Monex 2025 Review: Everything You Need to Know

Executive Summary

This detailed monex review looks at one of the well-known companies in financial services. The company focuses on forex and securities trading. Monex started in 1999 and has built a name as an experienced service provider, but customer feedback shows mixed results for satisfaction.

Monex works mainly as a forex and securities trading platform. It targets everyday investors who want access to international markets. The company says its experienced customer support team makes it different from competitors in the trading world, but user ratings on different review sites show big concerns about service quality and how open the company is with information.

Data shows Monex gets very low ratings on Consumer Affairs with just 1.1 stars. Trustpilot shows 3,636 reviews with mixed feedback. The difference in user experiences means that while some customers like Monex's services, especially the customer support, many others are unhappy with different parts of the platform.

The broker has been in the market since 1999, which shows it's stable and experienced. However, recent user feedback points to areas that need work. This review will look at all parts of Monex's services to help potential traders understand what to expect from this platform.

Important Disclaimer

This review uses publicly available information and user feedback from various sources. Some aspects of Monex's operations may not be fully detailed in this analysis because there's limited specific regulatory information in available materials. The evaluation method combines user ratings, reported experiences, and available company information to give a balanced assessment.

Potential users should know that forex and securities trading involves significant risk. Past performance does not guarantee future results. You must do thorough research and think about your personal financial situation before using any trading platform, and this review aims to provide helpful guidance but should not be considered as financial advice.

Rating Framework

Broker Overview

Monex started in the financial services market in 1999. The company set itself up as an online securities and forex trading platform. It has grown through various corporate changes, including mergers that became part of the larger Monex Group structure, and initially focused on online securities trading but has expanded to include forex trading services for retail investors who want access to international financial markets.

The broker's business model focuses on giving trading access to forex and securities markets. The company describes this as supported by an experienced customer support system. Available information shows Monex presents itself as a service provider that focuses on professional risk management and expert guidance for its clients.

However, this monex review shows that user experiences are very different. The company's long history suggests it's operationally stable, but customer feedback shows challenges in service delivery and user satisfaction. The platform's approach to client relations and transparency has received criticism from some users, as seen in various review platforms where customers have expressed concerns about service quality and communication practices.

The broker's target customers appear to be retail investors interested in forex and securities trading. Specific details about minimum investment requirements, account types, and platform specifications are not clearly detailed in available public information.

Regulatory Status: Specific regulatory information is not clearly detailed in available materials. References suggest oversight by relevant US authorities.

