IFX Brokers 2025 Review: Everything You Need to Know

Executive Summary

IFX Brokers is a South Africa-based fully automated STP (Straight Through Processing) broker. It has been providing comprehensive trading services across multiple financial instruments since 2017. This ifx brokers review reveals a broker that positions itself as an accessible entry point for traders seeking diverse market exposure with competitive conditions.

The broker's standout features include exceptionally high leverage of up to 1:1000 and an ultra-low minimum deposit requirement of just $10. This makes it particularly attractive to new traders and those with limited capital. Operating under the regulation of South Africa's Financial Sector Conduct Authority (FSCA), IFX Brokers offers access to forex, stocks, commodities, cryptocurrencies, ETFs, and indices through the popular MetaTrader 4 and MetaTrader 5 platforms.

According to [TradingBrokers.com], the broker operates as an STP model. It provides direct market access with variable spreads and commission structures starting from $0. The company supports multiple funding methods including OZOW, PAYFAST, major credit cards, wire transfers, e-wallets like Skrill and Neteller, and cryptocurrency deposits, catering to a global clientele's diverse payment preferences.

The primary target audience consists of retail traders seeking low-barrier entry to financial markets. These traders are particularly interested in high-leverage trading opportunities and multi-asset portfolio diversification.

Important Disclaimer

IFX Brokers operates under South African jurisdiction. It is regulated by the Financial Sector Conduct Authority (FSCA). Traders should be aware that the regulatory framework governing this broker may differ significantly from brokers operating under European, US, or other international regulatory regimes.

The legal protections, compensation schemes, and dispute resolution mechanisms available may vary accordingly. This review is compiled based on publicly available information and user feedback as of 2025. Market conditions, regulatory requirements, and broker policies are subject to change.

Potential clients should conduct their own due diligence and verify current terms and conditions directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

IFX Brokers was established in 2017. It has positioned itself as a technology-driven brokerage firm headquartered in Jeffreys Bay, South Africa. According to [FX-List.com], the company has built its reputation on providing transparent and compliant trading environments for retail and institutional clients alike.

The broker's commitment to regulatory compliance is evidenced by its registration with the Financial Sector Conduct Authority (FSCA). This is South Africa's primary financial services regulator. Operating as a fully automated STP broker, IFX Brokers facilitates direct market connectivity, ensuring that client orders are processed efficiently without dealer intervention.

This model typically results in faster execution speeds and reduced conflicts of interest, as [TradingBrokers.com] reports. The company's technological infrastructure supports real-time price feeds and automated order routing to liquidity providers. This enhances the overall trading experience for users across different time zones and market conditions.

The broker's platform ecosystem centers around the industry-standard MetaTrader 4 and MetaTrader 5 platforms. These provide traders with familiar and robust trading environments. According to available information, clients can access an extensive range of financial instruments including major and minor forex pairs, individual stocks, commodities like gold and oil, popular cryptocurrencies, exchange-traded funds (ETFs), and global stock indices.

This ifx brokers review finds that the diversity of available instruments positions the broker well for traders seeking portfolio diversification opportunities.

Regulatory Jurisdiction: IFX Brokers operates under FSCA regulation in South Africa. This provides clients with regulatory oversight that ensures compliance with local financial services legislation and consumer protection standards.

Deposit and Withdrawal Methods: The broker supports comprehensive funding options including OZOW, PAYFAST, MasterCard, Visa, traditional bank wire transfers, popular e-wallets Skrill and Neteller, and various cryptocurrency payment methods. These offer flexibility for international clients.

Minimum Deposit Requirements: With a minimum deposit of just $10, IFX Brokers maintains one of the lowest entry barriers in the industry. This makes trading accessible to beginners and those with limited initial capital.

Promotional Offers: Specific information regarding bonus promotions and incentive programs was not detailed in available sources. This suggests the broker may focus more on competitive trading conditions rather than promotional marketing.

Available Trading Instruments: The broker provides access to six major asset categories: foreign exchange pairs, individual company stocks, physical and energy commodities, digital cryptocurrencies, exchange-traded funds, and global market indices.

Cost Structure: According to [TradingBrokers.com], the broker operates with variable spread pricing and commission structures beginning at $0. However, specific costs may vary depending on account type, trading volume, and prevailing market conditions.

