Is SOD safe?

Pros

Cons

Is SOD Safe or Scam?

Introduction

SOD, also known as SOD Global, is a forex broker that has gained attention in the online trading community. Operating primarily in the realm of forex and contracts for difference (CFDs), SOD positions itself as a platform for traders seeking access to various financial markets. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with scams and unregulated brokers, making it essential for traders to assess the legitimacy and safety of brokers like SOD.

This article aims to provide an objective analysis of whether SOD is a safe trading platform or a potential scam. Our investigation is based on a comprehensive review of various online sources, including regulatory bodies, user reviews, and industry reports. We will evaluate SOD's regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. By the end of this analysis, traders will have a clearer understanding of whether SOD is a trustworthy broker or one to avoid.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of any forex broker. A regulated broker is subject to strict oversight by financial authorities, which helps to protect traders from fraud and malpractice. In the case of SOD, the broker claims to operate under the jurisdiction of the United Kingdom. However, multiple sources indicate that SOD lacks any valid regulatory licenses, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation is alarming, as it implies that SOD is not held accountable to any regulatory standards. This lack of oversight can lead to issues such as difficulty in withdrawing funds, manipulation of trading conditions, and potential fraud. Moreover, the fact that SOD is described as a "non-existent" entity by some reviewers highlights the importance of exercising caution. Traders are generally advised to engage only with brokers that have robust regulatory frameworks in place, as this significantly reduces the risk of encountering scams. Therefore, the question remains: Is SOD safe? The evidence suggests otherwise.

Company Background Investigation

SOD Global Limited was reportedly founded in 2006, but the details surrounding its ownership and operational history remain murky. The lack of transparency regarding the company's management team and their professional backgrounds is troubling. A credible broker typically provides information about its founders and key personnel, including their qualifications and experience in the financial industry. However, SOD has not made such information readily available, which raises suspicions about its legitimacy.

Moreover, the company's website does not provide adequate information about its physical address or contact details, further obscuring its operational legitimacy. A trustworthy broker should have a clear and transparent presence, allowing clients to verify their claims easily. The opacity surrounding SODs ownership structure and operational history contributes to the growing concerns about its safety. Without proper disclosure and transparency, the question of Is SOD safe? remains unanswered, leaning toward skepticism.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its credibility. SOD claims to offer competitive spreads and a variety of trading instruments, including forex, commodities, and indices. However, upon closer inspection, the details surrounding its fees and commissions appear vague and inconsistent.

| Fee Type | SOD Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific information regarding spreads and commissions raises red flags. A reputable broker should provide clear and detailed information about its fee structure, allowing traders to make informed decisions. Additionally, some user reviews have reported unexpected charges and hidden fees, which could indicate deceptive practices. This uncertainty around trading costs leads to the conclusion that Is SOD safe? is a question worth reconsidering for potential traders.

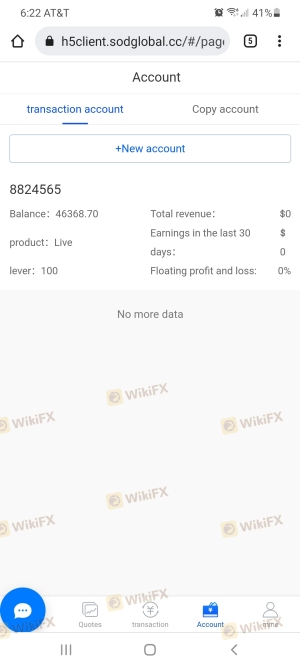

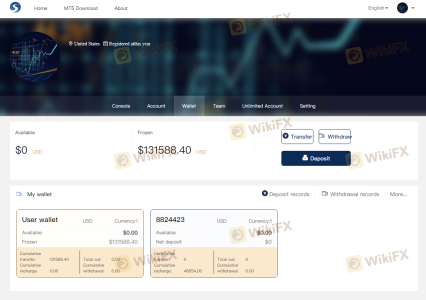

Customer Fund Safety

The safety of customer funds is paramount when evaluating any forex broker. SOD's website claims to employ various security measures to protect client funds, but the absence of regulatory oversight raises serious concerns. A regulated broker typically segregates client funds from its operational capital, ensuring that traders' money is protected in the event of financial issues.