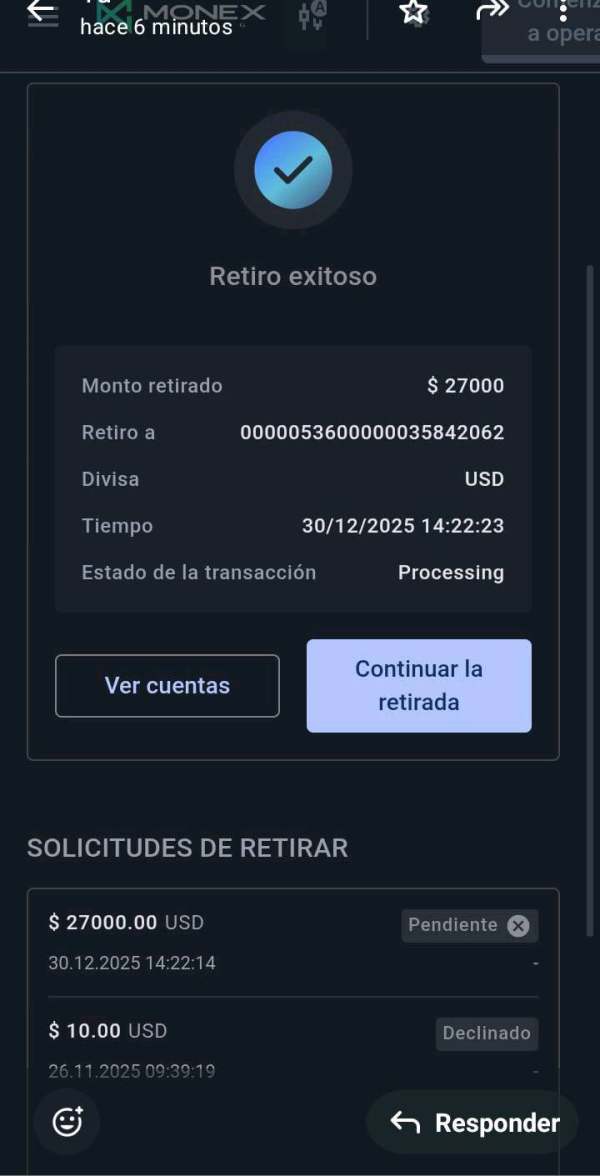

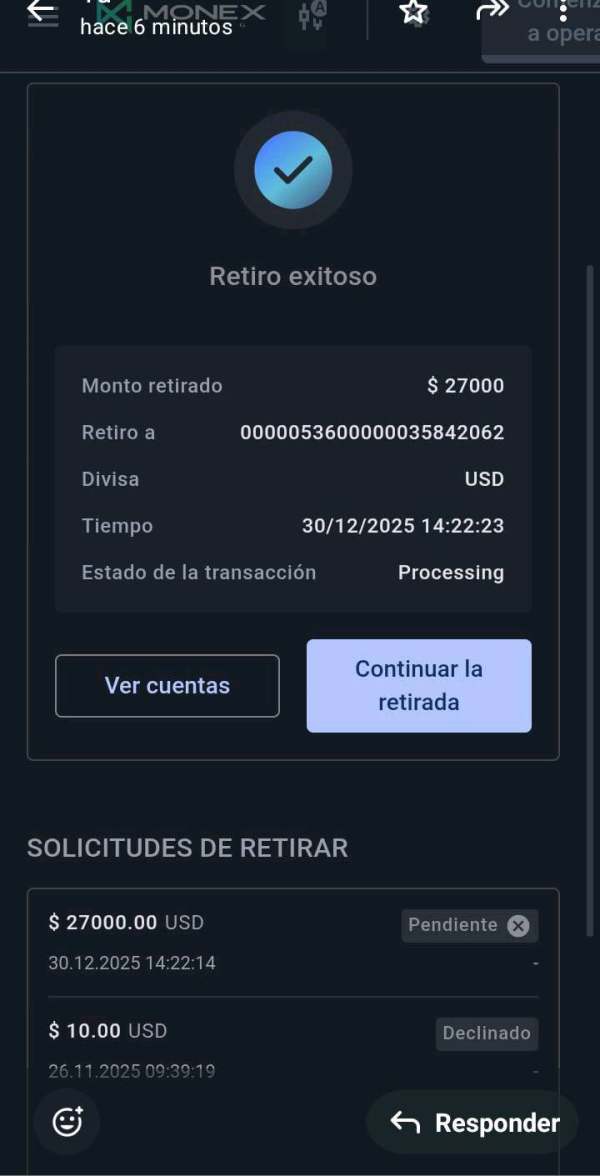

Deposit and Withdrawal Methods: Detailed information about funding options and withdrawal processes is not specified in accessible sources.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available materials.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in current available information.

Tradeable Assets: The platform primarily focuses on forex and securities trading. The complete range of available instruments is not comprehensively detailed in accessible materials.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not detailed in available sources. This represents a significant information gap for potential users.

Leverage Options: Leverage ratios and margin requirements are not specified in accessible materials.

Platform Options: Specific trading platform details and software options are not clearly outlined in available information.

Geographic Restrictions: Information about regional availability and restrictions is not specified in current materials.

Customer Support Languages: Supported languages for customer service are not detailed in accessible sources.

This monex review highlights significant information gaps. Potential users should consider these when evaluating the platform.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Monex's account conditions faces limitations because there's not enough publicly available information. Standard account features such as account types, minimum deposit requirements, and special account options are not clearly detailed in accessible materials, and this lack of transparency creates challenges for potential users who want to understand the basic requirements for opening and maintaining trading accounts.

Potential traders cannot properly assess whether Monex's account structure meets their needs without specific information about account tiers, minimum funding requirements, or special features like Islamic accounts. The absence of clear account condition details may reflect broader transparency issues that have contributed to user dissatisfaction expressed in various review platforms.

The account opening process, verification requirements, and ongoing account maintenance procedures are not specifically outlined in available materials. This information gap makes it difficult for potential users to understand what to expect when using the platform, and for a comprehensive monex review, such details would be essential for proper evaluation.

Professional traders and retail investors typically need clear understanding of account structures, fees, and requirements before committing to a trading platform. The limited availability of such information may contribute to user frustration and the mixed reviews seen across various platforms.

The assessment of Monex's trading tools and resources is limited by insufficient specific information in available materials. Details about analytical tools, research resources, educational materials, and automated trading support are not comprehensively outlined in accessible sources, and this represents a significant information gap for potential users who want to understand the platform's capabilities.

Modern forex and securities trading platforms typically offer various analytical tools, market research, economic calendars, and educational resources to support trader decision-making. It becomes challenging to evaluate the platform's competitive position in the market without specific information about Monex's offerings in these areas.

