LAPIS Review 1

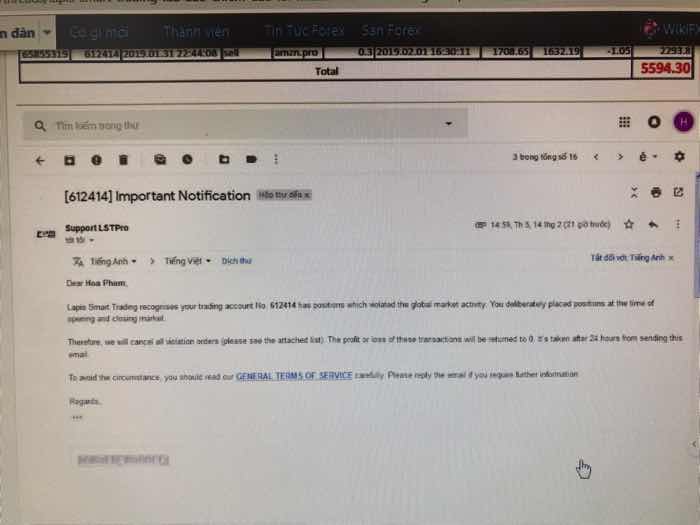

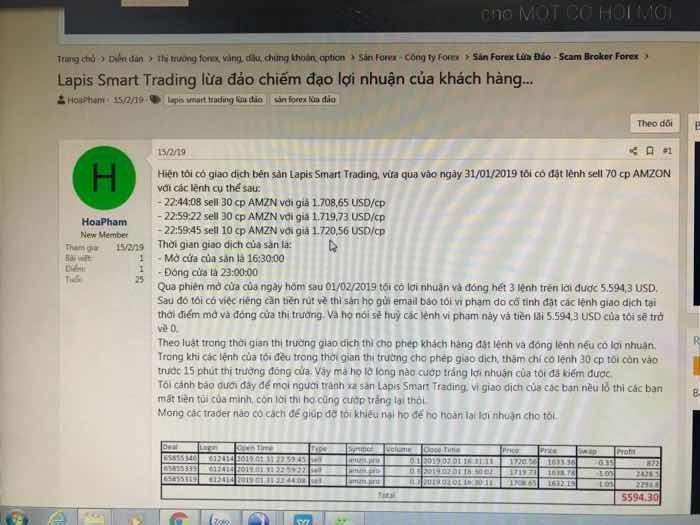

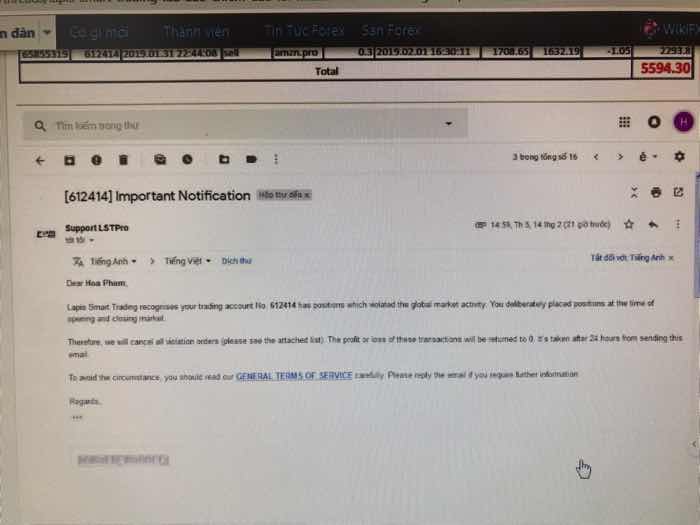

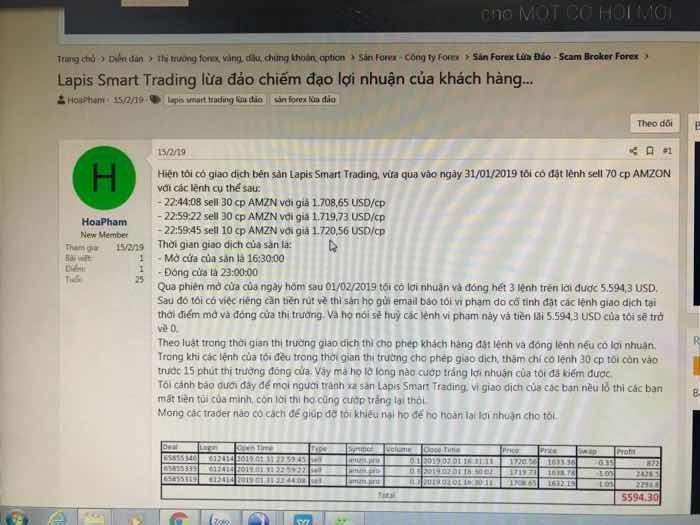

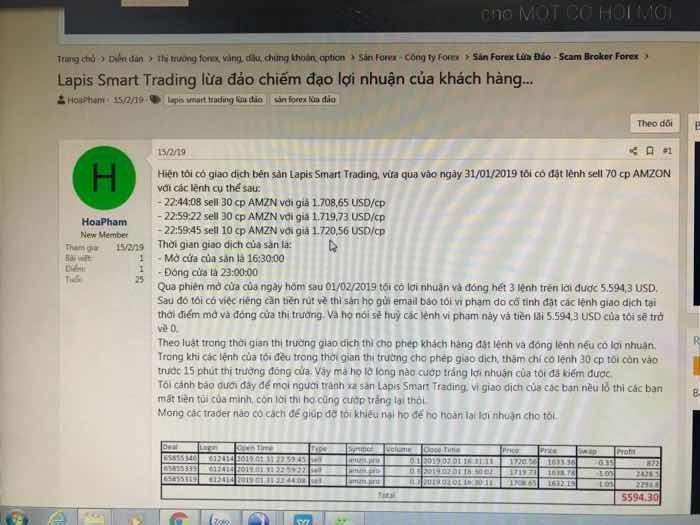

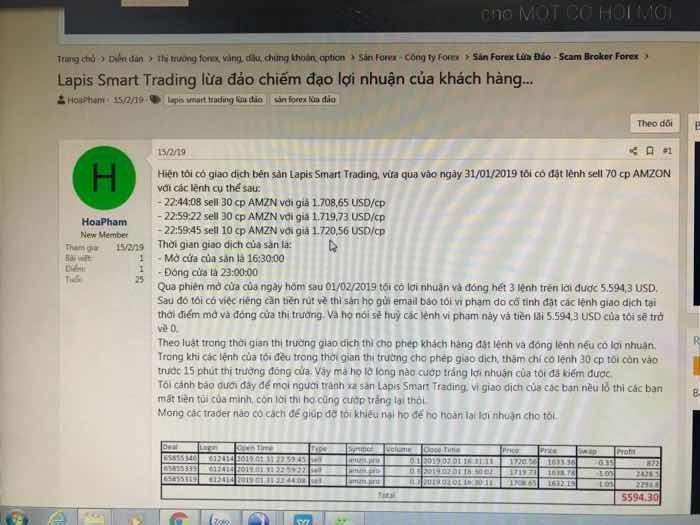

Stay away from LAPIS .All your losses and profits will be pocketed by it.Hope someone help take back my fund.

LAPIS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Stay away from LAPIS .All your losses and profits will be pocketed by it.Hope someone help take back my fund.

LAPIS is an offshore forex broker that presents itself as a trading platform offering high leverage opportunities and multiple account types for retail traders. This lapis review examines a broker that appears to target traders seeking high-leverage trading with relatively low entry barriers. The platform features starting spreads from 1 pip and leverage up to 1:500 with a minimum deposit requirement of just $50.

Based on available information, LAPIS operates from Seychelles jurisdiction. However, specific regulatory details remain unclear from current documentation. The broker primarily serves retail traders looking for accessible forex trading opportunities. These traders often have limited initial capital but seek substantial leverage capabilities. The platform utilizes MT4 as its primary trading interface and offers three distinct account tiers: Copper, Silver, and Gold accounts. Each tier is designed to accommodate different trader profiles and capital levels.

