Is Kingdom safe?

Business

License

Is Kingdom Safe or Scam?

Introduction

In the dynamic world of forex trading, the reputation and reliability of brokers play a pivotal role in the trading experience. Kingdom, a forex broker, has garnered attention for its offerings in the forex market, but questions regarding its credibility have surfaced. Traders must exercise caution when evaluating brokers, as the financial stakes are high, and the risk of scams is ever-present. This article aims to investigate whether Kingdom is a trustworthy broker or a potential scam. Our evaluation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer fund safety, user experiences, and risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy. A well-regulated broker is typically seen as more trustworthy, as regulatory bodies enforce strict compliance standards. Kingdom's regulatory status has raised concerns, as it lacks registration with major financial authorities. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulatory oversight from recognized authorities such as the FCA, ASIC, or CySEC is alarming. These regulators provide a safety net for traders, ensuring that brokers adhere to strict operational guidelines. Kingdom's lack of regulation means it operates without the protective measures that regulated brokers must follow, raising red flags regarding its legitimacy and operational practices. Furthermore, the company has not demonstrated a history of compliance with any regulatory requirements, further complicating its credibility.

Company Background Investigation

Understanding the company behind a forex broker is essential for assessing its trustworthiness. Kingdom's history is relatively obscure, with limited information available about its establishment and ownership structure. The company appears to be registered in an offshore jurisdiction, which often serves as a haven for unregulated brokers. This lack of transparency in ownership is concerning, as it makes it difficult to hold the company accountable in case of disputes or financial malpractice.

The management teams background is another critical factor in evaluating Kingdom's trustworthiness. Unfortunately, information regarding the qualifications and professional experiences of its leadership is scarce. This opacity raises concerns about the broker's operational integrity and commitment to ethical trading practices. Moreover, the company's transparency level is inadequate, with minimal information disclosed about its business practices or financial health.

Trading Conditions Analysis

A broker's trading conditions significantly impact a trader's overall experience. Kingdom advertises competitive trading conditions, but a closer examination reveals potential issues. The overall fee structure appears convoluted, with reports of hidden fees and unfavorable trading policies that could affect profitability. Below is a comparison of core trading costs:

| Cost Type | Kingdom | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the spread for major currency pairs seems attractive, traders should be wary of any additional costs that may not be immediately apparent. Reports suggest that Kingdom may impose withdrawal fees or other charges that could diminish profits. Such practices are often indicative of brokers that prioritize profit over client satisfaction, raising questions about whether Kingdom is truly safe for traders.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Kingdom's measures for safeguarding client funds have come under scrutiny. It is unclear whether the broker employs segregated accounts, which are essential for protecting client funds from operational risks. Furthermore, there is no information available regarding investor protection schemes or negative balance protection policies, which are standard offerings from regulated brokers.

The lack of transparency surrounding fund safety raises concerns about the potential for financial mismanagement. Historical reports of fund safety issues or disputes involving Kingdom further exacerbate these concerns. Traders must be cautious, as investing with a broker that does not prioritize fund safety can lead to significant financial losses.

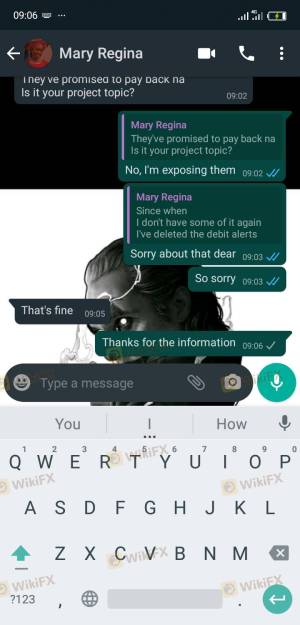

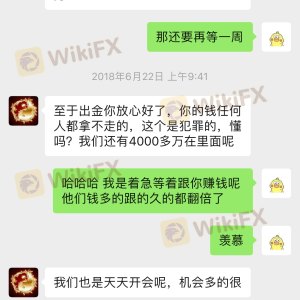

Customer Experience and Complaints

User feedback is a valuable resource for assessing a broker's reliability. Reviews of Kingdom have highlighted a range of customer experiences, with many users expressing dissatisfaction with the broker's services. Common complaints include withdrawal delays, lack of responsive customer support, and issues with account management. Below is a summary of major complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Account Management | High | Poor |

The severity of these complaints indicates significant operational issues within Kingdom. Furthermore, the company's responsiveness to customer concerns has been criticized, suggesting a lack of commitment to client satisfaction. Typical case studies reveal instances where clients struggled to withdraw funds or received inadequate support, raising alarms about whether Kingdom is a safe broker.

Platform and Trade Execution

The trading platform offered by a broker is integral to the trading experience. Kingdom utilizes a web-based platform that has received mixed reviews regarding its performance and stability. Users have reported issues with order execution, including slippage and rejected orders, which can severely impact trading outcomes. The absence of advanced trading tools and features on the platform further diminishes its appeal.

Additionally, the potential for platform manipulation is a concern. Reports of unusual trading activity and discrepancies in order execution raise questions about the integrity of Kingdom's trading environment. Traders should be vigilant and consider whether the platform meets their trading needs and expectations.

Risk Assessment

Engaging with any forex broker entails inherent risks. Kingdom presents several risk factors that traders must consider. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated status raises concerns. |

| Fund Safety | High | Lack of transparency regarding fund protection. |

| Customer Support | Medium | Poor response to complaints. |

To mitigate these risks, traders should conduct thorough due diligence before committing funds to Kingdom. Seeking alternative brokers with robust regulatory oversight and positive user reviews is advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Kingdom presents several red flags that warrant caution. The lack of regulatory oversight, transparency issues, and numerous customer complaints indicate that traders should be wary of engaging with this broker. While some traders may find attractive trading conditions, the potential for financial loss and operational challenges outweighs the benefits.

For traders seeking reliable alternatives, it is recommended to consider brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Prioritizing safety and transparency is essential in the forex market, and choosing a broker with a solid reputation can significantly enhance the trading experience. Overall, the question remains: Is Kingdom safe? Given the current evidence, it is prudent for traders to approach with caution and consider other options.

Is Kingdom a scam, or is it legit?

The latest exposure and evaluation content of Kingdom brokers.

Kingdom Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Kingdom latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.