Is Kudotrade safe?

Pros

Cons

Is Kudotrade A Scam?

Introduction

Kudotrade is a relatively new player in the forex trading market, positioning itself as an online broker that offers various trading services, including forex, CFDs, and cryptocurrencies. Established in 2024, it aims to attract both novice and experienced traders by promising competitive trading conditions and advanced trading technology. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. This is especially true in an industry rife with fraudulent schemes and unregulated brokers.

In this article, we will investigate Kudotrade's legitimacy by examining its regulatory status, company background, trading conditions, client fund security measures, customer experiences, platform performance, and associated risks. Our analysis is based on a comprehensive review of available information, including user reviews, regulatory databases, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy and safety for traders. Kudotrade claims to be registered in Saint Lucia and operates under the auspices of the Financial Services Commission of Mauritius. However, it is essential to note that Saint Lucia does not regulate forex trading activities, and the offshore licensing provided by Mauritius may not offer the same level of protection as brokers regulated by more stringent authorities.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Financial Services Commission of Mauritius | GB24203599 | Mauritius | Licensed (but offshore) |

While Kudotrade possesses a license from the Financial Services Commission of Mauritius, the quality of this regulatory oversight is questionable. Offshore regulations often lack the rigorous compliance standards found in jurisdictions like the UK (FCA), the US (SEC), or Australia (ASIC). This means that while Kudotrade may be legally allowed to operate, it does not guarantee that it adheres to best practices in client fund protection or operational transparency.

Additionally, the company has been in operation for less than a year, raising concerns about its stability and long-term viability. The absence of a solid regulatory framework may expose traders to significant risks, including the potential for fraudulent activities and a lack of recourse in the event of disputes or financial losses.

Company Background Investigation

Kudotrade is operated by Kudotrade Ltd, which claims to have its headquarters in Saint Lucia, with additional operational claims in Dubai, UAE. However, the lack of transparency regarding its ownership structure and the management team raises red flags. The company's official website provides limited information about its history, ownership, and the qualifications of its management team.

The founders and key personnel behind Kudotrade remain largely anonymous, which is not uncommon in the online brokerage industry but adds to the skepticism surrounding the platform. Legitimate brokers typically provide detailed information about their management team, including their qualifications and experience in the financial markets. This lack of transparency can lead to concerns about the broker's intentions and operational integrity.

Furthermore, the companys website is riddled with grammatical errors and incomplete pages, suggesting a lack of professionalism and attention to detail. Such negligence can be indicative of a broker that may not prioritize the interests of its clients, further compounding the risks associated with trading on their platform.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its competitiveness and fairness. Kudotrade claims to provide a variety of trading instruments, including major currency pairs, commodities, and cryptocurrencies. However, the specifics of their fee structure and trading conditions are not clearly outlined, which is a common tactic used by less reputable brokers.

| Fee Type | Kudotrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 1.0 pips |

| Commission Model | None (STP) | Varies (typically $5-10 per lot) |

| Overnight Interest Range | Not specified | Varies (typically 2-5%) |

Kudotrade advertises spreads as low as 0.7 pips for major currency pairs, which is competitive compared to industry averages. However, the absence of transparency regarding commissions and overnight interest rates raises concerns. Traders may encounter hidden fees or charges that are not disclosed upfront, leading to unexpected costs and reduced profitability.

Moreover, the broker's use of both STP (Straight Through Processing) and ECN (Electronic Communication Network) models is unclear, particularly in how it affects execution quality and overall trading costs. The lack of detailed information on these trading conditions may indicate an attempt to obscure unfavorable terms that could negatively impact traders experiences.

Client Fund Security

The security of client funds is a paramount concern for any trader. Kudotrade claims to implement various measures to protect client funds, but the lack of detailed information on these measures makes it difficult to assess their effectiveness.

Kudotrade does not clearly state whether it offers segregated accounts for client funds, which is a common practice among reputable brokers. Segregated accounts help ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of protection in the event of financial difficulties.

Additionally, the absence of information regarding investor protection schemes, such as compensation funds or negative balance protection, raises concerns about the safety of traders' investments. Without these safeguards, traders may be at risk of losing their entire investment without recourse.

Historically, there have been no reported incidents of fund security breaches associated with Kudotrade, but the lack of regulatory oversight and transparency leaves clients vulnerable to potential risks.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a broker. Kudotrade has received mixed reviews, with some users praising the platform for its user-friendly interface and quick withdrawal processes. However, numerous complaints highlight significant issues, particularly concerning withdrawal delays and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow to respond |

| Poor Customer Support | Medium | Unresponsive |

| Misleading Promotions | High | No acknowledgment |

Common complaints include withdrawal requests taking excessively long, with users reporting waiting periods of up to 28 days. Such delays can be frustrating and may indicate underlying issues with the broker's financial stability or operational practices. Additionally, many users have reported aggressive sales tactics aimed at convincing them to deposit more funds, which is a significant red flag.

One notable case involved a trader who attempted to withdraw funds after a successful trading period but faced repeated delays and lack of communication from the support team. This experience reflects a broader trend of dissatisfaction among clients and raises concerns about the broker's commitment to customer service.

Platform and Trade Execution

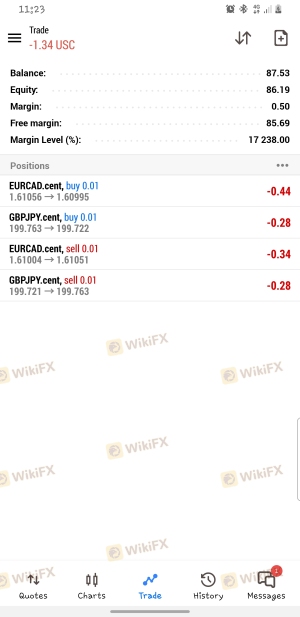

The trading platform is a critical component of any broker's service, impacting the overall trading experience. Kudotrade utilizes the widely recognized MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, some users have reported issues with platform stability and order execution quality.

Traders have expressed concerns about slippage and order rejections, which can significantly affect trading outcomes. The lack of transparency regarding execution speeds and potential manipulation raises questions about the broker's operational integrity. While MT5 is a reputable platform, the implementation and management by Kudotrade may not meet the expectations of traders seeking reliable execution.

Risk Assessment

Using Kudotrade presents several risks that potential traders should consider. The lack of regulation, transparency, and a history of client complaints contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated operations expose traders to potential fraud. |

| Fund Security Risk | High | Lack of transparency regarding fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Support Risk | Medium | Poor response times and unresolved complaints. |

To mitigate these risks, traders should conduct thorough research, start with small investments, and test withdrawal processes before committing significant funds. Additionally, it is advisable to seek brokers with established reputations and robust regulatory oversight.

Conclusion and Recommendations

In conclusion, while Kudotrade presents itself as a modern forex broker, the evidence suggests that it may not be a safe or reliable option for traders. The lack of robust regulatory oversight, combined with numerous complaints regarding customer service and withdrawal issues, raises significant concerns about its legitimacy.

Traders should exercise extreme caution when considering this platform and may want to explore alternative brokers that offer better regulatory protections, transparency, and customer support. Reputable options include brokers regulated by the FCA, ASIC, or other well-known authorities, which provide a more secure trading environment.

Ultimately, the decision to engage with Kudotrade should be made with careful consideration of the risks involved, and potential traders are encouraged to prioritize their financial security by choosing established, regulated brokers.

Is Kudotrade a scam, or is it legit?

The latest exposure and evaluation content of Kudotrade brokers.

Kudotrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Kudotrade latest industry rating score is 2.05, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.05 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.