TIO Markets 2025 Review: Everything You Need to Know

Executive Summary

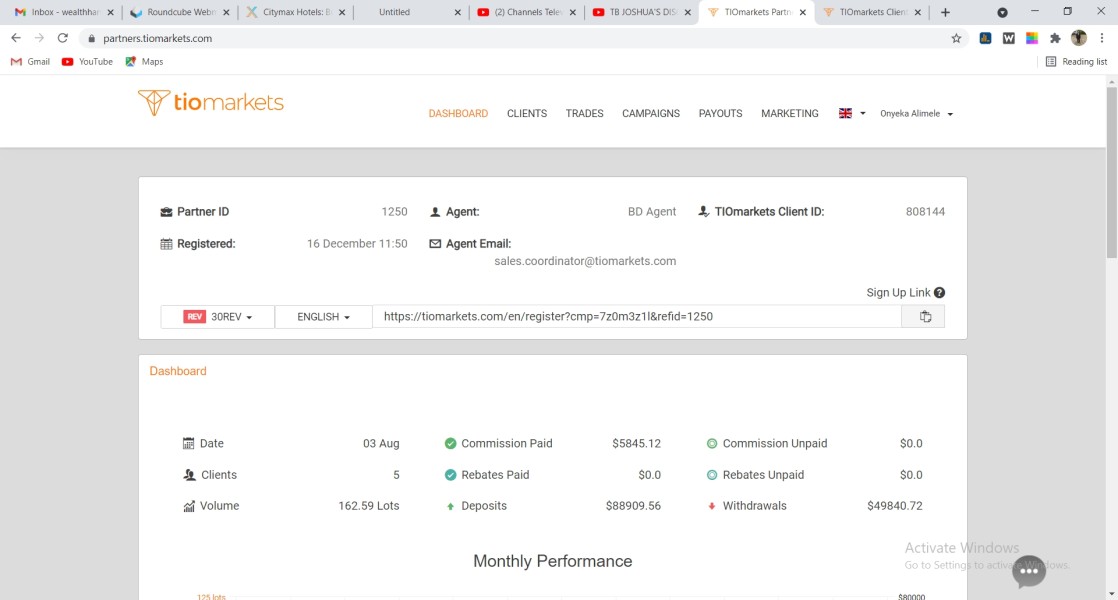

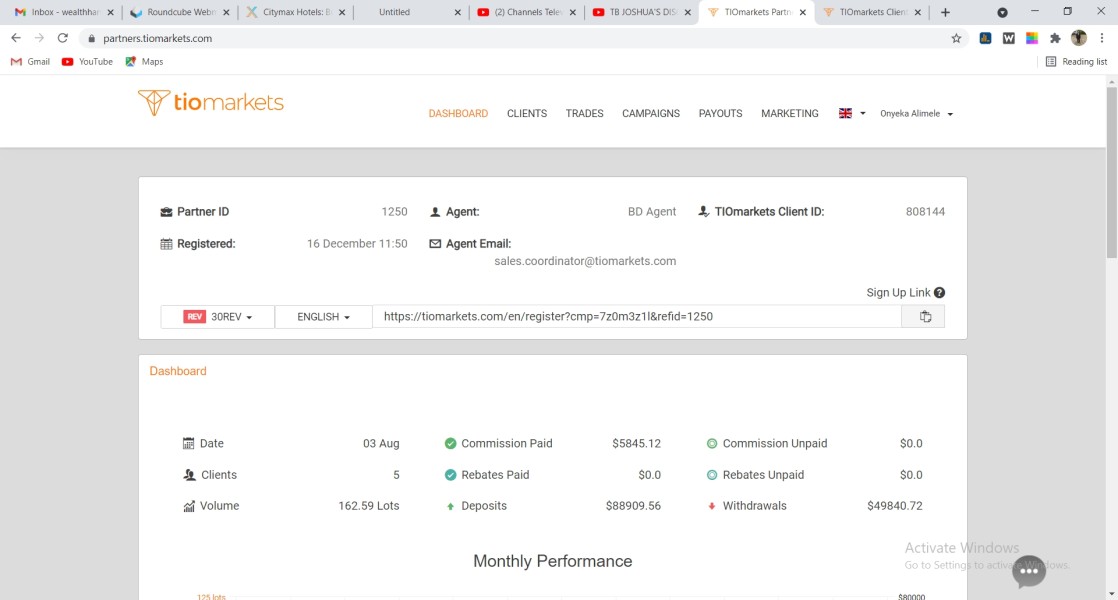

This comprehensive tio markets review evaluates TIO Markets as a regulated forex broker. The company has built itself as a reliable trading platform since it started in 2019. TIO Markets UK Limited operates under strict Financial Conduct Authority (FCA) regulation with license number 488900, offering traders a secure environment for forex and CFD trading.

