | MSB License | USA | Active |

| Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) | MSB License | Canada | Active |

| Australian Transaction Reports and Analysis Centre (AUSTRAC) | Digital Currency Spot License | Australia | Active |

While Bitget holds licenses from the VFSC, FinCEN, FINTRAC, and AUSTRAC, it is essential to note that these regulatory bodies are not as stringent as others like the FCA or SEC. The quality of regulation varies significantly, and while Bitget appears to comply with local laws, the absence of rigorous oversight might expose users to higher risks. Historical compliance issues, if any, should also be examined to gauge the platform's reliability.

Company Background Investigation

Bitget was founded in 2018 and has since evolved into a significant player in the cryptocurrency trading space. The company is headquartered in Singapore and has expanded its reach to over 100 countries. The ownership structure of Bitget is not extensively disclosed, but it is led by a team of experienced professionals from various sectors, including finance and technology.

The management team, including CEO Sandra Lou, has a background in internet technology and finance, which contributes to the platform's operational integrity. However, the transparency regarding company ownership and governance remains limited, which can be a red flag for potential investors. Users generally prefer platforms that disclose their ownership structure and provide insights into their corporate governance.

Bitget's commitment to transparency is somewhat reflected in its Proof of Reserves (PoR) initiative, which aims to assure users that their funds are backed by adequate reserves. However, the self-audited nature of these reports may not provide the level of assurance that independent audits would offer.

Trading Conditions Analysis

When it comes to trading conditions, Bitget presents a competitive fee structure that appeals to both novice and experienced traders. The platform offers various trading instruments, including spot trading and futures contracts, with a focus on low trading fees. However, it is essential to scrutinize any unusual fee policies that could impact traders' profitability.

| Fee Type | Bitget | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1% | 0.2% |

| Commission Model | 0.02% (Maker) / 0.06% (Taker) | 0.05% (Maker) / 0.1% (Taker) |

| Overnight Interest Range | Varies by asset | Varies |

Bitget's trading fees are competitive, especially for futures trading, where they are lower than many industry peers. However, the absence of fiat withdrawal options could deter some users, as it limits the ease of accessing profits. Additionally, while the low fees are attractive, it is crucial for traders to be aware of any hidden charges or conditions that may apply, particularly in volatile market conditions.

Customer Fund Security

The security of customer funds is paramount in the cryptocurrency trading space. Bitget has implemented several measures to safeguard user assets, including cold storage for the majority of funds, two-factor authentication (2FA), and a robust insurance fund. The exchange claims to maintain a $300 million protection fund to cover potential losses from cyberattacks or other incidents.

However, the effectiveness of these measures can be questioned, especially given that Bitget is not regulated by major financial authorities. The lack of independent audits and transparency regarding the allocation of funds within the protection fund may raise concerns about the adequacy of these security measures.

Additionally, while Bitget has not reported any significant security breaches since its inception, the history of other exchanges suffering devastating hacks underscores the need for continuous vigilance and improvement in security protocols.

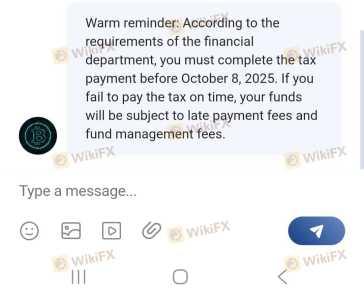

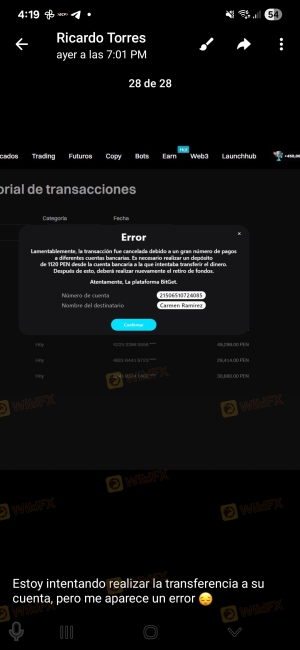

Customer Experience and Complaints

User feedback is a critical component in evaluating the reliability of any trading platform. Bitget has received mixed reviews from its users. While many praise the platform's user-friendly interface and innovative features, such as copy trading, others have raised concerns about customer support responsiveness and the handling of complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow Customer Support | High | Average |

| Withdrawal Issues | Medium | Below Average |

| Technical Glitches | Medium | Average |

Common complaints include slow response times from customer support during peak trading hours and occasional technical glitches on the platform. For instance, some users have reported difficulties in executing trades during high volatility, leading to frustration and potential financial losses.

While Bitget has made efforts to enhance its customer support, including 24/7 availability, the effectiveness of these measures remains a point of contention among users.

Platform and Execution

The performance of a trading platform is crucial for a seamless trading experience. Bitget's platform is generally well-regarded for its stability and ease of use. However, the quality of order execution, including slippage and rejection rates, is also vital for traders.

Traders have reported satisfactory execution speeds, but instances of slippage during periods of high market activity have been noted. Such occurrences can significantly impact trading performance, especially for those employing high-frequency trading strategies.

Additionally, there have been no reported signs of platform manipulation, which is a positive indicator of Bitget's operational integrity. Nonetheless, users should remain vigilant and monitor their trades closely, especially during volatile market conditions.

Risk Assessment

Every trading platform comes with its inherent risks. For Bitget, the primary risks include regulatory uncertainty, potential cybersecurity threats, and the volatility of the cryptocurrency market itself.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risks | Medium | Unregulated in major jurisdictions. |

| Cybersecurity Risks | High | Potential exposure to hacks. |

| Market Volatility | High | High price fluctuations can lead to losses. |

To mitigate these risks, it is advisable for users to enable all available security features, including 2FA, and to conduct thorough research before trading. Additionally, maintaining a diversified portfolio can help reduce exposure to market volatility.

Conclusion and Recommendations

In conclusion, Bitget presents itself as a legitimate trading platform with a range of innovative features, including low trading fees and a unique copy trading service. However, the lack of comprehensive regulation and transparency raises valid concerns about its overall safety.

While there are no overt signs of fraud or significant security breaches, potential users should approach with caution. It is advisable for traders, particularly those new to the cryptocurrency space, to conduct thorough research and consider their risk tolerance before engaging with Bitget.

For those seeking alternatives, platforms with more robust regulatory oversight, such as Binance or Kraken, may offer a more secure trading environment. Ultimately, the choice of trading platform should align with individual trading goals, risk appetite, and the level of security desired.

Is Bitget a scam, or is it legit?

The latest exposure and evaluation content of Bitget brokers.

Bitget Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bitget latest industry rating score is 2.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.