Bullwaves 2025 Review: Everything You Need to Know

In the evolving landscape of online trading, Bullwaves has emerged as a relatively new player. While it offers a variety of trading options and utilizes popular platforms like MT4 and MT5, user feedback reveals mixed experiences regarding its reliability and customer service. Overall, the consensus indicates that potential traders should exercise caution when considering this broker.

Note: It is essential to acknowledge the varying regulatory environments across different regions, which may affect user experiences and trust levels. This review aims to provide a balanced and accurate assessment based on available information.

Ratings Overview

We rate brokers based on comprehensive research, user feedback, and expert analysis.

Broker Overview

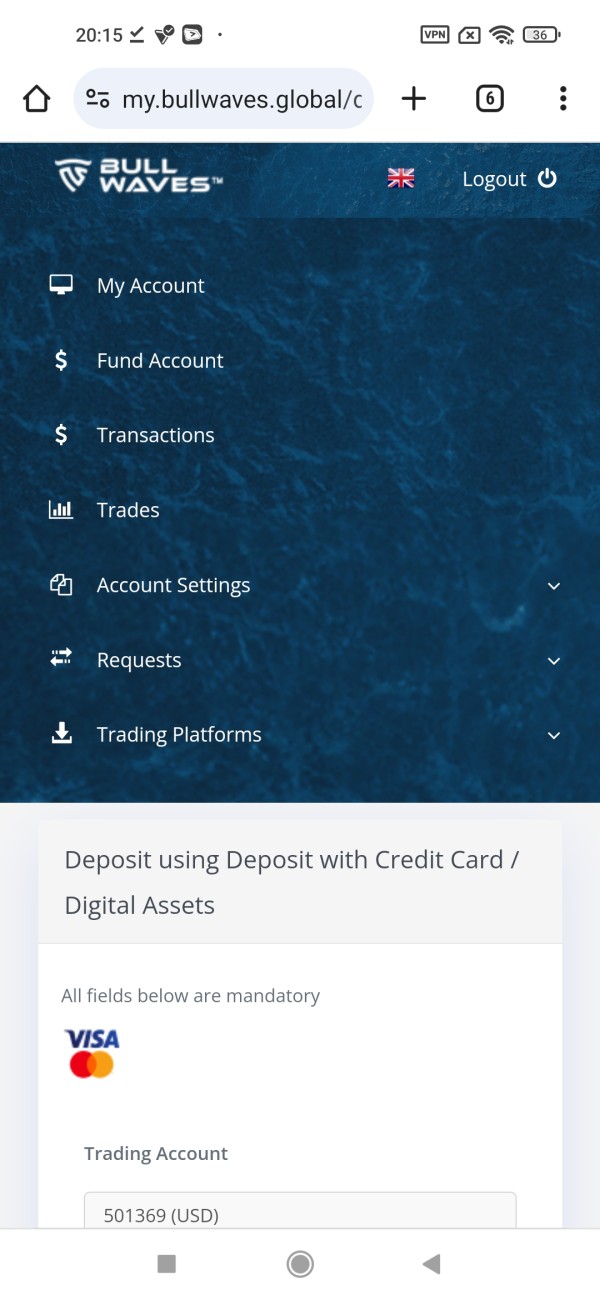

Founded in 2023, Bullwaves operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA). This broker provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to both novice and experienced traders. The broker primarily focuses on forex and CFD trading, offering a limited range of tradable assets compared to industry leaders.

Bullwaves is registered under Equitex Capital Limited and is based in Seychelles. However, the regulatory framework in Seychelles is often viewed as less rigorous than that of more established jurisdictions, raising concerns regarding investor protection.

Detailed Breakdown

Regulatory Environment

Bullwaves operates under the Seychelles FSA, which is classified as a "red tier" regulator, indicating lower levels of oversight compared to more reputable authorities like the FCA or ASIC. This lack of stringent regulation can be a significant concern for traders seeking security and compliance in their trading activities.

