Maxpro365 2025 Review: Everything You Need to Know

Executive Summary

This Maxpro365 review shows major concerns about the broker's legitimacy and business practices. Our detailed analysis of user feedback and available information reveals that Maxpro365 connects to questionable business practices that create serious red flags for potential investors. Multiple sources show that users have expressed major doubts about the platform's credibility, with many considering it potentially fraudulent.

The broker's reputation has been badly damaged by widespread user complaints and allegations of scam-related activities. Unlike established forex brokers that maintain transparent operations and proper regulatory oversight, Maxpro365 lacks the basic characteristics that define trustworthy financial service providers. The overwhelming negative sentiment from the trading community suggests that this platform may not be suitable for serious investors seeking reliable trading environments.

Our investigation shows that Maxpro365 mainly targets inexperienced traders who may not know the warning signs of unregulated brokers. The lack of clear regulatory information, combined with ongoing user complaints about platform reliability and fund security, positions this broker as a high-risk option that experienced traders typically avoid.

Important Notice

This review is based on available user feedback, online resources, and market research conducted as of 2025. Due to the limited transparency of Maxpro365's operations, specific regulatory information and detailed trading conditions are not easily available through official channels. Our assessment relies heavily on user testimonials and third-party evaluations to provide a complete overview of the broker's performance and reputation.

Potential investors should use extreme caution when considering any financial service provider that lacks clear regulatory oversight or has been connected with fraudulent activities. This review aims to present factual information based on available sources to help traders make informed decisions about their investment choices.

Rating Framework

Broker Overview

Maxpro365 presents itself as an online trading platform claiming to offer investment opportunities across various financial markets. However, the broker's background and operational history remain largely unclear, with limited verifiable information available about its founding date, corporate structure, or executive leadership. According to multiple user reports and review platforms, the company has been operating without clear regulatory authorization, which immediately raises concerns about its legitimacy.

The platform's business model appears to focus on attracting retail traders through aggressive marketing tactics and promises of high returns. However, investigations by various review sites suggest that Maxpro365 may be using deceptive practices commonly connected with fraudulent investment schemes. The broker's lack of transparency about its corporate registration, physical address, and regulatory compliance creates an environment of uncertainty that legitimate financial service providers typically avoid.

Unlike established forex brokers that maintain complete websites with detailed information about their services, regulatory status, and corporate governance, Maxpro365's online presence lacks the professional standards expected in the financial services industry. The absence of clear contact information, regulatory disclosures, and detailed terms of service further undermines the platform's credibility and suggests potential involvement in questionable business practices.

Regulatory Status

Available information does not provide clear details about Maxpro365's regulatory oversight. The absence of verifiable licensing information from recognized financial authorities represents a significant red flag for potential investors.

