Is EZINVEST safe?

Pros

Cons

Is Ezinvest A Scam?

Introduction

Ezinvest is an online brokerage firm that has established itself in the forex trading market, offering a wide range of financial products including forex, CFDs, commodities, and cryptocurrencies. Founded in 2008, Ezinvest operates under the regulatory framework of the Cyprus Securities and Exchange Commission (CySEC), which is crucial for ensuring a level of security and transparency for traders. However, with the proliferation of scams in the online trading industry, it is imperative for traders to carefully evaluate the credibility and reliability of any brokerage before committing their funds. This article aims to provide a comprehensive analysis of Ezinvest, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risk assessment. The findings are based on a thorough review of available data from reputable financial websites and user feedback.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining the safety and reliability of a brokerage. Ezinvest is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is known for enforcing strict compliance standards for financial firms operating in the European Union. The presence of a regulatory body not only ensures that the brokerage adheres to ethical practices but also provides a safety net for traders in case of disputes or financial issues.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 203/13 | Cyprus | Verified |

CySEC's regulations require that Ezinvest maintains client funds in segregated accounts, ensuring that traders money is kept separate from the company's operational funds. This means that in the unlikely event of Ezinvest facing financial difficulties, traders' funds are protected. Additionally, as a CySEC-regulated entity, Ezinvest is required to participate in the Investor Compensation Fund, which offers compensation of up to €20,000 per client in case of insolvency. Overall, the regulatory framework surrounding Ezinvest indicates a commitment to maintaining high standards of investor protection.

Company Background Investigation

Ezinvest is owned by WGM Services Ltd, a company based in Nicosia, Cyprus. Since its inception in 2008, it has grown to serve over 10,000 clients globally. The management team at Ezinvest comprises professionals with extensive experience in finance and trading, which contributes to the firm's credibility. Transparency is a key aspect of Ezinvest's operations, as it provides detailed information about its services, trading conditions, and regulatory compliance on its website. This level of openness is essential for building trust with potential clients.

The company has also made efforts to enhance its educational offerings, providing traders with resources to improve their trading skills. This includes access to market analysis, webinars, and demo accounts, which allow new traders to familiarize themselves with the trading environment without risking real capital. Overall, Ezinvest's background and operational practices suggest a reliable broker that prioritizes transparency and customer education.

Trading Conditions Analysis

Ezinvest offers competitive trading conditions, including a variety of account types and trading instruments. The brokerage operates under a commission-free model for forex trading, which is appealing to many traders. However, it is essential to scrutinize the overall fee structure, as hidden costs can diminish profitability.

| Fee Type | Ezinvest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Ezinvest are competitive, starting from as low as 0.6 pips for major currency pairs, which is below the industry average. However, traders should be aware of the inactivity fees that Ezinvest imposes on accounts that remain dormant for an extended period. This fee structure is not uncommon in the industry, but it is something traders should consider when evaluating their trading strategy.

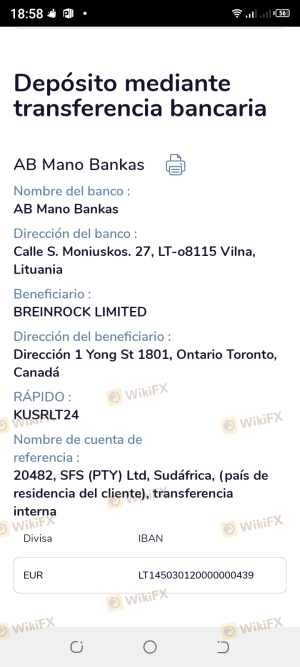

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Ezinvest takes several measures to ensure the security of its clients' funds. As mentioned earlier, client funds are held in segregated accounts with tier-1 banks, which are known for their financial stability. This segregation means that in the event of financial difficulties faced by Ezinvest, client funds remain unaffected.

Additionally, Ezinvest employs SSL encryption to protect sensitive data transmitted over the internet. This is a standard security measure that ensures personal and financial information is safeguarded from unauthorized access. However, it is worth noting that Ezinvest does not offer negative balance protection, which could expose traders to significant losses in highly volatile market conditions. Overall, while Ezinvest has implemented robust security measures, the lack of negative balance protection is a point of concern for potential traders.

