Ezinvest 2025 Review: Everything You Need to Know

Ezinvest has garnered a mixed reputation among traders in 2025, with users highlighting both its strengths and weaknesses. The broker, established in 2008 and regulated by the Cyprus Securities and Exchange Commission (CySEC), offers a variety of trading instruments and platforms, including the popular MetaTrader 4 (MT4). However, concerns about its customer service responsiveness and the high minimum deposit requirement have been noted.

Note: It's essential to consider that Ezinvest operates under different entities based on geographical regions, affecting its regulatory oversight and available features. This review aims to present a fair and accurate assessment of Ezinvest, drawing upon various sources of information.

Ratings Overview

We evaluate brokers based on user feedback, expert opinions, and factual data.

Broker Overview

Founded in 2008, Ezinvest is a Cyprus-based online broker that provides access to a wide range of financial markets. The company is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring a level of security for its users. Ezinvest primarily offers trading through the MetaTrader 4 platform, which is widely regarded for its user-friendly interface and robust features. The broker allows trading in various asset classes, including forex, commodities, indices, and CFDs.

Detailed Breakdown

Regulatory Regions

Ezinvest operates globally, providing services in over 178 countries. However, it is not available in the United States, Canada, and a few other jurisdictions. The regulatory framework provided by CySEC ensures that client funds are safeguarded in segregated accounts, adding a layer of security for traders.