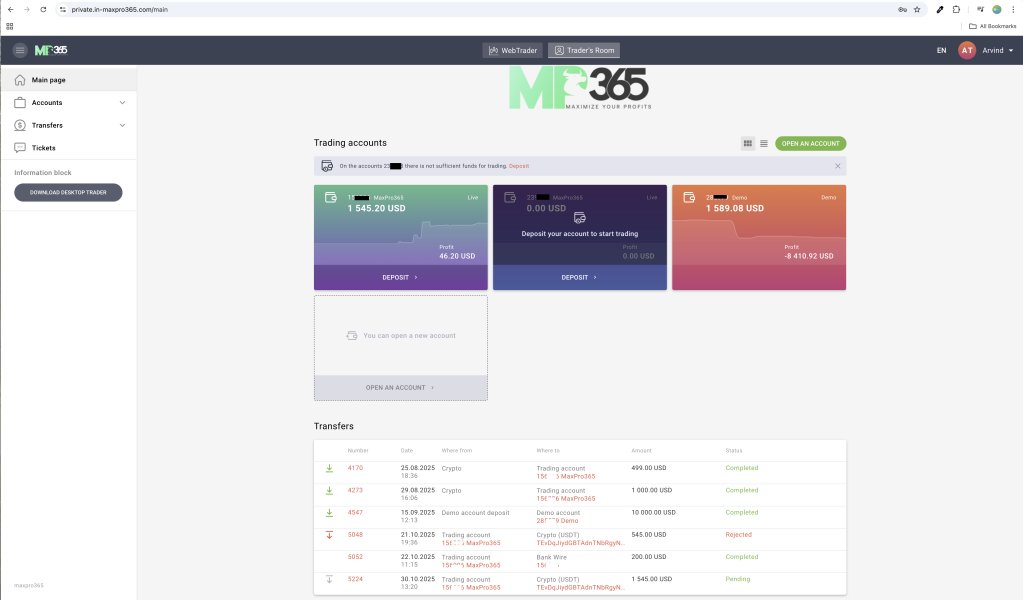

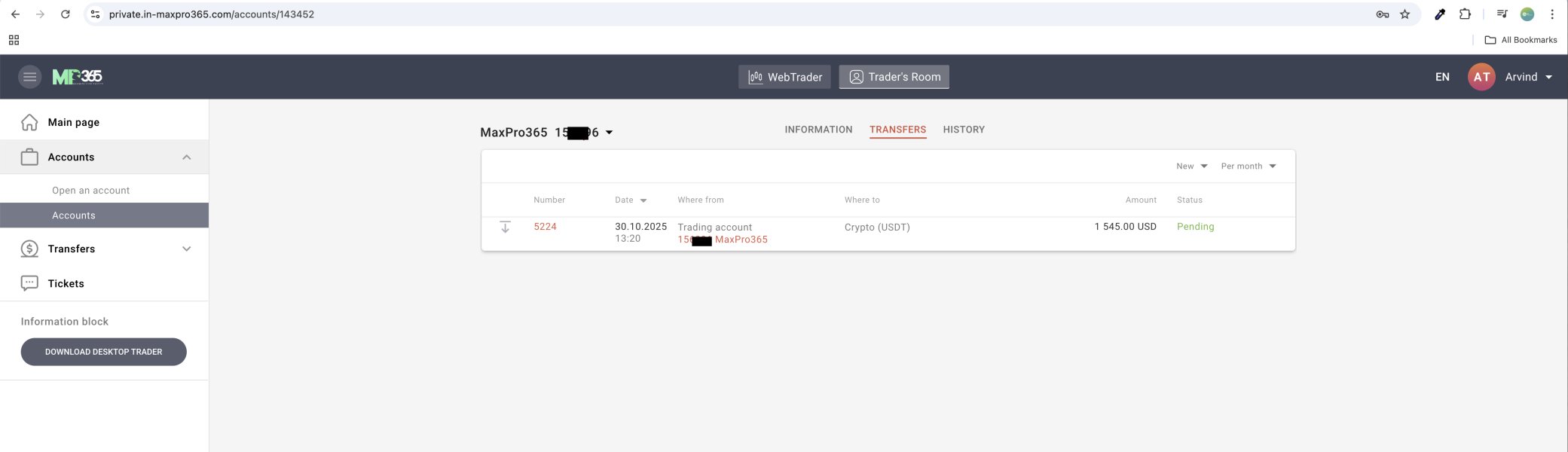

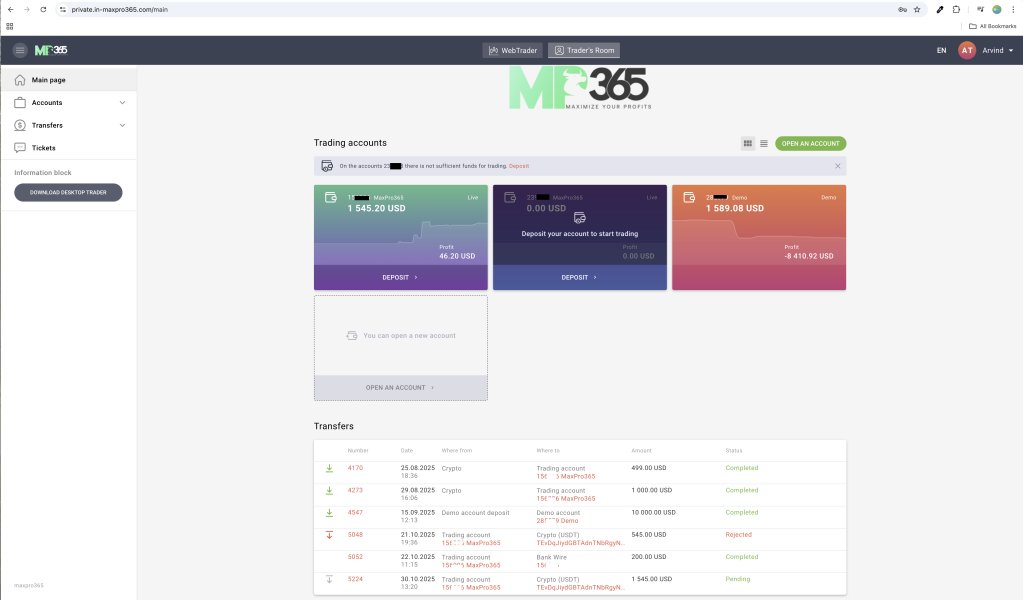

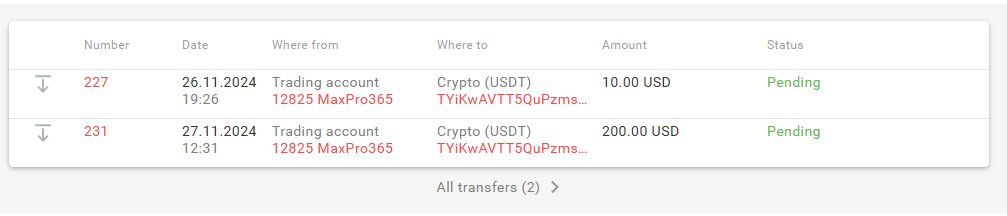

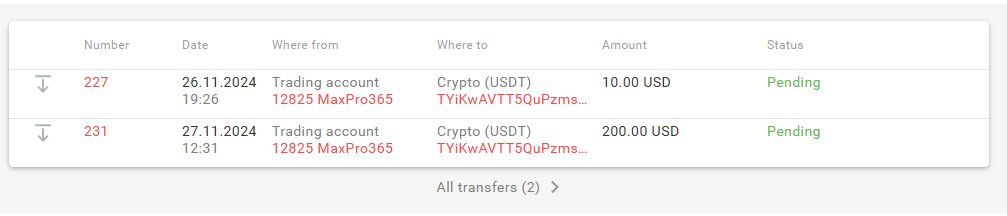

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal options is not clearly documented in available sources. This lack of transparency about financial transactions is concerning for traders considering the platform.