However, potential traders should exercise caution when considering LAPIS. The lack of clear regulatory information and limited transparency regarding company operations present significant concerns for trader safety and fund security.

LAPIS operates as an offshore entity registered in Seychelles. Specific regulatory oversight information is not clearly established in available documentation. Users should exercise particular caution when dealing with offshore brokers, as regulatory protections may be limited or absent entirely.

This evaluation is based on publicly available information and may contain gaps due to limited disclosure from the broker. Traders are strongly advised to conduct independent research and consider regulatory protections before committing funds to any trading platform. This advice is particularly important for platforms with unclear regulatory status.

| Criterion | Score | Rating |

|---|---|---|

| Account Conditions | 7/10 | Good |

| Tools and Resources | 5/10 | Average |

| Customer Service and Support | 5/10 | Average |

| Trading Experience | 6/10 | Above Average |

| Trust and Reliability | 4/10 | Below Average |

| User Experience | 5/10 | Average |

LAPIS presents itself as a forex trading platform operating from Seychelles. However, specific establishment dates and comprehensive company background information are not readily available in current documentation. The broker appears to focus primarily on providing forex trading services to retail clients, particularly those seeking high-leverage trading opportunities with relatively low capital requirements.

The company's business model centers around offering multiple account types with varying conditions. This approach targets different segments of the retail trading market. LAPIS positions itself as an accessible entry point for new traders while simultaneously offering features that may appeal to more experienced traders seeking higher leverage ratios.

The broker operates exclusively through the MT4 trading platform. MT4 remains one of the most widely used platforms in the forex industry. LAPIS primarily focuses on forex trading services, though the full scope of available trading instruments is not comprehensively detailed in available materials. The absence of clear regulatory information and limited company transparency represent significant concerns for potential clients. These issues are important considerations when reviewing this lapis review for broker selection decisions.

Regulatory Status: LAPIS operates from Seychelles jurisdiction. However, specific regulatory oversight and licensing details are not clearly established in available documentation. This presents potential concerns for trader protection and regulatory compliance.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in current available materials. This represents a significant information gap for potential clients.

Minimum Deposit Requirements: The broker requires a minimum deposit of $50. This positions it as accessible to traders with limited initial capital.

Bonus and Promotions: Current promotional offerings and bonus structures are not specified in available documentation.

Tradeable Assets: LAPIS primarily focuses on forex trading. However, the complete range of available trading instruments and asset classes is not comprehensively detailed.

Cost Structure: The broker advertises starting spreads from 1 pip. However, specific commission structures and additional fees are not clearly outlined in available materials.

Leverage Options: Maximum leverage is advertised at 1:500. This represents a high-leverage offering typical of offshore brokers targeting retail clients.

Platform Options: Trading is conducted exclusively through the MT4 platform. This limits options for traders who prefer alternative trading interfaces.

Geographic Restrictions: Specific information regarding geographic restrictions and service availability is not detailed in current documentation.

Customer Support Languages: Available customer support languages and communication options are not specified in available materials.

This lapis review highlights significant information gaps that potential clients should consider when evaluating this broker.

LAPIS offers three distinct account types: Copper, Silver, and Gold accounts. Each is designed to accommodate different trader profiles and capital levels. This tiered approach allows the broker to serve a range of clients from beginners to more experienced traders. The minimum deposit requirement of $50 for entry-level accounts makes the platform accessible to traders with limited initial capital. This accessibility is particularly attractive for newcomers to forex trading.

Each account tier reportedly offers different spreads and leverage conditions. However, specific details regarding the exact differences between account types are not comprehensively outlined in available documentation. The low entry barrier represented by the $50 minimum deposit is competitive within the offshore broker space and aligns with the broker's apparent strategy. This strategy targets retail traders seeking accessible trading opportunities.

However, the lack of detailed information regarding account-specific features, benefits, and exact trading conditions represents a significant transparency concern. Potential clients would benefit from clearer disclosure regarding what distinguishes each account type and what specific advantages higher-tier accounts provide. This lapis review notes that while the account structure appears designed to accommodate various trader needs, the limited available information makes it difficult to fully assess the value proposition of each account tier.

