Is Invest Markets safe?

Pros

Cons

Is Invest Markets A Scam?

Introduction

Invest Markets is an online forex and CFD broker that has gained attention in the trading community since its establishment. Operating under the umbrella of Arvis Capital Limited, this broker offers a range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. With the rise of online trading, it is crucial for traders to exercise caution and thoroughly evaluate the brokers they choose to work with. This is particularly important given the prevalence of scams and unreliable brokers in the industry. In this article, we will conduct a comprehensive investigation into Invest Markets, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, and overall risk assessment.

To ensure a thorough analysis, we will utilize a variety of sources, including regulatory databases, user reviews, and expert analyses. Our evaluation framework will help us determine whether Invest Markets is a trustworthy broker or if it raises red flags that traders should be aware of.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors when assessing its legitimacy and safety. Invest Markets claims to be regulated by the International Financial Services Commission (IFSC) of Belize. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | 000307/166 | Belize | Verified |

While having a license from the IFSC indicates that the broker operates under some regulatory oversight, it is essential to note that the IFSC is considered a less stringent regulatory body compared to other top-tier regulators, such as the FCA in the UK or ASIC in Australia. The IFSC has been criticized for its lax regulatory standards, which may allow for the licensing of less reputable brokers.

Invest Markets has faced scrutiny regarding its regulatory compliance, with warnings issued by financial authorities in various jurisdictions, including Brazil and Spain, stating that the broker does not have the necessary approvals to offer financial services. This raises significant concerns about the broker's legitimacy and the protection of client funds.

Company Background Investigation

Invest Markets is operated by Arvis Capital Limited, a company registered in Belize. The broker began its operations in 2019 and has positioned itself as a player in the competitive online trading market. While the broker provides some details about its operations, there is limited transparency regarding its ownership structure and the backgrounds of its management team.

The lack of information about the management team raises concerns about the broker's credibility. A strong management team with relevant experience can significantly enhance a broker's reliability. However, without public disclosure of their qualifications and professional history, it is challenging to assess the broker's commitment to ethical practices and customer service.

Furthermore, the company's transparency regarding its operations and financial practices appears to be insufficient. Traders are often advised to choose brokers that prioritize transparency and provide clear information about their business practices, fees, and potential risks.

Trading Conditions Analysis

Invest Markets offers a range of trading conditions that include various account types and fee structures. The broker provides four types of accounts: Basic, Gold, Platinum, and VIP, with the minimum deposit starting at $250. However, the trading costs associated with these accounts are a critical aspect to consider.

Here is a comparison of core trading costs at Invest Markets:

| Cost Type | Invest Markets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 3.2 pips (Basic) | 1.0-1.5 pips |

| Commission Model | No commissions | Varies |

| Overnight Interest Range | Not specified | Varies |

The spreads offered by Invest Markets, particularly on the Basic account, are significantly higher than the industry average, which could impact profitability for traders. Additionally, the broker's fee structure includes progressive inactivity fees, which can escalate quickly if an account remains dormant for an extended period. This practice is concerning, as it can lead to unexpected costs for traders who may not be actively trading.

Customer Funds Safety

Ensuring the safety of customer funds is paramount in the trading industry. Invest Markets claims to implement measures to protect client funds, including segregating client accounts from the company's operational funds. However, the absence of a compensation scheme or negative balance protection raises concerns about the safety of traders' investments.

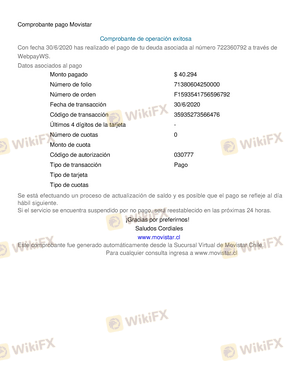

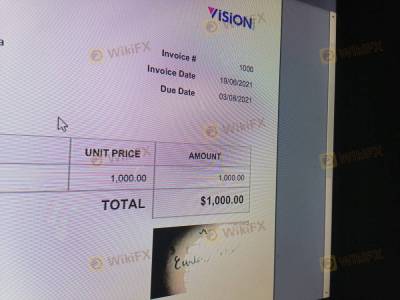

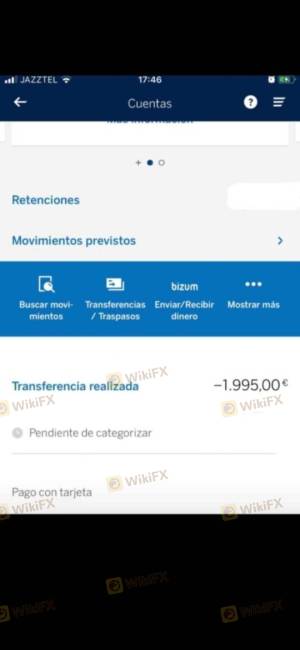

The lack of robust investor protection mechanisms can leave traders vulnerable in the event of financial difficulties faced by the broker. Additionally, there have been reports of funds being difficult to withdraw, which raises further questions about the broker's reliability in managing client funds.

Customer Experience and Complaints

User feedback is a valuable resource for assessing a broker's reputation. Invest Markets has received mixed reviews from customers, with some praising its trading platform and range of instruments, while others have reported negative experiences. Common complaints include issues with withdrawal processes, pressure from account managers to invest more funds, and concerns about transparency in trading practices.

Here is a summary of the main complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Pressure Tactics | Medium | Limited response |

| Transparency Concerns | High | Unclear responses |

Several users have reported difficulties in withdrawing their funds, with some claiming that their requests were delayed or denied without adequate justification. These issues can significantly impact a trader's experience and trust in the broker.

Platform and Trade Execution

The trading platform offered by Invest Markets includes the popular MetaTrader 4 (MT4) and a proprietary web-based platform. While MT4 is well-regarded for its features and user-friendliness, the performance and stability of the proprietary platform have raised concerns among users. Reports of slippage and order rejections have been noted, which can hinder trading efficiency and profitability.

Risk Assessment

Trading with Invest Markets carries inherent risks that potential clients should be aware of. The following risk assessment summarizes key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight |

| Fund Safety Risk | High | No investor protection mechanisms |

| Withdrawal Risk | Medium | Complaints about withdrawal delays |

| Transparency Risk | High | Limited information about management |

To mitigate these risks, traders are advised to conduct thorough research, consider using smaller amounts for initial trades, and remain vigilant about their trading practices.

Conclusion and Recommendations

In conclusion, while Invest Markets presents itself as a legitimate broker, several red flags warrant caution. The broker's regulatory status, coupled with mixed customer feedback and concerns about fund safety, suggests that potential traders should approach with care.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternatives that are regulated by top-tier authorities and have a proven track record of customer satisfaction. Some recommended alternatives include brokers regulated by the FCA, ASIC, or CySEC, which provide stronger protections and clearer operational practices.

Ultimately, thorough due diligence is essential when selecting a broker, and traders should prioritize their financial safety and security above all else.

Is Invest Markets a scam, or is it legit?

The latest exposure and evaluation content of Invest Markets brokers.

Invest Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Invest Markets latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.