The absence of detailed information about research and analysis resources may impact user experience. This is particularly true for traders who rely on comprehensive market analysis and educational support, since professional trading platforms generally provide robust research capabilities and educational materials to support user success.

Educational resources, including webinars, tutorials, and market analysis, are typically important factors in broker selection, especially for newer traders. The lack of specific information about such resources in available materials represents another area where transparency could be improved.

Customer Service and Support Analysis

Customer service represents one area where Monex appears to receive some positive recognition. Available information indicates the presence of an experienced customer support team, and this aspect of the service seems to be a relative strength compared to other evaluated criteria, though specific details about support channels, response times, and service quality metrics are not comprehensively detailed.

The reported experience of the customer support team suggests that Monex has invested in building expertise in client relations and problem resolution. However, it's difficult to fully assess the scope and quality of customer service offerings without specific information about support availability, response times, and multilingual capabilities.

Professional trading platforms typically provide multiple support channels including phone, email, live chat, and comprehensive FAQ sections. The availability and quality of these services significantly impact user experience, particularly when technical issues or account questions arise during trading sessions.

While the reported experience of the support team is positive, the overall low user ratings across review platforms suggest that customer service quality may not consistently meet user expectations. Other service aspects may overshadow the positive customer support experience.

Trading Experience Analysis

The evaluation of Monex's trading experience faces significant limitations because there's insufficient specific information about platform performance, execution quality, and trading environment. Details about platform stability, order execution speed, slippage rates, and overall trading conditions are not clearly outlined in available materials.

Modern traders typically expect reliable platform performance, fast order execution, competitive spreads, and stable trading environments. Potential users cannot adequately assess whether Monex's trading infrastructure meets contemporary standards and expectations without specific information about these crucial aspects.

Platform functionality, including charting capabilities, order types, risk management tools, and mobile trading options, represents critical factors in broker selection. The absence of detailed information about these features makes it challenging to evaluate the platform's suitability for different trading styles and experience levels.

The monex review reveals that trading experience assessment is complicated by limited publicly available information about platform specifications and performance metrics. This information gap may contribute to user uncertainty and mixed feedback observed across various review platforms.

Trust and Reliability Analysis

Trust and reliability represent significant concerns in this Monex evaluation. Available data suggests challenges in these critical areas, and the notably low Consumer Affairs rating of 1.1 stars indicates substantial user dissatisfaction and potential trust issues. Additionally, references to transparency concerns and possible review management practices raise questions about the company's approach to customer relations and public communication.

Regulatory oversight and compliance represent fundamental aspects of broker trustworthiness. Specific regulatory information is not clearly detailed in available materials, and for financial services providers, clear regulatory status and compliance information are essential for user confidence and platform credibility.

The mixed user feedback across various platforms, combined with low overall ratings, suggests that trust-building remains a significant challenge for Monex. User concerns about transparency and service quality contribute to reliability questions that potential clients should carefully consider.

Financial security measures, fund protection protocols, and company transparency are typically crucial factors in broker evaluation. The limited availability of specific information in these areas, combined with negative user feedback, contributes to the low trust and reliability rating in this assessment.

User Experience Analysis

User experience analysis reveals significant challenges based on available feedback and ratings. The overall low user satisfaction scores across multiple review platforms indicate widespread dissatisfaction with various aspects of the Monex service offering, and Consumer Affairs rating of 1.1 stars and mixed Trustpilot feedback with 3,636 reviews suggest consistent user experience issues.

The disparity between positive aspects like experienced customer support and overall negative user ratings suggests that while some service elements may be satisfactory, the overall user journey and experience quality require improvement. Interface design, ease of use, and overall service delivery appear to be areas of concern based on user feedback.

Registration and account verification processes, fund management procedures, and general platform usability are typically important factors in user experience evaluation. Limited specific information about these processes makes comprehensive assessment challenging, though negative user feedback suggests potential issues in these areas.

Common user complaints appear to center around service quality, transparency concerns, and overall platform experience. The pattern of negative feedback across multiple review platforms indicates systemic user experience challenges that potential clients should carefully consider before engaging with the platform.

Conclusion

This comprehensive monex review reveals a trading platform with mixed performance across key evaluation criteria. Monex brings experience from its 1999 founding and maintains an experienced customer support team, but significant challenges in user satisfaction, transparency, and trust indicate areas requiring substantial improvement.

The platform may be suitable for traders willing to work with experienced customer support. However, potential users should carefully consider the low user ratings and transparency concerns before committing funds, and the significant information gaps regarding regulatory status, account conditions, and platform specifications represent additional considerations for potential clients.

Overall, Monex's strengths in customer support experience are overshadowed by trust and reliability concerns. This suggests that traders may find better alternatives in the competitive forex and securities trading market.