Minimum Deposit Requirements

Concrete details about minimum deposit amounts are not specified in the available information, making it difficult for potential clients to understand the financial commitment required.

Information about promotional offers and bonus structures is not detailed in the available sources, though such offerings are often used by questionable brokers to attract unsuspecting traders.

Trading Assets

The range of tradeable instruments offered by Maxpro365 is not fully documented in available sources, leaving potential clients unclear about market access opportunities.

Cost Structure

Detailed information about spreads, commissions, and other trading costs is not easily available, which prevents traders from conducting proper cost-benefit analyses before engaging with the platform.

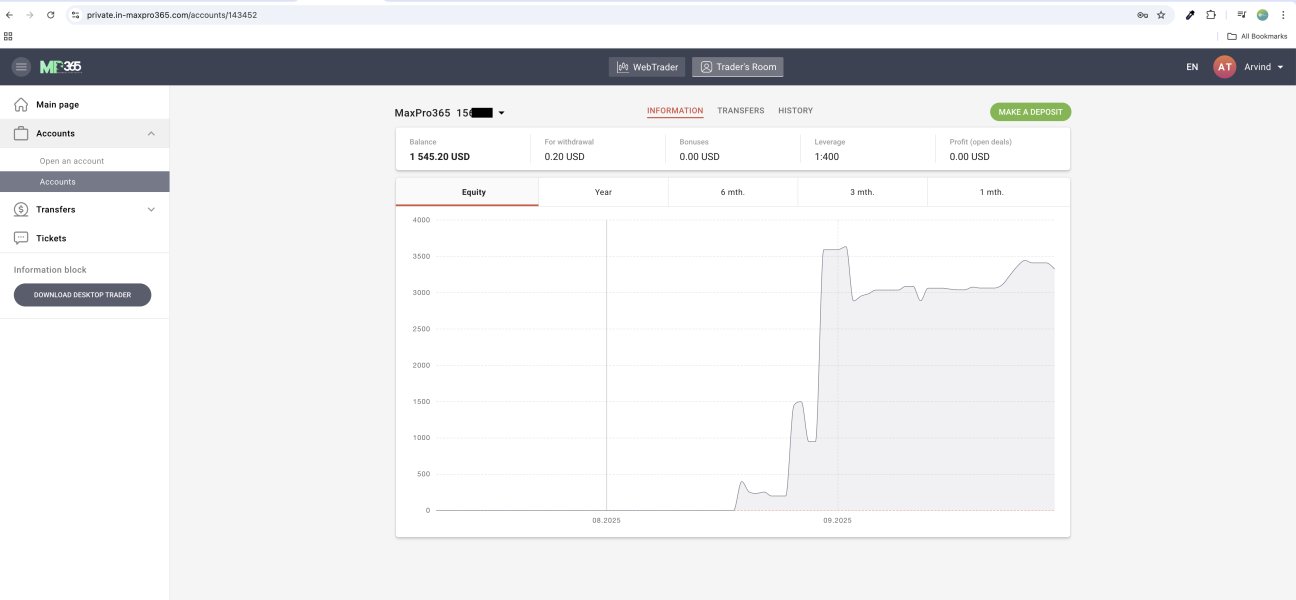

Leverage Ratios

Specific leverage offerings are not clearly outlined in the available information, representing another area where transparency is lacking.

The trading platforms available through Maxpro365 are not specifically detailed in accessible sources, making it difficult to assess the technological infrastructure.

Geographic Restrictions

Information about regional limitations and service availability is not clearly specified in the available documentation.

Customer Support Languages

The range of languages supported by customer service is not clearly mentioned in available sources.

This Maxpro365 review highlights the concerning lack of detailed information about basic trading conditions and operational parameters.

Account Conditions Analysis

The account structure and conditions offered by Maxpro365 remain largely undisclosed, which represents a significant concern for potential traders. According to user feedback analyzed in various review platforms, the broker's account opening process lacks the transparency and documentation standards typically required by legitimate financial service providers. The absence of clear information about account types, their respective features, and associated benefits suggests that the platform may not operate according to industry best practices.

User reports show skepticism about the legitimacy of account conditions, with several traders expressing concerns about the lack of detailed terms and conditions. Unlike regulated brokers that provide complete documentation about account specifications, minimum balance requirements, and account management procedures, Maxpro365 appears to operate with minimal disclosure about these critical aspects.