The broker stands out with its easy entry requirements. It features a minimum deposit of just $50, making it particularly attractive for new traders. TIO Markets provides flexible leverage options of up to 1:500, alongside comprehensive asset coverage including forex pairs, indices, stocks, commodities, and futures. Client funds benefit from strong protection through the £85,000 investor compensation scheme.

This shows the broker's commitment to trader security. According to user feedback, TIO Markets excels in communication quality and customer benefits, with traders consistently praising the platform's fast response times and professional support services. The broker serves mainly beginner and intermediate-to-advanced traders seeking flexible leverage options and diversified trading assets across multiple market sectors.

TIO Markets operates through both MT4 and MT5 platforms. This ensures traders have access to industry-standard tools and automated trading capabilities. The overall user satisfaction remains notably positive, with particular emphasis on the broker's transparent communication and competitive trading conditions.

Important Disclaimers

TIO Markets operates through multiple jurisdictions with varying regulatory standards. The primary entity, TIO Markets UK Limited, maintains FCA regulation in the United Kingdom, while TIO Markets Limited operates under FSA registration in St. Vincent and the Grenadines (Company Number: 24986 IBC 2018). Traders should be aware that regulatory protections and available services may differ between these jurisdictions.

This review is based on publicly available information, official regulatory filings, and verified user feedback as of 2025. The analysis aims to provide objective insights into TIO Markets' services and performance. Trading involves significant risk, and between 74-89% of retail investor accounts lose money when trading CFDs with providers in this sector.

Rating Framework

Broker Overview

TIO Markets emerged in the competitive forex landscape in 2019. The company established itself as TIO Markets UK Limited, a company registered in England and Wales under company number 06592025. The broker has positioned itself as a technology-focused trading platform, emphasizing competitive spreads, rapid execution speeds, and comprehensive tools designed for traders across all experience levels.

