Regarding the legitimacy of MASON GROUP forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is MASON GROUP safe?

Pros

Cons

Is MASON GROUP markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Duncan Futures Limited

Effective Date: Change Record

2005-03-08Email Address of Licensed Institution:

cs@duncanfutures.hkSharing Status:

No SharingWebsite of Licensed Institution:

duncanfutures.hkExpiration Time:

--Address of Licensed Institution:

香港中環皇后大道16-18號新世界大廈一座7樓708室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Mason Group Safe or Scam?

Introduction

Mason Group is a Hong Kong-based brokerage firm that has been operating in the forex market since its establishment in 2005. As a financial services provider, Mason Group offers various trading options, including forex, futures, and securities. In a market filled with numerous brokers, it is crucial for traders to conduct thorough evaluations to ensure they are partnering with a reliable and legitimate trading platform. The potential for scams in the forex industry is significant, making it essential for traders to assess the credibility of brokers like Mason Group before committing their capital. This article employs a comprehensive investigation framework, utilizing data from various sources, including customer reviews, regulatory disclosures, and industry analyses, to determine whether Mason Group is safe or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in assessing its safety. Mason Group claims to be regulated by the Securities and Futures Commission of Hong Kong (SFC), which is a reputable regulatory body. However, the quality and strictness of regulation can vary significantly between jurisdictions. Below is a summary of Mason Group's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AAG 007 | Hong Kong | Verified |

The SFC's oversight is intended to protect investors by ensuring that licensed brokers adhere to strict operational guidelines. These guidelines typically include maintaining adequate capital reserves, segregating client funds, and providing transparent reporting. It is worth noting that while Mason Group is regulated, the general sentiment among traders is mixed, with some expressing concerns regarding the broker's operational practices. Historical compliance records indicate that Mason Group has not faced any major regulatory sanctions, which could be a positive sign for potential clients. However, the absence of negative disclosures does not automatically guarantee safety; thus, potential clients must remain vigilant and conduct further investigations into the broker's operational history.

Company Background Investigation

Mason Group was founded in 2005 and has since established itself as a player in the Hong Kong financial services market. The company operates under the name Mason Group Holdings Limited and offers a range of financial products, including brokerage services for futures and securities. The management team consists of experienced professionals in the finance industry, although specific details about their backgrounds are not extensively disclosed on the company's website.

The transparency of a broker is vital for building trust with clients. In the case of Mason Group, while the basic company information is available, potential clients may find the lack of detailed disclosures regarding the management team's professional history concerning. Furthermore, the company's ownership structure and financial backing are not clearly outlined, which may raise red flags for potential investors. A broker's commitment to transparency is crucial, as it reflects its willingness to uphold ethical standards in its operations.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. Mason Group offers various trading instruments, but the fee structure can be a point of contention. Below is a comparison of core trading costs at Mason Group compared to industry averages:

| Fee Type | Mason Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | Varies | $5 - $10 per lot |

| Overnight Interest Range | Varies | 2% - 5% |

Mason Group's spread on major currency pairs appears to vary, which can be a disadvantage for traders seeking predictability in their trading costs. Additionally, some reviews have highlighted hidden fees, particularly related to withdrawals and inactivity. Such practices can erode trust and lead traders to question whether Mason Group is truly safe for their investments. Traders should carefully review the terms and conditions related to fees before committing to this broker.

Customer Fund Safety

The safety of client funds is paramount when evaluating a brokerage firm. Mason Group claims to implement safety measures, including the segregation of client funds in separate accounts. This practice is standard among regulated brokers and is designed to protect clients' capital in the event of financial difficulties faced by the brokerage. However, the effectiveness of these measures is often contingent on the broker's adherence to regulatory requirements.

Moreover, the absence of negative historical incidents related to fund security is a positive indicator. However, potential investors should remain cautious and inquire about specific policies regarding negative balance protection and investor compensation schemes. Such protections are vital in ensuring that traders do not incur losses exceeding their deposits.

Customer Experience and Complaints

Customer feedback plays a significant role in assessing a broker's reliability. Reviews of Mason Group reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others have raised concerns about withdrawal issues and delayed responses from customer support. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Inconsistent support |

| Hidden Fees | High | Unclear explanations |

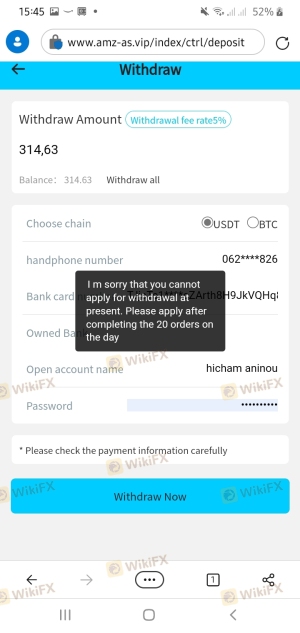

One notable complaint involved a trader who was unable to withdraw funds from their account, citing unreasonable withdrawal conditions imposed by the broker. Such complaints can significantly undermine confidence in Mason Group's operations and raise questions about its trustworthiness. While the company has responded to some complaints, the overall consistency and effectiveness of its customer service remain in question.

Platform and Trade Execution

The trading platform's performance is critical for traders seeking a seamless trading experience. Mason Group offers a proprietary trading platform, which has received mixed reviews regarding its stability and user experience. Users have reported issues with order execution, including slippage and rejected orders, which can be detrimental, especially in fast-moving markets.

The quality of order execution is a crucial factor for traders, as it directly impacts their ability to capitalize on market opportunities. Traders should be wary of any signs of platform manipulation or unfair practices, as these can further indicate whether Mason Group is a safe choice for trading.

Risk Assessment

Using Mason Group comes with inherent risks that traders should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight in some areas |

| Financial Stability Risk | Medium | Concerns over fund safety |

| Customer Service Risk | High | Inconsistent support responses |

To mitigate these risks, traders should consider diversifying their investments and maintaining a clear understanding of the broker's operational policies. Engaging with regulated brokers in more stringent jurisdictions is also advisable for those seeking enhanced protection for their funds.

Conclusion and Recommendations

In conclusion, while Mason Group is regulated by the SFC in Hong Kong, potential clients should approach this broker with caution. The mixed reviews regarding customer experiences, the lack of transparency in management, and concerns over withdrawal processes raise significant questions about whether Mason Group is indeed safe.

For traders looking for a reliable forex broker, it may be prudent to explore alternatives with stronger regulatory oversight and better customer service records. Recommended alternatives include brokers with established reputations and comprehensive investor protection policies. Ultimately, due diligence is essential for any trader considering Mason Group, as the risks associated with trading can be substantial.

Is MASON GROUP a scam, or is it legit?

The latest exposure and evaluation content of MASON GROUP brokers.

MASON GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MASON GROUP latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.