Is LAPIS safe?

Pros

Cons

Is Lapis Safe or a Scam?

Introduction

Lapis Smart Trading, commonly referred to as Lapis, positions itself as an offshore forex broker registered in the Seychelles. With a focus on providing access to various financial markets, it aims to attract traders, particularly from Vietnam. However, the forex market is notorious for its complexities and potential pitfalls, making it crucial for traders to carefully evaluate the credibility of brokers like Lapis. In this article, we will investigate the safety and legitimacy of Lapis by examining its regulatory status, company background, trading conditions, customer feedback, and more. Our evaluation framework is based on a comprehensive analysis of available data from credible sources, including user reviews and regulatory information.

Regulation and Legitimacy

Regulation is a fundamental aspect that determines the trustworthiness of a forex broker. A regulated broker is typically subject to stringent oversight, ensuring that they adhere to industry standards and protect their clients' interests. Unfortunately, Lapis operates without any valid regulatory licensing, which raises significant concerns about its legitimacy.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unregulated |

The absence of regulation means that traders using Lapis have limited to no recourse in case of disputes or issues related to fund withdrawals. This lack of oversight significantly heightens the risk associated with trading with Lapis. Additionally, numerous reports indicate that the broker has a history of complaints regarding fund security and withdrawal difficulties, further questioning its reliability. Given these factors, it is imperative for potential clients to ask, is Lapis safe? The answer, based on current evidence, is concerning.

Company Background Investigation

Lapis Smart Trading was established in 2018 and claims to offer a straightforward trading experience with a focus on customer satisfaction. However, the company's ownership structure and management team remain largely opaque, which is a red flag for any prospective trader. The lack of transparency regarding the individuals behind the broker raises questions about accountability and the broker's operational integrity.

While some sources suggest that Lapis has been operational for several years, the absence of verifiable information about its founders and management team is alarming. A strong management team with relevant experience is essential for a broker's credibility, and Lapis appears to fall short in this regard. The company's website is also currently unavailable, which further complicates the assessment of its legitimacy. Thus, potential clients must consider whether they feel confident trading with a broker that lacks transparency and verifiable credentials.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is crucial. Lapis provides several account types, including copper, silver, and gold accounts, with varying minimum deposit requirements. However, the overall fee structure raises concerns about its competitiveness and fairness.

Trading Cost Comparison Table

| Fee Type | Lapis | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 - 3.0 pips | 0.5 - 1.5 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Lapis are notably higher than the industry average, which can significantly impact trading profitability. Additionally, the lack of a clear commission structure may lead to hidden costs that traders could encounter when attempting to withdraw their funds. This ambiguity prompts further scrutiny into whether is Lapis safe for traders, as high trading costs can erode profits and lead to dissatisfaction.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Lapis claims to have measures in place for fund security; however, it does not provide clear information on fund segregation or investor protection policies. The lack of regulatory oversight means that there are no safety nets for traders in case of financial discrepancies or broker insolvency.

Moreover, previous complaints from users indicate that Lapis may have engaged in practices that jeopardize client funds, including difficulties in withdrawing profits. This history raises serious concerns about whether is Lapis safe for potential traders looking to invest their hard-earned money. Given the absence of robust safety measures, traders should exercise extreme caution.

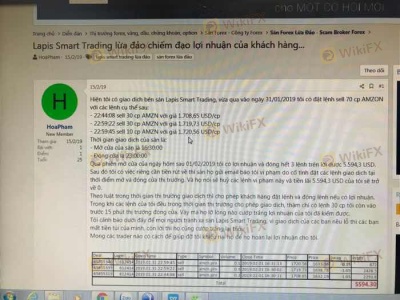

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Lapis reveal a pattern of complaints, primarily related to withdrawal issues and poor customer support. Many users have reported frustration over delays in processing withdrawals and unresponsive customer service, which can be detrimental to a trader's experience.

Complaints Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Account Management Issues | High | Poor |

The overwhelming negative sentiment surrounding Lapis raises significant concerns about its operational integrity. For instance, one user reported being unable to access their funds for several months, while another highlighted the lack of support from the customer service team. These experiences underscore the importance of asking, is Lapis safe for traders, as a broker's responsiveness and ability to resolve issues are critical to ensuring a positive trading environment.

Platform and Execution

The trading platform offered by Lapis is the widely used MetaTrader 4 (MT4), which is known for its user-friendly interface and robust features. However, the platform's stability and execution quality are crucial factors that determine a trader's success. Reports suggest that users have experienced slippage and order rejections, which can significantly affect trading outcomes.

Moreover, the inability to verify the platform's performance due to the unavailability of the website and lack of user testimonials further complicates the assessment. Traders must consider whether they are willing to risk their investments with a broker that has unresolved issues regarding platform reliability and execution quality.

Risk Assessment

When considering trading with Lapis, it is essential to evaluate the associated risks comprehensively. The absence of regulation, high trading costs, poor customer feedback, and questionable fund safety all contribute to a high-risk profile for this broker.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated and lacks oversight |

| Trading Costs | Medium | Higher than average spreads and hidden fees |

| Customer Support | High | Consistent complaints about responsiveness |

| Platform Reliability | Medium | Reports of slippage and order rejections |

Traders should approach Lapis with caution, considering these risks and the potential for financial loss. It is advisable to conduct thorough research and possibly seek alternative brokers with better reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the safety and legitimacy of Lapis Smart Trading. The lack of regulation, high trading costs, poor customer feedback, and questionable fund safety practices strongly suggest that is Lapis safe is a critical question that remains unanswered in a positive light.

For traders, especially those new to forex trading, it is advisable to seek out regulated brokers with transparent practices and positive customer reviews. Some reputable alternatives include brokers regulated by authorities such as the FCA, ASIC, or CySEC, which provide a safer trading environment.

Ultimately, while Lapis may offer trading opportunities, the associated risks and concerns warrant careful consideration, and potential clients should proceed with extreme caution.

Is LAPIS a scam, or is it legit?

The latest exposure and evaluation content of LAPIS brokers.

LAPIS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LAPIS latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.