Leverage Options: Maximum leverage reaches 1:1000. This positions IFX Brokers among the higher-leverage offerings in the retail trading space, particularly appealing to traders employing scalping or high-frequency trading strategies.

Platform Selection: Both MetaTrader 4 and MetaTrader 5 are available. These provide traders with choice between the classic MT4 interface and the more advanced features of MT5, including additional timeframes and order types.

Regional Restrictions: Specific geographical limitations were not detailed in available documentation. However, regulatory requirements typically restrict certain jurisdictions.

Customer Support Languages: Available sources did not specify the range of languages supported by customer service representatives. This ifx brokers review notes this as an area requiring direct verification with the broker.

Account Conditions Analysis

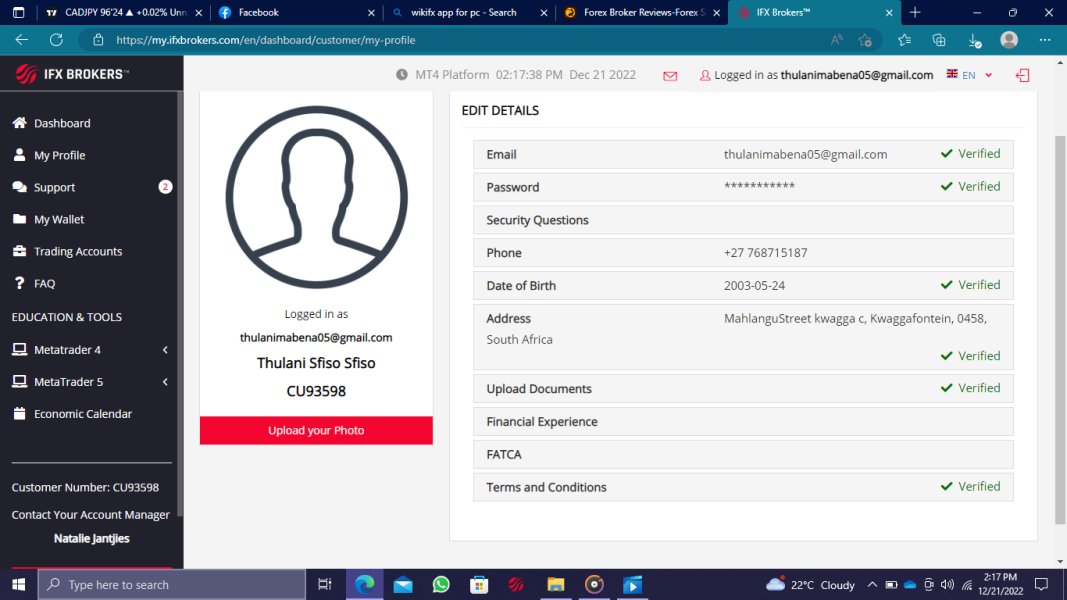

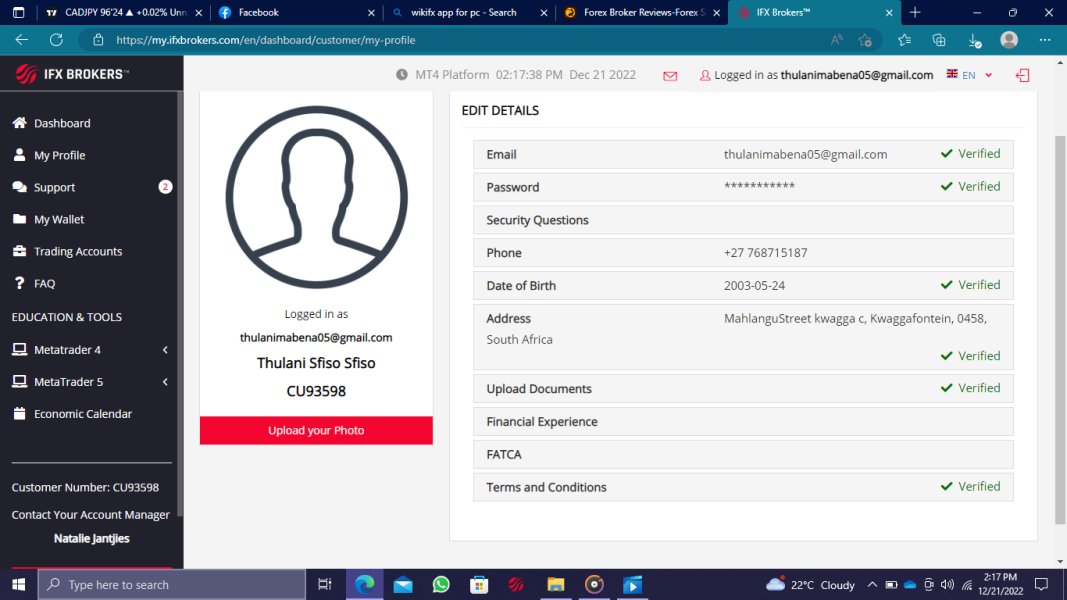

IFX Brokers demonstrates exceptional accessibility in its account structure. The $10 minimum deposit requirement represents one of the industry's most inclusive entry points. According to [TradingBrokers.com], this low threshold enables new traders to begin their trading journey without significant financial commitment, while the commission structure starting from $0 provides cost-effective trading opportunities.

This is particularly beneficial for high-frequency traders and those working with smaller position sizes. The account opening process appears streamlined and modernized, following contemporary digital onboarding standards common among regulated brokers. While specific details about account tier variations were not extensively documented in available sources, the broker's STP model suggests that all clients receive direct market access regardless of account size.

This is typically a significant advantage over market maker models that may present conflicts of interest. User feedback regarding account conditions has been generally positive, with traders appreciating the low barrier to entry and the absence of hidden fees in basic account structures. However, as noted in [IfxBrokers.com] testimonials, while users praise the reliability of deposit and withdrawal services, some express concerns about the overall customer service experience.

This can impact account management satisfaction. Compared to industry standards, IFX Brokers' $10 minimum deposit significantly undercuts many established brokers who typically require $100-$500 minimum deposits. This positioning makes the broker particularly attractive to emerging market traders and those in regions where purchasing power may be limited.

The ifx brokers review data suggests this strategy has been effective in attracting a diverse international client base.

The broker's technology stack centers on the MetaTrader platform ecosystem. It provides traders with access to both MT4 and MT5 environments. These platforms offer comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors (EAs), and signal service integration.