The verification process for account opening is reportedly inconsistent, with some users claiming that the broker accepts clients without proper Know Your Customer procedures. This approach contradicts regulatory requirements in most jurisdictions and raises questions about the platform's commitment to anti-money laundering compliance. The lack of proper account verification procedures often shows that a broker is operating outside regulatory frameworks.

Furthermore, the absence of specialized account types such as Islamic accounts, professional trader accounts, or demo accounts suggests that Maxpro365 may not serve diverse trading needs. Legitimate brokers typically offer various account structures to accommodate different trader profiles and regulatory requirements. This Maxpro365 review reveals that the broker's account conditions fail to meet industry standards for transparency and completeness.

The trading tools and educational resources provided by Maxpro365 appear to be significantly limited based on available user feedback and platform analysis. Unlike established brokers that offer complete research tools, market analysis, and educational materials, Maxpro365 seems to lack the basic resources that serious traders require for informed decision-making. User reports suggest that the platform's analytical capabilities are basic at best, with limited access to advanced charting tools, technical indicators, and market research.

Educational resources, which are crucial for trader development and platform credibility, appear to be virtually non-existent according to user testimonials. Legitimate brokers typically invest heavily in educational content, including webinars, tutorials, market commentary, and trading guides to support their clients' success. The absence of such resources at Maxpro365 shows either a lack of commitment to client education or insufficient resources to develop complete educational programs.

Research and analysis tools that professional traders rely on for market insights are reportedly inadequate or entirely missing from the Maxpro365 platform. Users have expressed frustration with the limited availability of real-time market data, economic calendars, and fundamental analysis resources. This deficiency significantly hampers traders' ability to conduct thorough market analysis and make informed trading decisions.

Automated trading support and third-party tool integration appear to be limited or non-functional based on user experiences. The platform's inability to support advanced trading strategies and automated systems further restricts its appeal to experienced traders who require sophisticated trading environments.

Customer Service and Support Analysis

Customer service quality at Maxpro365 has received mostly negative feedback from users across various review platforms. According to multiple user testimonials, the broker's support team is often unresponsive, unprofessional, or entirely unavailable when clients encounter issues with their accounts or trading activities. This poor service quality is particularly concerning given that reliable customer support is essential for resolving trading-related problems and maintaining client confidence.

Response times for customer inquiries are reportedly excessive, with many users claiming that their support requests go unanswered for days or weeks. When responses are provided, they often lack the technical expertise and problem-solving capabilities that traders expect from professional financial service providers. The inadequate support infrastructure suggests that Maxpro365 may not have invested sufficiently in customer service operations.

Communication channels appear to be limited, with users reporting difficulties in reaching support representatives through traditional methods such as phone, email, or live chat. The lack of multiple communication options and reliable contact information further complicates the customer service experience and raises questions about the broker's commitment to client satisfaction.

Language support capabilities are unclear based on available information, but user feedback suggests that non-English speaking clients may face additional challenges when seeking assistance. The absence of multilingual support teams limits the broker's ability to serve international clients effectively and shows a lack of global service infrastructure.

Trading Experience Analysis

The trading experience provided by Maxpro365 has been characterized by numerous user complaints about platform stability, execution quality, and overall functionality. According to user feedback compiled from various sources, the trading platform suffers from frequent technical issues, including system crashes, delayed order execution, and connectivity problems that significantly impact trading activities. These technical deficiencies create an unreliable trading environment that can result in financial losses for traders.

Order execution quality appears to be problematic, with users reporting instances of slippage, requotes, and delayed fills that are inconsistent with professional trading standards. The lack of reliable execution is particularly concerning for traders who depend on precise timing for their strategies. Unlike regulated brokers that are required to provide best execution practices, Maxpro365 seems to operate without such quality assurances.

Platform functionality and user interface design have received criticism for being outdated, confusing, or difficult to navigate. Users have expressed frustration with the platform's limited features, poor chart quality, and inadequate order management capabilities. The substandard platform experience suggests that Maxpro365 has not invested adequately in developing competitive trading technology.

Mobile trading capabilities, which are essential for modern traders who need access to markets on-the-go, appear to be limited or non-functional based on user reports. The absence of reliable mobile trading options further restricts the platform's utility and shows a lack of commitment to providing complete trading solutions. This Maxpro365 review shows that the overall trading experience falls significantly short of industry standards.

Trust and Safety Analysis

Trust and safety concerns represent the most critical issues identified in this Maxpro365 evaluation. Multiple sources have raised serious questions about the broker's legitimacy, with several review platforms and user testimonials suggesting potential involvement in fraudulent activities. The absence of verifiable regulatory licensing from recognized financial authorities immediately places Maxpro365 in the high-risk category for potential investors.

