Regarding the legitimacy of FXOpen forex brokers, it provides CYSEC, FCA, FSPR, ASIC and WikiBit, (also has a graphic survey regarding security).

Is FXOpen safe?

Software Index

Risk Control

Is FXOpen markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

FXOpen EU Ltd

Effective Date:

2013-04-17Email Address of Licensed Institution:

info@fxopen.euSharing Status:

No SharingWebsite of Licensed Institution:

www.fxopen.comExpiration Time:

--Address of Licensed Institution:

38, Spyrou Kyprianou STr, CCS BLDG - OFFice N101, CY-4154 LiMassol / P.O. BOX 51605, CY-3507 LiMassolPhone Number of Licensed Institution:

+357 25 024 000Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

FXOpen Ltd

Effective Date:

2013-03-22Email Address of Licensed Institution:

compliance@fxopen.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.fxopen.co.ukExpiration Time:

--Address of Licensed Institution:

Beaumont Business Centre 80 Coleman Street London City Of London EC2R 5BJ UNITED KINGDOMPhone Number of Licensed Institution:

+442035191224Licensed Institution Certified Documents:

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

FXOPEN NZ LIMITED

Effective Date:

2011-12-16Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2015-07-21Address of Licensed Institution:

Level 3 187 Queen Street Cbd, Auckland, 0000, New ZealandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

FXOpen AU Pty Ltd

Effective Date: Change Record

2011-12-12Email Address of Licensed Institution:

jafar.calley@fxopen.orgSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-08-30Address of Licensed Institution:

--Phone Number of Licensed Institution:

08 6557 8587Licensed Institution Certified Documents:

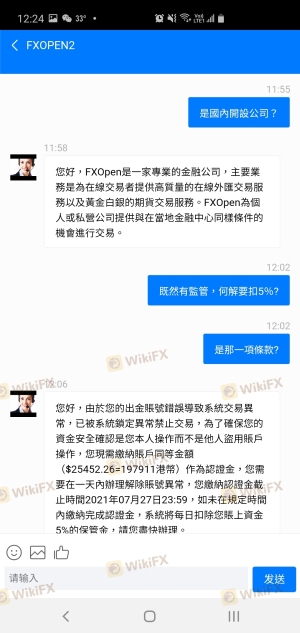

Is FXOpen A Scam?

Introduction

FXOpen is a prominent player in the forex trading market, established in 2005 and known for offering a range of trading services including forex, indices, commodities, and cryptocurrencies. As a broker that caters to both novice and experienced traders, FXOpen provides various account types and trading platforms, aiming to create a user-friendly trading environment. However, with the rise of online trading, the need for traders to carefully evaluate their broker's credibility has never been more crucial. The forex market is rife with risks, and choosing an untrustworthy broker can lead to significant financial losses. This article employs a comprehensive approach to investigate FXOpen's legitimacy and reliability, focusing on its regulatory status, company background, trading conditions, client fund safety, user experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory landscape is a vital aspect of any forex broker's credibility. FXOpen operates under multiple regulatory jurisdictions, which adds a layer of protection for its clients. The following table summarizes FXOpen's core regulatory information:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 579202 | United Kingdom | Verified |

| ASIC | 412871 | Australia | Verified |

| CySEC | 194/13 | Cyprus | Verified |

FXOpen is regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). These regulators are known for their stringent compliance requirements, which include regular audits and the necessity for brokers to maintain segregated accounts for client funds. This regulatory framework suggests a high level of investor protection and operational transparency.

Historically, FXOpen has maintained a good compliance record, with no major regulatory infractions reported. However, it is crucial to note that FXOpen's Australian entity faced scrutiny in the past, leading to a temporary suspension of its license due to concerns regarding operational practices. This incident highlights the importance of ongoing regulatory compliance and the need for traders to remain vigilant when selecting a broker.

Company Background Investigation

FXOpen was founded in 2005, initially as an educational platform focusing on technical analysis and financial markets before transitioning to a full-fledged forex brokerage. The company has since expanded its operations globally, with headquarters in the UK, Australia, and Nevis. FXOpen's ownership structure is relatively transparent, with its various entities regulated by respected financial authorities.

The management team at FXOpen consists of experienced professionals with backgrounds in finance and trading, contributing to the broker's reputation for reliability. The company's commitment to transparency is evident in its regular updates regarding trading conditions, regulatory changes, and customer service initiatives. FXOpen's website provides detailed information about its services, regulatory status, and trading platforms, which is a positive indicator of its operational integrity.

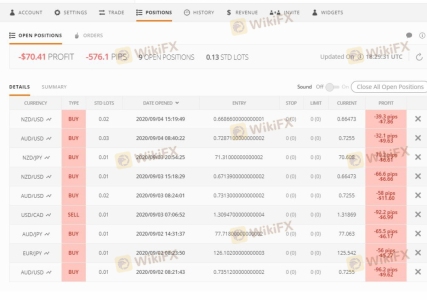

Trading Conditions Analysis

FXOpen offers a competitive trading environment, characterized by various account types, low spreads, and flexible leverage options. The overall fee structure is designed to be attractive to both novice and professional traders. Below is a comparison of FXOpen's core trading costs against industry averages:

| Cost Type | FXOpen | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 pips |

| Commission Model | $1.50 per lot | $3.00 per lot |

| Overnight Interest Range | Varies | Varies |

FXOpen's spreads start from 0.0 pips for its ECN accounts, which is highly competitive compared to the industry average. The commission structure is also favorable, especially for high-volume traders. However, FXOpen does impose withdrawal fees depending on the payment method, which can be a drawback for some clients.