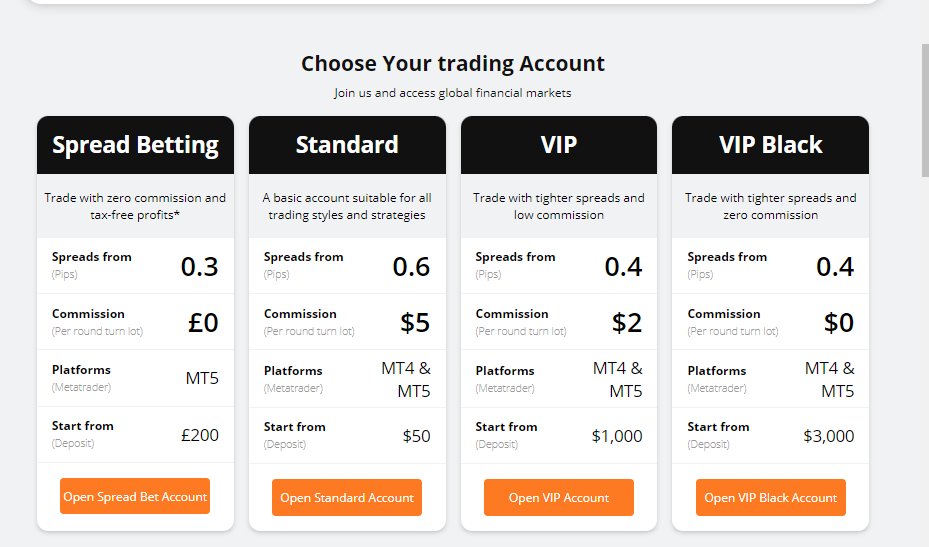

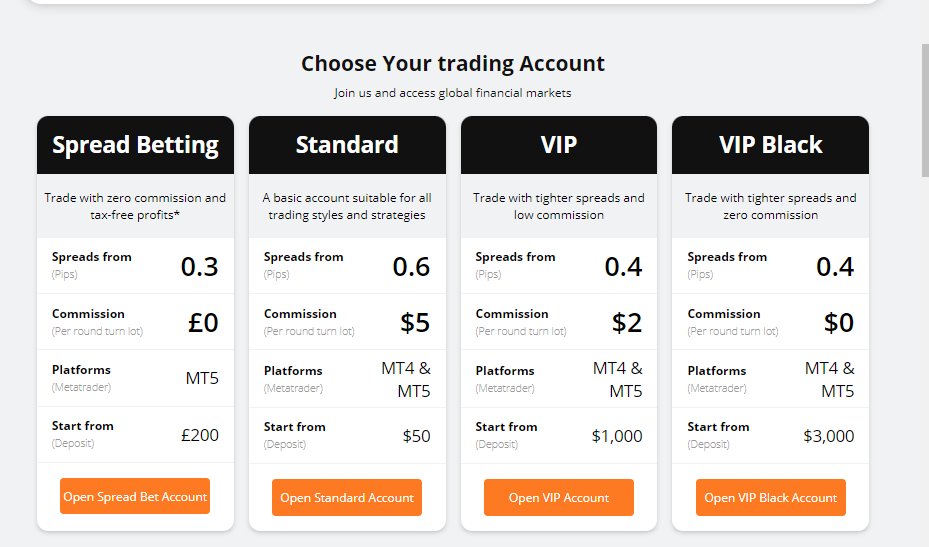

The company's business model centers on providing access to global financial markets through contracts for difference (CFDs) and forex trading. TIO Markets offers four distinct retail account types: Spread, Standard, VIP, and VIP Black accounts, each tailored to different trading volumes and experience levels. This tiered approach allows the broker to serve both entry-level traders and high-volume institutional clients effectively.

TIO Markets delivers trading services across multiple asset categories. These include major and minor forex pairs, global stock indices, individual equities, precious metals and energy commodities, and futures contracts. The platform operates primarily through MetaTrader 4 and MetaTrader 5, industry-standard platforms that provide comprehensive charting tools, automated trading capabilities, and extensive technical analysis resources.

The broker maintains dual regulatory oversight through the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority (FSA) in St. Vincent and the Grenadines. This ensures compliance with international trading standards while providing services to diverse geographical markets.

Regulatory Jurisdictions

TIO Markets operates under dual regulatory oversight. Its primary entity TIO Markets UK Limited is regulated by the FCA in the United Kingdom under license number 488900. Additionally, TIO Markets Limited maintains registration with the FSA in St. Vincent and the Grenadines, providing services to international clients outside the UK jurisdiction.

Minimum Deposit Requirements

The broker maintains an accessible entry threshold with a minimum deposit requirement of $50. This positions it as beginner-friendly compared to many competitors in the forex brokerage space.

Available Trading Assets

TIO Markets provides access to a comprehensive range of tradeable instruments. These include major and minor forex pairs, global stock indices, individual equities from major exchanges, commodities covering precious metals and energy products, and futures contracts across various market sectors.

Leverage Options

The platform offers flexible leverage configurations with options up to 1:500 for international clients and 1:30 for UK residents in compliance with ESMA regulations. This allows traders to adjust their risk exposure according to their trading strategies and regulatory requirements.

Clients can choose between MetaTrader 4 and MetaTrader 5 platforms. Both offer comprehensive charting packages, automated trading support through Expert Advisors, and extensive technical analysis tools suitable for various trading approaches.

Cost Structure

While specific spread and commission details were not extensively detailed in available materials, user feedback indicates competitive pricing structures. Traders express satisfaction regarding overall trading costs and execution quality.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

TIO Markets demonstrates strong performance in account accessibility with its tio markets review highlighting the broker's commitment to inclusive trading conditions. The $50 minimum deposit requirement represents one of the most competitive entry thresholds in the industry. This makes professional forex trading accessible to newcomers without significant capital requirements.

The broker's four-tier account structure (Spread, Standard, VIP, and VIP Black) provides clear progression paths for traders as their experience and trading volumes increase. This tiered approach ensures that both beginner traders and high-volume professionals can find appropriate service levels matching their specific needs.

Leverage flexibility stands as another significant advantage, with international clients accessing up to 1:500 leverage while UK residents operate under the regulated 1:30 limit. This dual approach ensures compliance with regional regulations while maximizing trading opportunities where permitted.

User feedback consistently emphasizes the straightforward account opening process and transparent fee structures. The absence of hidden charges and clear communication regarding trading conditions contribute to the positive account experience ratings from the trader community.

TIO Markets provides comprehensive trading infrastructure through its MT4 and MT5 platform offerings. This ensures traders have access to industry-standard tools and functionalities. Both platforms support automated trading through Expert Advisors, comprehensive technical analysis packages, and real-time market data across all available asset classes.

The platform selection caters to different trader preferences, with MT4 offering proven reliability and extensive third-party support, while MT5 provides enhanced features including additional timeframes, economic calendar integration, and improved order management systems. While specific educational resources and research materials were not extensively detailed in available information, the broker's focus on providing professional-grade trading platforms indicates a commitment to supporting trader development through access to sophisticated analytical tools.

