Kudotrade 2025 Review: Everything You Need to Know

Kudotrade has emerged as a new player in the Forex and CFD brokerage space, claiming to offer competitive trading conditions and a user-friendly platform. However, the reviews and analyses available paint a mixed picture, with significant red flags regarding its legitimacy and operational practices. Notably, users have raised concerns about withdrawal issues and the broker's regulatory status, which warrants a closer examination.

Note: It's important to highlight that Kudotrade operates under different entities in various jurisdictions, which complicates its regulatory standing and overall trustworthiness. This review aims to present a balanced view based on multiple sources to ensure fairness and accuracy.

Rating Overview

We rate brokers based on user feedback, expert analysis, and factual data regarding their operations.

Broker Overview

Kudotrade, established in 2024, operates as an online trading platform under the name Kudotrade Ltd, claiming to be registered in Saint Lucia and Mauritius. The platform utilizes the widely recognized MetaTrader 5 (MT5) for trading, offering access to a variety of asset classes including Forex, CFDs on stocks, commodities, and cryptocurrencies. However, it lacks regulation from major financial authorities, which raises concerns about its operational integrity.

Detailed Analysis

Regulatory Status:

Kudotrade is registered in Saint Lucia, a jurisdiction known for minimal regulatory oversight in Forex trading. According to multiple sources, including BrokersView, the Financial Services Regulatory Authority (FSRA) of Saint Lucia does not regulate Forex activities. Additionally, while it claims to have an office in Dubai, no verification of this has been found with local authorities. This lack of regulation poses significant risks for investors.