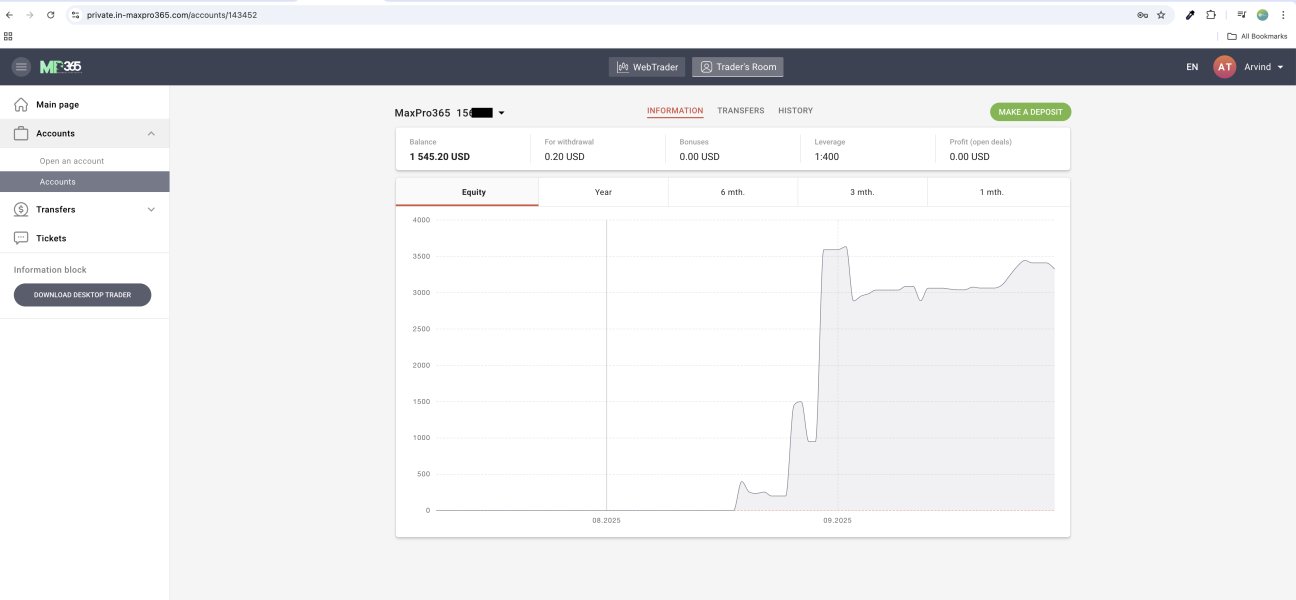

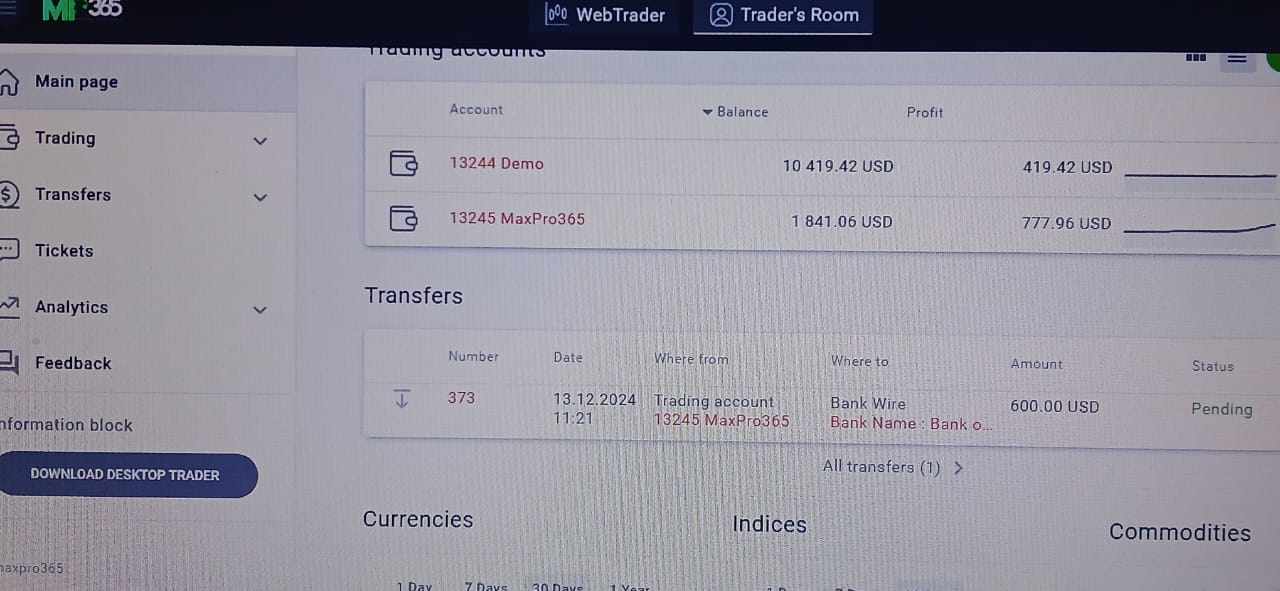

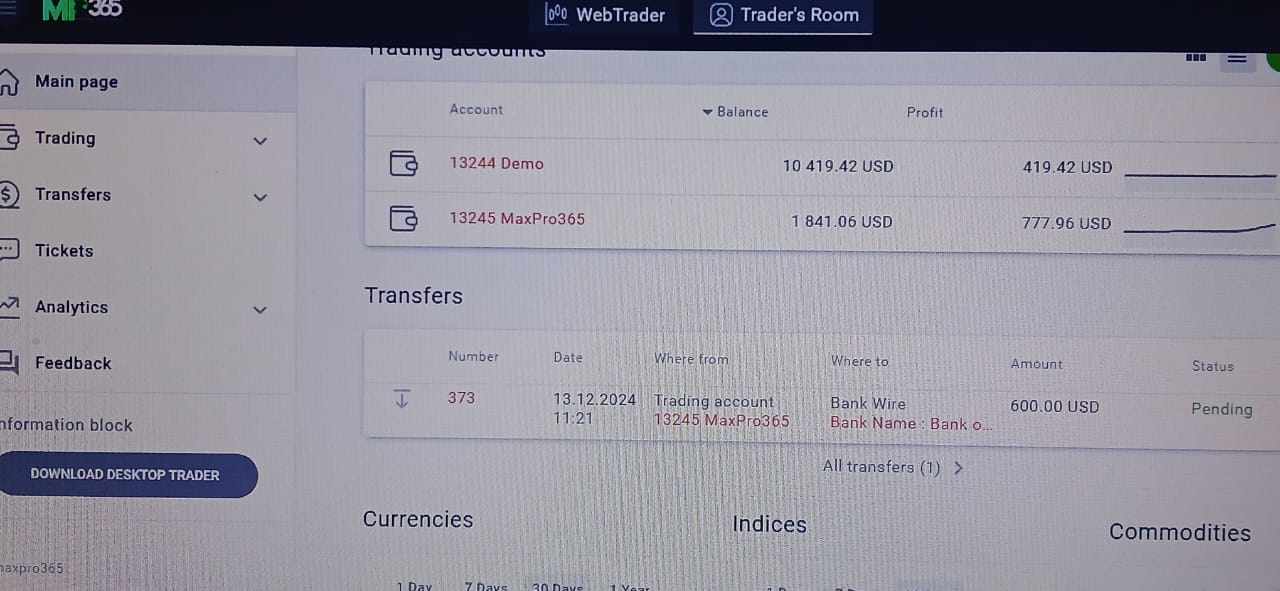

Fund security measures appear to be inadequate or non-existent based on available information. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks and provide clear documentation about fund protection procedures. Maxpro365's lack of transparency about client fund management raises significant concerns about the safety of deposited capital.

Corporate transparency is severely lacking, with minimal verifiable information available about the company's ownership, management team, or operational headquarters. This opacity is characteristic of fraudulent operations that seek to avoid accountability and regulatory oversight. The absence of clear corporate governance structure makes it impossible for clients to assess the broker's financial stability or operational integrity.

Industry reputation has been severely damaged by persistent allegations of scam-related activities and user complaints about fund withdrawal difficulties. Several review platforms and scam alert websites have specifically identified Maxpro365 as a potentially fraudulent operation, which represents a clear warning signal for prospective investors. The overwhelming negative sentiment within the trading community reflects the widespread concerns about the broker's trustworthiness.

User Experience Analysis

Overall user satisfaction with Maxpro365 is overwhelmingly negative based on testimonials and reviews collected from various platforms. Users consistently report frustration with virtually every aspect of their interaction with the broker, from initial account opening through ongoing trading activities and customer service experiences. The prevalence of negative feedback suggests systematic issues with the broker's operations rather than isolated incidents.

Interface design and platform usability have been criticized for failing to meet modern standards expected by today's traders. Users describe the platform as outdated, confusing, and lacking essential features that facilitate efficient trading activities. The poor user interface design contributes to a frustrating trading experience that drives users to seek alternatives with more professional platforms.

Registration and account verification processes are reportedly inconsistent and unprofessional, with some users experiencing delays or complications that prevent them from accessing their accounts promptly. The lack of streamlined onboarding procedures suggests inadequate investment in user experience optimization and customer journey management.