The availability of multiple asset classes through a single platform simplifies portfolio management. This allows traders to diversify their strategies across forex, commodities, indices, and equity markets without requiring multiple broker relationships.

Customer Service and Support Analysis (8/10)

Customer service represents a standout feature in this tio markets review, with consistent user praise for communication quality and response efficiency. Traders frequently highlight the broker's professional approach to customer support and the rapid resolution of queries and technical issues.

The support infrastructure includes multiple contact channels with phone, email, and live chat options providing comprehensive coverage for different communication preferences. User feedback indicates that support staff demonstrate strong technical knowledge and genuine commitment to problem resolution.

Response times receive particularly positive mentions in user reviews, with traders noting quick acknowledgment of support requests and efficient follow-through on complex issues. This level of service quality contributes significantly to overall user satisfaction and platform confidence.

The broker's proactive communication approach, including regular updates on market conditions and platform developments, enhances the overall support experience. This demonstrates commitment to maintaining strong client relationships throughout the trading journey.

Trading Experience Analysis (7/10)

Platform stability and execution quality form the foundation of positive trading experiences reported by TIO Markets users. The MT4 and MT5 infrastructure provides reliable performance during normal and high-volatility market conditions, ensuring consistent access to trading opportunities.

Order execution receives favorable user feedback, with traders noting competitive fill rates and minimal slippage during standard market conditions. The platform's technical infrastructure supports rapid trade processing, which is essential for active trading strategies and scalping approaches.

The comprehensive charting packages available through both MT4 and MT5 enable detailed technical analysis and strategy development. Advanced order types and risk management tools provide traders with sophisticated control over their positions and exposure levels.

User feedback indicates satisfaction with the overall trading environment, including liquidity access and spread competitiveness. The tio markets review data suggests that traders appreciate the balance between platform sophistication and user-friendly operation across different experience levels.

Trust and Security Analysis (8/10)

Regulatory compliance forms the cornerstone of TIO Markets' credibility, with FCA authorization under license number 488900 providing robust oversight and consumer protection standards. The UK regulatory framework ensures adherence to strict capital adequacy requirements and operational standards.

Client fund protection through the £85,000 investor compensation scheme provides significant security for retail traders. This ensures account protection in the unlikely event of broker insolvency. This protection level exceeds many international competitors and demonstrates commitment to client security.

The dual regulatory structure, including FSA registration in St. Vincent and the Grenadines, enables international service provision while maintaining appropriate oversight standards. This approach balances accessibility with regulatory compliance across different jurisdictions.

Company transparency and regulatory reporting requirements under FCA oversight ensure ongoing monitoring of operational standards and financial stability. User trust indicators remain consistently positive, reflecting confidence in the broker's operational integrity and long-term viability.

User Experience Analysis (7/10)

Overall user satisfaction with TIO Markets reflects positively across multiple experience dimensions, from initial account setup through ongoing trading activities. The platform's intuitive design and comprehensive functionality receive consistent praise from traders across different experience levels.

Interface design through MT4 and MT5 platforms provides familiar environments for experienced traders while remaining accessible for newcomers to forex trading. The standardized platform approach ensures consistency and reduces learning curves for traders transitioning from other brokers.

User feedback indicates particular satisfaction with the broker's transparent approach to fees, conditions, and market access. Clear communication regarding trading terms and platform capabilities contributes to positive user experiences and long-term client relationships.

Some users have noted potential concerns regarding leverage adjustments, though specific details regarding these policy changes were not extensively documented in available materials. This represents an area where enhanced communication and transparency could further improve user confidence and satisfaction levels.

Conclusion

This comprehensive tio markets review reveals a well-regulated and professionally operated forex broker that successfully balances accessibility with sophisticated trading capabilities. TIO Markets demonstrates particular strength in customer service quality, regulatory compliance, and flexible account conditions that accommodate traders across different experience levels.

The broker's combination of low minimum deposits, competitive leverage options, and comprehensive asset coverage makes it particularly suitable for beginning traders seeking professional-grade platforms and intermediate-to-advanced traders requiring diversified market access. The FCA regulatory framework provides robust consumer protection while maintaining operational standards appropriate for serious forex trading.

Primary advantages include the accessible $50 minimum deposit, flexible leverage configurations, strong customer support infrastructure, and comprehensive investor protection schemes. Potential considerations include the need for enhanced transparency regarding policy changes and continued communication with users regarding platform developments and regulatory updates.