Is VAST safe?

Business

License

Is Vast Safe or Scam?

Introduction

Vast, known formally as Vast Scenery Court Group Limited, is a forex and CFD broker that has been operational since 2018. Based in the UK, it positions itself as a provider of online trading services across various financial instruments, including forex, commodities, indices, and cryptocurrencies. As the forex market continues to grow, the need for traders to carefully evaluate brokers has never been more critical. With numerous reports of scams and fraudulent activities in the industry, traders must remain vigilant and conduct thorough investigations before committing their capital. This article employs a structured approach to assess whether Vast is a safe trading option or a potential scam, examining its regulatory standing, company background, trading conditions, customer fund security, and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy. A regulated broker is subject to oversight by financial authorities, ensuring compliance with industry standards and protecting client funds. Unfortunately, Vast operates without any valid regulatory oversight, which raises significant red flags. Below is a summary of the brokers regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Vast is not held accountable by any reputable authority, which could jeopardize the safety of client funds. Regulatory bodies, such as the UKs Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), have stringent requirements for brokers, including maintaining segregated accounts and undergoing regular audits. The lack of such oversight for Vast indicates a higher risk for traders, as there are no guarantees of fair trading practices or fund protection.

Company Background Investigation

Vast Scenery Court Group Limited was founded in 2018 and claims to operate from the UK. However, its actual operational history and ownership structure remain ambiguous. The company does not provide sufficient information regarding its management team or their professional backgrounds, raising concerns about transparency. A lack of clear information regarding the companys leadership and operational history can be a warning sign for potential clients.

Moreover, the broker's website lacks detailed disclosures about its corporate governance, which is essential for building trust. Reliable brokers typically provide comprehensive information about their history, ownership, and management team, fostering confidence among clients. The limited information available regarding Vast's operations may deter potential traders who value transparency and accountability in their trading partners.

Trading Conditions Analysis

Vast's trading conditions are a crucial aspect to consider when evaluating its reliability. The broker offers a variety of trading instruments, but it is essential to analyze the overall cost structure associated with trading. Below is a comparison of Vast's core trading costs with industry averages:

| Cost Type | Vast | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.2 pips | 1.5 pips |

| Commission Model | $6 per lot round trip | $5 per lot |

| Overnight Interest Range | Higher than average | Average |

Vast's spreads, particularly for major currency pairs, are higher than the industry average, which can significantly impact trading profitability. Furthermore, the commission structure is relatively standard, but traders should be cautious of any hidden fees that may not be clearly disclosed. The broker does not provide transparent information about its overnight interest rates, which could lead to unexpected costs for traders holding positions overnight.

Customer Fund Security

The safety of client funds is a paramount concern for any trader. Vast does not provide adequate information regarding its security measures for client funds. A reputable broker should have policies in place for fund segregation, investor protection, and negative balance protection. Unfortunately, Vast has not demonstrated any such measures, which poses a risk for traders.

Without regulatory oversight, there are no guarantees that client funds are protected or that the broker operates under strict financial guidelines. Historical issues related to fund security or disputes have not been publicly documented for Vast, but the lack of transparency regarding its financial practices raises significant concerns.

Customer Experience and Complaints

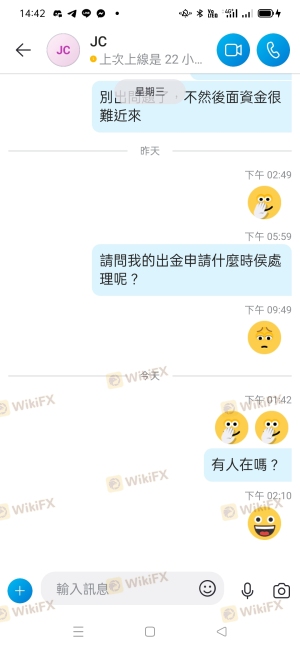

Analyzing customer feedback is crucial in assessing a broker's reliability. The experiences of existing users can provide insights into the broker's operational integrity and customer service quality. However, many reviews for Vast indicate a pattern of complaints, particularly regarding withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Slow |

| Misleading Information | High | Non-responsive |

Several clients have reported difficulties in withdrawing their funds, often citing delays and unresponsive customer service. In some cases, traders have been encouraged to deposit additional funds before they could access their existing balances, a common tactic employed by dubious brokers. These patterns of complaints suggest potential operational issues that could indicate a lack of integrity.

Platform and Trade Execution

The trading platform is another critical factor in evaluating a broker's reliability. Vast offers the popular MetaTrader 4 platform, known for its user-friendly interface and advanced features. However, the execution quality, including slippage rates and order rejection occurrences, is essential to assess. Reports from users indicate that there may be issues with order execution, including higher-than-expected slippage and occasional rejections of orders, which can negatively affect trading performance.

Risk Assessment

Engaging with Vast carries inherent risks due to its unregulated status and lack of transparency. Below is a summary of the key risk areas associated with trading with Vast:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight; funds may be at risk. |

| Withdrawal Risk | High | Reports of delayed withdrawals and poor customer support. |

| Transparency Risk | Medium | Limited information about the company and its practices. |

Traders should exercise caution and consider the risks associated with trading with Vast. It is advisable to conduct extensive research and consider regulated alternatives that offer better protection and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Vast is not a safe trading option. The lack of regulatory oversight, combined with numerous reports of customer complaints and poor transparency, raises significant concerns about the broker's integrity. Traders should be particularly wary of the potential for withdrawal issues and the overall safety of their funds.

For those considering trading in the forex market, it is recommended to seek out brokers that are well-regulated and have a proven track record of reliability. Alternatives such as brokers regulated by the FCA or ASIC may provide a safer trading environment. In summary, while Vast may offer some appealing features, the associated risks and lack of regulatory protection make it a broker best approached with caution.

Is VAST a scam, or is it legit?

The latest exposure and evaluation content of VAST brokers.

VAST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VAST latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.