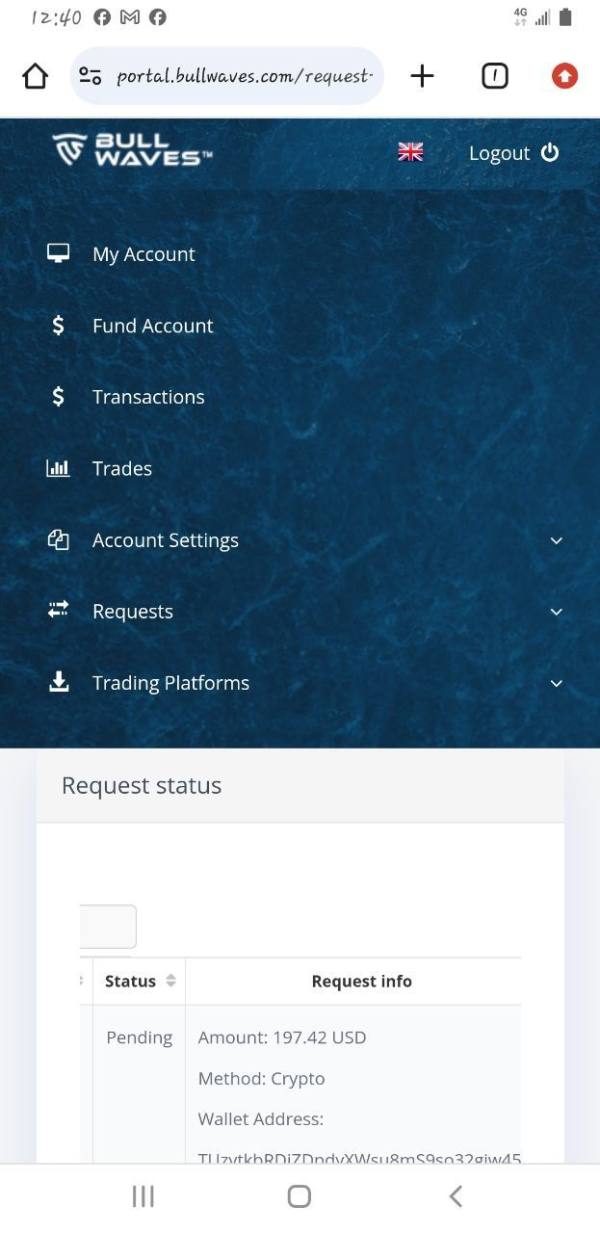

Deposit/Withdrawal Currencies & Cryptocurrencies

Bullwaves primarily deals in USD and EUR, with limited options for deposits and withdrawals. While it supports bank cards, Neteller, and wire transfers, it lacks support for popular cryptocurrencies like Bitcoin, which may deter crypto enthusiasts.

Minimum Deposit

The minimum deposit for opening a trading account with Bullwaves is set at $250, which is relatively accessible compared to some competitors. However, higher-tier accounts require significantly larger deposits, which may not be suitable for all traders.

Information regarding specific bonuses or promotions at Bullwaves is sparse, and the absence of clear promotional offerings may be a drawback for potential clients looking for added value.

Tradable Asset Classes

Bullwaves specializes in forex and CFDs, offering a modest selection of 33 currency pairs, alongside a couple of CFDs in precious metals and a few major indices. This limited range is a stark contrast to competitors like IG and CMC Markets, which offer hundreds of tradable assets.

Costs (Spreads, Fees, Commissions)

The fee structure at Bullwaves features no commissions, which is attractive. However, spreads vary based on account type, starting from 2.0 pips for the classic account. Additionally, there is an inactivity fee of $10 charged after 30 days of no trading activity, which is relatively high compared to industry standards.

Leverage

Leverage options at Bullwaves go up to 1:500, which can be appealing for experienced traders. However, such high leverage also increases the risk of significant losses, necessitating caution.

Bullwaves supports both MT4 and MT5, two of the most popular trading platforms available. However, the lack of proprietary platforms and other popular tools like TradingView may limit options for some traders.

Restricted Regions

While specific restricted regions are not explicitly mentioned, traders from jurisdictions with stringent financial regulations may face challenges when attempting to open accounts with Bullwaves.

Available Customer Service Languages

Bullwaves primarily offers customer support in English. However, the quality of customer service has been criticized, with reports of slow response times and a lack of 24/7 support options, which could be particularly problematic for traders in different time zones.

Repeated Ratings Overview

Detailed Breakdown of Ratings

-

Account Conditions (5/10): Bullwaves offers three account types, each with varying spreads and leverage options. However, the limited flexibility in account types and the high minimum deposits for advanced accounts may deter some traders.

Tools and Resources (4/10): The broker lacks essential research tools and educational resources, which are critical for both novice and experienced traders. This deficiency raises concerns about the overall trading experience.

Customer Service and Support (3/10): User feedback indicates significant shortcomings in customer service, with many reporting unresponsive support and a lack of live chat options, despite claims of 24/7 availability.

Trading Experience (6/10): The trading experience is generally satisfactory due to the availability of MT4 and MT5. However, the limited range of tradable assets and high inactivity fees detract from the overall experience.

Trustworthiness (4/10): The regulatory status of Bullwaves is a significant concern, as it operates under a less reputable authority. Users are advised to exercise caution due to potential risks associated with trading with this broker.

User Experience (5/10): The user experience is mixed, with some users praising the platform's ease of use, while others highlight issues with website navigation and customer support.

In summary, while Bullwaves presents itself as a viable option for forex and CFD trading, potential traders should carefully consider the broker's regulatory status, customer service quality, and limited asset offerings before committing funds. The consensus from various reviews indicates that Bullwaves may not be the most reliable choice in the crowded forex market, and users are encouraged to explore alternatives with stronger regulatory oversight and better customer support.