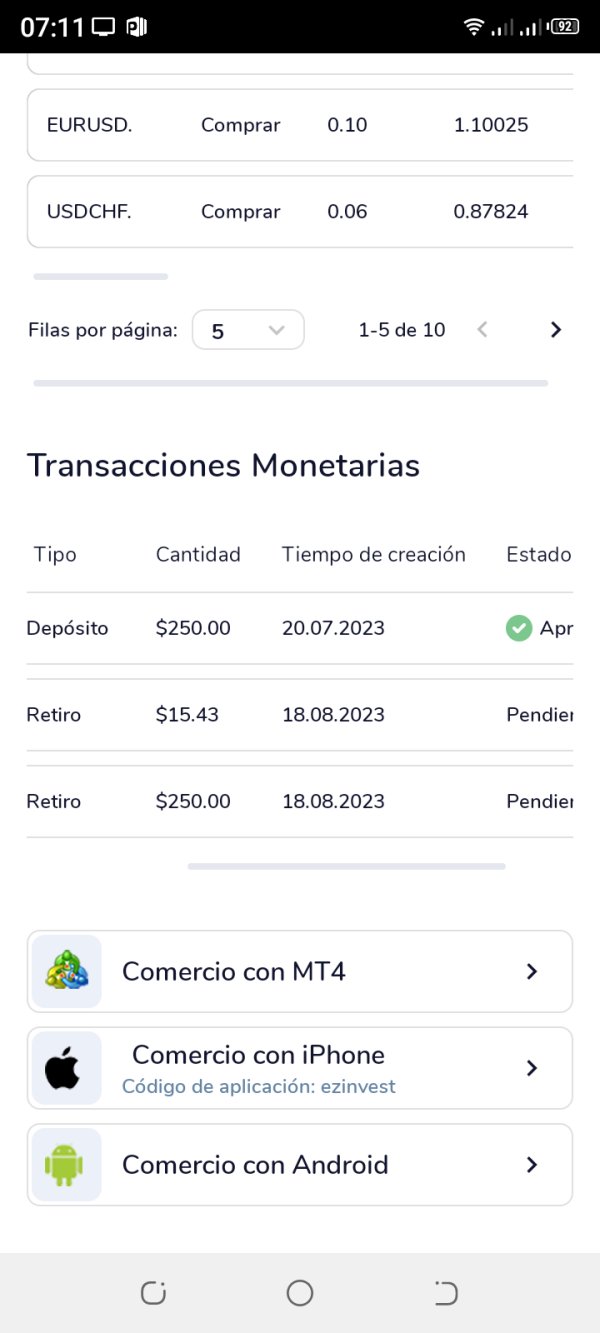

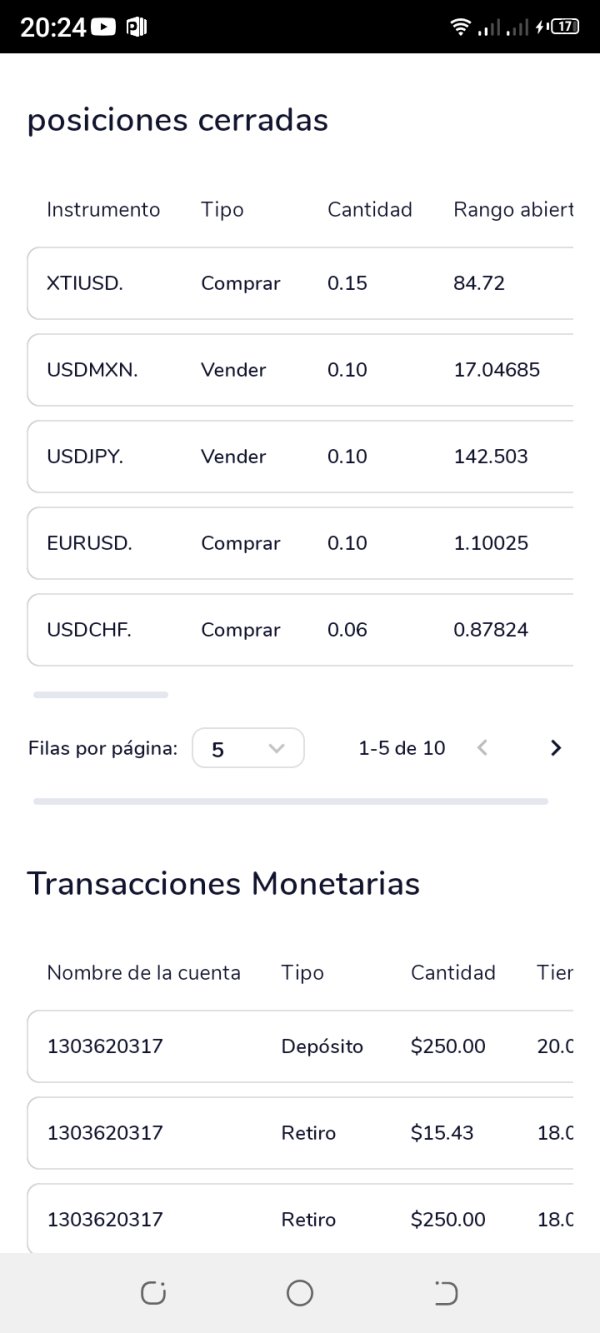

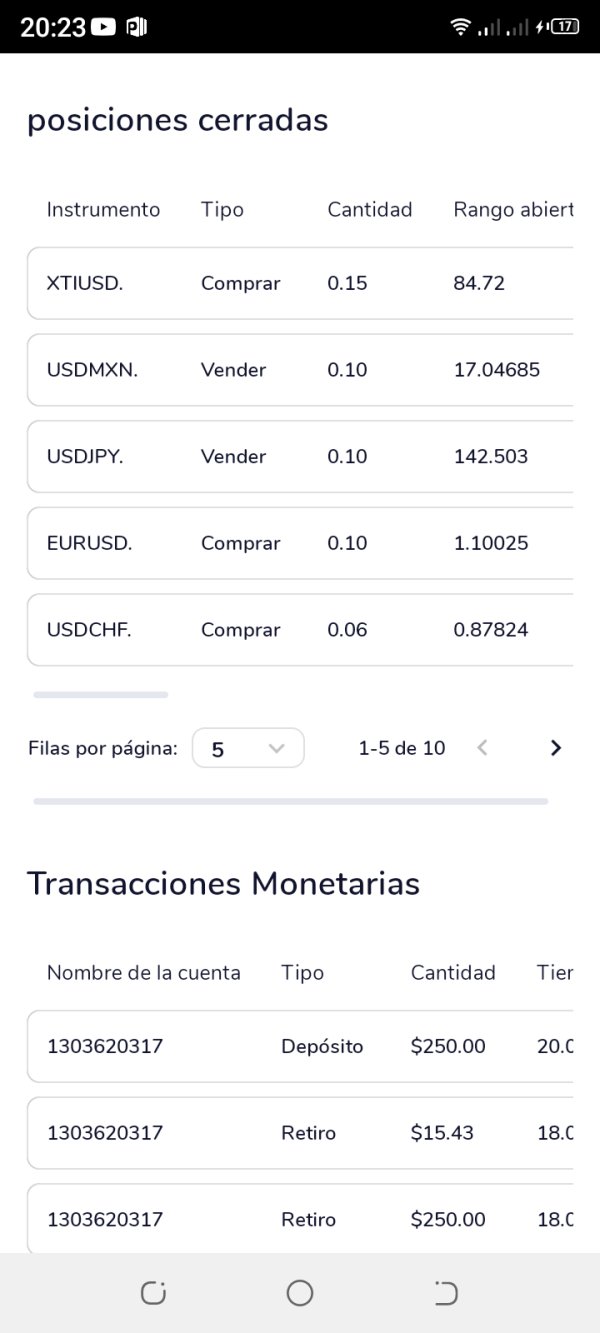

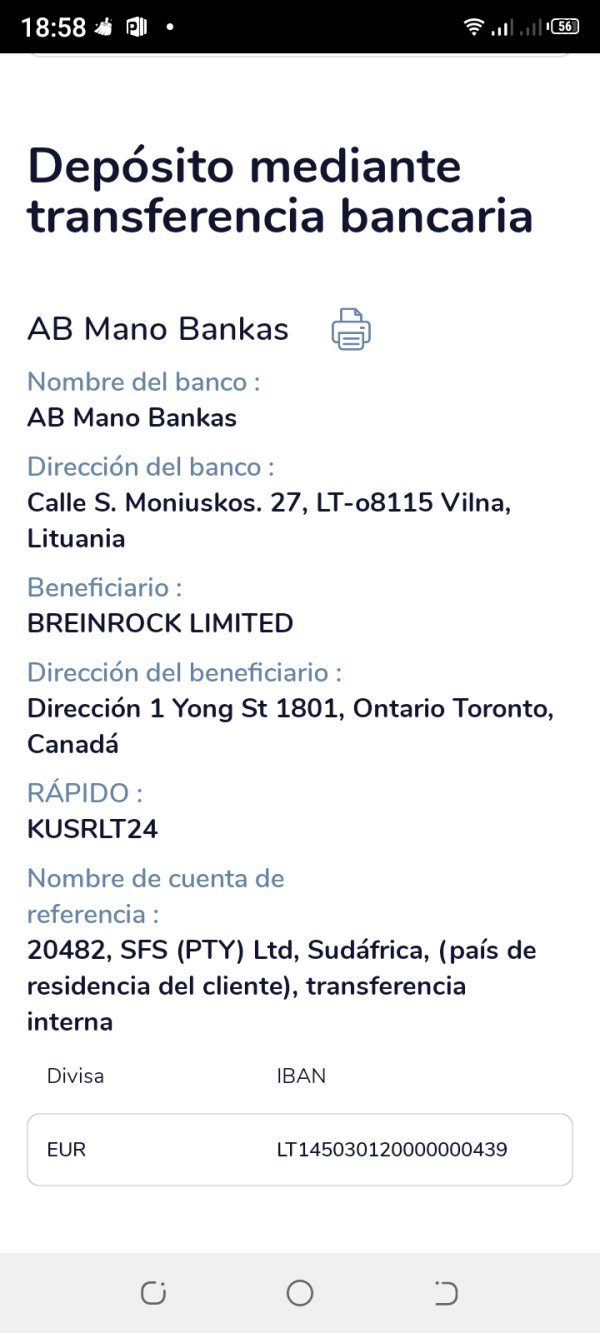