While the overall trading conditions appear favorable, it is essential to scrutinize any unusual fees or policies. For instance, FXOpen charges an inactivity fee of $10 after a period of inactivity, which could deter less active traders. Additionally, withdrawal fees for certain methods can add up, potentially impacting overall profitability.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. FXOpen employs several measures to ensure the security of its clients' assets. Client funds are held in segregated accounts, which means they are kept separate from the broker's operational funds. This practice is crucial in protecting clients' investments in the event of financial difficulties faced by the broker.

Furthermore, FXOpen offers negative balance protection, ensuring that traders cannot lose more than their account balance. This feature is particularly important for those who utilize high leverage, as it mitigates the risk of incurring debts beyond their initial investment. The broker is also a member of the Financial Commission, which provides an additional layer of protection through its compensation fund, covering up to €20,000 for eligible clients.

Despite these safeguards, it is essential to consider any historical issues related to fund security. While there have been no significant incidents reported recently, traders should remain cautious and stay informed about any potential risks associated with their chosen broker.

Customer Experience and Complaints

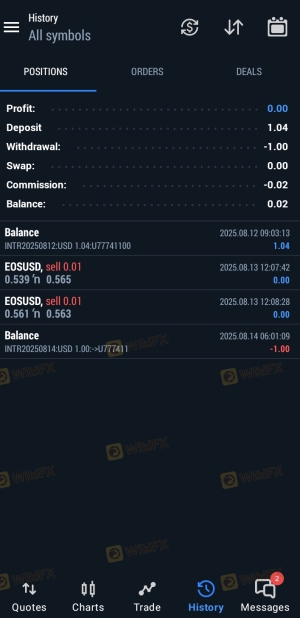

Analyzing customer feedback is a critical aspect of assessing a broker's reliability. FXOpen has received mixed reviews from users, with many praising its low spreads and fast execution times. However, there are also complaints regarding customer service responsiveness and withdrawal delays.

The following table summarizes the main types of complaints received about FXOpen:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Addressed but slow |

| Customer Support Issues | High | Varied response times |

| Platform Stability | Moderate | Generally stable |

One common complaint involves delays in processing withdrawals, which can be frustrating for traders who expect timely access to their funds. While FXOpen has a customer support system in place, some users report long wait times for responses, particularly during peak trading hours.

A notable case involved a trader who experienced significant delays in withdrawing profits, leading to concerns about the broker's reliability. Although FXOpen eventually resolved the issue, the experience highlighted the need for better communication and efficiency in handling client requests.

Platform and Trade Execution

FXOpen provides access to several trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as its proprietary Tick Trader platform. These platforms are known for their stability and user-friendly interfaces, making them suitable for traders of all experience levels.

The quality of order execution is a crucial factor for traders, and FXOpen generally performs well in this regard. The broker claims to have low slippage rates and minimal rejections of orders, although some users have reported occasional issues during high volatility periods. Overall, the platforms offer a reliable trading experience, but traders should remain aware of potential execution delays during peak market hours.

Risk Assessment

Using FXOpen does come with inherent risks, as is the case with any forex broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulatory scrutiny in the past |

| Fund Safety | Low | Strong measures in place |

| Customer Support | Medium | Mixed feedback on responsiveness |

While FXOpen is regulated by reputable authorities, the historical issues with its Australian entity raise some concerns about its overall compliance. Traders should remain vigilant and conduct thorough research before committing significant funds to any broker.

Risk Mitigation Recommendations

- Start with a Demo Account: Use the demo account to familiarize yourself with the platform and trading conditions without risking real money.

- Monitor Regulatory Changes: Stay updated on any changes in FXOpen's regulatory status or operational practices.

- Be Cautious with Withdrawals: Plan withdrawals in advance and consider potential delays, especially during high-traffic periods.

Conclusion and Recommendations

Based on the evidence presented, FXOpen does not appear to be a scam but rather a legitimate broker with a solid regulatory framework. However, potential clients should remain aware of historical compliance issues and the mixed feedback regarding customer service.

For traders seeking a reliable forex broker, FXOpen offers competitive trading conditions and a variety of account options. However, those who prioritize customer support and timely withdrawals may want to consider alternative options.

If you are looking for other trustworthy brokers, consider those with robust regulatory oversight and positive client feedback, such as IG or OANDA. Ultimately, due diligence is essential in the forex market, and traders should always be cautious when selecting a broker.

Is FXOpen a scam, or is it legit?

The latest exposure and evaluation content of FXOpen brokers.

FXOpen Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXOpen latest industry rating score is 6.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.