Customer Experience and Complaints

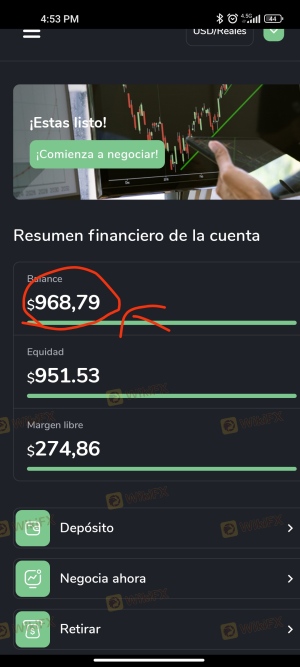

Customer feedback is an essential indicator of a brokerage's reliability. Ezinvest has received mixed reviews from users, with some praising its user-friendly platform and responsive customer service, while others have raised concerns about the quality of support and the handling of complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

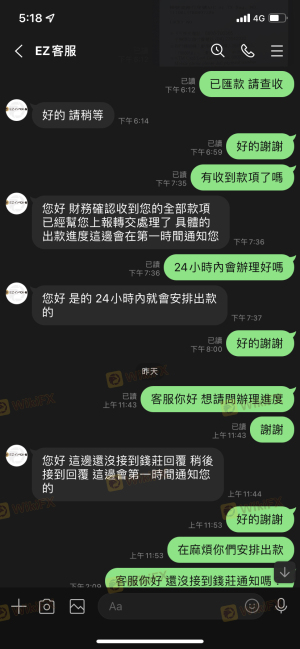

| Withdrawal Delays | High | Slow response |

| Inactivity Fees | Medium | Standard response |

| Customer Support | Medium | Variable quality |

Common complaints include delays in processing withdrawals and issues with customer support responsiveness. For instance, some users have reported waiting several days for their withdrawal requests to be processed. In contrast, others have had positive experiences with the customer support team, highlighting the variability in service quality. This inconsistency in customer experience is something potential clients should consider when evaluating whether to trade with Ezinvest.

Platform and Trade Execution

Ezinvest provides access to popular trading platforms, including MetaTrader 4 and its proprietary Sirix platform. Both platforms offer a range of features designed to enhance the trading experience. The execution speed on Ezinvest is generally reported to be satisfactory, with minimal slippage and a low rate of rejected orders.

However, some users have expressed concerns about potential platform manipulation, particularly in volatile market conditions. While there is no definitive evidence to support these claims, it is crucial for traders to remain vigilant and monitor their trades closely.

Risk Assessment

Trading with Ezinvest involves several risks, as with any online brokerage. The primary risks include market volatility, potential withdrawal delays, and the lack of negative balance protection.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Market Volatility | High | Prices can fluctuate rapidly, leading to significant losses. |

| Withdrawal Delays | Medium | Some users have reported slow processing times for withdrawals. |

| Lack of Negative Balance Protection | High | Traders could lose more than their deposited amount in extreme market conditions. |

To mitigate these risks, traders are advised to employ sound risk management strategies, such as setting stop-loss orders and only trading with capital they can afford to lose. Additionally, utilizing demo accounts to practice trading strategies can help build confidence before trading with real money.

Conclusion and Recommendations

In conclusion, Ezinvest presents itself as a legitimate brokerage with several positive attributes, including regulatory oversight by CySEC and a variety of trading instruments. However, potential traders should be aware of certain risks, including the lack of negative balance protection and variable customer support experiences.

While there are no clear signs of Ezinvest being a scam, traders should approach with caution and conduct their own research. For those seeking alternatives, brokers with stronger reputations for customer support and lower fees could be considered, such as IG Markets or eToro. Overall, Ezinvest may be suitable for traders who are comfortable navigating the risks associated with forex trading and are looking for a regulated platform.

Is EZINVEST a scam, or is it legit?

The latest exposure and evaluation content of EZINVEST brokers.

EZINVEST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EZINVEST latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.