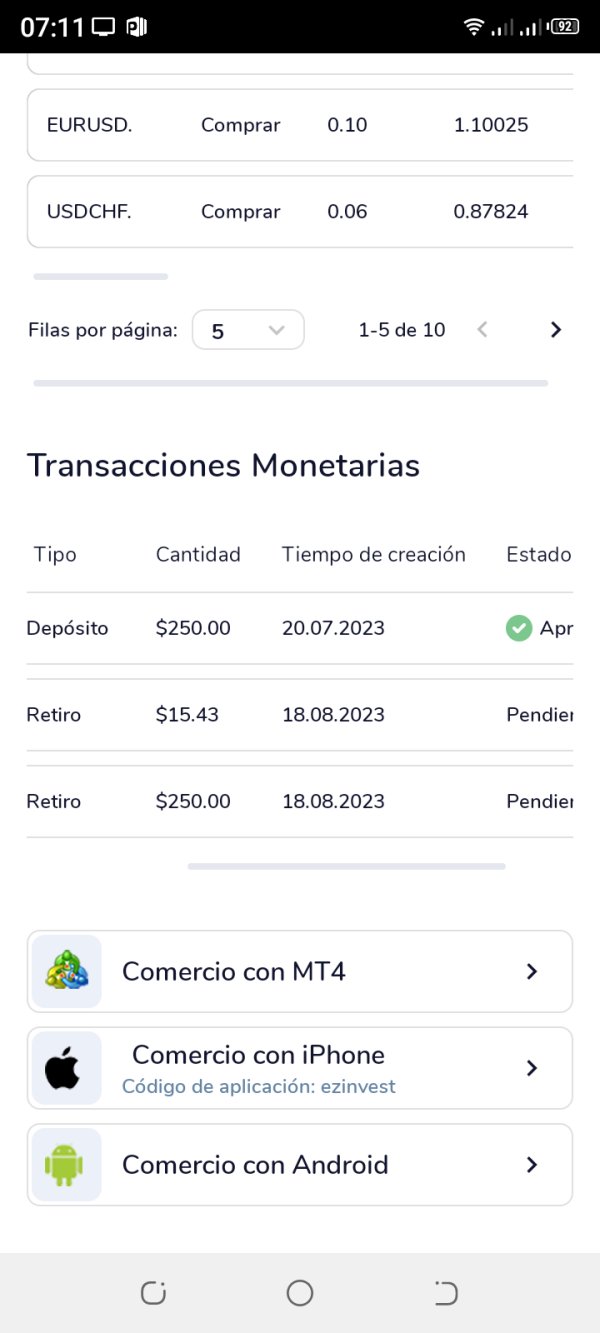

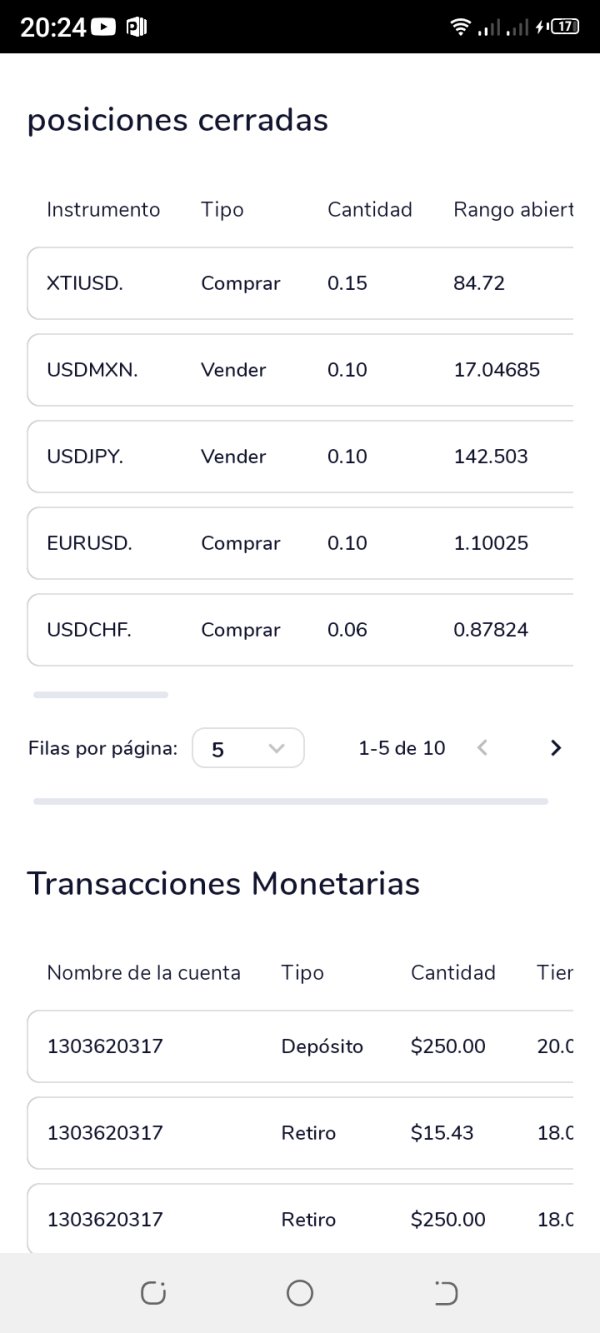

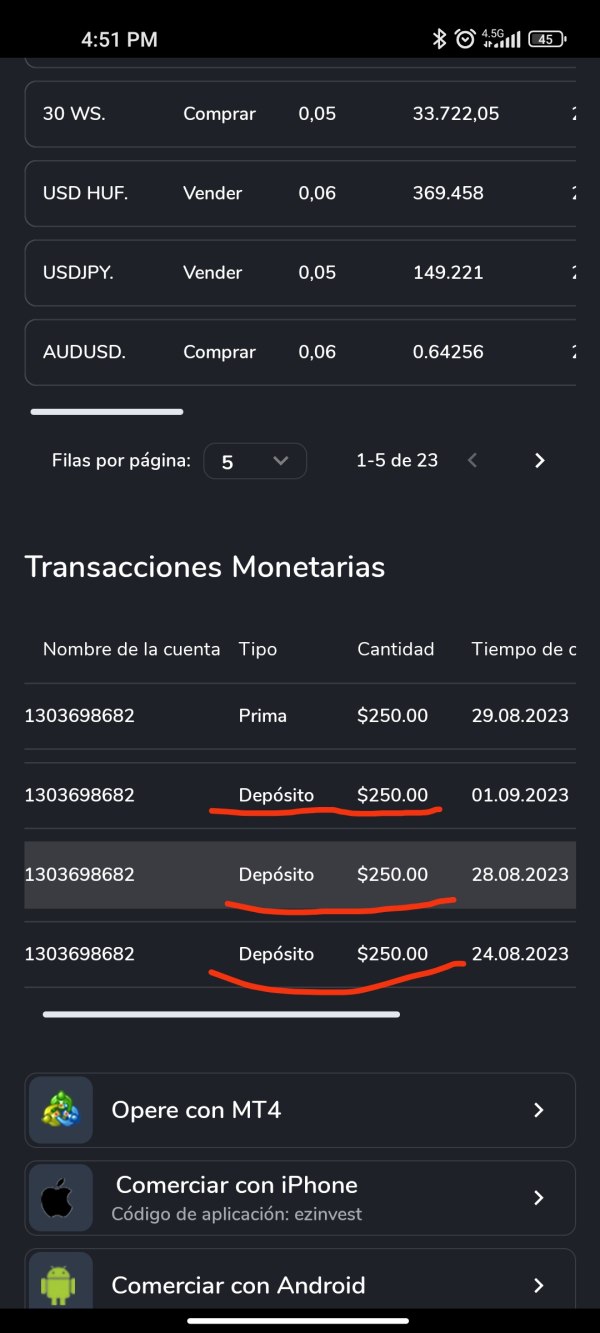

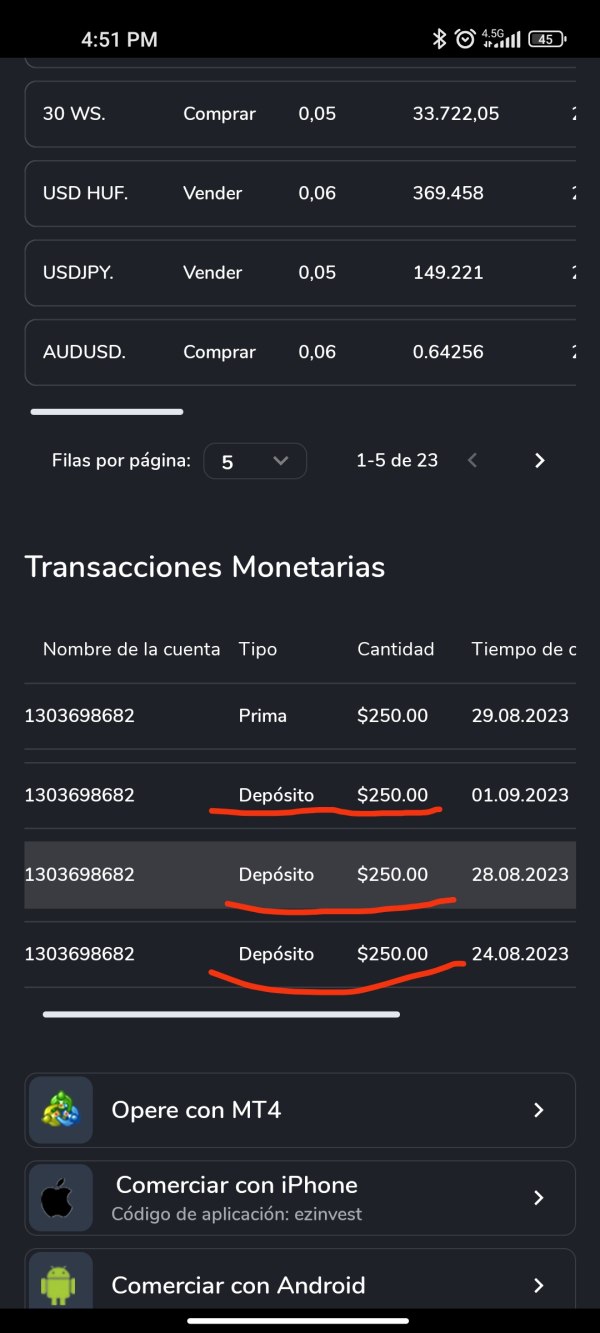

Deposit/Withdrawal Currencies

Ezinvest supports multiple currencies for deposits and withdrawals, including USD, EUR, and GBP. However, it does not currently support cryptocurrency deposits or withdrawals.

