Regarding the legitimacy of Финам forex brokers, it provides CBR and WikiBit, (also has a graphic survey regarding security).

Is Финам safe?

Risk Control

Software Index

Is Финам markets regulated?

The regulatory license is the strongest proof.

CBR Forex Trading License (EP)

Central Bank of Russia

Central Bank of Russia

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Общество с ограниченной ответственностью "ФИНАМ ФОРЕКС"

Effective Date:

2015-12-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

127006, г. Москва, пер. Настасьинский, д.7, стр. 2, комн. 17Phone Number of Licensed Institution:

8 (495) 796-90-24Licensed Institution Certified Documents:

Is Finam Safe or Scam?

Introduction

Finam is a well-known brokerage firm based in Russia, offering a range of trading services, including forex, stocks, and commodities. Established in 1994, it has positioned itself as a significant player in the Russian financial market. However, as with any financial institution, especially in the volatile forex market, traders must exercise caution and thoroughly evaluate the credibility of their brokers. This article aims to provide an objective analysis of Finam, examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risks. The assessment is based on a comprehensive review of various sources, including regulatory filings, user reviews, and expert evaluations.

Regulation and Legitimacy

Understanding the regulatory environment in which a broker operates is crucial for assessing its legitimacy. Finam claims to be regulated by several authorities, which adds a layer of credibility. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Central Bank of Russia | 045-13961-020000 | Russia | Active |

| Cyprus Securities and Exchange Commission (CySEC) | 073/06 | Cyprus | Active |

Finam is licensed by the Central Bank of Russia, which is essential for any brokerage operating in the country. This regulatory body ensures that brokers adhere to strict operational standards, protecting clients' interests. Additionally, Finam operates through its subsidiary, Just2Trade, which is regulated by CySEC, providing services to clients in the European Union. While these licenses suggest a level of oversight, they are not considered "Tier 1" regulations like those from the FCA in the UK or ASIC in Australia. This means that while Finam is regulated, the quality and rigor of the oversight may not be as stringent as that of more established regulatory bodies. Historically, Finam has maintained compliance with regulatory requirements, but the absence of Tier 1 regulation raises concerns for some potential clients.

Company Background Investigation

Finam was founded in 1994 as one of the first brokerage firms in Russia, initially focusing on providing investment services. Over the years, it has expanded its offerings and now provides access to various financial markets, including forex, stocks, and commodities. The ownership structure of Finam is relatively straightforward, with the company being part of a larger financial holding group that includes several subsidiaries involved in different aspects of financial services.

The management team at Finam boasts a wealth of experience in the financial sector, with many members having backgrounds in investment banking, asset management, and financial analysis. This expertise is crucial for navigating the complexities of financial markets and providing clients with effective trading strategies and support. However, the company's transparency regarding its operations and financial health has been criticized. While it provides some information on its website, there is a lack of detailed disclosures about its financial performance, which can be a red flag for potential investors.

Trading Conditions Analysis

Finam's trading conditions are an essential aspect of its appeal to traders. The broker offers various account types, with different minimum deposit requirements and fee structures. However, some users have reported concerns regarding the overall cost of trading with Finam. The following table summarizes the core trading costs associated with Finam:

| Fee Type | Finam | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.0 - 2.0 pips | 0.5 - 1.5 pips |

| Commission Model | Variable, depends on account type | Fixed or variable |

| Overnight Interest Range | 0.07% for USD withdrawals | 0.03% - 0.05% |

While Finam's spreads may be competitive during regular trading hours, users have noted that spreads can widen significantly during periods of high volatility, which can affect trading profitability. Additionally, the commission structure can be complex, with some users reporting unexpected fees that were not clearly disclosed at the time of account setup. This lack of clarity can lead to frustration and distrust among traders.

Client Funds Safety

The safety of client funds is a primary concern for any trader. Finam claims to implement several measures to protect clients' investments. These include segregating client funds from the company's operational funds, which is a standard practice among regulated brokers. Additionally, the broker offers negative balance protection, ensuring that clients cannot lose more than their initial investment.

However, there have been instances in the past where clients reported issues with fund withdrawals, raising questions about the reliability of Finam's processes. While the broker has stated that it adheres to all regulatory requirements for fund safety, the experiences of some users suggest that there may be gaps in execution, particularly during high-demand periods when withdrawal requests may be delayed.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reputation. Reviews of Finam are mixed, with some users praising its trading platform and customer service, while others have raised significant concerns. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent, often slow |

| Poor Customer Support | Medium | Some reports of unhelpful responses |

| Technical Issues with Platform | Medium | Frequent complaints of freezing and crashes |

Typical cases highlight the frustrations of clients who experienced delays in fund withdrawals, sometimes waiting weeks for their requests to be processed. In contrast, other clients have reported positive experiences, particularly regarding the trading platform's functionality and the quality of educational resources provided by Finam.

Platform and Trade Execution

The performance of the trading platform is crucial for a positive trading experience. Finam offers access to popular platforms like MetaTrader 4 and its proprietary trading software. Users have noted that while the platforms generally perform well, there are occasional stability issues, particularly during high volatility. Reports of slippage and order rejections have also surfaced, which can significantly impact trading outcomes.

Additionally, there are concerns about potential market manipulation, with some users alleging that the broker may engage in practices that disadvantage traders, such as widening spreads during critical market movements. Such practices, if true, could undermine trust in the broker.

Risk Assessment

Using Finam as a trading platform comes with its own set of risks. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Not Tier 1 regulated, potential for less oversight |

| Operational Risk | High | Reports of withdrawal delays and technical issues |

| Market Risk | Medium | Standard market risks associated with forex trading |

To mitigate these risks, traders should conduct thorough research before committing funds, start with a demo account to test the platform, and maintain a diversified investment strategy to reduce exposure to any single asset or broker.

Conclusion and Recommendations

In conclusion, while Finam has a long-standing presence in the Russian financial market and is regulated by the Central Bank of Russia, potential clients should approach with caution. The mixed reviews and reports of withdrawal issues raise red flags that cannot be ignored. Although the broker offers a range of trading instruments and educational resources, the overall transparency and reliability of its operations remain questionable.

For traders considering Finam, it's advisable to start with a small investment and thoroughly review the terms and conditions before proceeding. Additionally, those seeking more reliable alternatives may want to explore brokers with Tier 1 regulation and a stronger track record of customer satisfaction, such as IG Group or OANDA. Ultimately, making an informed decision is crucial in the ever-evolving landscape of forex trading.

Is Финам a scam, or is it legit?

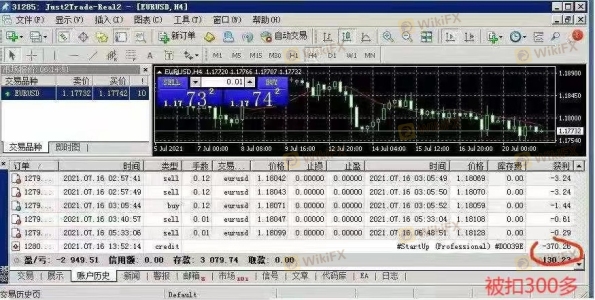

The latest exposure and evaluation content of Финам brokers.

Финам Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Финам latest industry rating score is 7.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.