According to [TradingBrokers.com], the availability of both platforms allows traders to choose based on their specific needs. MT4 is favored for its simplicity and widespread EA compatibility, while MT5 offers enhanced features for more sophisticated trading strategies. The range of available instruments across six major asset categories provides substantial diversification opportunities.

The inclusion of cryptocurrencies alongside traditional forex and CFD offerings reflects the broker's adaptation to evolving market demands. However, specific information regarding proprietary research tools, market analysis resources, or educational content was not extensively detailed in available sources. Automated trading support appears robust, with both platforms supporting EA functionality and algorithmic trading strategies.

This capability is particularly valuable for traders employing systematic approaches or those unable to monitor markets continuously due to time zone differences or other commitments. While the technological foundation appears solid, the absence of detailed information about additional research resources, economic calendars, or educational materials suggests this may be an area where IFX Brokers could enhance its offering.

This would help them better compete with full-service brokers who provide comprehensive market analysis and trader education programs.

Customer Service and Support Analysis

Customer service represents a significant challenge area for IFX Brokers based on available user feedback. According to reviews on [Trustpilot-style sources], multiple users have reported unsatisfactory experiences with customer service representatives, specifically citing issues with attitude and professionalism. One documented case mentions a specific representative, Lelanie Fouche, being described as having "rude attitude and unprofessional behavior when dealing with issues."

The broker provides multiple contact channels including telephone support, email communication, and online chat functionality. However, user feedback suggests that response times may be longer than industry standards, and the quality of support provided has been inconsistent. This represents a critical area for improvement, as customer service quality often determines client retention and satisfaction in the competitive brokerage industry.

The lack of specific information about multilingual support capabilities or 24/7 availability suggests that international clients may face additional challenges when seeking assistance outside of South African business hours. For a broker targeting global markets, expanded language support and extended service hours would significantly enhance the client experience. The contrast between reliable technical services (deposits, withdrawals, and platform functionality) and poor interpersonal customer service suggests that while IFX Brokers has invested effectively in operational infrastructure, human resource training and customer relations protocols may require substantial attention and improvement.