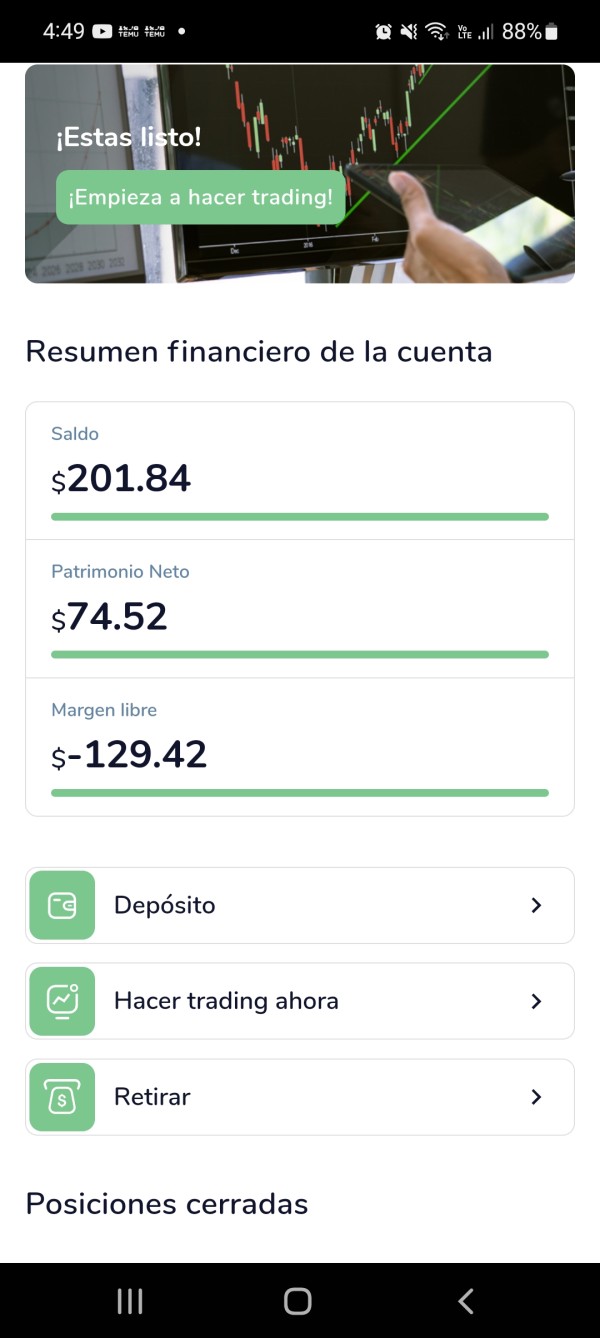

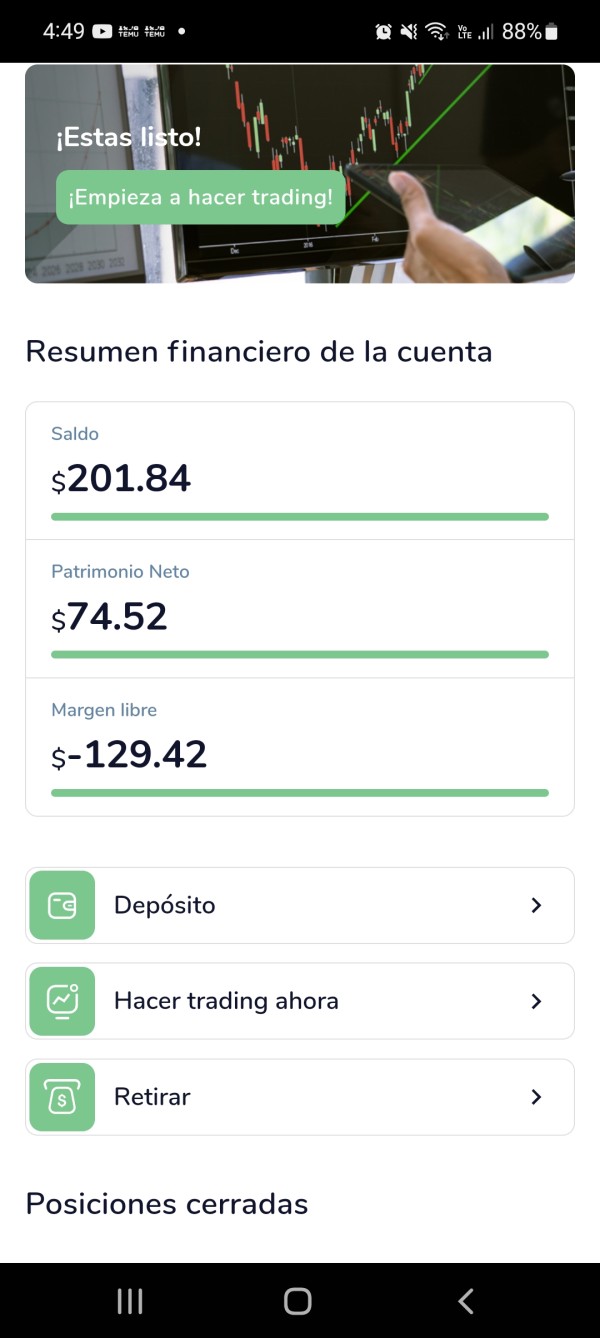

Minimum Deposit

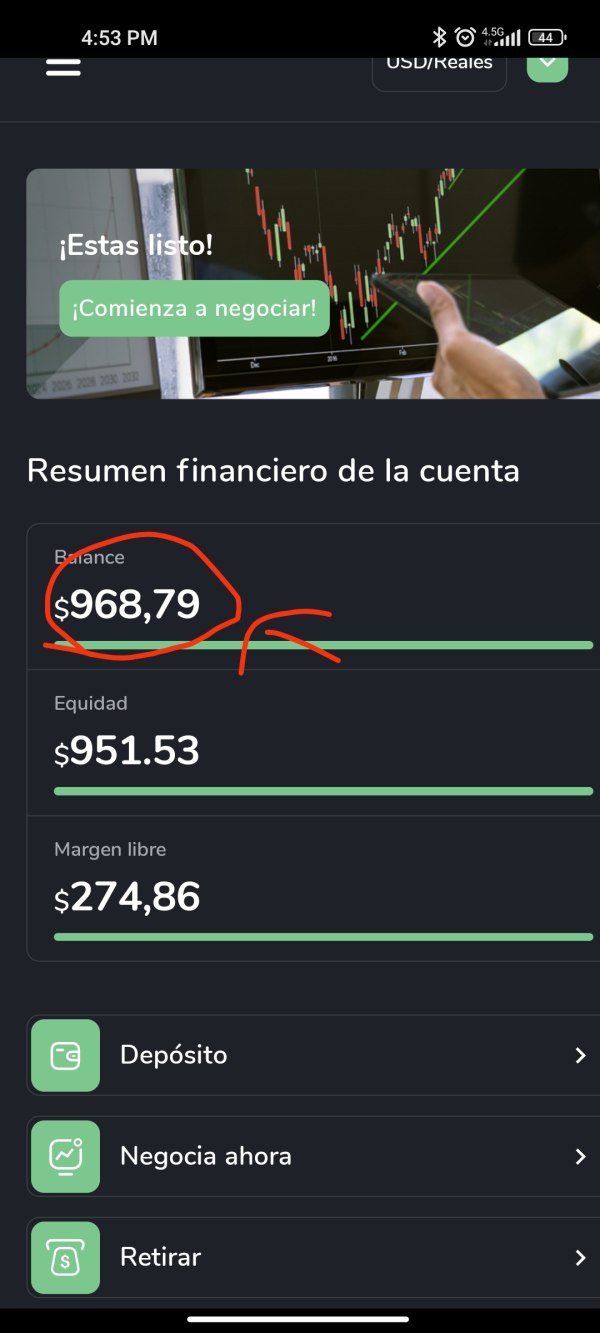

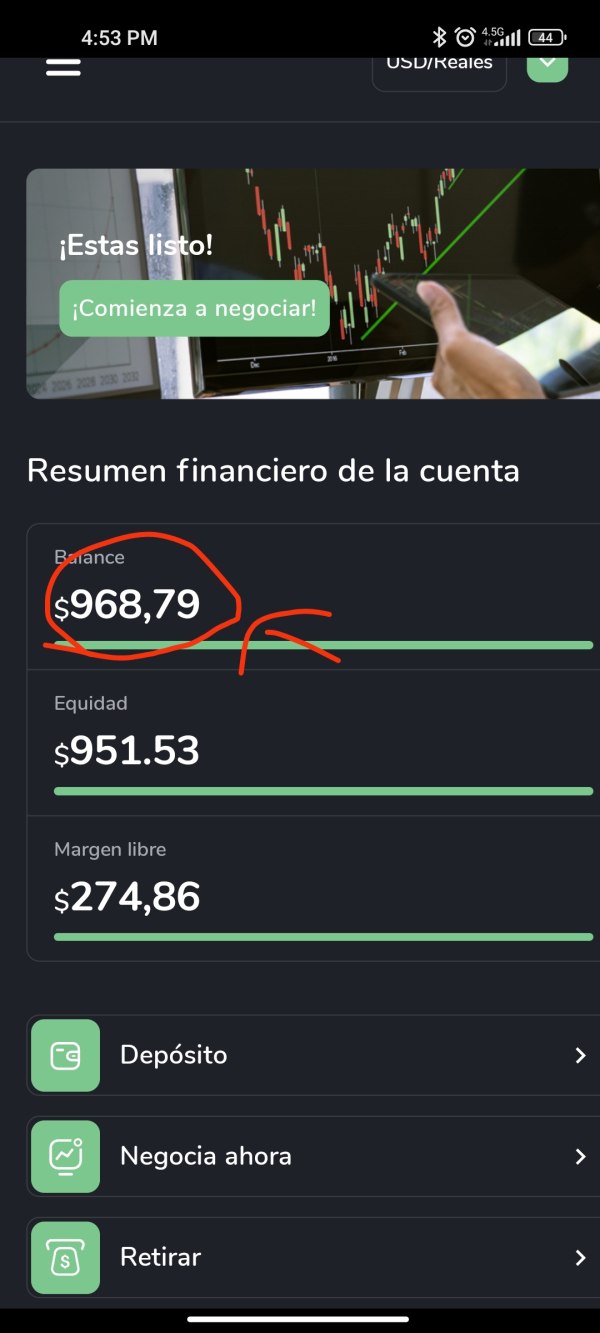

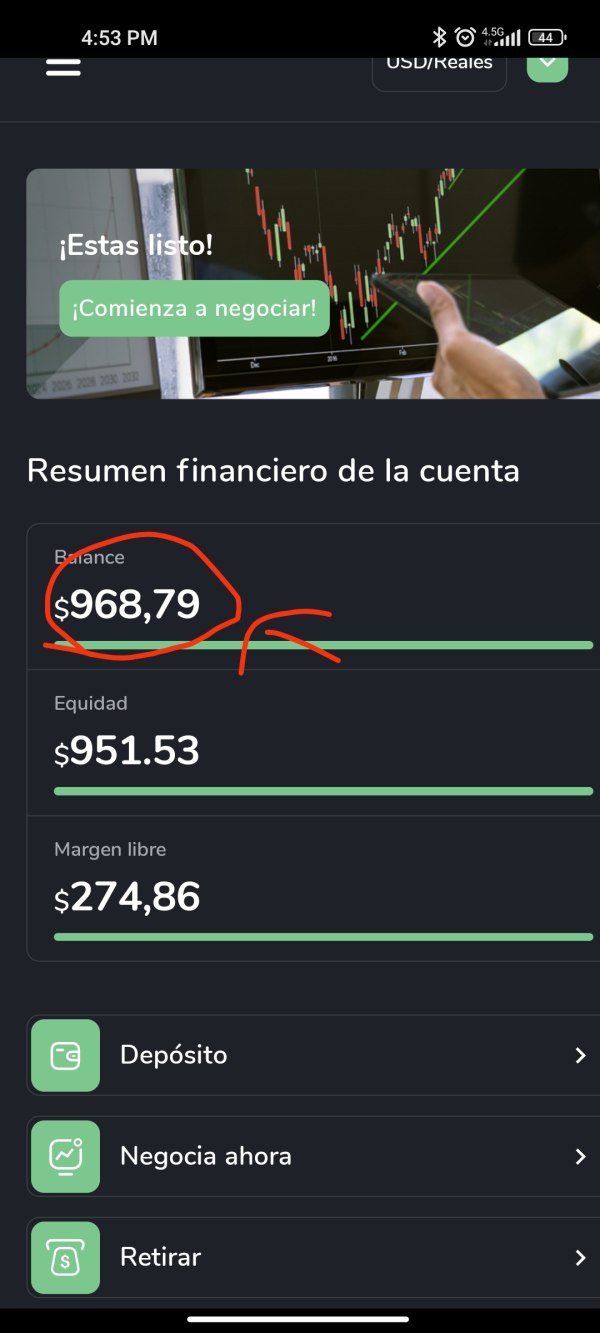

The minimum deposit required to open an account with Ezinvest is $500, which some users have found to be a barrier, especially for beginners. This is higher than some competitors that offer lower minimum deposit requirements.

As of now, Ezinvest does not offer any sign-up bonuses or promotions, which could be a drawback for potential clients looking for incentives to join.

Tradable Asset Classes

Ezinvest provides access to a wide variety of tradable instruments, including over 50 forex pairs, commodities, indices, and stocks. However, there are limitations on cryptocurrency trading, which is not available on their platform.

Costs (Spreads, Fees, Commissions)

Ezinvest employs a commission-free model for forex trading, but users should be aware of spreads, which can start from 0.6 pips on the ECN account and 3 pips on the standard account. Additionally, there may be withdrawal fees depending on the payment method used, and an inactivity fee is charged for dormant accounts.

Leverage

Ezinvest offers leverage up to 1:500, which can be appealing for experienced traders looking to maximize their trading positions. However, the high leverage also comes with increased risk.

Ezinvest primarily offers trading through the MT4 platform, known for its comprehensive features and capabilities. It also provides a proprietary mobile trading app and Sirix web trader, catering to different trader preferences.

Restricted Regions

While Ezinvest has a broad global reach, it does not accept clients from certain countries, including the USA, Canada, and others, which may limit its accessibility for some traders.

Available Customer Service Languages

Ezinvest offers customer support in multiple languages, including English, Spanish, German, French, and more. However, user feedback indicates variability in the quality and responsiveness of customer service.

Ratings Recap

Detailed Assessment

Account Conditions: Ezinvest's account conditions are average, with a minimum deposit of $500, which may deter new traders. The account types offered are somewhat limited compared to competitors.

Tools and Resources: The broker provides a decent range of trading tools, including educational resources and market analysis. However, some users have noted that the educational offerings could be improved.