LAPIS utilizes MT4 as its primary trading platform. This provides traders with access to a well-established and widely recognized trading interface. MT4 offers standard features including technical analysis tools, automated trading capabilities through Expert Advisors, and customizable charting options that many traders find familiar and functional.

However, beyond the MT4 platform itself, specific information regarding additional trading tools, market analysis resources, and educational materials is not detailed in available documentation. Modern traders often expect brokers to provide comprehensive market research, daily analysis, economic calendars, and educational resources to support their trading activities.

The absence of clear information regarding research and analysis resources represents a significant limitation. This is particularly concerning for newer traders who rely on broker-provided educational content and market insights. Additionally, details regarding automated trading support, advanced analytical tools, or proprietary trading resources are not specified in current materials.

For a comprehensive trading experience, traders typically seek brokers that offer robust educational programs, regular market analysis, and advanced trading tools beyond basic platform functionality. The limited information available regarding these supplementary resources suggests that LAPIS may not prioritize comprehensive trader education and support tools.

Customer service information for LAPIS is notably limited in available documentation. This presents concerns regarding support accessibility and quality. Specific details regarding customer service channels, availability hours, response times, and supported languages are not clearly outlined. This makes it difficult for potential clients to assess the level of support they can expect.

Professional forex brokers typically provide multiple contact methods including phone support, live chat, email assistance, and comprehensive FAQ sections. The availability of 24/5 support during market hours is generally considered standard, particularly for brokers serving international clients across multiple time zones.

Without clear information regarding customer service capabilities, traders cannot adequately assess whether they will receive timely assistance when needed. This is particularly concerning for active traders who may require immediate support for technical issues, account problems, or trading-related queries.

The absence of detailed customer service information also raises questions about the broker's commitment to client support and overall service quality. Established brokers typically prominently display their customer service capabilities as a key selling point. The lack of such information in LAPIS documentation represents a significant transparency gap.

LAPIS offers trading through the MT4 platform with starting spreads from 1 pip. This provides a foundation for the trading experience. MT4 is a reliable and widely-used platform that offers stability and functionality familiar to many forex traders. The platform supports various order types, technical analysis tools, and automated trading capabilities that form the backbone of most retail forex trading activities.

The advertised starting spreads of 1 pip are competitive within the offshore broker space. However, specific information regarding average spreads during different market conditions, execution speeds, and slippage rates is not detailed in available documentation. These factors significantly impact the actual trading experience and overall trading costs.

High leverage up to 1:500 provides opportunities for traders seeking to maximize their position sizes relative to their account capital. However, this also substantially increases risk exposure. The leverage offering aligns with typical offshore broker practices targeting retail clients seeking maximum trading flexibility.

However, crucial information regarding execution quality, order filling speeds, platform stability during high-volatility periods, and mobile trading capabilities is not comprehensively detailed. These factors are essential for assessing the practical trading experience that clients can expect. This lapis review notes that while basic trading infrastructure appears adequate, the lack of detailed performance metrics makes it difficult to fully evaluate trading experience quality.