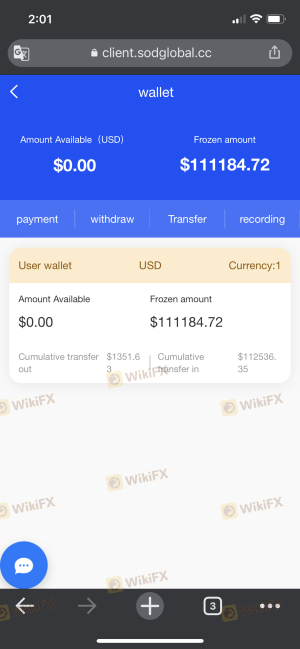

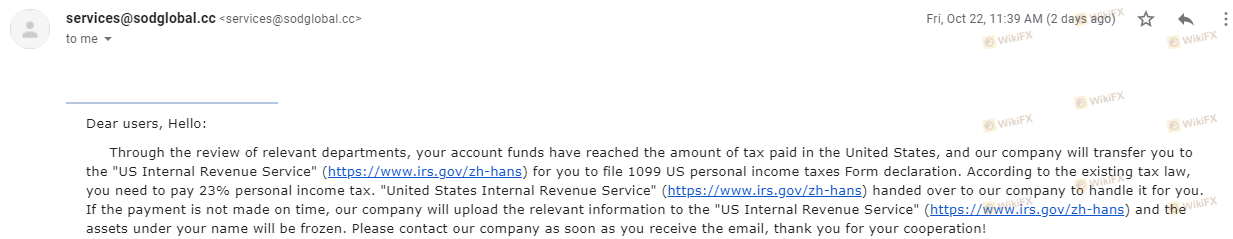

Additionally, investor protection schemes offered by regulatory bodies provide an extra layer of security for traders. However, as SOD is unregulated, it does not offer such protections. Historical issues related to fund safety have been reported, including complaints about difficulty in withdrawing funds and sudden account closures. These factors contribute to a growing perception that SOD may not prioritize customer fund safety, leading to the question: Is SOD safe? The evidence suggests that traders should exercise extreme caution.

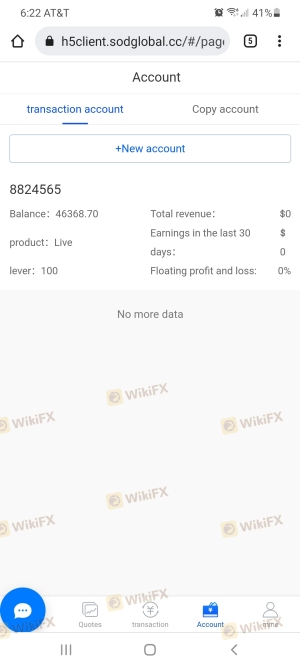

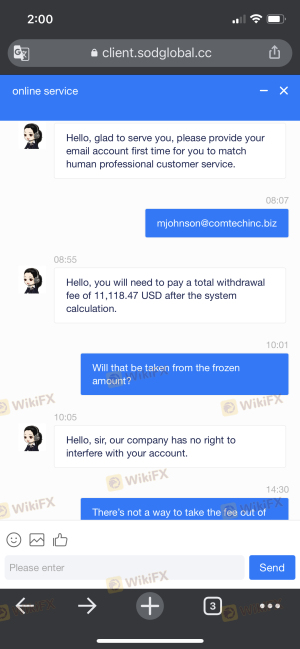

Customer Experience and Complaints

User feedback is a valuable resource for assessing a broker's reliability. A review of customer experiences with SOD reveals a pattern of complaints, primarily concerning withdrawal issues and unresponsive customer service. Many users have reported difficulties in accessing their funds, with some claiming that their accounts were frozen without explanation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Hidden Fees | High | Poor |

Two notable cases highlight these issues. In one instance, a trader reported that their funds were labeled as "dormant" and subsequently charged fees without prior notice. In another case, a user described their attempts to contact customer service as futile, as they received no response despite multiple inquiries. The consistent nature of these complaints raises significant concerns about SOD's operational integrity and customer support. Therefore, it is reasonable to ask: Is SOD safe? The overwhelming negative feedback suggests that potential traders may want to consider other options.

Platform and Trade Execution

The trading platform provided by a broker is crucial for a positive trading experience. SOD claims to offer the popular MetaTrader 5 platform, which is known for its robust features and user-friendly interface. However, user reviews indicate that the platform has experienced stability issues, including frequent disconnections and slow order execution times.

Many traders have expressed frustration with slippage during high-volatility periods, which can significantly impact trading outcomes. Additionally, there have been allegations of order manipulation, where trades were allegedly executed at unfavorable prices. Such practices can severely undermine a trader's confidence in the broker. Given these concerns, traders must seriously consider the implications of using SOD's platform. The question of Is SOD safe? becomes even more pressing in light of these performance issues.

Risk Assessment

Engaging with any broker entails inherent risks, and SOD is no exception. The following risk assessment summarizes the key risks associated with trading with SOD:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of segregation and investor protection. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

| Trading Platform Risk | High | Stability issues and potential order manipulation. |

To mitigate these risks, traders should consider using regulated brokers with a solid reputation, transparent fee structures, and responsive customer service. Additionally, conducting thorough research and reading user reviews can help traders make informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that SOD Global may not be a safe trading option for prospective traders. The lack of regulation, transparency issues, poor customer service, and concerning user experiences raise significant red flags. Therefore, the question Is SOD safe? appears to lean towards a negative response.

Traders are advised to exercise caution and consider alternative brokers that are well-regulated and known for their reliability. Some recommended alternatives include brokers that are regulated by top-tier authorities, offering robust customer support, clear fee structures, and a proven track record of protecting client funds. Ultimately, the safety of your trading experience should always be the top priority.

Is SOD a scam, or is it legit?

The latest exposure and evaluation content of SOD brokers.

SOD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SOD latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.