Trading Experience Analysis

The trading experience with IFX Brokers appears technically sound based on user feedback regarding platform stability and execution quality. Users report that both MetaTrader platforms operate reliably with fast execution speeds, which is crucial for the STP model's effectiveness. The automated order routing system appears to minimize slippage incidents, contributing to trader satisfaction with order fulfillment quality.

The high leverage offering of up to 1:1000 provides significant flexibility for traders employing various strategies. These range from conservative long-term approaches to aggressive scalping techniques. This leverage level, combined with the low minimum deposit, creates opportunities for traders to implement sophisticated position sizing strategies even with limited capital.

Platform functionality encompasses the full range of MetaTrader capabilities, including advanced charting tools, technical indicators, multiple order types, and one-click trading features. The availability of both MT4 and MT5 ensures that traders can select the environment that best matches their experience level and strategy requirements. While specific mobile trading experience details were not extensively documented, MetaTrader's mobile applications typically provide comprehensive functionality for traders requiring market access while away from desktop computers.

The ifx brokers review indicates that the technical trading infrastructure meets industry standards for retail forex and CFD trading.

Trust and Reliability Analysis

IFX Brokers' regulatory status under the Financial Sector Conduct Authority (FSCA) provides a foundation of institutional oversight and compliance requirements. FSCA regulation includes provisions for client fund protection, business conduct standards, and dispute resolution mechanisms, though the specific protections may differ from those offered under European or US regulatory frameworks. The broker's establishment in 2017 provides several years of operational history, though this is relatively recent compared to some established industry players.

According to [FX-List.com], the company has maintained its regulatory standing without documented major regulatory violations or sanctions. This supports its credibility within the South African financial services sector. Client fund safety measures and segregation policies were not specifically detailed in available sources, representing an area where potential clients should seek direct clarification from the broker.

