Is KUN safe?

Pros

Cons

Is Kun Safe or a Scam?

Introduction

Kun, a forex broker operating in the online trading space, has garnered attention for its unique offerings and market positioning. As a platform that aims to cater to both novice and experienced traders, it is essential for potential clients to thoroughly assess its credibility and reliability. Given the rapid growth of the forex market, traders are often drawn to various brokers, making it crucial to evaluate the legitimacy and safety of these platforms. This article aims to provide a comprehensive analysis of Kun, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. By utilizing a structured evaluation framework, we will determine whether Kun is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a significant factor in assessing its safety and legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. In the case of Kun, the broker operates without a recognized regulatory license, which raises concerns about its credibility and operational transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulatory oversight means that Kun does not have to comply with the stringent requirements imposed by financial authorities, leaving traders vulnerable to potential misconduct. Historically, brokers without regulation have been associated with high risks, including the inability to withdraw funds and the lack of investor protection. Therefore, it is crucial for traders to approach Kun with caution, as the lack of regulation is a significant red flag when determining if Kun is safe.

Company Background Investigation

Kun's history and ownership structure play a vital role in understanding its operational integrity. Established with the intent to provide a user-friendly trading experience, Kun has positioned itself as a player in the forex market. However, details about its founding members and management team remain sparse, leading to questions about its transparency.

The management team‘s background is crucial in evaluating the broker's reliability. A well-experienced team can enhance trust and credibility. Unfortunately, limited information about the executives raises concerns regarding their expertise in the financial sector. The opacity surrounding Kun’s operations and ownership structure further complicates the assessment of its legitimacy. In an industry where trust is paramount, the lack of clear communication and disclosure could suggest that Kun is not safe for potential investors.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. In the case of Kun, the broker offers various trading instruments and conditions, but the absence of transparent fee structures can be problematic.

| Fee Type | Kun | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

The spread for major currency pairs at Kun is slightly higher than the industry average, which could impact profitability for traders. Additionally, the lack of a clear commission structure raises concerns about hidden fees that may emerge during trading activities. Such practices are often associated with unregulated brokers, which is another indicator that Kun may not be safe for traders seeking a transparent trading environment.

Client Fund Security

Client fund security is one of the most critical aspects of assessing a forex broker. Traders need assurance that their funds are protected and that the broker has robust measures in place to prevent unauthorized access. Unfortunately, Kun's lack of regulatory oversight raises significant concerns regarding fund security.

While it is unclear whether Kun employs segregated accounts to separate client funds from operational funds, the absence of information on investor protection policies is alarming. Furthermore, without a regulatory body overseeing its operations, traders have no recourse in the event of fund mismanagement or fraud. Historical complaints about unregulated brokers often involve issues related to fund withdrawal and security breaches, which suggests that Kun may not be a safe option for traders looking to secure their investments.

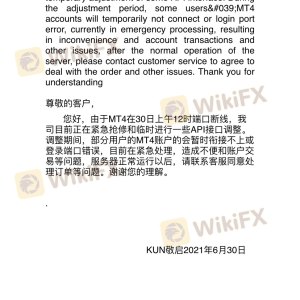

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews and testimonials from existing users can provide insights into the broker's operational practices and customer service quality. In the case of Kun, feedback has been mixed, with several users expressing dissatisfaction regarding withdrawal processes and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Limited Availability |

Common complaints revolve around difficulties in withdrawing funds, which is a significant concern for any trader. The slow response times from customer support further exacerbate these issues, indicating a lack of effective communication and service. Such patterns of complaints suggest that Kun may not be safe, as unresolved issues can lead to significant financial losses for traders.

Platform and Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. Kun offers a trading platform that is designed to be user-friendly, but concerns have been raised about its stability and execution quality. Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes.

The absence of clear data regarding execution quality and potential platform manipulations raises questions about the integrity of the trading environment. Traders need a platform that guarantees reliable execution without undue interference, and any signs of manipulation could indicate that Kun is not a safe choice for serious traders.

Risk Assessment

Using an unregulated broker like Kun comes with inherent risks that traders must consider. The overall risk landscape associated with Kun can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing potential for fraud. |

| Fund Security Risk | High | Lack of clear fund protection measures and segregation. |

| Customer Service Risk | Medium | Complaints about slow responses and withdrawal issues. |

| Platform Risk | High | Reports of slippage and order rejections indicate execution issues. |

Given the high-risk ratings in multiple categories, it is crucial for potential traders to approach Kun with extreme caution. Effective risk mitigation strategies should include extensive research, starting with a minimal investment, and ensuring that traders are prepared for potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Kun may not be a safe option for forex traders. The lack of regulatory oversight, combined with opaque operational practices and mixed customer feedback, raises significant concerns about the broker's legitimacy. Traders are advised to exercise caution and consider alternative options that offer better regulatory protection and transparency.

For those seeking reliable forex brokers, alternatives such as regulated platforms with strong reputations and positive customer experiences should be prioritized. A thorough evaluation of any broker's regulatory status, trading conditions, and customer feedback is essential to ensure a safe trading environment.

Is KUN a scam, or is it legit?

The latest exposure and evaluation content of KUN brokers.

KUN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KUN latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.