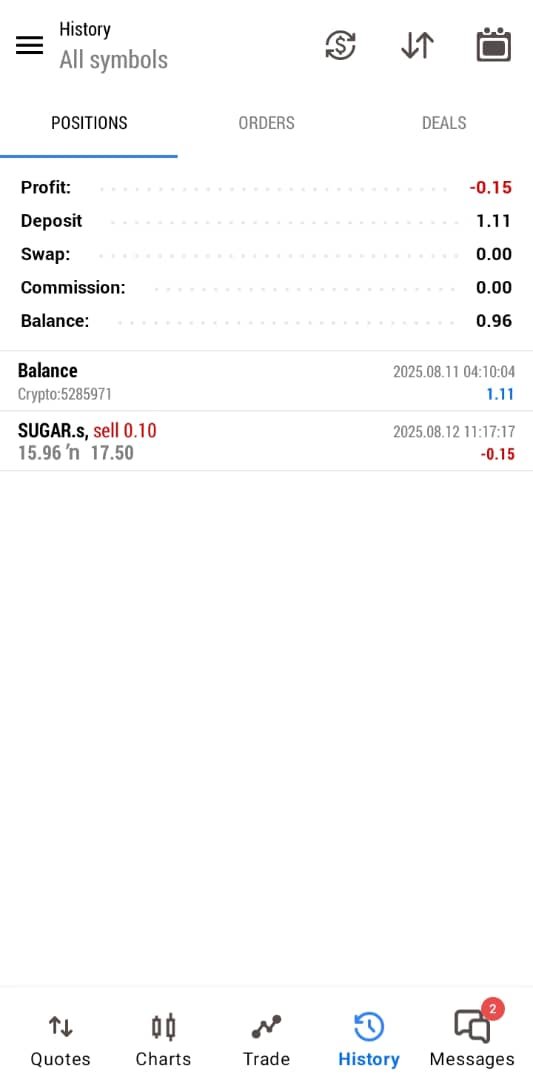

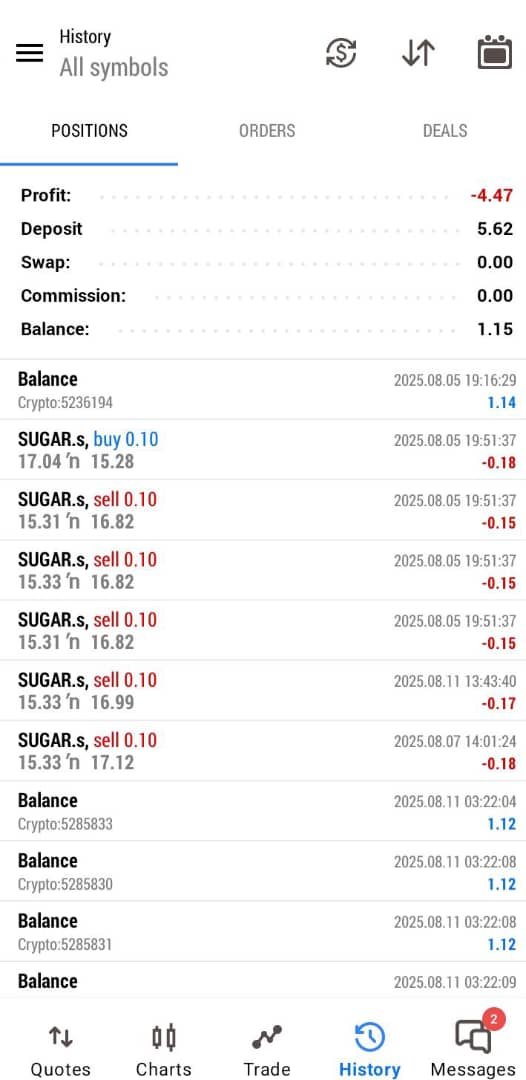

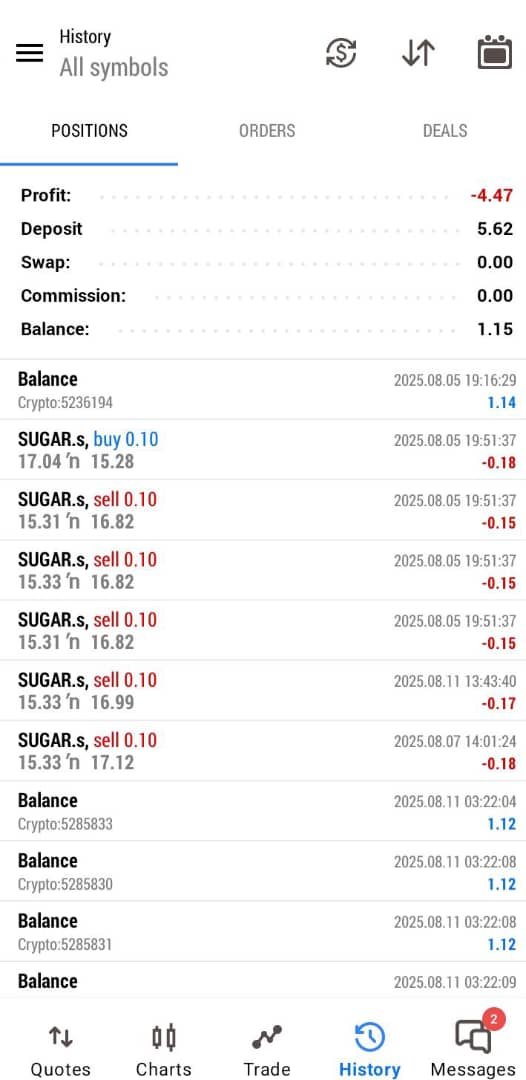

Deposit and Withdrawal Options:

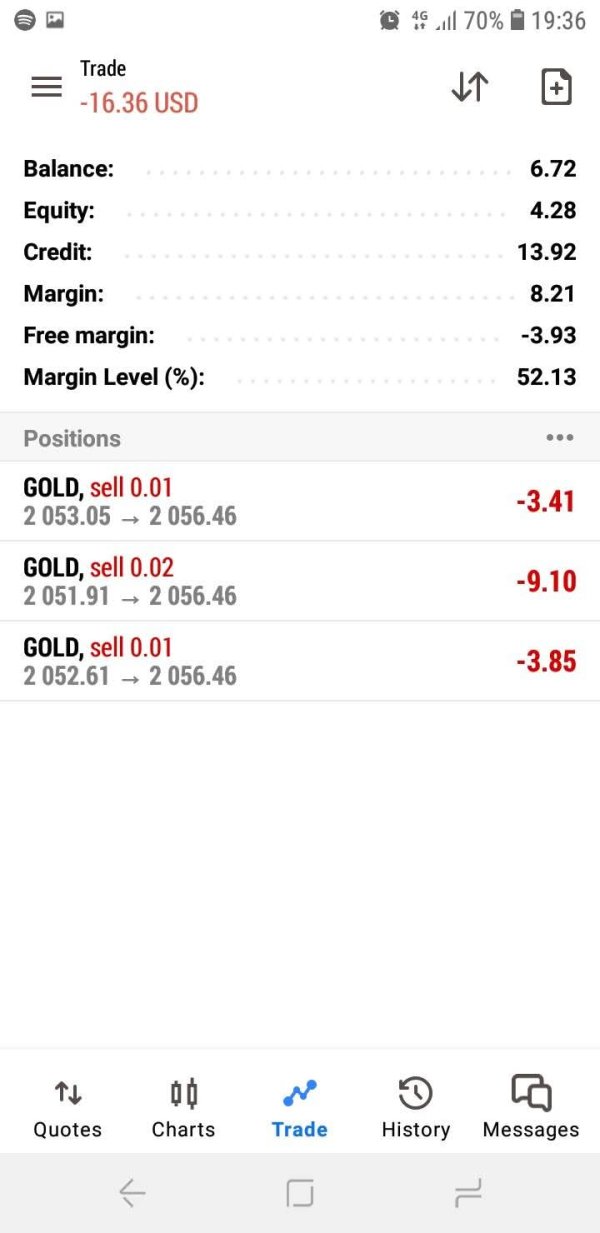

The broker allows deposits through credit cards and cryptocurrencies, but the details on withdrawal processes are vague and often lead to complaints from users about delays. Reports suggest that users have experienced prolonged waiting periods for fund withdrawals, with some claiming to wait up to 28 days. This issue is highlighted in several reviews, indicating a pattern of withdrawal challenges that could deter potential traders.