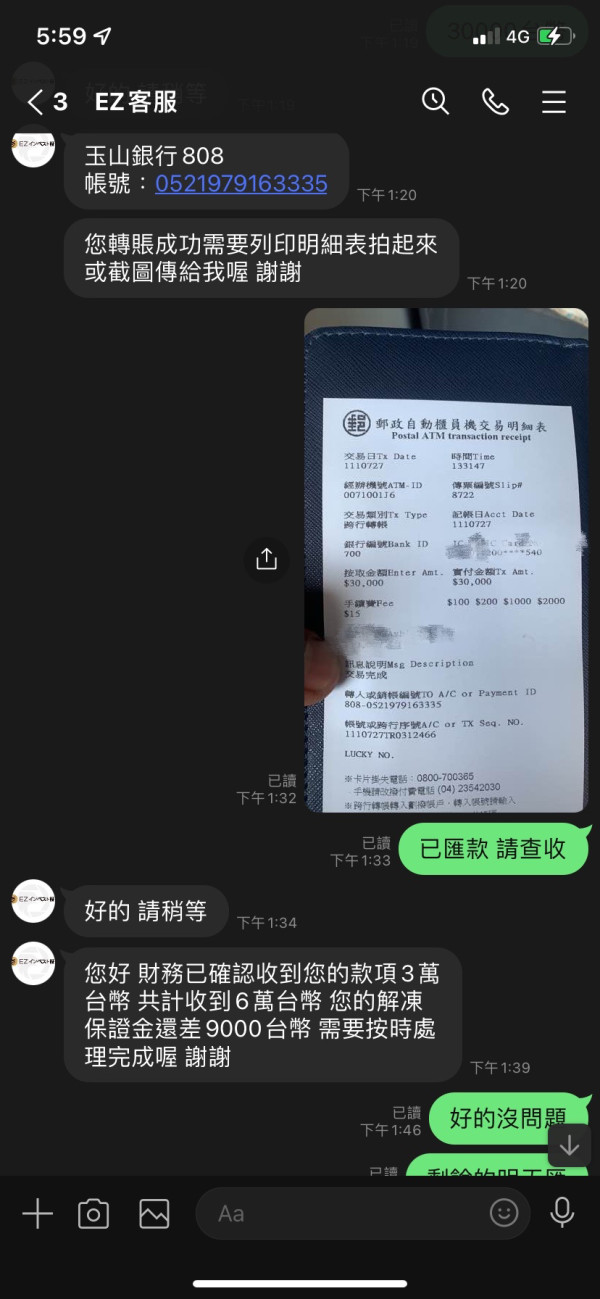

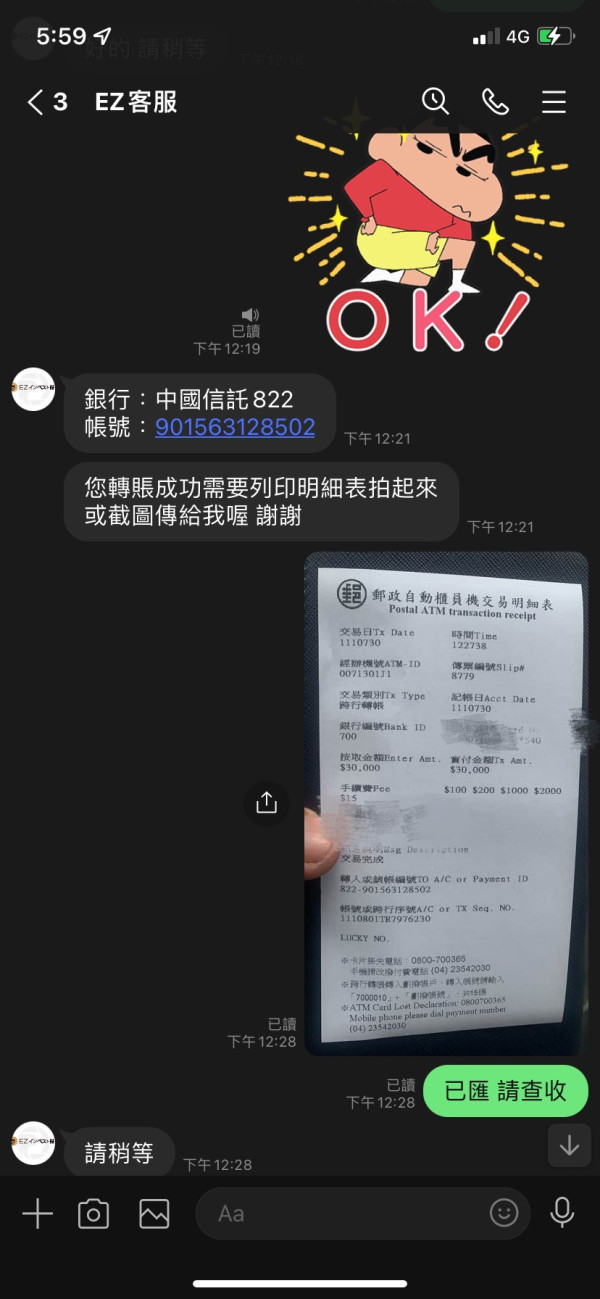

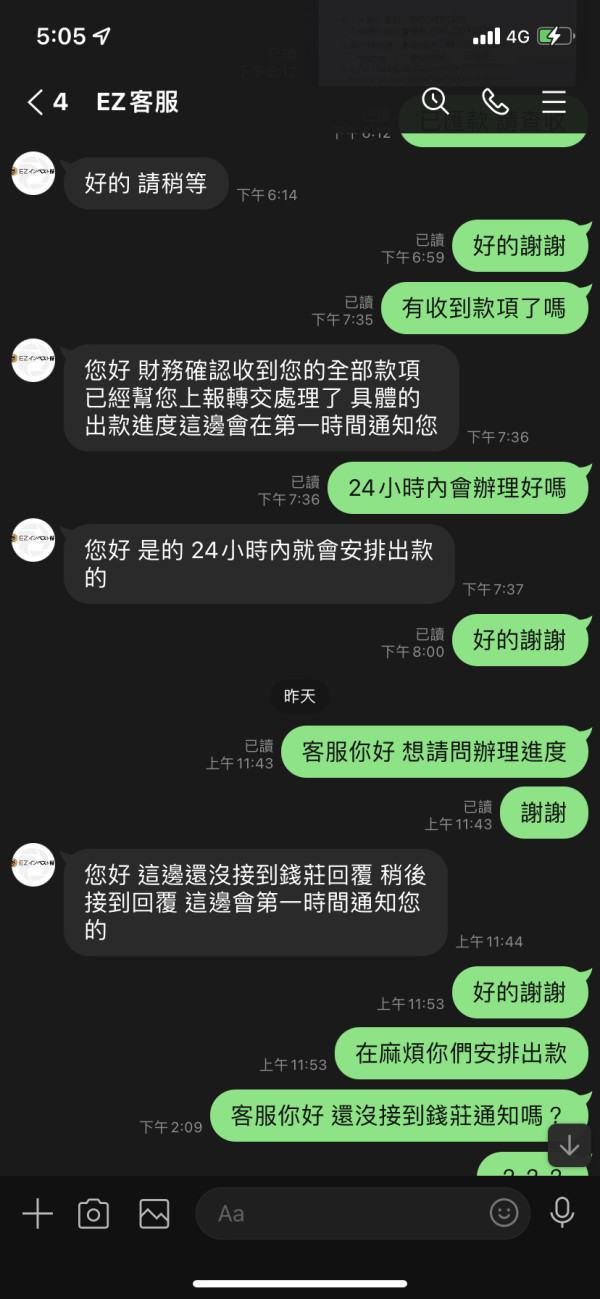

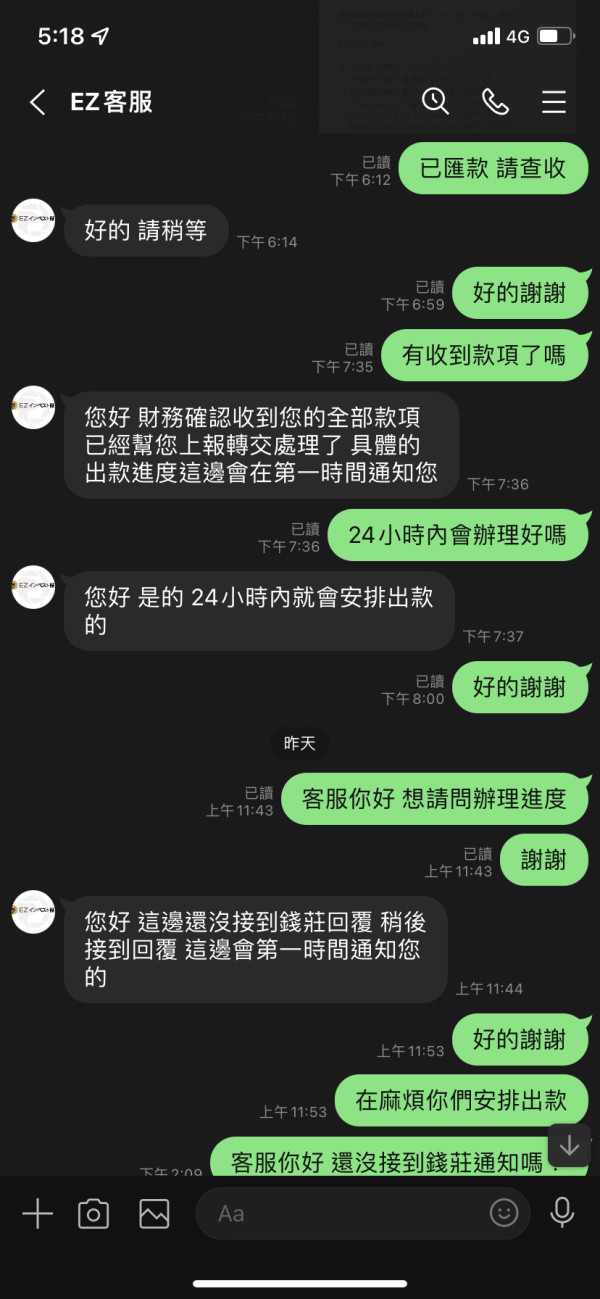

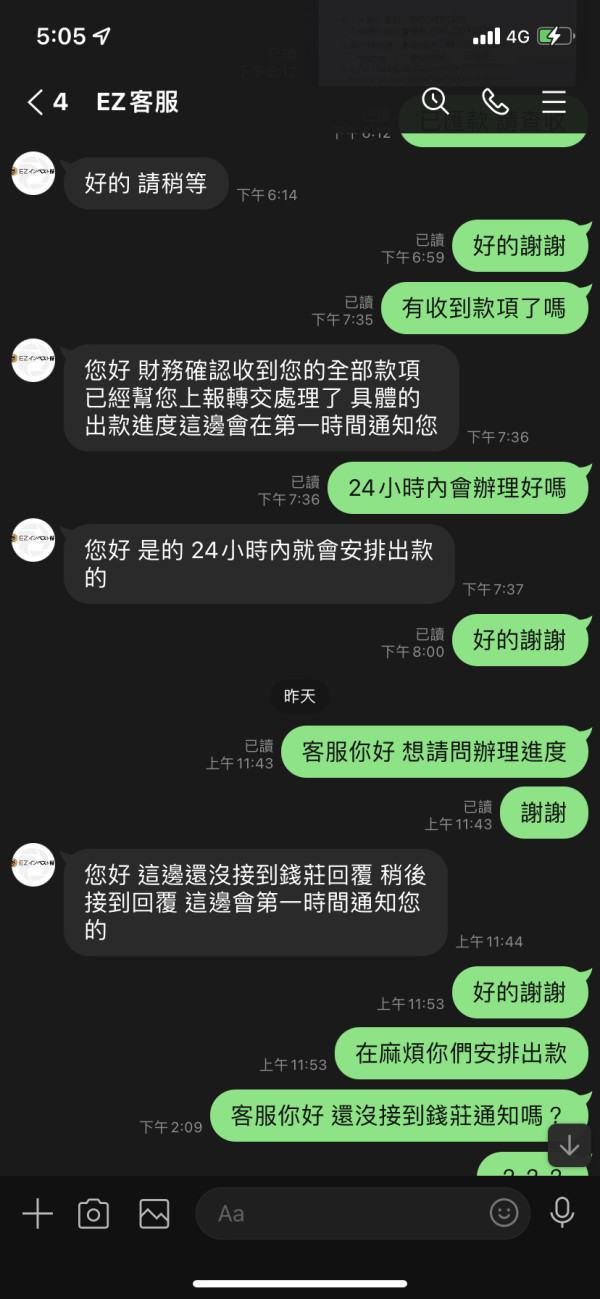

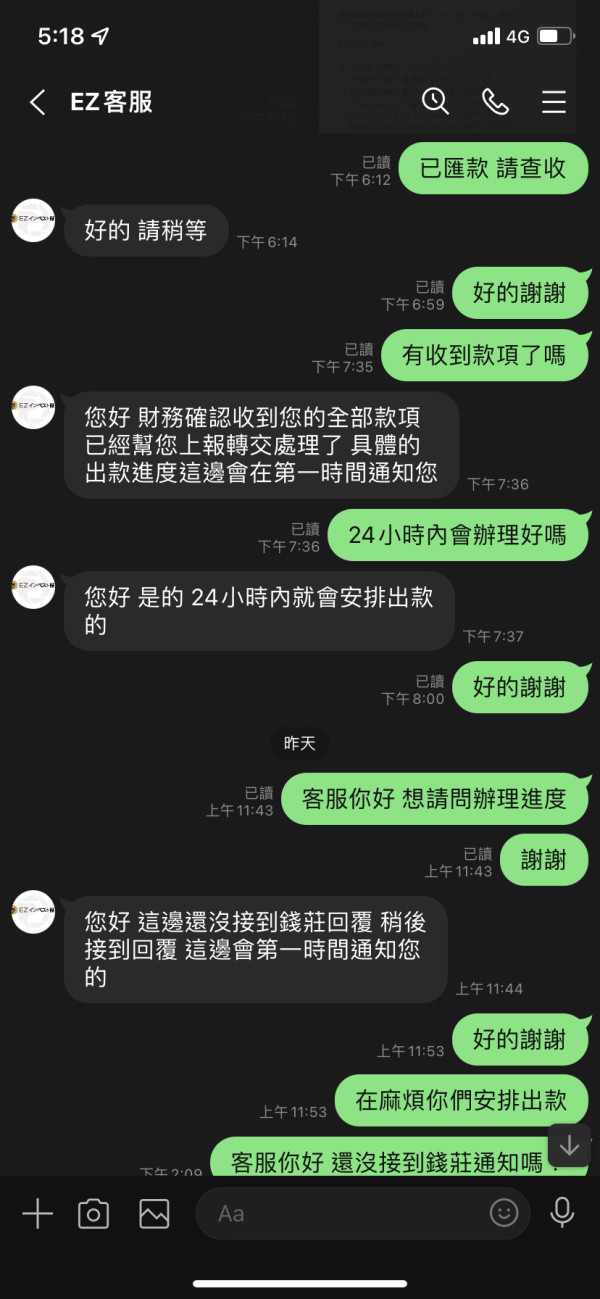

Customer Service and Support: While Ezinvest offers multiple support channels, user experiences suggest that response times can be slow, which is a significant drawback for traders needing immediate assistance.

Trading Setup (Experience): The overall trading experience on Ezinvest is satisfactory, with a stable platform and a variety of tradable instruments. However, the lack of guaranteed stop-loss and negative balance protection raises concerns.

Trustworthiness: Ezinvest is regulated by CySEC, which lends credibility to its operations. However, some reviews indicate potential issues with customer support that could affect trust.

User Experience: The user experience on Ezinvest is generally positive, with a user-friendly interface on the MT4 platform. Yet, there are complaints about the lack of advanced features and tools compared to other brokers.

In conclusion, Ezinvest presents a viable option for traders looking for a regulated broker with a variety of trading instruments. However, potential clients should weigh the higher minimum deposit and customer service responsiveness against their trading needs. As always, it's recommended to conduct thorough research and consider using the demo account before committing real funds.