Is UBE safe?

Pros

Cons

Is UBE Safe or Scam? A Comprehensive Analysis

Introduction

UBE Forex has emerged as a noteworthy player in the competitive landscape of the foreign exchange market, offering traders a range of services and trading platforms. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it imperative for traders to conduct thorough evaluations of forex brokers before committing their funds. In this article, we will explore the legitimacy of UBE Forex by examining its regulatory status, company background, trading conditions, customer experiences, and security measures. Our investigation draws from various online sources, including user reviews and regulatory databases, to provide a balanced assessment of whether UBE is safe for traders or if it exhibits characteristics of a scam.

Regulatory and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy. UBE Forex claims to operate under regulatory oversight, which is essential for ensuring compliance with financial laws and protecting investors. However, the quality and reputation of the regulatory body are equally important. Below is a summary of UBE's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Not Available | United States | Suspicious Clone |

The absence of a valid license from a recognized financial authority raises concerns about UBE's compliance with industry standards. Furthermore, reports indicate that UBE Forex has been classified as a "suspicious clone" by various watchdog organizations. This classification suggests that the broker may not be operating under legitimate regulatory frameworks, potentially putting clients' funds at risk. A robust regulatory framework is crucial for protecting clients from malpractice and ensuring fair trading practices. The lack of oversight from a reputable authority such as the FCA or ASIC is a significant red flag when evaluating whether UBE is safe.

Company Background Investigation

Understanding the companys history and ownership structure can provide valuable insights into its operational integrity. UBE Forex appears to have a relatively obscure background, with limited information available regarding its founding, ownership, and operational history. This lack of transparency can be concerning for potential clients.

Moreover, the management teams experience and qualifications are critical indicators of a broker's reliability. Unfortunately, UBE Forex does not publicly disclose detailed information about its management team, which raises questions about their expertise and commitment to ethical trading practices. A transparent organization typically provides information about its leadership, including their professional backgrounds and qualifications. The absence of such information may further contribute to doubts regarding whether UBE is safe for traders.

Trading Conditions Analysis

Evaluating the trading conditions offered by a broker is essential for understanding its cost-effectiveness and overall trading environment. UBE Forex claims to provide competitive spreads and various trading instruments. However, it is crucial to scrutinize the fee structure to identify any hidden costs or unusual policies. Below is a comparison of UBE's core trading costs:

| Fee Type | UBE Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by UBE Forex are higher than the industry average, which could significantly impact trading profitability. Additionally, the absence of a clear commission model raises concerns about potential hidden fees that could be levied on traders. A transparent fee structure is vital for traders to make informed decisions, and the lack of clarity in UBE Forexs pricing model may indicate underlying issues. Therefore, traders must exercise caution when considering whether UBE is safe for their trading activities.

Customer Fund Security

The safety of customer funds is paramount when selecting a forex broker. UBE Forex claims to implement various security measures to protect client funds, including fund segregation and investor protection policies. However, the effectiveness of these measures is called into question by reports of withdrawal issues and customer complaints.

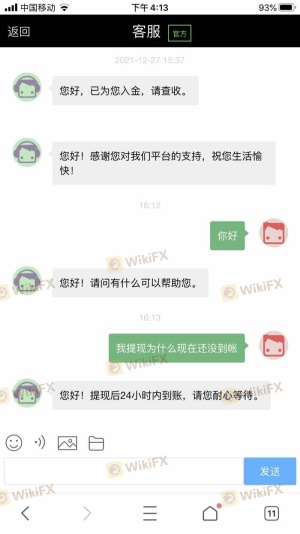

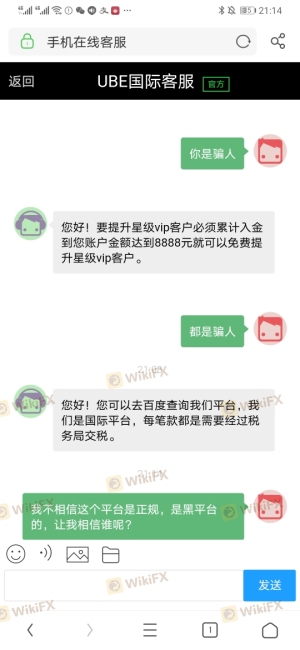

Fund segregation ensures that client funds are kept separate from the broker's operational funds, providing an additional layer of security. Furthermore, investor protection policies are essential for safeguarding clients in the event of broker insolvency. Unfortunately, there have been numerous complaints from users regarding their inability to withdraw funds from UBE Forex, which raises serious concerns about the broker's commitment to fund safety. Historical disputes and unresolved withdrawal issues further exacerbate the situation, making it critical for traders to assess whether UBE is safe before depositing their funds.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. An analysis of user reviews reveals a pattern of dissatisfaction among UBE Forex clients. Common complaints include withdrawal difficulties, lack of responsive customer support, and issues related to account management. Below is a summary of the main complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

| Account Management | High | Unresponsive |

The high severity of withdrawal issues is particularly alarming, as it directly impacts traders' ability to access their funds. Additionally, the company's poor response to complaints indicates a lack of commitment to customer service, further eroding trust in the broker. A few notable case studies highlight instances where clients reported being unable to access their funds despite repeated attempts to contact customer service. Such experiences lead to a significant question about whether UBE is safe for traders looking to invest their capital.

Platform and Trade Execution

The trading platform's performance is crucial for ensuring a seamless trading experience. UBE Forex claims to offer a user-friendly platform with reliable execution speeds. However, user reviews indicate mixed experiences regarding platform stability and order execution quality. Reports of slippage and order rejections have surfaced, raising concerns about the broker's execution practices.

A reliable trading platform should provide consistent execution with minimal slippage and no rejections. The presence of such issues may indicate underlying problems with the broker's infrastructure or operational practices. Traders must consider these factors when evaluating whether UBE is safe for their trading endeavors.

Risk Assessment

The overall risk associated with trading with UBE Forex must be carefully considered. Based on the findings from our analysis, we can summarize the key risk areas as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of valid regulatory oversight |

| Fund Security | High | History of withdrawal issues |

| Customer Support | Medium | Poor responsiveness to complaints |

| Trading Costs | Medium | Higher spreads than industry average |

Given the high-risk levels associated with regulatory compliance and fund security, traders should approach UBE Forex with caution. It is advisable to consider alternative brokers with better regulatory standing and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the investigation into UBE Forex raises significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, combined with numerous customer complaints and withdrawal issues, strongly suggests that UBE Forex may not be a safe choice for traders. Therefore, it is essential for potential clients to exercise extreme caution and conduct thorough research before engaging with this broker.

For traders seeking reliable alternatives, we recommend considering brokers regulated by reputable authorities such as the FCA or ASIC, which offer transparent fee structures, robust customer support, and a proven commitment to fund security. Ultimately, protecting ones investment should be the foremost priority, and choosing a broker with a solid reputation is a critical step in achieving that goal.

In summary, while some aspects of UBE Forex may appear appealing, the overwhelming evidence points to a conclusion that raises serious doubts about whether UBE is safe for traders.

Is UBE a scam, or is it legit?

The latest exposure and evaluation content of UBE brokers.

UBE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UBE latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.