Is EDP safe?

Pros

Cons

Is EDP Safe or Scam?

Introduction

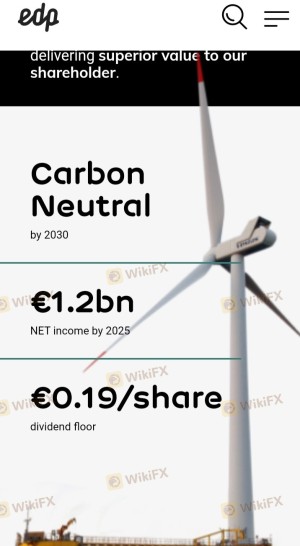

EDP, short for Energias de Portugal, is a broker based in Portugal that has been operating since 2019. It positions itself as a platform for trading forex and other financial instruments. As the forex market continues to attract traders worldwide, it is crucial for individuals to carefully assess the credibility and reliability of brokers before investing their hard-earned money. The potential for scams in the forex industry is significant, with unregulated brokers posing higher risks to traders. This article aims to investigate whether EDP is a safe trading option or if there are red flags that warrant caution. Our analysis is based on a comprehensive review of various sources, including regulatory information, user experiences, and financial data.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and provides a layer of protection for traders. Unfortunately, EDP is not currently regulated by any recognized financial authority. This lack of regulation raises significant concerns regarding the safety of traders' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory framework means that EDP does not have to adhere to the strict standards that regulated brokers must follow. This can lead to potential issues such as fund mismanagement and lack of transparency. Moreover, without regulatory oversight, traders have limited recourse if they encounter problems with the broker. In contrast, regulated brokers provide protections such as segregated accounts for client funds and compensation schemes in the event of insolvency. Therefore, it is essential for traders to consider the regulatory status of EDP seriously, as is EDP safe remains a pressing question.

Company Background Investigation

EDP was established in 2019 and has since aimed to cater to a global audience. However, its relatively short history raises questions about its stability and reliability. The ownership structure of EDP is not transparently disclosed, which adds to the uncertainty surrounding its operations. A lack of information about the management team further complicates matters. The qualifications and experience of key personnel are vital indicators of a broker's credibility, and without this information, potential clients may feel apprehensive.

Transparency in operations is essential for building trust with clients. EDP's limited disclosure practices could indicate a lack of accountability, which is concerning for potential traders. A reputable broker typically provides detailed information about its management team, including their professional backgrounds and previous experiences in the financial industry. The absence of such information raises doubts about the broker's legitimacy and operational integrity. Thus, the question of is EDP safe becomes increasingly relevant, as the lack of transparency can be a significant red flag for potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is vital. EDP's fee structure has been noted to be somewhat ambiguous, with traders reporting unexpected charges. This lack of clarity can lead to frustration and confusion among users. A typical trading environment should feature transparent fees that allow traders to understand the costs associated with their activities.

| Fee Type | EDP | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | Unknown | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Moderate |

The spread on major currency pairs at EDP appears to be variable, which can lead to higher trading costs compared to industry standards. Additionally, the commission model is unclear, which could indicate hidden fees that traders may not anticipate. Such discrepancies in fees could significantly impact trading profitability, making it essential for traders to fully understand the cost structure before committing to EDP. The question of is EDP safe is further complicated by these unclear trading conditions.

Client Fund Safety

The safety of client funds is paramount when considering a broker. EDP has been criticized for its lack of adequate measures to protect client funds. The absence of segregated accounts means that client funds may not be kept separate from the broker's operational funds, increasing the risk of loss in case of financial difficulties. Furthermore, there is no information regarding investor protection schemes that would typically safeguard traders' investments.

Historically, unregulated brokers have been associated with various financial scandals and fund mismanagement. The lack of any reported incidents involving EDP does not necessarily indicate safety; rather, it highlights the need for caution when dealing with an unregulated entity. Traders should be aware that if issues arise, they may have little to no recourse for recovering their funds. Thus, the inquiry into is EDP safe is crucial, as the absence of robust security measures could lead to significant financial losses for traders.

Customer Experience and Complaints

User feedback is an essential aspect of evaluating a broker's reliability. EDP has received mixed reviews, with some users praising its platform while others report significant issues. Common complaints include withdrawal delays and difficulties in contacting customer support. Such experiences can be indicative of broader operational issues within the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Unresolved Issues |

Typical cases highlight the frustrations faced by users, such as a trader who reported being unable to withdraw their funds for an extended period. This raises serious concerns about the broker's operational integrity and its commitment to customer service. The consistency of complaints regarding withdrawal issues suggests that potential traders should exercise caution when considering EDP. The question of is EDP safe is underscored by these complaints, as a broker's ability to facilitate withdrawals is a critical component of trust.

Platform and Trade Execution

The performance of a trading platform is another vital factor in assessing a broker's reliability. EDP's platform has received mixed reviews regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly affect trading outcomes. A reliable platform should provide smooth execution and minimal disruptions, as these factors are crucial for successful trading.

Traders have also expressed concerns about potential manipulation, which is a significant red flag in the forex industry. If a broker's platform exhibits signs of manipulating prices or executing trades unfavorably, it can lead to significant losses for clients. Thus, the evaluation of is EDP safe must consider the platform's reliability and the quality of trade execution.

Risk Assessment

Using EDP as a trading platform involves various risks that potential traders should be aware of. The lack of regulation, unclear fee structures, and mixed customer feedback contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | Medium | Lack of fund protection |

| Operational Risk | High | Complaints about service |

To mitigate these risks, potential traders should consider using regulated brokers that provide clear fee structures and robust customer support. Additionally, conducting thorough research and due diligence is essential before committing to any trading platform.

Conclusion and Recommendations

In conclusion, the investigation into EDP raises significant concerns regarding its safety as a trading platform. The lack of regulation, unclear fee structures, and mixed customer experiences suggest that traders should approach this broker with caution. While there are no overt signs of fraud, the risks associated with using EDP are substantial.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated and have a proven track record of customer satisfaction. Brokers that are overseen by reputable regulatory bodies provide essential protections and are more likely to adhere to industry standards. Therefore, the question of is EDP safe ultimately leans towards a cautious "no," and traders are encouraged to explore safer options for their trading needs.

Is EDP a scam, or is it legit?

The latest exposure and evaluation content of EDP brokers.

EDP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EDP latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.