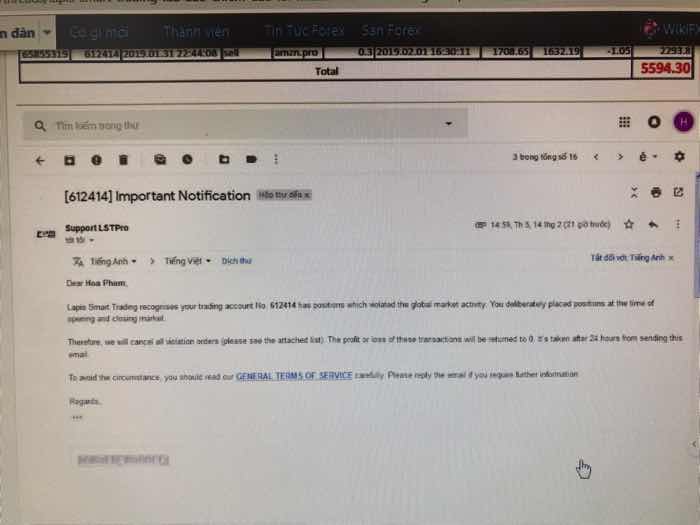

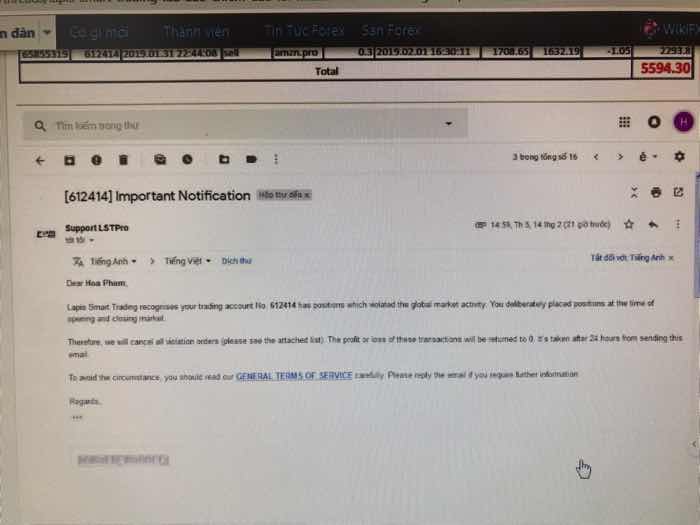

Trust and reliability represent significant concerns in this LAPIS evaluation. The broker operates from Seychelles jurisdiction without clearly established regulatory oversight or licensing information. This immediately raises questions regarding trader protection and regulatory compliance. Established regulatory frameworks provide essential protections including segregated client funds, compensation schemes, and regulatory oversight of business practices.

The absence of clear regulatory information means traders cannot rely on standard regulatory protections that are typically available with properly licensed brokers. This includes protections regarding fund segregation, dispute resolution mechanisms, and regulatory oversight of business practices and financial stability.

Company transparency is limited, with minimal information available regarding corporate structure, management team, financial backing, or operational history. Established brokers typically provide comprehensive corporate information, regulatory documentation, and transparent business practices as fundamental trust-building measures.

Without clear regulatory oversight and comprehensive corporate transparency, traders face elevated risks regarding fund safety, business continuity, and recourse options in case of disputes. The offshore jurisdiction and limited regulatory clarity significantly impact the overall trust and reliability assessment for this broker.

User experience evaluation for LAPIS is limited by the lack of comprehensive information regarding interface design, account management processes, and overall client satisfaction. The MT4 platform provides a familiar trading interface for many users. However, specific customizations or enhancements that LAPIS may have implemented are not detailed.

The low minimum deposit requirement of $50 creates an accessible entry point for new traders. This positively impacts the initial user experience for those with limited capital. The multiple account tiers suggest an attempt to accommodate different user needs and experience levels. However, specific benefits and features of each tier are not clearly outlined.

Critical user experience factors including account registration processes, verification procedures, deposit and withdrawal efficiency, and overall platform usability are not comprehensively documented. These elements significantly impact day-to-day user satisfaction and overall broker experience.

The target user profile appears to be retail traders seeking high leverage and low entry barriers. This aligns with the broker's basic offerings. However, without detailed user feedback, comprehensive feature documentation, or clear service standards, it is difficult to assess whether the actual user experience meets expectations or industry standards.

LAPIS presents itself as an offshore forex broker offering high leverage and low minimum deposit requirements. This may appeal to retail traders seeking accessible trading opportunities. However, this lapis review reveals significant concerns regarding regulatory oversight, transparency, and comprehensive service offerings that potential clients must carefully consider.

While the broker offers competitive leverage up to 1:500 and maintains a low $50 minimum deposit threshold, the absence of clear regulatory information and limited transparency regarding company operations present substantial risks. The lack of detailed information regarding customer service, trading tools, and user experience further complicates the evaluation process.

LAPIS may be suitable for experienced traders who understand and accept the risks associated with offshore, unregulated brokers. These traders must prioritize high leverage and low entry barriers over regulatory protection and comprehensive service offerings. However, most traders, particularly beginners, would benefit from choosing brokers with clear regulatory oversight and comprehensive transparency regarding their operations and protections.

FX Broker Capital Trading Markets Review