Regarding the legitimacy of BULL WAVES forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is BULL WAVES safe?

Pros

Cons

Is BULL WAVES markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Equitex Capital Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@bullwaves.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.Bullwaves.comExpiration Time:

--Address of Licensed Institution:

Office No. A19C, Providence Complex, Providence, Mahé, SeychellesPhone Number of Licensed Institution:

+248 4379848Licensed Institution Certified Documents:

Is Bullwaves Safe or a Scam?

Introduction

Bullwaves is a relatively new player in the forex market, aiming to attract traders with its promises of low fees and a user-friendly trading environment. As the online trading landscape grows, so does the necessity for traders to carefully evaluate the legitimacy and reliability of brokers like Bullwaves. With numerous reports of scams and fraudulent activities in the forex trading sector, it becomes imperative for potential clients to conduct thorough due diligence before committing their funds. This article employs a comprehensive assessment framework, focusing on regulatory compliance, company background, trading conditions, customer fund safety, user experiences, platform performance, and risk evaluation to determine whether Bullwaves is a trustworthy broker or a potential scam.

Regulation and Legitimacy

One of the main indicators of a broker's reliability is its regulatory status. Bullwaves operates under the jurisdiction of the Seychelles Financial Services Authority (FSA), a regulatory body that oversees financial services in the Seychelles. However, it is crucial to note that the FSA is often considered a "red tier" regulator, meaning it does not enforce stringent compliance standards compared to more reputable authorities like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC).

The following table summarizes Bullwaves' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 185 | Seychelles | Active |

While Bullwaves claims to maintain client funds in segregated accounts and offers negative balance protection, the lack of oversight from a highly regarded regulatory body raises concerns about its operational integrity. Historical compliance records indicate that offshore brokers often face scrutiny for inadequate financial disclosures, which is evident in Bullwaves' case. Hence, traders should exercise caution when considering whether Bullwaves is safe for trading.

Company Background Investigation

Established in 2023, Bullwaves is operated by Equitex Capital Limited, which is based in Seychelles. The companys relatively short history raises questions regarding its stability and reputation in the forex trading community. The ownership structure is not extensively disclosed, which is a common practice among offshore brokers, potentially indicating a lack of transparency.

The management team behind Bullwaves has not been detailed in available resources, making it difficult to assess their qualifications and experience in the financial sector. Without a well-established leadership team, the broker's ability to navigate market complexities and regulatory requirements is questionable. Furthermore, the absence of clear information regarding the company's operational history and management expertise can be perceived as a red flag, making it difficult for traders to trust Bullwaves fully.

Trading Conditions Analysis

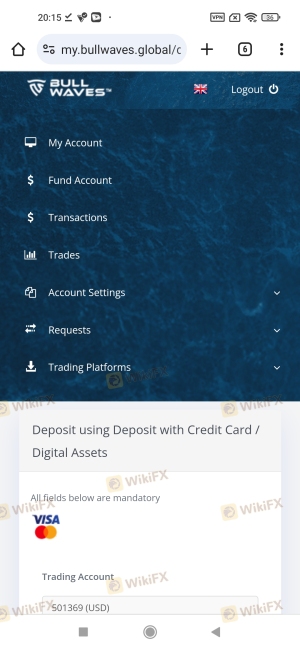

Bullwaves offers a variety of trading accounts, each with different minimum deposit requirements and trading conditions. The broker claims to provide commission-free trading, which may seem appealing to many traders; however, it is essential to delve deeper into the fee structure to uncover any hidden costs.

Heres a comparison of core trading costs:

| Fee Type | Bullwaves | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 0.8 pips |

| Commission Model | $0 | $5 |

| Overnight Interest Range | Varies | Varies |

While Bullwaves advertises low spreads, the starting point of 2.0 pips for major currency pairs is considerably higher than the industry average. This discrepancy may lead to higher trading costs in the long run, especially for active traders who rely on tight spreads and low commissions to maximize their profits. Additionally, the broker imposes a monthly inactivity fee of $10 after 30 days of no trading activity, which could be detrimental for casual or infrequent traders. Overall, while the trading conditions may appear attractive at first glance, they warrant careful consideration to determine if Bullwaves is truly safe for trading.