Minimum Deposit and Bonuses:

The minimum deposit requirement for opening a standard account is set at $50, which is relatively low compared to industry standards. However, the absence of clear promotional offers or bonuses is notable, as many brokers in the industry leverage such incentives to attract new clients.

Cost Structure:

Kudotrade's cost structure is somewhat unclear. While the standard account claims to have zero commissions, the lack of transparency regarding spreads and other fees raises concerns. The pro account, which uses ECN technology, charges a commission of $8 per lot, which is relatively high compared to other brokers. This ambiguity in cost can lead to unexpected expenses for traders.

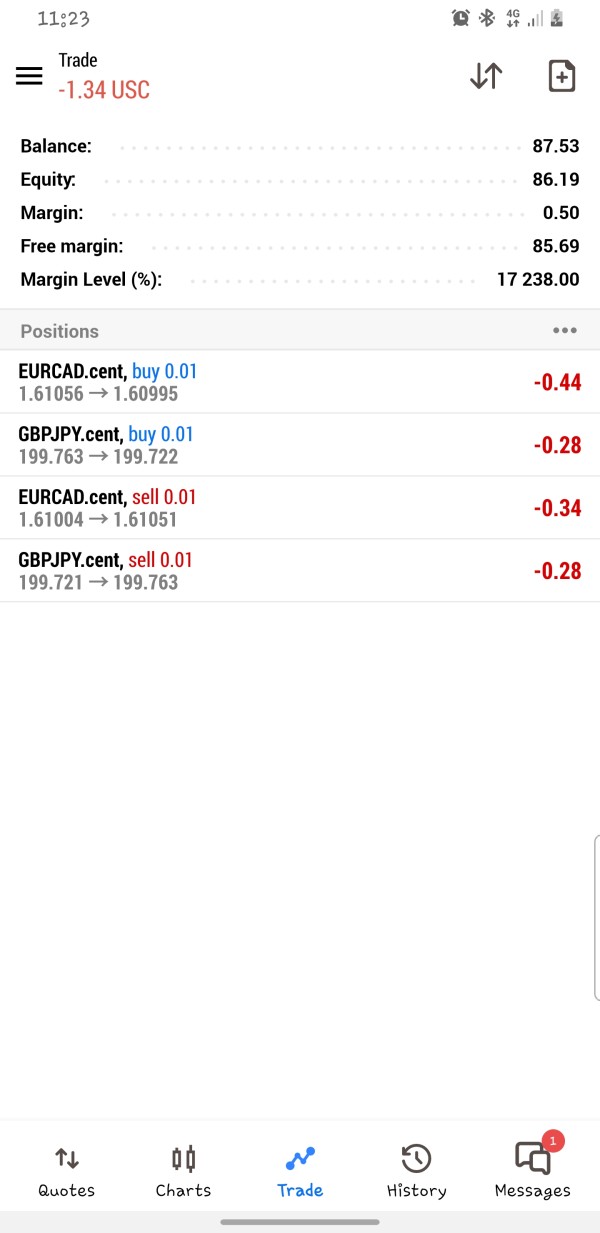

Leverage and Trading Platforms:

The broker offers leverage up to 1:1000, which is significantly higher than what is typically allowed by reputable regulatory bodies. This high leverage can amplify both profits and losses, making trading with Kudotrade particularly risky. The trading platform, MT5, is generally well-regarded, but users have reported limitations in account management, as they cannot independently open new accounts.

Restricted Regions and Customer Support Languages:

Kudotrade does not provide a comprehensive list of restricted regions, which is concerning for potential users. Customer support appears to be limited, with reports of unresponsive service when users encounter issues. The primary language for customer support is English, which may not cater to a global audience effectively.

Repeated Rating Overview

Detailed Breakdown

-

Account Conditions: The low score reflects the unclear fee structure and high commissions on pro accounts. Users have expressed dissatisfaction with the lack of transparency regarding account terms.

Tools and Resources: The availability of MT5 is a positive, but the absence of additional analytical tools or resources diminishes the overall offering.

Customer Service and Support: The significant complaints regarding slow responses and unhelpful service contribute to a low rating in this category.

Trading Setup/Experience: While the platform is functional, the user experience is hampered by issues related to account management and withdrawal processes.

Trustworthiness: The lack of regulation, along with numerous negative reviews regarding withdrawal issues, leads to a very low trust rating.

User Experience: Overall user experiences are mixed, with many reporting difficulties in accessing funds and inadequate support.

Conclusion

In conclusion, while Kudotrade presents itself as a legitimate trading platform with low entry barriers, the significant red flags surrounding its regulatory status, withdrawal challenges, and overall trustworthiness should give potential investors pause. The lack of transparency and high leverage options further complicate its appeal. Prospective traders are advised to exercise caution and consider alternative, more regulated brokers for their trading needs.