Regarding the legitimacy of Brisk Markets forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Brisk Markets safe?

Risk Control

License

Is Brisk Markets markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Brisk Markets Ltd

Effective Date:

--Email Address of Licensed Institution:

support@briskmarkets.netSharing Status:

No SharingWebsite of Licensed Institution:

http://www.briskmarkets.net/Expiration Time:

--Address of Licensed Institution:

Office No. A17E, Providence Complex, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4379855Licensed Institution Certified Documents:

Is Brisk Markets Safe or a Scam?

Introduction

Brisk Markets is an online forex broker that has emerged in the trading landscape since its establishment in 2022. Based in Saint Vincent and the Grenadines, it positions itself as a provider of diverse trading opportunities, including forex, commodities, and cryptocurrencies. However, the rapid growth of online trading has led to an influx of brokers, some of which may not operate under legitimate conditions. Therefore, it is crucial for traders to carefully evaluate the credibility of brokers like Brisk Markets before committing their funds. This article aims to provide an objective analysis of Brisk Markets, focusing on its regulatory status, company background, trading conditions, customer safety, and overall reputation in the market. The evaluation is based on a comprehensive review of various sources, including user feedback, expert analyses, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is a primary factor in determining its safety and legitimacy. Brisk Markets claims to be registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework concerning forex trading. According to multiple reviews, Brisk Markets does not hold a valid license from any reputable regulatory authority. Below is a summary of the regulatory information available:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Saint Vincent FSA | N/A | Saint Vincent | Not Verified |

The lack of regulation raises significant red flags regarding the safety of funds deposited with Brisk Markets. Since the Financial Services Authority of Saint Vincent and the Grenadines does not oversee forex brokers, traders may find it challenging to seek recourse in case of disputes or fund mismanagement. Furthermore, the absence of a regulatory framework means that Brisk Markets is not compelled to adhere to industry standards for transparency and client protection. This lack of oversight can expose traders to higher risks, making it essential to question is Brisk Markets safe?

Company Background Investigation

Brisk Markets was established in 2022, and its ownership structure remains largely opaque. The broker does not provide detailed information about its management team or the experience of its key personnel. This lack of transparency is concerning, as it leaves potential clients in the dark about who is operating the platform and their qualifications. The company's address, listed as the first floor of the St. Vincent Bank Ltd building in Kingstown, has also raised suspicions, as many offshore brokers often use generic or unverifiable addresses to evade accountability.

Additionally, the company's website lacks comprehensive information about its operations, trading conditions, and customer support services. This opacity can be a significant drawback for traders looking for reliable and trustworthy brokers. The absence of a clear corporate structure and management profile further complicates the question of is Brisk Markets safe? Without a transparent operational framework, traders may find it difficult to trust the broker with their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for assessing its overall value and reliability. Brisk Markets presents a competitive trading environment with a minimum deposit requirement of $250 and leverage of up to 1:500. However, the broker's fee structure raises some concerns. Below is a comparison of core trading costs:

| Fee Type | Brisk Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.2 pips | From 1.0 pips |

| Commission Model | $0 to $3.5 | $2 to $5 |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Brisk Markets may seem attractive, the lack of transparency regarding commission structures and other potential hidden fees should give traders pause. Additionally, the broker does not offer negative balance protection, which could leave traders vulnerable to significant losses. These factors contribute to the growing skepticism around is Brisk Markets safe?

Customer Funds Safety

The safety of customer funds is a critical consideration when evaluating any forex broker. Brisk Markets does not provide adequate information regarding its fund protection measures. Unlike regulated brokers, which are required to segregate client funds from company assets, Brisk Markets does not guarantee such protections. Moreover, there is no indication that the broker offers any form of investor compensation scheme, which is a common practice among reputable brokers to safeguard client investments.

The absence of negative balance protection is another significant risk factor. In volatile market conditions, traders could potentially lose more than their initial investment, leading to financial distress. Furthermore, there have been no publicly reported incidents of fund mismanagement or disputes, but the lack of regulatory oversight means that any such issues could be easily concealed. This raises the question once more of is Brisk Markets safe?

Customer Experience and Complaints

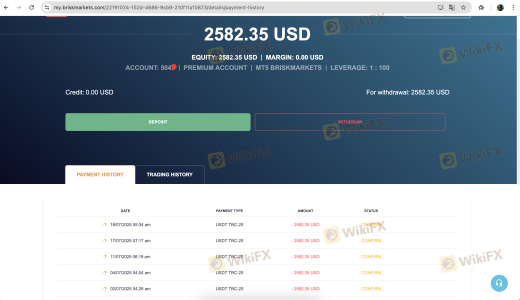

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Brisk Markets reveal a mix of experiences, with many users reporting difficulties in withdrawing their funds and receiving adequate support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Support Quality | Medium | Inconsistent |

| Account Blocking | High | Poor Communication |

Many users have expressed frustration over withdrawal delays, with some claiming that their accounts were blocked without explanation. In one notable case, a trader reported that after several attempts to withdraw funds, they were met with repeated requests for additional documentation, which ultimately led to their account being frozen. Such experiences raise serious concerns about the broker's operational integrity and responsiveness to client needs. Therefore, it is crucial to consider is Brisk Markets safe? before engaging in trading activities.

Platform and Trade Execution

The trading platform offered by Brisk Markets is based on MetaTrader 5 (MT5), a widely respected trading software known for its robust features. However, user reviews indicate that the platform may experience stability issues, such as lagging during high volatility periods. Additionally, there are reports of slippage and order rejections, which can significantly impact trading outcomes. These issues could indicate a lack of effective risk management practices on the part of the broker.

Traders have also reported instances where they felt their orders were manipulated, raising further concerns about the broker's ethical practices. The overall user experience on the platform appears to vary widely, with some users praising its functionalities while others express dissatisfaction with execution quality. This inconsistency adds to the uncertainty surrounding the question of is Brisk Markets safe?

Risk Assessment

Engaging with any forex broker carries inherent risks, and Brisk Markets is no exception. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No reputable regulation, exposing traders to fraud. |

| Financial Risk | High | Lack of negative balance protection and fund segregation. |

| Operational Risk | Medium | Reports of withdrawal issues and poor customer service. |

| Platform Risk | Medium | Potential for order manipulation and execution delays. |

To mitigate these risks, it is advisable for traders to conduct thorough research before investing. Utilizing demo accounts to test the platform and understanding the terms and conditions can also help in making informed decisions. Additionally, it is prudent to diversify investments and avoid putting all funds into a single broker, especially one with questionable practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that Brisk Markets exhibits several characteristics that warrant caution. The lack of regulatory oversight, transparency issues, and reports of withdrawal difficulties raise significant concerns about its safety and legitimacy. Therefore, it is crucial for traders to carefully consider whether is Brisk Markets safe? before proceeding with any investments.

For traders seeking a more secure trading environment, it is advisable to consider alternatives that are well-regulated and have a proven track record of positive customer experiences. Reputable brokers, such as those regulated by the FCA, ASIC, or CySEC, often provide better protections for client funds and more transparent trading conditions. In light of the potential risks associated with Brisk Markets, opting for a trusted broker can help safeguard investments and enhance the overall trading experience.

Is Brisk Markets a scam, or is it legit?

The latest exposure and evaluation content of Brisk Markets brokers.

Brisk Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Brisk Markets latest industry rating score is 4.16, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.16 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.