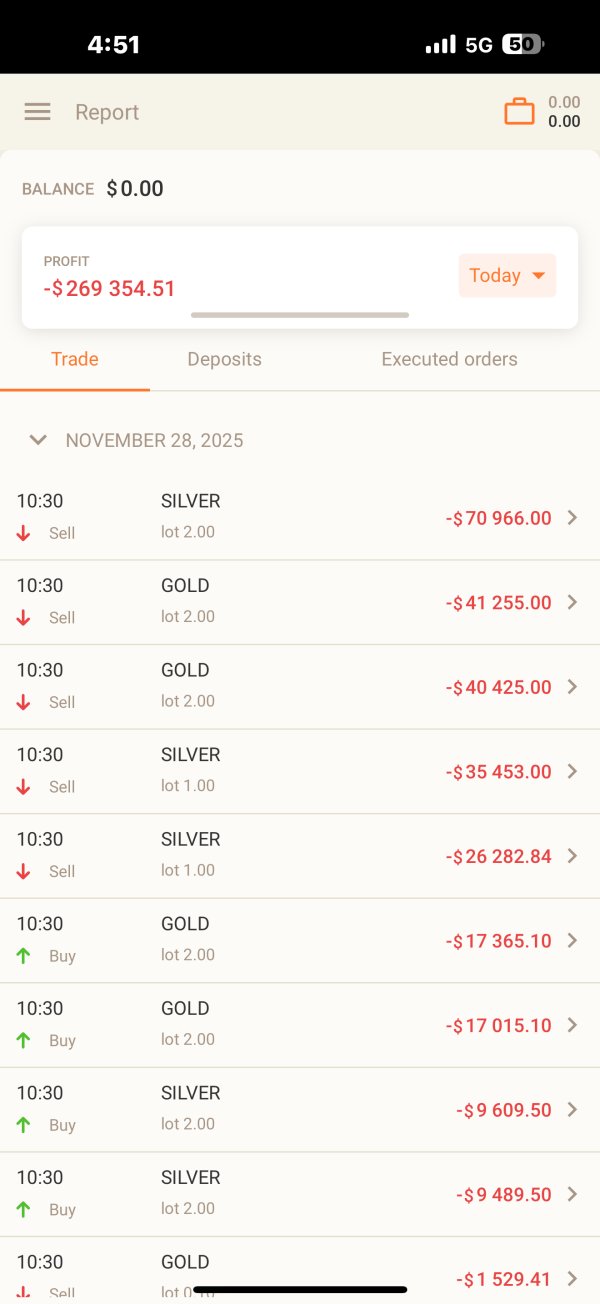

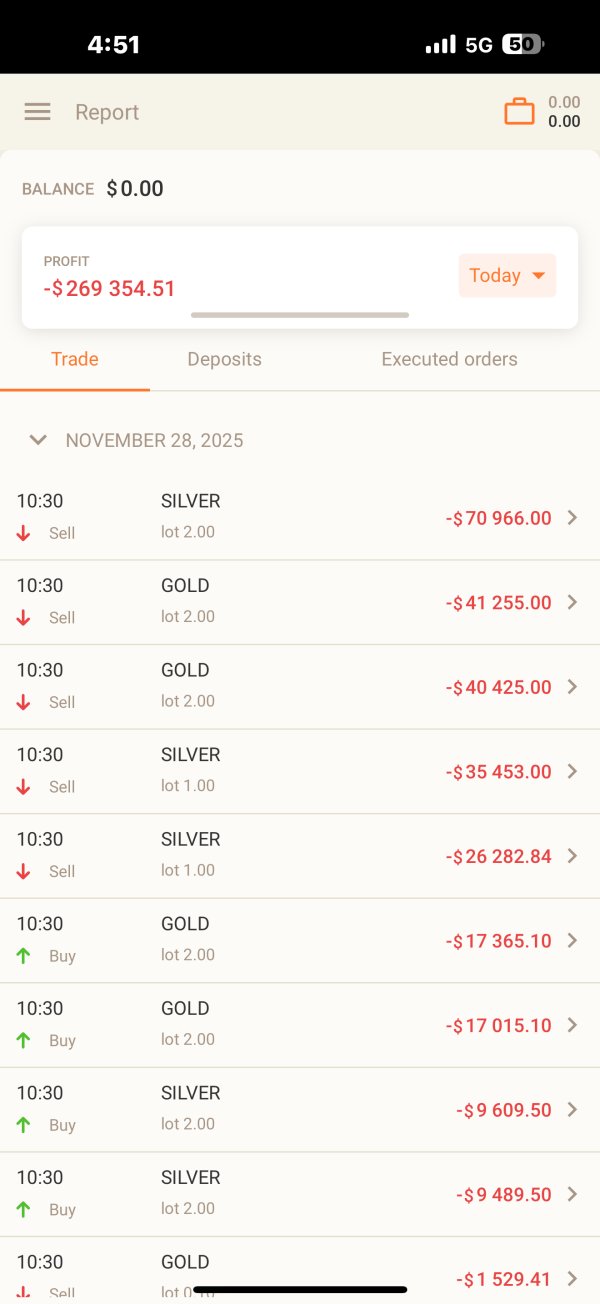

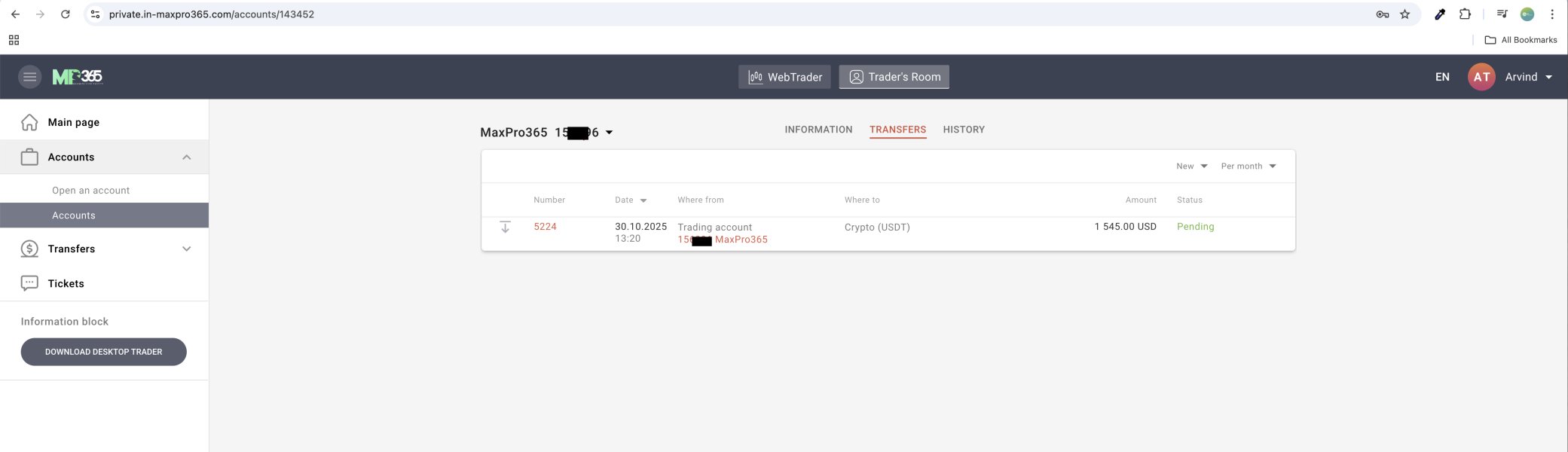

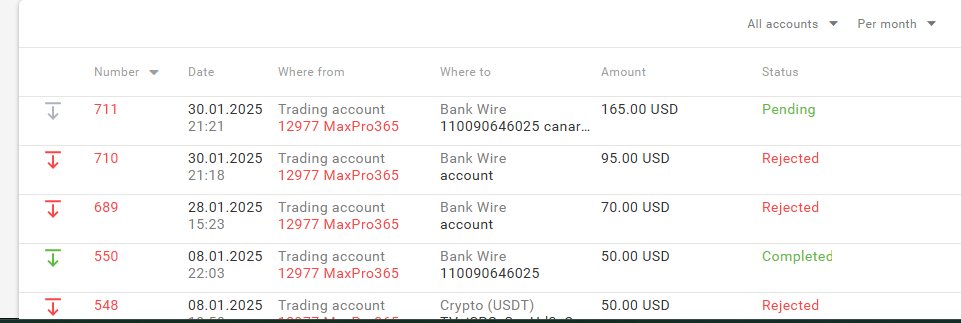

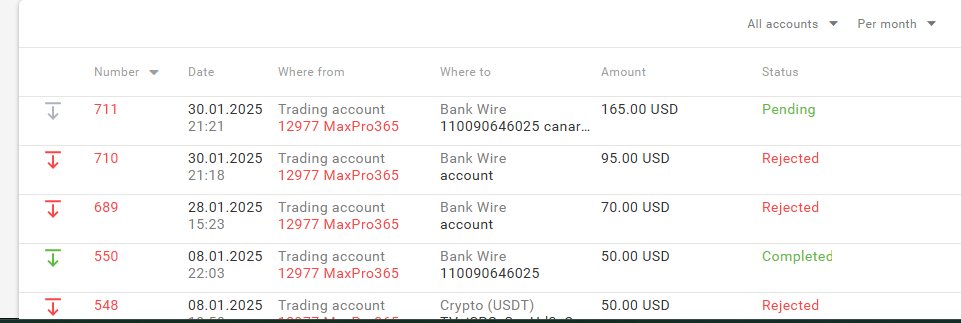

Fund management experiences represent a particularly problematic area, with multiple users reporting difficulties withdrawing their deposits or profits. These withdrawal issues are among the most serious concerns raised by the user community and align with patterns commonly connected with fraudulent brokers. The inability to access deposited funds represents a fundamental breach of trust that legitimate brokers work diligently to avoid.

Common user complaints center around the broker's lack of transparency, poor communication, technical problems, and concerns about fund security. The consistency of these complaints across multiple review platforms shows that these issues are not isolated incidents but rather systematic problems with the broker's operational model.

Conclusion

This complete Maxpro365 review reveals a broker that fails to meet the basic standards expected from legitimate financial service providers. The overwhelming evidence suggests that Maxpro365 operates with questionable practices that pose significant risks to potential investors. The lack of regulatory oversight, combined with persistent user complaints and allegations of fraudulent activities, makes this platform unsuitable for serious traders seeking reliable and secure trading environments.

The broker's poor performance across all evaluated categories—from account conditions and trading tools to customer service and trust factors—shows systematic deficiencies that are unlikely to be resolved without fundamental changes to the company's operational approach. Experienced traders and financial professionals would typically avoid brokers with such concerning profiles, and newcomers to trading should be particularly cautious about platforms that lack proper regulatory credentials and transparent operations.

Based on the evidence gathered in this analysis, Maxpro365 cannot be recommended for traders who prioritize security, reliability, and professional service standards. Potential investors would be better served by choosing established, regulated brokers that maintain transparent operations and positive reputations within the trading community.