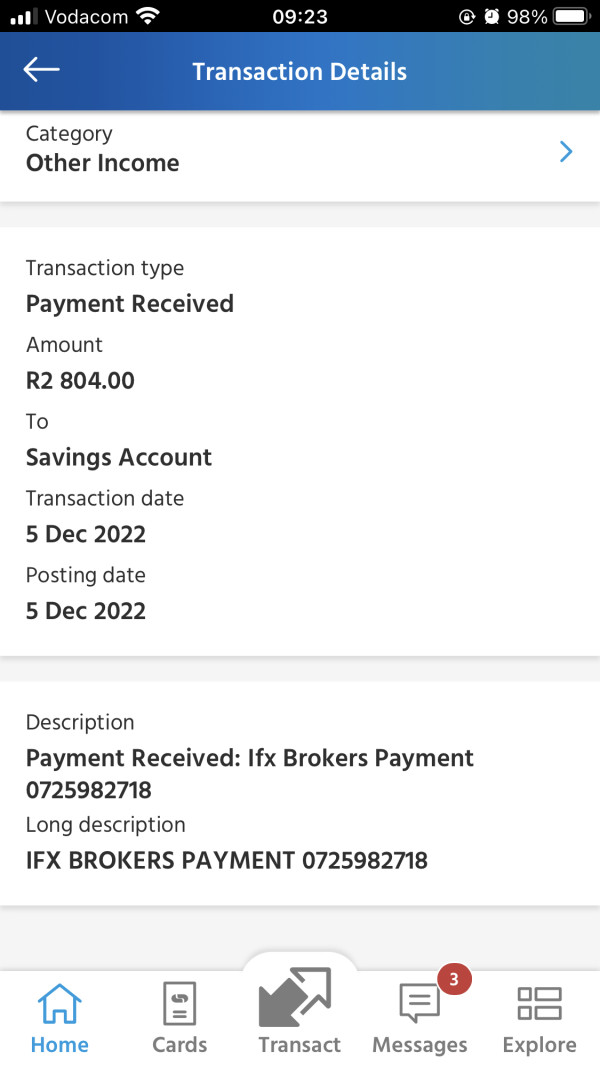

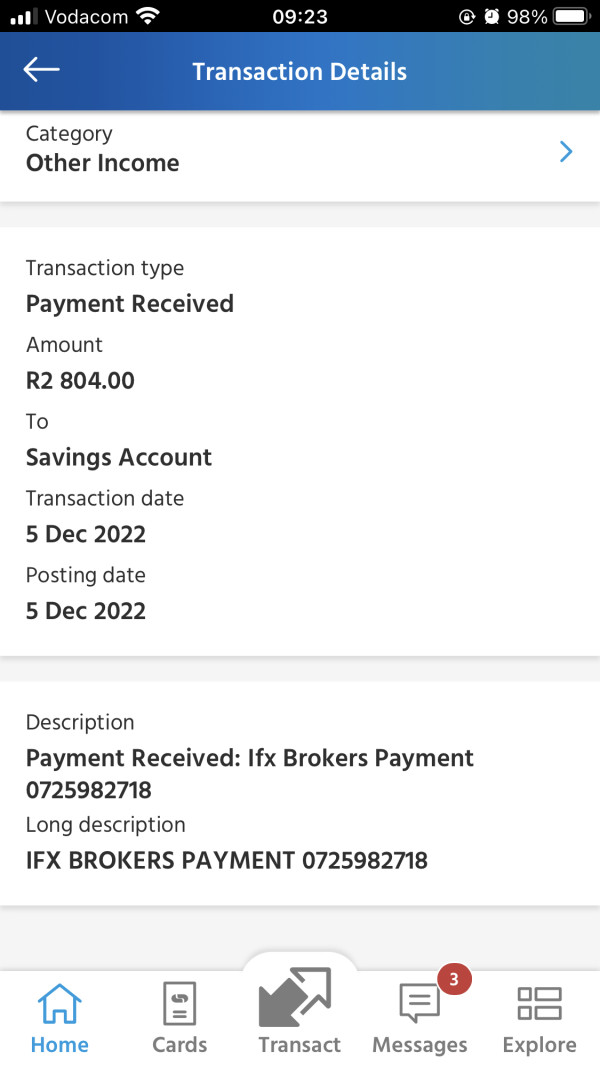

The absence of third-party verification or industry awards in available documentation suggests that while the broker maintains regulatory compliance, it may not have achieved broader industry recognition for excellence. User feedback regarding fund security and withdrawal reliability has been generally positive, with [IfxBrokers.com] testimonials specifically praising the "easy and reliable service when it comes to depositing and withdrawing." This practical reliability in fund operations supports client confidence in the broker's operational integrity, even if broader transparency measures could be enhanced.

User Experience Analysis

Overall user satisfaction with IFX Brokers presents a mixed picture. Strong technical performance is offset by customer service challenges. Users consistently praise the reliability of core trading functions, including platform stability, order execution, and fund transfer operations.

The straightforward account opening process and low entry requirements receive positive feedback from new traders who appreciate the accessible onboarding experience. The platform interface design benefits from MetaTrader's established user experience principles, providing familiar navigation and functionality for traders experienced with industry-standard platforms. The registration and verification processes appear streamlined and efficient, meeting contemporary expectations for digital financial services.

However, customer service quality emerges as the primary user complaint, with multiple reports of unprofessional interactions and inadequate problem resolution. This creates a significant disconnect between the technical reliability users experience and the human support they receive when issues arise. The broker appears most suitable for self-directed traders who prioritize low costs and technical reliability over comprehensive support services.

New traders or those requiring frequent assistance may find the customer service limitations frustrating, while experienced traders focused on execution quality and cost efficiency may find the offering more satisfactory. Recommended improvements include comprehensive customer service training, expanded support hours, and enhanced communication protocols to align human service quality with the technical infrastructure's reliability.

Conclusion

This ifx brokers review reveals a broker that excels in technical execution and accessibility while facing significant challenges in customer service delivery. IFX Brokers successfully serves traders seeking low-cost entry to diverse financial markets, with its $10 minimum deposit and 1:1000 leverage creating opportunities for both novice and experienced traders. The broker is most suitable for cost-conscious traders who prioritize technical reliability over comprehensive support services, particularly those comfortable with self-directed trading approaches.

The strong platform offering and reliable fund operations make it viable for traders focused on execution quality and minimal fees. Key advantages include exceptional accessibility through low minimum deposits, comprehensive asset class coverage, reliable technical infrastructure, and competitive cost structures. Primary disadvantages center on customer service quality issues and limited educational or research resources compared to full-service competitors.

Potential clients should carefully consider their support requirements and trading independence level when evaluating IFX Brokers as their trading partner.