Customer Fund Safety

The safety of client funds is paramount when evaluating the reliability of a trading broker. Bullwaves claims to implement several safety measures, including segregated accounts for client funds and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status.

The lack of robust regulatory oversight means that Bullwaves is not required to adhere to stringent financial standards, which raises concerns about the actual implementation of these safety measures. Additionally, there have been no reported incidents of fund security breaches; however, this does not guarantee future safety. Traders should remain vigilant, as the absence of regulatory scrutiny often correlates with increased risks.

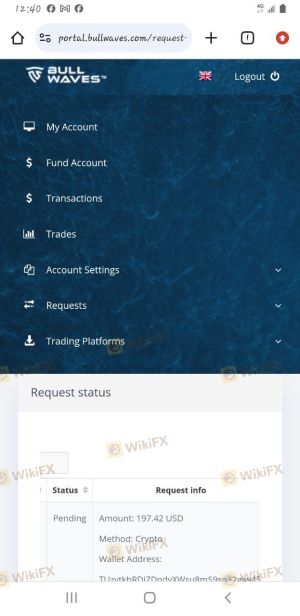

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews of Bullwaves reveal a mix of experiences, with several users praising the platform's ease of use and customer support. However, numerous complaints highlight significant issues, including delayed withdrawals, poor communication, and unresponsive customer service.

The table below summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Slow |

| Lack of Transparency | High | Unaddressed |

For instance, some traders have reported waiting weeks for their withdrawal requests to be processed, leading to frustration and distrust. The company's response to these complaints has been inadequate, with many users stating they received no follow-up or resolution. Such patterns are concerning and may indicate that Bullwaves is not a safe option for traders who prioritize responsive support and efficient fund management.

Platform and Trade Execution

The trading platform offered by Bullwaves relies on the widely used MetaTrader 4 and MetaTrader 5, which are known for their reliability and extensive functionality. However, the platform's performance has been criticized for occasional glitches and slow execution speeds, which can be detrimental during fast-moving market conditions.

Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. The lack of proprietary technology may limit the broker's ability to optimize trading conditions effectively. Overall, while the platform is functional, the execution quality and potential for manipulation require scrutiny when assessing whether Bullwaves is safe for trading.

Risk Assessment

Engaging with Bullwaves presents several risks that traders should be aware of. The combination of its regulatory status, customer complaints, and platform performance contributes to a higher risk profile.

Heres a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Operates under a low-tier regulator. |

| Fund Security | Medium | Claims of segregation, but oversight is lacking. |

| Customer Service | High | Numerous complaints regarding support and response times. |

To mitigate these risks, traders should consider using smaller amounts for initial trades and ensure they are comfortable with the level of risk involved. Diversifying trading activities and exploring alternative brokers with stronger regulatory backing may also be prudent.

Conclusion and Recommendations

In conclusion, while Bullwaves presents itself as a viable option for forex trading, several factors raise significant concerns about its safety and reliability. The lack of robust regulatory oversight, combined with customer complaints regarding fund withdrawals and support, suggests that traders should approach this broker with caution.

For those considering trading with Bullwaves, it is advisable to conduct thorough research and possibly seek alternative brokers with higher regulatory standards and better customer service records. Recommended alternatives include established brokers like IC Markets and IG, which offer more comprehensive regulatory support and a proven track record in the industry. Ultimately, the question "Is Bullwaves safe?" leans toward a cautious "no," as potential traders should prioritize their financial security in an increasingly complex trading environment.

Is BULL WAVES a scam, or is it legit?

The latest exposure and evaluation content of BULL WAVES brokers.

BULL WAVES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BULL WAVES latest industry rating score is 2.05, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.05 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.